Hook & thesis

Moog Inc. (MOG.A) has broken out to a fresh 52-week high and is riding a clear rerating in aerospace and defense stocks. The market is finally paying a premium for Moog's differentiated exposure to space sensors & actuators and aircraft control systems, and that rerating looks only partly priced in. With market capitalization near $10.25 billion, solid free cash flow generation and modest leverage, this is a trade to buy the continuation of the rerating — not a momentum gamble.

My thesis: this is a fundamentals-driven rerate. Moog's combination of structural end-market tailwinds (space and aircraft aftermarket), a deep backlog that analysts have highlighted, and positive technicals (even with a short-term overbought RSI) gives the stock room to move higher. I recommend initiating a long position at $305.00, targeting $360.00 with a stop at $285.00 and a primary holding horizon of long term (180 trading days).

What Moog does and why it matters

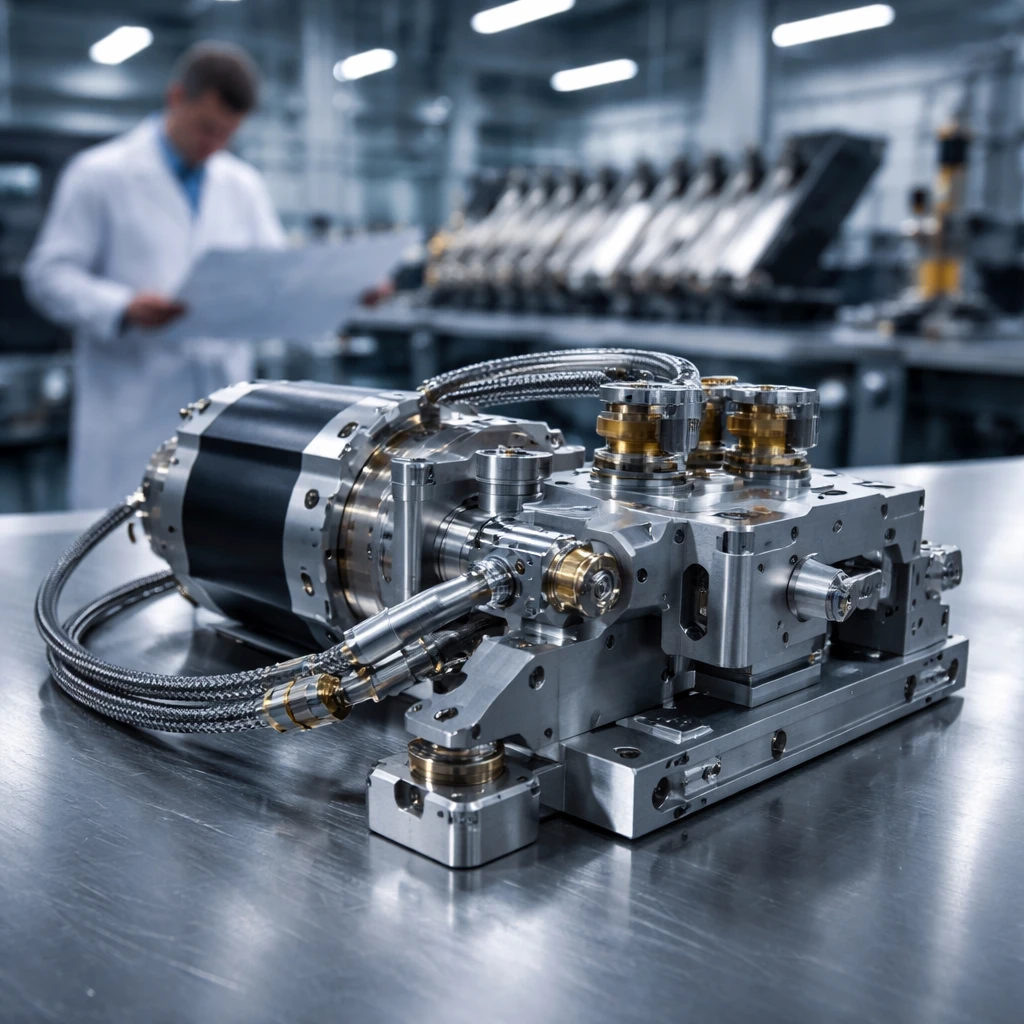

Moog is a designer, manufacturer and systems integrator of precision motion and fluid controls for aerospace, defense and industrial customers. It operates across Space and Defense, Military Aircraft, Commercial Aircraft and Industrial segments. The company's products are mission-critical components in flight controls, satellite pointing systems and other precision applications.

Why investors should care: markets that matter to Moog are expanding. Independent market research cited in the press shows space sensors and actuators markets growing at high-teens to mid-teens CAGRs over the next decade, and the broader aircraft components market is forecast to grow at roughly a 5% CAGR through the next decade. That combination - accelerating growth in space plus steady aerospace demand and aftermarket replacement cycles - gives Moog recurring revenue opportunity and upside to margins as volumes scale.

Key fundamentals supporting the rerating

- Market capitalization is approximately $10.25 billion, a size that puts Moog solidly in the mid-cap aerospace specialty equipment bucket while still leaving it beneath the largest defense conglomerates.

- Valuation is elevated but not frothy for a business with strong cash generation: trailing P/E sits around ~38x (snapshot P/E ~37.8; alternate measure ~39x in some filings). That multiple reflects investors paying up for growth and quality.

- Free cash flow last reported was $214.9 million - healthy for a $10B market cap and supportive of buybacks/dividend optionality even with a modest dividend yield (~0.38%).

- Balance sheet metrics are conservative: debt-to-equity ~0.51, current ratio ~2.33, quick ratio ~1.46. The company carries operating leverage without aggressive financial leverage.

- Returns are solid for the sector - return on equity ~12.6%, return on assets ~5.7% - supporting the premium multiple relative to industrial peers.

Technical and market structure cues

Shares are trading at ~$304.90 after a push to a 52-week high of $307.86 on 01/30/2026. Momentum indicators are mixed: a 10-day SMA sits around $290.99 and the 50-day SMA is $252.91, confirming a strong medium-term trend higher. RSI is elevated at ~74.9, which flags short-term overbought conditions. MACD shows a small negative histogram with the MACD line just below its signal line, suggesting short-term momentum could consolidate. Importantly, short interest and short-volume history show incremental short exposure and sizeable days-to-cover near ~3 - a setup that can amplify rallies if positive news or earnings beat flows through.

Valuation framing

At a market cap of roughly $10.25 billion and an enterprise value near $11.21 billion, the stock trades at EV/sales around ~2.77 and EV/EBITDA in the low-20s. Those multiples are above long-cycle industrial averages but broadly in line with high-quality aerospace suppliers that enjoy technology moats and defense exposure. The recent rerating reflects a shift from 'industrial' multiple to 'aerospace-technology' multiple - investors are paying for stable cash flow, high engineering content and exposure to space programs with multi-year hardware tails.

To justify the current multiple sustainably, Moog needs steady revenue growth and margin expansion, or continued FCF growth that supports buybacks. The company's cash generation and relatively low net leverage make that path plausible, but execution risk remains.

Catalysts to watch

- Backlog conversion and quarterly revenue beats - upside here should accelerate multiple expansion.

- Program awards or contract wins in space sensors/actuators - given the high R&D and integration barrier to entry, new awards can materially increase long-term revenue visibility.

- Better-than-expected margin and FCF profile - continued improvement makes buybacks and higher returns on capital more likely.

- Defense spending / OEM aircraft production ramps - both commercial OEM deliveries and defense procurement funding would be direct demand drivers.

- Short-covering squeezes around earnings or contract announcements - the short-interest profile increases odds of outsized moves on positive news.

Trade plan (actionable)

Direction: Long

Entry price: $305.00

Target price: $360.00

Stop loss: $285.00

Horizon: long term (180 trading days). I expect the rerating to play out over multiple quarters as backlog converts to revenue, new program wins materialize and FCF continues. Short-term traders should note possible consolidation in the next 10 trading days; swing traders may prefer to scale in over the next 45 trading days if RSI cools.

Rationale: entry near current levels captures momentum without chasing beyond the 52-week high. The $360 target represents a reasonable premium to the current valuation assuming continued revenue and margin improvement. The $285 stop limits downside to roughly 6.6% from entry and sits under short-term moving averages and intra-month support levels.

Risks and counterarguments

- Valuation vulnerability: The stock trades at near-20x EV/EBITDA and ~38x P/E. If growth disappoints, multiple contraction could quickly erase gains.

- Aerospace cyclicality: Civil aircraft demand and OEM production rates are cyclical. A slowdown in airline capex or delayed deliveries would reduce revenue visibility.

- Program execution risk: Large defense and space programs carry schedule and margin risk. Delays or cost overruns can compress margins and push revenue out of the forecast window.

- Short-term technical pullback: RSI near 75 and a weak MACD histogram raise the chance of a 10-15% pullback in short order. If you cannot tolerate near-term volatility, scale in rather than buy full size at once.

- Customer concentration and supply chain: Aerospace systems often depend on a small number of OEMs and complex suppliers; supply chain shocks could hurt delivery schedules and margins.

Counterargument: One coherent counterargument is that much of the rerating is sentiment-driven and already priced in; Moog's trailing P/E near 38x demands steady execution. If the company posts a modest revenue miss or guides cautiously, multiple compression is likely and the trade will underperform. In that scenario, the stock becomes a sell into weakness rather than a buy.

What would change my mind

I would downgrade this trade if Moog reported a material revenue or margin miss, if free cash flow deteriorated meaningfully from the current ~$215 million level, or if backlog visibility shrank. Conversely, I would add to the position if Moog posts several consecutive quarters of above-consensus revenue conversion, margin expansion, or a major space program award that materially increases long-term revenue visibility.

Conclusion

Moog is a classic 'quality industrial with growth optionality' story. The stock's move to a new 52-week high reflects a shift in investor perception from cyclical industrial to high-value aerospace supplier. With solid free cash flow, conservative leverage and attractive end-market exposure, Moog has the ingredients for further upside on execution. The trade is a long position at $305.00, target $360.00, stop $285.00, held over a long-term horizon (180 trading days). Position sizing should reflect the possibility of a short-term pullback given elevated RSI and the market's sensitivity to program execution and aerospace cycles.

| Metric | Value |

|---|---|

| Market cap | $10.25B |

| Price / Earnings | ~38x |

| EV | $11.21B |

| Free cash flow | $214.9M |

| Return on equity | 12.6% |

| Debt / Equity | 0.51 |

| 52-week range | $143.67 - $307.86 |

Key points

- Moog's rerating is backed by strong free cash flow, conservative leverage and exposure to growing space and aircraft components markets.

- Entry at $305.00 captures continuation; target $360.00 with stop at $285.00; horizon long term (180 trading days).

- Short interest and days-to-cover add a tactical upside element via potential short covering, but technicals suggest possible short-term consolidation.

- Watch quarterly backlog conversion, margin trajectory and program awards as the primary catalysts.