Hook & thesis

Intuitive Surgical is on sale after a January stretch of profit-taking that pushed shares well below the short-term moving averages. The company reported a strong Q4 with $2.9 billion in revenue (up ~19% year-over-year) and double-digit procedure growth, yet investors punished the stock because management tempered 2026 growth guidance to roughly 13-15% procedures. That disconnect - solid fundamentals versus near-term guidance disappointment - creates a tactical buying opportunity.

Technically, ISRG is oversold: the relative strength index sits near 20 and the MACD is signaling bearish momentum, conditions that often precede a mean-reversion bounce in a high-quality growth name. For traders willing to size the position and manage risk, I recommend a defined long trade: entry $475.00, stop $445.00, target $540.00, mid-term horizon (45 trading days).

What the company does and why the market should care

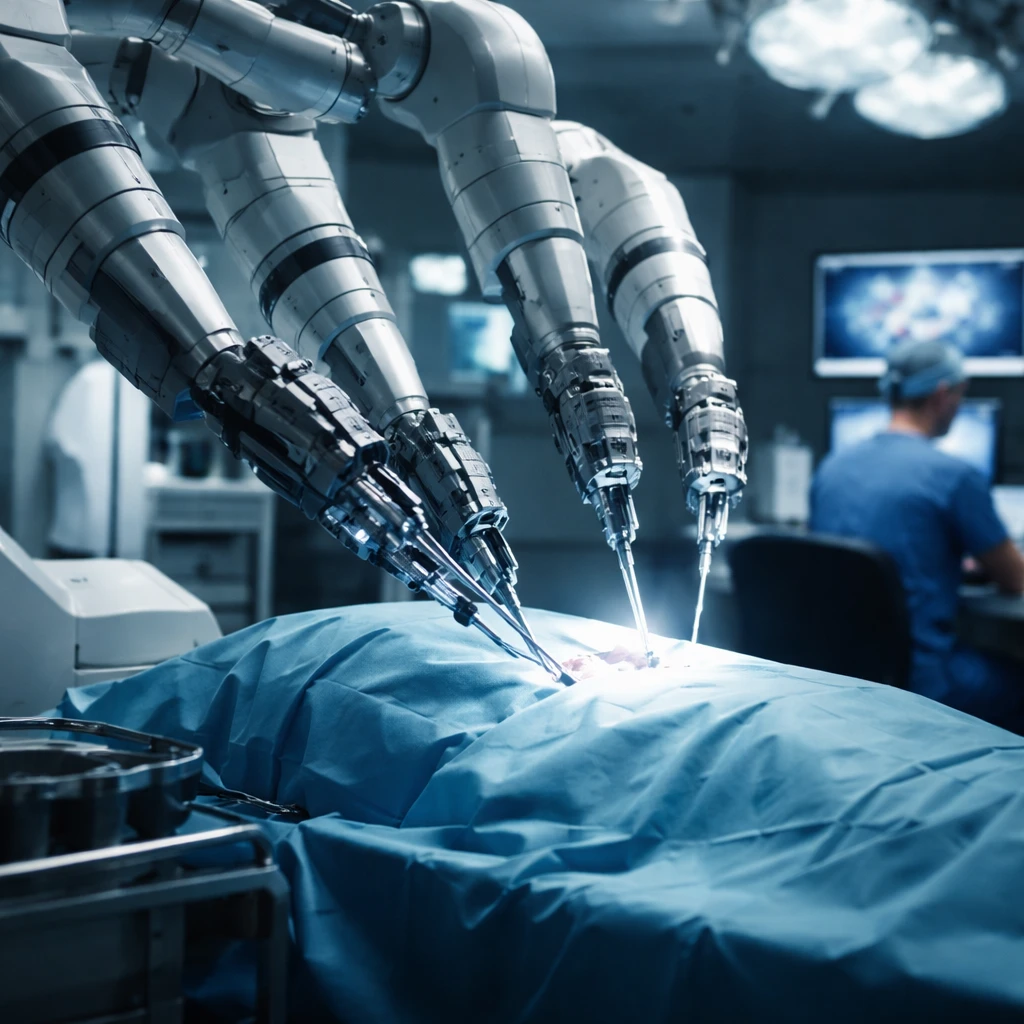

Intuitive Surgical builds and services robotic-assisted surgical systems, most notably the da Vinci platform, and the Ion endoluminal system. The business is a hardware-plus-consumables model: system placements drive recurring revenue from instruments, accessories and services. That recurring piece now makes up roughly 75% of total revenue and smooths earnings variability because installed base growth compounds instrument and service demand over time.

Why that matters: surgical automation and AI-enabled improvements to outcomes are multi-year secular tailwinds. Intuitive’s installed base - reported at over 11,100 systems globally in recent coverage - and a large procedural database give it an advantage in training software and rolling out tightly integrated hardware/software upgrades. Regulators have begun clearing AI enhancements for related products, and the Ion system has shown strong early adoption growth, which helps diversify long-term growth drivers beyond da Vinci placements.

Hard numbers backing the setup

- Q4 revenue: $2.9 billion, up about 19% year-over-year.

- Procedure growth: ~17-18% year-over-year for da Vinci; Ion system procedures grew substantially (reported at ~44% in the quarter).

- Market capitalization: approximately $169.7 billion.

- Free cash flow: about $2.49 billion; the company remains cash-generative despite heavy reinvestment in R&D and installed-base expansion.

- Valuation on recent metrics: P/E roughly 59-60x based on reported trailing/near-term earnings.

- Liquidity and activity: two-week average volume ~2.35 million shares; recent daily volume has been elevated suggesting active repositioning by larger holders.

Valuation framing

On the surface the multiples are rich: the market cap of ~$169.7B plus a P/E near 60x and a price/free-cash-flow multiple north of 60 imply investors are paying for sustained double-digit growth and execution on higher-margin software/AI opportunities. That premium reflects the company’s durable recurring revenue base (instruments, accessories and services) and the potential for AI/automation to expand addressable market and margins over time.

That said, the current selloff has compressed the momentum premium rather than the fundamental premium: the company still reports high single- to double-digit organic growth and consistent FCF generation. A tactical trade here is not a call on structural valuation compression but a bet on sentiment mean-reversion and continued execution against the installed-base model while the valuation conversation plays out more slowly.

Catalysts to watch (near term)

- Upcoming quarterly updates and procedure metrics - continued double-digit procedure growth will reinforce the recurring revenue thesis.

- Further FDA or regulatory approvals / AI clearances for software enhancements - any progress will re-rate optionality for autonomous or semi-autonomous procedures.

- Management commentary on system placements vs. procedural growth (dislocations here drove the January selloff) - clarity on placement cadence can calm investors.

- Overall market risk appetite for growth names - broader risk-on flows will support a bounce in richly valued growth names like ISRG.

Trade plan (actionable)

| Entry | Stop | Target | Horizon | Risk profile |

|---|---|---|---|---|

| $475.00 | $445.00 | $540.00 | mid term (45 trading days) | medium - defined loss with room for mean-reversion |

Rationale: Entering at $475 captures meaningful downside from the recent highs and sits below the current quote while remaining above the 52-week low of $425. The $445 stop limits losses to a controlled amount if the market keeps repricing the growth multiple or if guidance deterioration accelerates. The $540 target is a realistic bounce target toward the 21-50 day moving average region and would represent a solid partial reversion; this target leaves upside to the prior higher trading ranges if constructive news emerges.

Why this is a tactical swing rather than a full conviction buy

This trade is explicitly a mid-term swing: it relies on a sentiment rebound and stabilization of procedure placement/consumption trends rather than a change in the company’s long-term fundamentals. If you like the long-term story, consider sizing this trade as a starter position and layering on confirmed trend recovery; for pure trade accounts, keep position size small relative to portfolio and adhere to the stop.

Risks and counterarguments

- Valuation remains high: A P/E near 60x assumes multi-year above-market growth. If 2026 guidance of ~13-15% procedure growth marks a genuine step-down rather than a single-year modest slowdown, multiples could compress further.

- Execution risk on next-gen products: AI and Ion system upside are optionality today. Failure to commercialize or regulatory setbacks would reduce the long-term growth case and justify a lower multiple.

- Competition and margin pressure: Other medical device players and potential entrants in robotic surgery and visualization could pressure placements and pricing over time.

- Macro/market risk: Growth stocks remain sensitive to rate and liquidity cycles. A broader risk-off episode could push ISRG materially lower despite stable fundamentals.

- Near-term guidance risk: Management lowered its cadence expectation for 2026 procedures versus 2025. If downward revisions continue or guidance is more conservative than market anticipates, the bounce could be muted or reversed.

Counterargument: A sensible investor could reasonably wait for a deeper reset given that ISRG still trades at a high multiple and management guided to slower growth for 2026. If you’re uncomfortable with valuation risk or if macro volatility is high, patience for a more meaningful valuation reset or for clear signs of margin expansion tied to software/AI monetization is a defensible approach.

Conclusion and what would change my mind

My base tactical view is to buy the January selloff with a disciplined stop: enter $475.00, stop $445.00, target $540.00, horizon mid term (45 trading days). The trade balances strong recent execution (Q4 revenue $2.9B, double-digit procedure and recurring revenue) and severely oversold technicals (RSI ~20) against real valuation and guidance risks. If Intuitive reports another quarter of weaker-than-expected placements or lowers 2026 procedure guidance materially below the current 13-15% range, I would exit the trade and reassess the structural thesis. Conversely, if the company provides upbeat commentary on AI-enabled product commercialization or procedure acceleration, I would expand the position and shift to a longer time horizon.

Final practical notes

Keep position sizes modest and use the stop diligently — this is a trade that depends on sentiment and catalysts more than immediate valuation relief. Monitor procedure metrics, management commentary, and any regulatory news around AI enhancements; those items will determine whether this bounce is a tactical pop or the start of a reconvergence to a higher trading range.