Hook & thesis

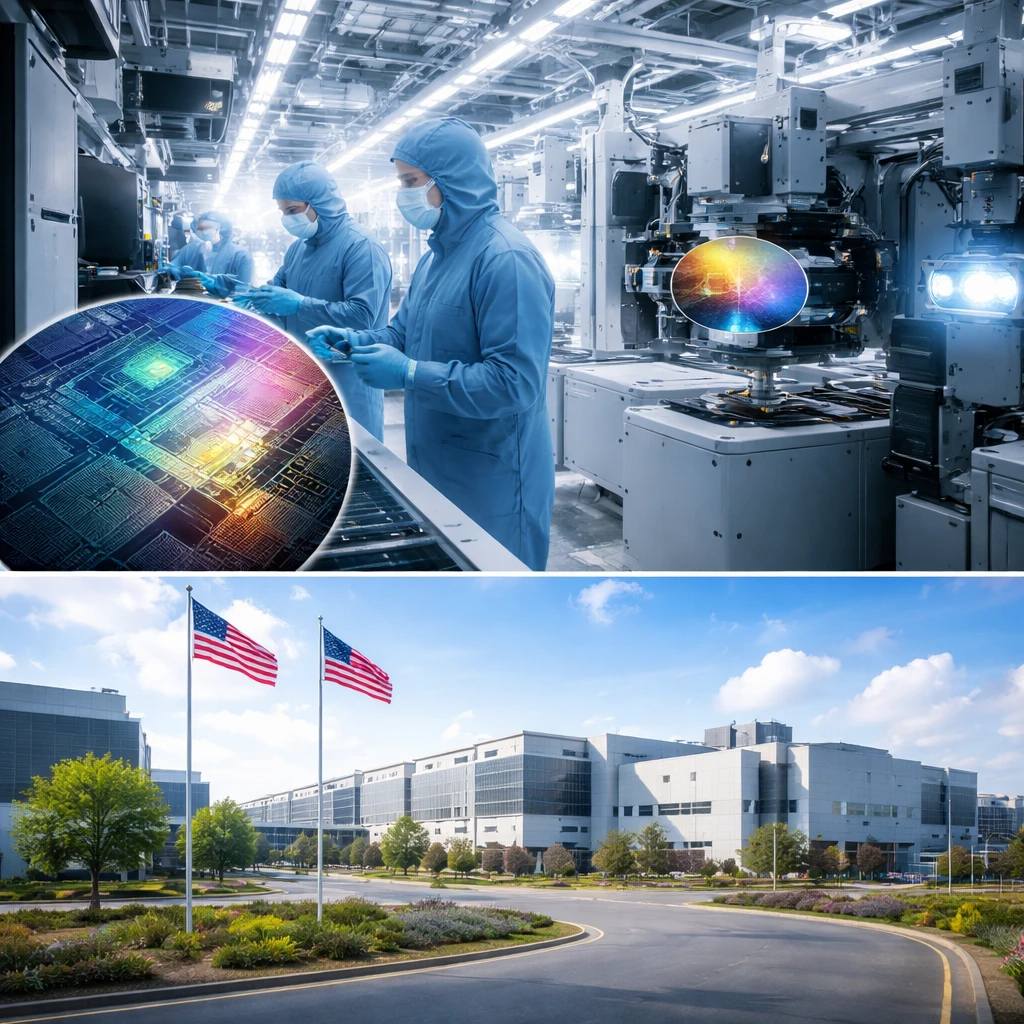

GlobalFoundries (GFS) is quietly morphing from a pure-play mature-node foundry into a longer-duration infrastructure platform for the reshoring wave and AI/communications tailwinds. The company has moved aggressively on two fronts: capability expansion in silicon photonics and strategic partnerships to embed itself in the AI infrastructure supply chain. For traders and investors, that transition matters because it changes the risk profile - from purely cyclical wafer demand to secular, policy-backed capital spending that can sustain higher utilization and pricing over multiple years.

We view the present pullback as an opportunity to initiate a controlled long position. The technicals show constructive momentum (RSI ~57, rising EMAs, bullish MACD) while the company's market cap of $24.34B and 52-week range ($29.77 - $48.57) offer a valuation frame that is reachable if reshoring and photonics initiatives accelerate. Our trade plan targets a move to $55 over a long-term horizon (180 trading days) with a stop loss to limit downside if demand or execution disappoints.

The business and why the market should care

GlobalFoundries manufactures semiconductors and provides foundry services, including shuttle, mask, post-fab and turnkey offerings. The differentiator that matters today is scale in mature and specialty nodes combined with a growing push into silicon photonics and AI infrastructure-related processes. Those niches are capital-intensive and have higher barriers to entry than commodity mature-node logic, which plays to GlobalFoundries' strengths as a well-capitalized, policy-favored domestic foundry.

Two developments crystallize the argument. First, the acquisition of Advanced Micro Foundry (published 11/18/2025) accelerates GlobalFoundries' silicon photonics capabilities and expands its relevance to telecom and AI interconnects. Second, partnerships such as the Applied Materials collaboration (09/24/2025) to build waveguide fabrication capacity in Singapore show the company is lining up both IP and process tooling to capture growth in optical communications and AR/VR photonics - areas expected to see multi-year capacity buildup.

Supporting data and recent trends

Look at the market and technical context: GFS trades at $43.81 today with a market cap of $24.34B. The 52-week low is $29.77 and the high is $48.57, implying meaningful upside to prior peaks if catalysts re-accelerate growth. Momentum indicators are constructive: a 10-day SMA near $44.14, 20-day SMA $41.55, and 50-day SMA $38.44, while the RSI sits at 57.55 and MACD readings point to bullish momentum.

Liquidity and positioning matter for trade execution. Average volume sits around 3.7M over the last 30 days, though two-week average volume is higher (~4.77M), which supports entry and exits without extreme slippage. Short interest has been elevated historically, with days-to-cover swinging between ~1.46 and ~6.66 across reporting periods; recent short-volume prints show active shorting, which increases volatility but also creates the potential for squeeze-driven rallies during positive newsflow.

Valuation framing

Valuation remains mixed: book-value metrics show a price/book around 2.17 while the PE ratio is negative due to recent operating losses. For a capital-intensive foundry, that combination is not unusual during periods of heavy reinvestment. At a $24.34B market cap, GFS is trading at a premium to being a purely mature-node commodity foundry but still below multiples you would expect for a firm with established leadership in advanced nodes like TSMC or Samsung. The premium reflects expectations for differentiated specialty capability and policy support; the discount reflects execution risk and near-term profitability pressure.

Given the company's strategic moves into photonics and AI infrastructure, a market-implied rerating toward the $50-$60 range is plausible if utilization improves and contract wins materialize. Our $55 target represents a mid-point capture of this rerating while leaving room for disappointment on margins or capacity timing.

Catalysts (2-5)

- Policy and tariff developments that accelerate semiconductor reshoring and domestic fabs - positive revisions to U.S. industrial policy or additional incentives could raise utilization and pricing.

- Integration and commercial ramp of the Advanced Micro Foundry asset - visible volume or revenue contribution from photonics would materially reframe the growth story.

- New customer design wins for AI networking and optical interconnects announced by partners or end customers; such wins validate photonics roadmap and support higher long-term ASPs.

- Operational updates showing improved gross margins or better-than-expected fab utilization in upcoming quarters.

Trade plan (actionable)

We recommend initiating a long position with the following rules:

- Entry Price: $44.00

- Stop Loss: $39.00

- Target Price: $55.00

- Trade Direction: long

- Time Horizon: long term (180 trading days)

Why these levels? An entry at $44 sits near the 10-day SMA and the recent trading pivot, offering a reasonable risk/reward while not chasing intraday spikes. The stop at $39 protects capital in case the stock reverts below the 50-day EMA (~$39.43), which would suggest the momentum thesis has failed. The target of $55 is ambitious but achievable within 180 trading days if policy tailwinds, photonics ramp, and utilization improvements converge.

We also suggest staging entries on weakness toward $40 and trimming positions into outsized short-covering spikes; given the active short sellers and elevated short-volume, market moves can be abrupt.

Technical snapshot (quick table)

| Metric | Value |

|---|---|

| Current price | $43.81 |

| 10-day SMA | $44.14 |

| 50-day SMA | $38.44 |

| RSI | 57.55 |

| MACD | Bullish momentum |

Risks and counterarguments

Every trade has downside scenarios. Below are the key risks and at least one counterargument to the bullish thesis:

- Execution risk on capacity and M&A integration: Integrating Advanced Micro Foundry and bringing photonics capacity up to volume is non-trivial. Delays or quality issues would pressure investor confidence and margins.

- Capital intensity and cash flow pressure: Semiconductor fabs require steady CAPEX; higher spending without commensurate utilization would hurt free cash flow and valuation.

- Competition from incumbents: TSMC, Samsung and regional government-backed fabs could outspend or out-execute GlobalFoundries in targeted niches, limiting market share gains.

- Demand cyclicality and macro risk: A broader slowdown in enterprise spending or AI capex could reduce wafer demand and delay utilization improvement.

- Market volatility from short interest: Elevated short volumes create two-way volatility. While that can accelerate rallies, it can also exacerbate sell-offs and gap risk on negative news.

Counterargument: Critics will point out that GlobalFoundries is still not an advanced-node leader and that photonics revenue will take time to meaningfully impact the P&L. If the market reverts to valuing GFS as a mature-node foundry with limited pricing power, the rerating toward $55 will not materialize and the stock could trade back toward the low 30s or worse.

What would change our mind

We will reassess the bullish stance if any of the following occur:

- Visible setbacks in photonics integration or notable customer churn announcements - that would push our view toward neutral or short.

- Quarterly updates showing sustained margin deterioration or utilization falling materially below guidance; this would indicate that capital investment is not translating into revenue.

- Material shifts in policy that reduce reshoring incentives or tariffs that make domestic capacity less competitive relative to global peers.

Conclusion

GlobalFoundries is a pragmatic way to play semiconductor reshoring and the growing photonics/AI-infrastructure market. The company's recent M&A and partnerships give it optionality beyond commodity foundry work, and technicals suggest momentum to build on. Our trade is a defined-risk long: enter at $44.00, stop at $39.00, and target $55.00 within a long-term window of 180 trading days. The key to success will be transparent execution - visible ramps, improving margins and demonstrable customer wins. If those show up, upside is compelling; if not, the stop protects capital and allows us to re-evaluate.

Key dates referenced: Advanced Micro Foundry acquisition announced 11/18/2025; Applied Materials partnership announced 09/24/2025; CFO appointment announced 12/10/2025.