Hook / Thesis

Advanced Micro Devices (AMD) is positioned to take the 2026 narrative from “contender” to “leader” in the race for AI and data-center compute. Hyperscalers are actively diversifying away from a single dominant GPU vendor, and AMD’s combined CPU + GPU + accelerator product stack, complemented by a growing Win in client and enterprise designs, gives it a structural growth runway. The market is already pricing optimism into the stock, but the fundamentals and momentum support an actionable long trade.

My trade plan: initiate a long at $237.00, use a protective stop at $200.00, and target $375.00 over roughly 180 trading days. I also outline shorter-term take-profits and the conditions that would invalidate this thesis.

What AMD does and why the market should care

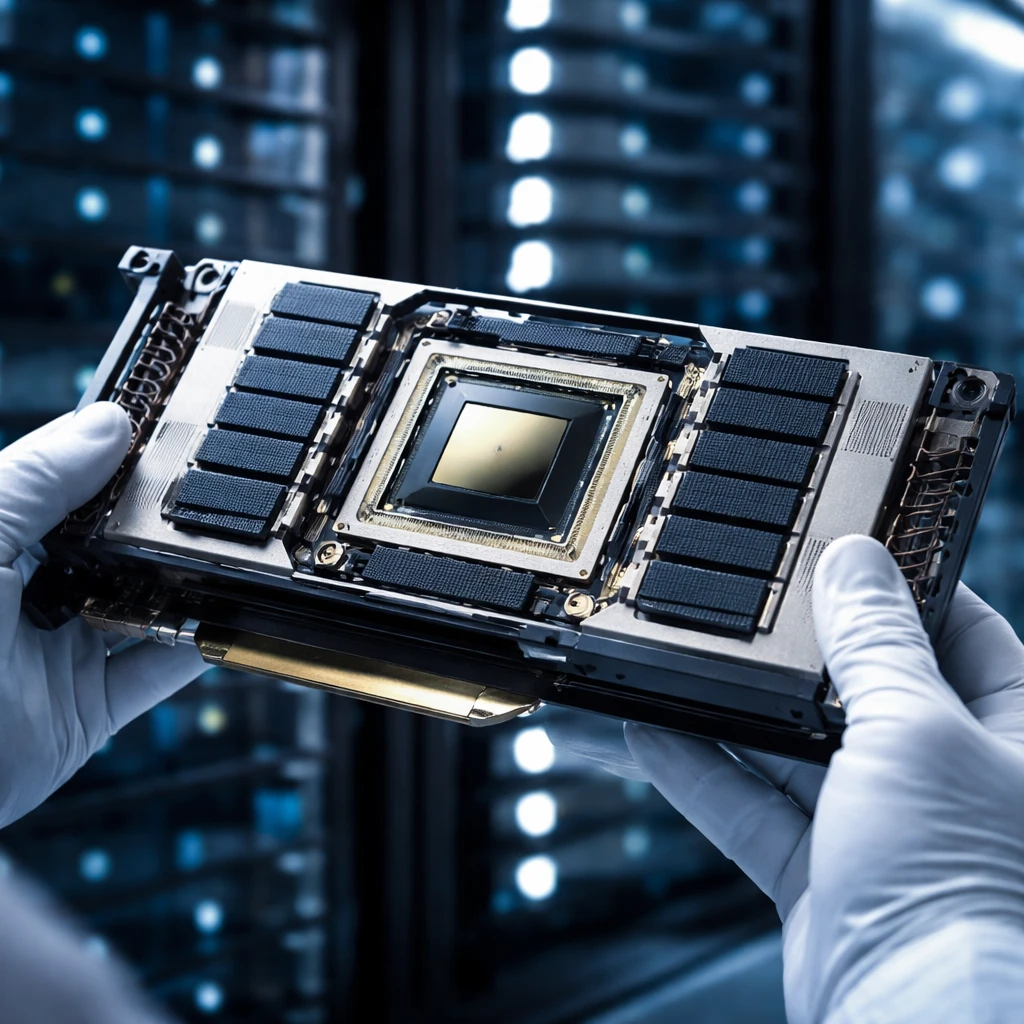

AMD sells semiconductors across four revenue-bearing segments: Data Center, Client (PC platforms), Gaming, and Embedded. The Data Center business now includes server CPUs, GPUs, AI accelerators, DPUs and other datacenter-targeted silicon. That breadth matters: hyperscalers want a diversified stack - CPUs for general compute, GPUs and accelerators for ML training and inference, and interconnect/networking elements for scale.

The market cares because hyperscaler capex for AI infrastructure is large and ongoing. When major cloud customers adopt AMD Instinct accelerators alongside or instead of incumbents, AMD gains both immediate revenue and multiyear design traction. Recent reporting notes increased hyperscaler adoption and a broadened product roadmap that addresses more layers of AI infrastructure, which is a fundamental demand driver that can sustain multi-year revenue growth.

Evidence and numbers

Key financial and market figures to anchor the thesis:

- Market cap: roughly $385.5 billion.

- Trailing EPS (most recent): $2.03; trailing P/E about 116.6.

- Price-to-sales: 12.03; price-to-book: 6.34.

- Free cash flow: $5.448 billion (most recent reported figure).

- Enterprise value: ~$383.8 billion; EV/EBITDA: 63.9.

- Balance sheet: debt-to-equity low at 0.05; current ratio ~2.76; quick ratio ~2.01.

On the margin of fundamentals, AMD is cash-generative (free cash flow north of $5.4B) and conservatively levered - a useful combination when funding R&D and capacity for GPUs and accelerators. The high P/E and EV multiples indicate expectations of significant earnings growth; those expectations can be met if data-center revenue and margins expand materially in 2026.

Technical backdrop

Near-term technicals are constructive: the 9-day EMA ($244.58) sits above the 21-day EMA ($235.53) and the MACD shows bullish momentum with a positive histogram. RSI around 53 is neutral-to-favorable, leaving room to run without immediate overbought extremes. Short-interest is modest by days-to-cover (~1.05), limiting the likelihood of major short-squeeze volatility but also indicating the street is not overly bearish.

Valuation framing

The market is attaching a premium to AMD that implies accelerated revenue and profit expansion. At a market cap of ~$385B and trailing EPS of $2.03, the trailing P/E is elevated at ~116. This premium is defensible only if AMD converts data-center share gains into robust margin expansion and sustained cash-flow growth. Compare the balance-sheet strength and free cash flow generation to the lofty multiples: structurally sound fundamentals provide flexibility, but the company must deliver outsized top-line growth and margin leverage for the current valuation to be justified.

Put simply: the business can support higher equity value if Data Center revenue and operating income scale quickly. If growth disappoints or GPUs remain dominated by a rival without meaningful share shifts, the valuation becomes a vulnerability.

Catalysts (what could drive AMD higher)

- Broad adoption of AMD Instinct accelerators at major hyperscalers and cloud providers - accelerated deployments materially lift Data Center revenue (news flow noted adoption trends on 02/01/2026 and 02/01/2026).

- CPU wins in enterprise and client (Ryzen AI PC designs and server CPU design wins), which drive higher ASPs and ecosystem lock-in for combined CPU+GPU solutions.

- Margin expansion from better product mix and wafer/packaging cost improvements, turning free cash flow into accelerating EPS growth.

- Strategic partnerships (custom ASICs, interconnect deals) that embed AMD deeper into multi-year hyperscaler roadmaps.

- Positive industry tailwinds for HBM and high-bandwidth memory demand, which supports GPU ASPs and content per unit.

Trade plan (actionable)

Primary trade: enter long at $237.00. Primary target $375.00. Stop loss $200.00. Trade direction: long. Risk level: medium.

Horizon: long term (180 trading days). I expect the full thesis - share gains, product ramp and margin improvement - to play out over a multi-quarter cadence; 180 trading days allows for multiple earnings releases, supply-chain cadence, and visible hyperscaler adoption announcements.

Staged exit guidance:

- Short-term tactical partial exit: if price reaches $280.00 within the first 10 trading days (short term - 10 trading days), consider trimming 25% to lock in quick gains and reduce risk.

- Mid-term review: at $320.00 around 45 trading days (mid term - 45 trading days), re-assess based on latest public commentary from hyperscalers, AMD revenue and margin prints, and any competitive product launches.

- Full target: $375.00 over 180 trading days if Data Center revenue and margins show the necessary step-up; take profits or re-evaluate position sizing at that point.

Why these levels? $280-$320 brackets reflect achievable re-rating as investors price in stronger data-center traction and margin improvement; $375 is an upside revaluation that assumes meaningful acceleration in revenue and EPS from current trailing numbers.

Risks and counterarguments

Every trade has risk. Below are the primary risks that could derail this long thesis:

- GPU leadership and competitive dynamics: Nvidia remains a dominant force in high-end GPU training silicon. If Nvidia releases new architectures or pricing strategies that materially blunt AMD’s competitive inroads, AMD’s data-center share gains could stall.

- Execution and supply constraints: Ramping complex GPU and accelerator product lines at scale is non-trivial. Any production delays, yield issues, or supply shortages for HBM memory could limit sales and margin expansion.

- Valuation vulnerability: Current multiples (trailing P/E ~116, EV/EBITDA ~63.9) already price in strong earnings growth. Missing revenue or margin targets would likely trigger a sharp multiple contraction and downside pressure.

- Macro and capex timing: Hyperscaler capex can be lumpy. A pause or reallocation in AI infrastructure spend would reduce near-term demand and push expected revenues into later periods.

- Customer concentration / contract risk: A slower-than-expected ramp among a few large customers would disproportionately affect results, given enterprise wins often drive front-loaded revenue.

Counterargument: the street may reasonably contend that AMD’s premium valuation already bakes in a best-case AI outcome and that Nvidia’s entrenched ecosystem and software advantage (for certain high-end models) put a practical ceiling on AMD’s near-term gains. That is a valid point: if market participants become more skeptical about AMD replacing or meaningfully displacing incumbents in the highest-margin GPU segments, the stock could trade down even with solid product progress.

What would change my mind

I would downgrade the thesis if any of the following occur:

- Public hyperscaler rollouts show AMD as a secondary supplier with minimal deployed capacity over multiple quarters.

- Earnings prints show negative margin momentum (operating margin contraction) with free cash flow falling materially below $5B annualized run-rate.

- AMD reports meaningful production issues or material delays on next-gen accelerators that push commercial availability beyond the current roadmap timeframes.

- Macroeconomic shock that forces hyperscalers to sharply reduce AI capex for multiple quarters.

Conclusion

AMD’s position heading into 2026 looks fundamentally stronger than a simple “GPU vendor” story. The company brings CPUs, GPUs and accelerators to market with a value proposition that large cloud customers find compelling as they diversify infrastructure. The balance sheet and cash generation give AMD flexibility to invest through the cycle. That said, the market already assigns a lofty premium; this trade is not a blind long but a conditional trade that expects visible share gains and margin improvement over the next several quarters.

Practical recommendation: initiate a long at $237.00 with a $200.00 stop. Hold toward a $375.00 target across roughly 180 trading days, trimming incrementally along the way at $280 and $320 based on the cadence of results and hyperscaler announcements. Keep position sizing mindful of the valuation risk: if revenue or margin beats fail to materialize, pare exposure early rather than waiting for a full price decline.

Key monitoring events: quarterly earnings, hyperscaler design wins and deployment announcements, HBM supply commentary, and competitor product/price moves.

Trade responsibly: the thesis is actionable but conditional; watch the catalysts and risks closely and adjust sizing as new data arrives.