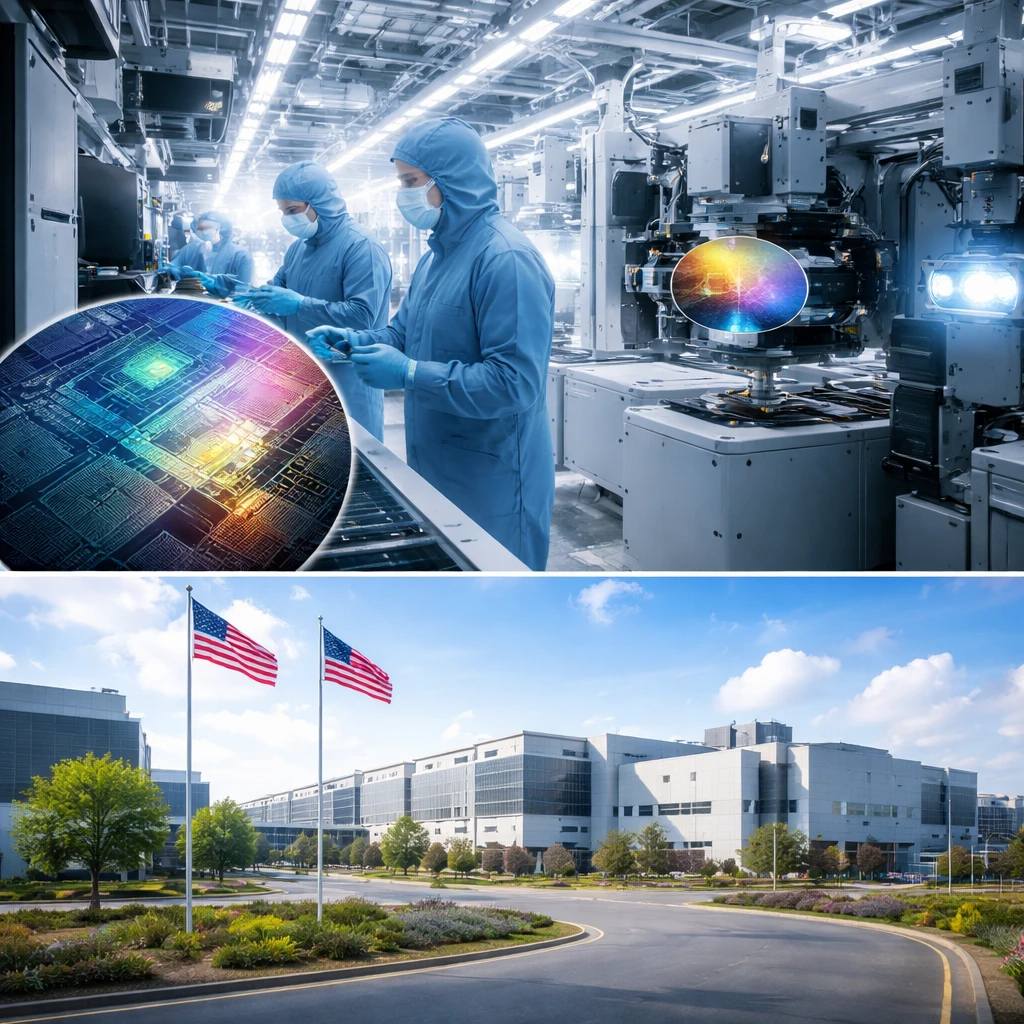

CIBC: U.S. Pulling Ahead as Capital-Intensive Manufacturing Surges

CIBC economists Benjamin Tal and Katherine Judge find a widening divergence in North American manufacturing, with U.S. output and capital intensity rising well above Canadian levels. U.S. manufacturing GDP is now almost 10% above pre-pandemic figures while Canadian output remains below its 2019 baseline. The bank's analysis highlights a sharp incre…