IonQ (IONQ) is the kind of stock that can feel like it’s trading on two tracks at once. One track is the long-term story: quantum computing as a strategic technology that governments want onshore and under control. The other track is pure positioning and tape action: big swings, heavy short activity, and sharp reactions to any whiff of “Department-level” urgency.

My stance: IONQ is setting up for a tradable rebound after a pullback that has dragged it below its key short and intermediate moving averages. The fundamental narrative is still hot, and the market keeps rewarding companies that look “closest to production” or “closest to defense relevance.” IonQ’s recent push toward vertical integration is the kind of move that can reinforce that perception, even if near-term financials don’t justify the valuation.

But let’s be clear: this is a trade idea, not a marriage. At roughly $45.88, IONQ is still a high-multiple, sentiment-driven name. That’s exactly why a tight plan matters.

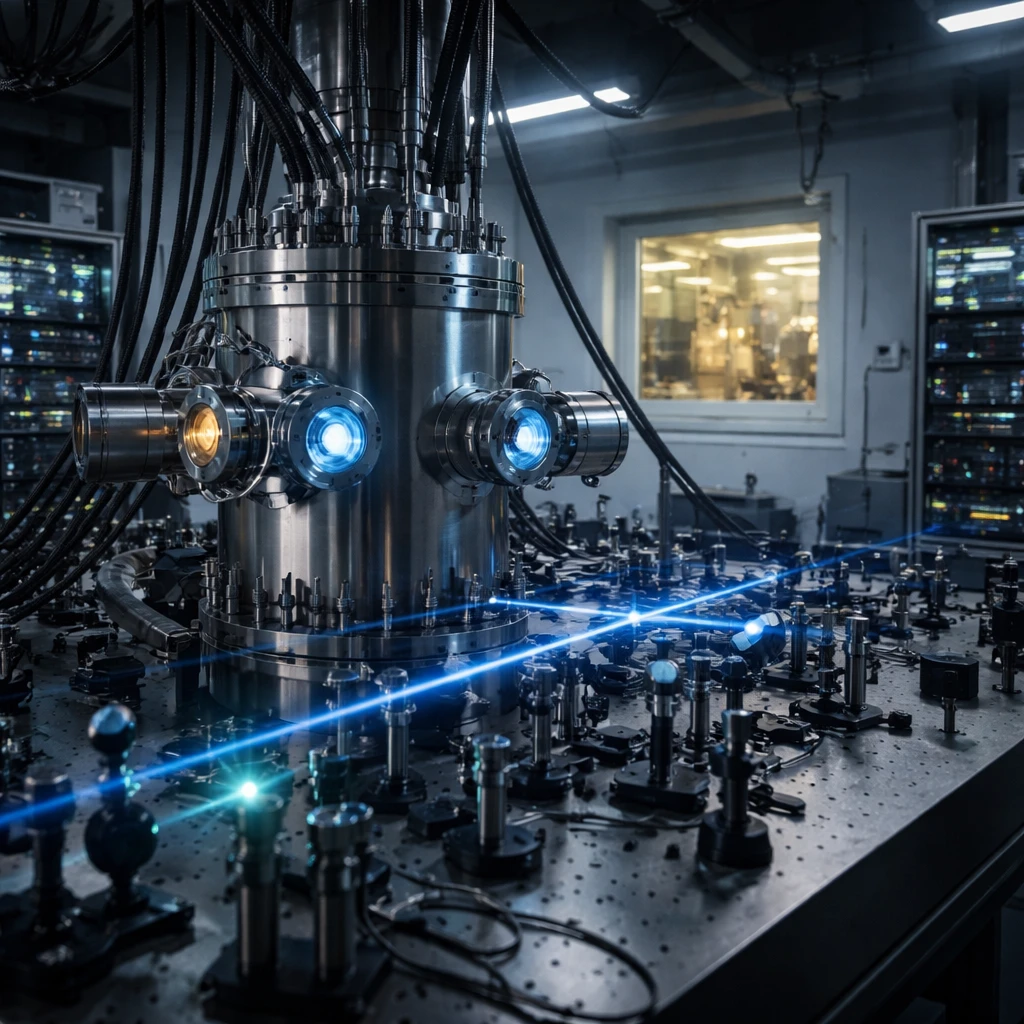

What IonQ does and why the market cares

IonQ develops and manufactures quantum computers, focusing on quantum computing and quantum information processing. The market cares because quantum is increasingly viewed as a strategic capability, not just a science project. If you believe federal agencies will keep steering funding, contracts, and industrial policy toward domestic quantum ecosystems, then the “real winners” may not be the most elegant lab demonstrations. They may be the companies that can integrate hardware, manufacturing, and delivery with credible scale and timelines.

IonQ is also operating in a competitive landscape where accuracy claims, architectures, and roadmaps matter. Recent media comparisons in the space have highlighted IonQ’s relative positioning versus other pure-plays, and that helps keep IONQ in the center of the retail and momentum crowd’s attention. Attention is not the same as fundamentals, but in high-beta thematic stocks, attention often is the fuel.

The numbers that matter right now

Here’s what the tape is saying:

| Metric | Value |

|---|---|

| Current price | $45.88 |

| Day range | $43.04 - $46.44 |

| 52-week range | $17.88 - $84.64 |

| Market cap | $16.12B |

| 30-day avg volume | 18.41M |

| Recent daily volume | 25.18M |

| RSI | 43.85 |

| 10/20/50-day SMA | $48.26 / $48.25 / $48.52 |

| MACD | Bearish momentum |

| Short interest (01/15/2026) | 73.68M shares (4.39 days to cover) |

IONQ is trading below its 10-, 20-, and 50-day simple moving averages, with the 50-day around $48.52. That matters because for a lot of institutions and systematic traders, reclaiming those levels is the line between “downtrend bounce” and “trend resumption.”

Momentum is still negative on MACD (bearish histogram), but RSI around 43.85 is getting into the zone where sellers often start to tire, especially in a name that can move 5%-10% on a single headline cycle.

Positioning: the squeeze ingredient is still on the shelf

Short interest remains substantial. On 01/15/2026, short interest was 73.68M shares with 4.39 days to cover. That’s not the kind of number that guarantees a squeeze, but it’s enough to create air pockets upward if the stock starts reclaiming key technical levels and shorts get forced to reduce exposure.

Short volume has also been consistently heavy in recent sessions. For example, on 01/27/2026, reported short volume was 6.31M shares out of 10.11M total volume for that print. Again, not a prophecy, but it tells you this is a battleground ticker.

Valuation framing: expensive, and that’s the point

At a market cap around $16.12B and price-to-sales around 201.87x, IonQ is priced like a future category leader today. That’s hard to defend with traditional valuation. It also means the stock is highly sensitive to narrative shifts: anything that strengthens the “strategic national priority” storyline can keep the valuation elevated, while anything that undermines commercialization timelines can cut it quickly.

This is where I land: you don’t buy IONQ because it’s cheap. You trade it because the market repeatedly treats quantum as a scarce, high-optionality asset, and IonQ is one of the most liquid proxies.

The fundamental driver that can move the stock

The biggest driver is the market’s belief that quantum capability will be pulled forward by government urgency and domestic manufacturing focus. IonQ has leaned into that framing with a push toward vertical integration. In the latest major headline cycle, IonQ agreed to acquire U.S. chip manufacturer SkyWater Technology in a $1.8B deal, structured at $35 per share consisting of $15 cash and $20 in IonQ stock. The strategic pitch is faster production timelines and lower costs through tighter control of manufacturing.

Even if you’re skeptical, you can see why momentum traders care. It’s a concrete action that fits the political-industrial narrative: domestic capability, supply chain control, and faster iteration cycles.

Catalysts (what could push this trade to target)

- Technical mean reversion: A reclaim of the 50-day SMA near $48.52 can flip systematic flows and invite momentum dip-buyers back in.

- Deal digestion: Continued positive coverage and follow-through buying tied to the SkyWater acquisition narrative could keep the bid under the stock.

- Short-covering dynamics: With ~4.39 days to cover, a fast move through resistance can force shorts to reduce risk, accelerating upside.

- Thematic risk-on rotation: If high-beta tech catches a bid, IONQ typically behaves like a leveraged expression of that appetite.

The trade plan

I want a plan that respects two realities: (1) IONQ can rip when sentiment turns, and (2) it can absolutely punish you if the tape stays heavy. So I’m keeping it defined.

- Trade direction: Long

- Time horizon: mid term (45 trading days). That’s enough time for a catalyst cycle and for the stock to attempt to reclaim the 50-day area, without overstaying the valuation risk.

- Entry: $46.00. This is slightly above the current price and near the recent intraday highs, signaling I want confirmation rather than catching a falling knife.

- Target: $52.00. That’s a realistic mean reversion level above the moving-average cluster and within the stock’s normal volatility profile.

- Stop loss: $42.90. Below the recent session low area ($43.04), giving the trade room while still cutting it if the market rejects the bounce.

How I’d manage it: If IONQ tags the high $40s quickly and then stalls, I would expect chop. The cleanest version of this trade is a push through the high $40s with volume that stays elevated versus the ~18.41M 30-day average. If volume dries up while price drifts, the odds of a deeper fade increase.

Counterargument to the thesis

The most serious counterargument is simple: this stock is priced for a future that may not arrive on the timeline the market wants. Plenty of credible voices argue quantum computing is still decades away from broad commercial viability. If that perception takes hold in a risk-off tape, the “strategic tech” narrative won’t save a 200x sales multiple from compression.

Risks (what can break the trade)

- Valuation compression risk: At price-to-sales around 201.87x, the stock is vulnerable to sharp de-rating even without company-specific bad news.

- Bearish technical structure: MACD is still in bearish momentum and the stock is below the 10/20/50-day SMAs. Downtrends can persist longer than expected.

- Deal integration and execution risk: The SkyWater acquisition is large ($1.8B) and partly stock-funded. Any hiccup in integration or skepticism about cost/timeline benefits can pressure shares.

- Liquidity-driven whipsaws: Average volume is high and short activity is heavy. That combination can create violent intraday reversals that tag stops before the “right” move happens.

- Sentiment headline risk: Quantum is a narrative market. A negative research piece, government-budget chatter, or a sour turn in the thematic basket can hit the stock quickly.

Conclusion: actionable bias, but keep it tight

I like IONQ here as a mid term (45 trading days) rebound trade, not because the valuation is attractive, but because the setup is getting technically washed out while the narrative remains potent and positioning is still crowded. The entry at $46.00 forces the stock to prove it can regain momentum. The target at $52.00 is a realistic mean reversion if it reclaims key moving averages. The stop at $42.90 is my line in the sand.

What would change my mind: If the stock fails to hold the low-$40s and volume expands on down days, I’d assume the market is shifting from “dip-buy the quantum leader” to “sell the expensive story.” On the upside, if IONQ reclaims and holds above the 50-day area (~$48.52) with sustained volume, I’d be more willing to let winners run and reassess targets.