Tower Semiconductor (NASDAQ:TSEM) saw its stock jump 16% on Thursday morning following an announcement that it will work with NVIDIA (NASDAQ:NVDA) to develop advanced silicon photonics technology tailored for AI data centers.

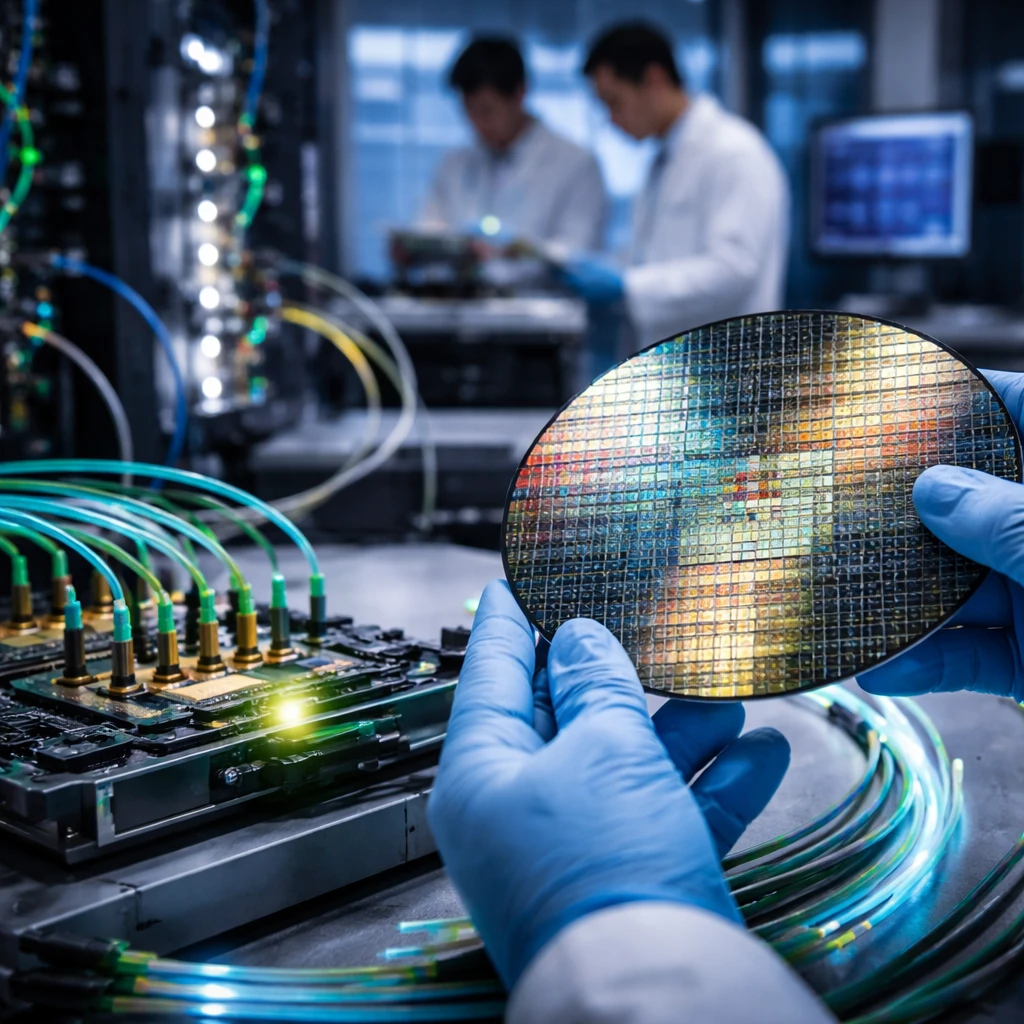

The Israel-based semiconductor foundry said the collaboration will support scaling of AI infrastructure deployments by producing high-performance silicon photonics for 1.6T data center optical modules designed to operate with NVIDIA networking protocols. Tower said its silicon photonics approach can enable up to double the data rate compared with earlier solutions, increasing bandwidth for optical connectivity and helping speed AI application performance.

Company leadership highlighted the significance of the work for next-generation data center architectures. "Tower Semiconductor is proud to deliver advanced, high-speed technologies that support demanding data center and AI requirements," said Russell Ellwanger, CEO of Tower Semiconductor. The company added that it continues to invest across its SiGe and silicon photonics platforms to support evolving data center needs.

NVIDIA framed the collaboration as a response to expanding infrastructure requirements driven by AI. "The exponential growth of AI is driving the need for a new class of high-speed, scalable networking to connect AI infrastructure," said Gilad Shainer, Senior Vice President of Networking at NVIDIA.

Tower described its silicon photonics platform as optimized for high-speed optical interconnects, positioning the firm to act as a foundry partner for firms focused on AI infrastructure, data center networking, and advanced telecommunications. The announcement and the technical details cited - the 1.6T optical module focus and the potential to double data rates - were central to investor reaction in the stock market Thursday.

The partnership centers on technology that addresses increased bandwidth demands in AI environments by moving more data across optical links at higher rates. Tower emphasized investments in both SiGe and silicon photonics as part of its strategy to support these next-generation networking architectures.

While the company described the technical aims and its continued investment priorities, the announced collaboration and the claimed performance gains remain the basis for market response and future execution.