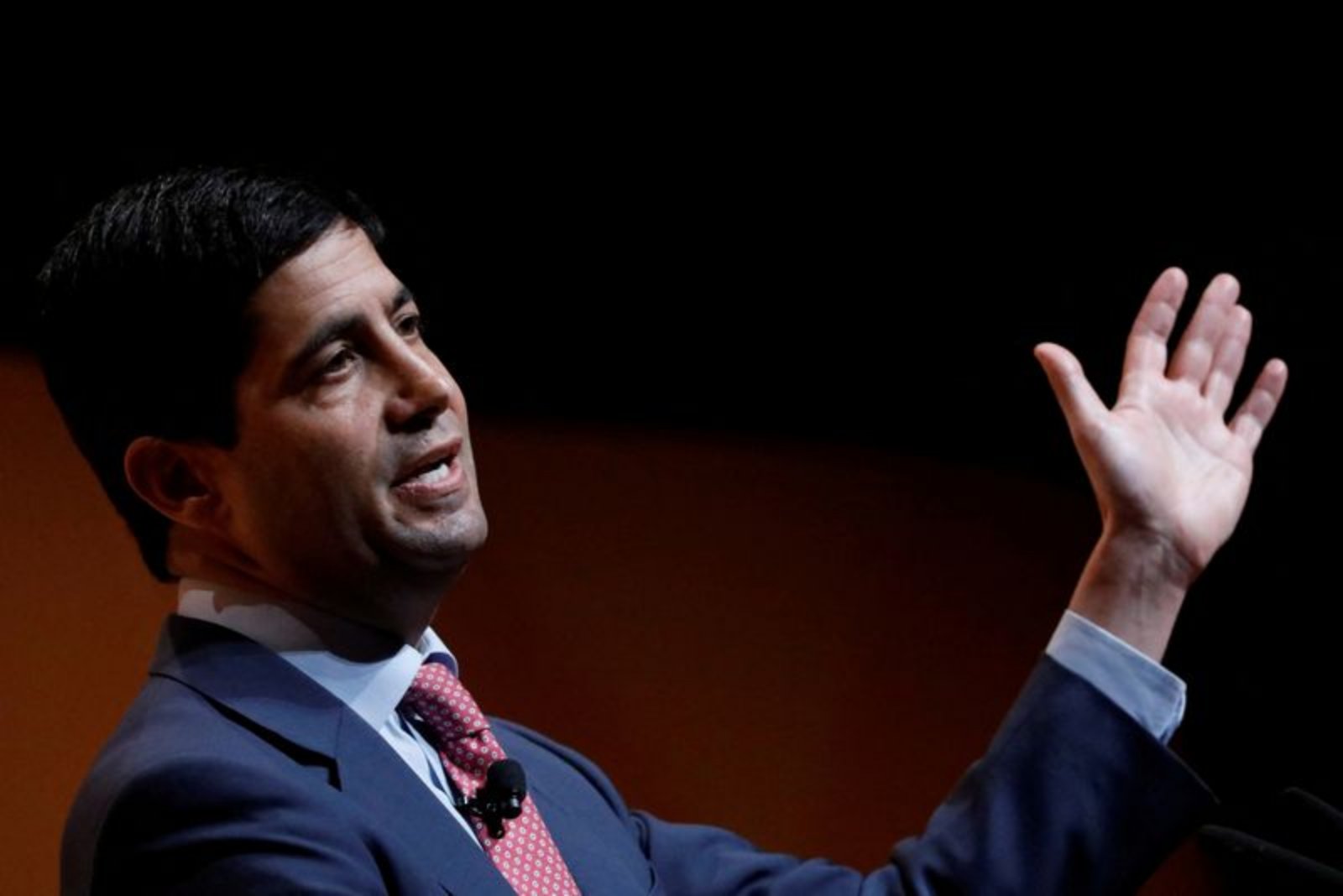

Trump taps Kevin Warsh to lead Federal Reserve as Powell prepares to step down

President Donald Trump announced the selection of former Federal Reserve governor Kevin Warsh to succeed Jerome Powell when Powell leaves the Fed in May. The nomination follows months of public vetting of several contenders. Markets showed muted volatility with the dollar giving up some gains, Treasury yields rising and U.S. stock futures pointing …