S&P Global Ratings says African sovereigns are confronting a sharply higher external repayment schedule in 2026 that will test external buffers and increase rollover risk. In its recent African sovereign outlook, the agency notes that government external debt repayments are now more than three times the size of comparable obligations in 2012 and cautions that external vulnerabilities have grown as a result.

"Structurally high debt and low, concentrated revenue bases will continue to pose key risks and, with government external debt repayments likely to exceed $90 billion this year, external vulnerabilities have also increased," S&P's Benjamin Young wrote in the report. The agency added that government external debt repayments are approaching a peak.

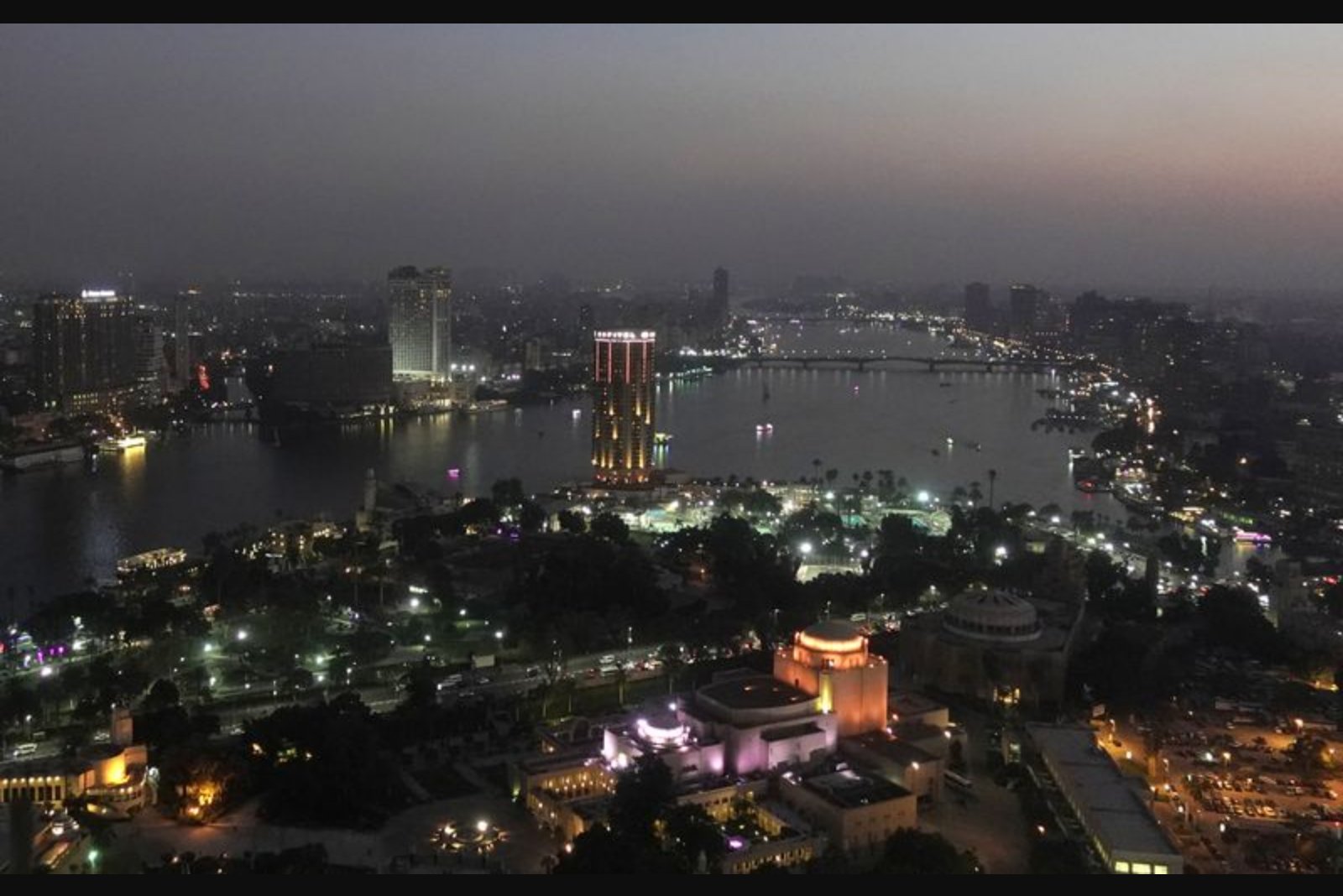

Egypt represents almost one-third of the expected repayments in the current cycle, with $27 billion scheduled in principal repayments. Angola, South Africa and Nigeria follow as other large contributors to the overall repayment tally. The concentration of repayments in a small group of countries amplifies regional refinancing and foreign-exchange pressures.

S&P observes that average sovereign ratings across the region have reached their highest levels since late 2020, a reflection of reform momentum and improved growth dynamics. Analysts at the agency, however, emphasise that this upturn largely reflects stabilisation of key credit metrics rather than a marked improvement - structural adjustments required to materially reduce debt burdens will generally take longer to implement.

Improving global financial conditions and a desire among investors to diversify have reopened access to global capital markets for a number of African sovereign borrowers. The report notes, however, that market re-entry has not been uniform or cheap. Some borrowers, such as the Republic of Congo, have had to offer double-digit yields in recent months, a cost level widely viewed as expensive for sovereign issuers. As a result, several governments have resorted to off-market transactions like private placements or total return swaps.

Macroeconomic projections in S&P's outlook indicate steady growth and only modest fiscal consolidation. Average real GDP growth is forecast at 4.5% in 2026 while fiscal deficits are expected to narrow modestly to about 3.5% of GDP. Despite these projections, government debt is expected to remain elevated, at roughly 61% of GDP on average across the region.

Faced with a rising redemption burden, numerous governments have adopted liability management techniques to lower refinancing risk. These measures include buybacks, exchanges and maturity extensions. The report identifies Côte d'Ivoire, Benin, Uganda, Republic of Congo, Mozambique, Kenya and South Africa as notable users of such strategies.

The combination of concentrated repayment schedules, structurally high debt, and still-elevated debt-to-GDP ratios means countries will likely need prolonged and sustained adjustment efforts to reduce vulnerability, according to S&P - a process that the agency says is unlikely to yield rapid declines in debt burdens.