The once widely cited projection that the global market for obesity medicines would reach roughly $150 billion within the next decade is being reassessed as price cuts, new oral options and increased competition change the growth trajectory for GLP-1 therapies.

Investors and analysts are revising both the size of the peak market and the timetable for when those levels might be reached, citing rapid price erosion in the United States and the growing role of cash-pay consumer channels. The market dynamics have shifted since the initial surge of demand for potent GLP-1 treatments, which prompted some early forecasts to target $150 billion - or even $200 billion - by the early 2030s.

"The peak has come down a little bit," said Terence McManus, a portfolio manager at Bellevue Asset Management, which holds shares in Eli Lilly. He pointed to lower consumer prices and the emergence of generic versions of Novo Nordisk's Ozempic as drivers of the reassessment. "Maybe a few years ago people didn’t appreciate that that would happen so quickly," he added.

Several major research houses and sell-side analysts have trimmed expectations. Forecasts for 2030 are now commonly around $100 billion - roughly 30% below earlier estimates - and some forecasters have pushed the $150 billion milestone out to 2035. Jefferies, for example, cut its peak-market estimate by 20% in January, lowering its peak projection to $80 billion from an estimate in 2023 of more than $100 billion in the early 2030s.

"That $150 billion pie is gone, even if you’re very bullish on volumes," said Jefferies analyst Michael Leuchten.

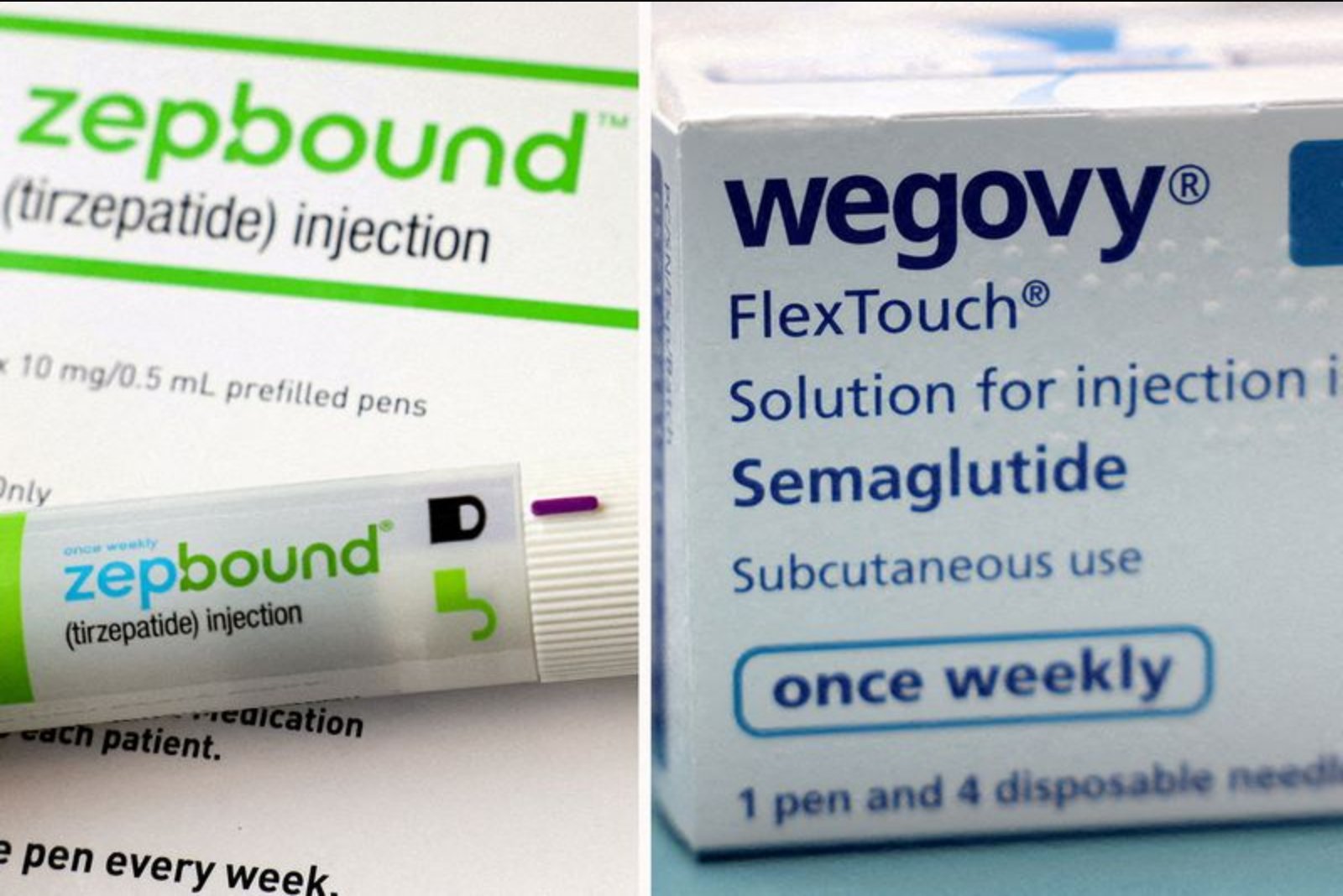

Two companies dominate the discussion. Novo Nordisk and Eli Lilly remain central to the market and are scheduled to report fourth-quarter financial results on Wednesday. Lilly reached a $1 trillion valuation last year, and Novo’s Wegovy weight-loss pill has made a strong market entrance.

Some analysts expect Novo to present guidance showing declines in sales and operating profit for 2026 when it issues its outlook on Wednesday. Meanwhile, market consensus compiled by LSEG indicates that analysts expect Lilly’s revenue to rise by over 21% in 2026 and for adjusted earnings to increase by more than 40% versus 2025 estimates. Novo declined to comment. Lilly did not immediately respond to requests for comment.

Goldman Sachs analysts have also pared back their assumptions. Goldman’s current estimate for global obesity drug sales by 2030 stands at $105 billion, down from prior projections of $130 billion, reflecting steeper-than-expected price erosion and shifting patient-use patterns.

After Wegovy’s launch in 2021 and Lilly’s Zepbound in 2023, these therapies were priced at about $1,000 per month in pharmacy channels. Under pressure to address U.S. drug costs, manufacturers now offer them through company websites at starting prices between $149 and $299, in part tied to a deal with the former Trump administration. The lower price points reduce revenue per patient, meaning that volume growth will need to be meaningfully higher to reach earlier revenue scenarios.

"Prices have come down quite sharply, so you certainly need volumes to pick up a lot," said HSBC analyst Rajesh Kumar, who has so far retained his long-term forecasts but flagged 2026 as an inflection point to assess consumer demand.

Prescription data add nuance to the volume question. According to IQVIA figures cited in analyst research, combined prescriptions for Wegovy injection and pill and Zepbound injection totaled 730,000 in the week ended January 23. New Wegovy prescriptions rose 4%, mainly driven by the new pill formulation, while Zepbound prescriptions increased by 0.9%.

Absent a significant step-up in sustained patient volumes, the most optimistic revenue forecasts for the sector may be at risk. Kumar estimates the market could still exceed $120 billion by the end of 2030 if consumption expands enough. He also noted that wider availability of oral GLP-1 formulations could lengthen patient adherence to therapy, which would help offset lower price points.

Lilly expects regulatory approval for its oral version in April, a development that analysts say could materially affect treatment persistence and market composition once uptake is measured in coming months.

Market research firm IQVIA has also moderated its timeline. It moved its forecast for a roughly $130 billion global obesity market out to 2034 from an earlier 2028 estimate.

Not all industry figures and analysts have scaled back their outlooks. Pfizer’s chief executive Albert Bourla has said he still expects the obesity market to reach $150 billion annually by 2030. Pfizer recently completed a $10 billion agreement to acquire biotech Metsera for obesity-related assets.

BMO Capital Markets, which in 2023 raised its estimate for annual GLP-1 sales to $158 billion by 2033 - with about $100 billion attributed to obesity treatments - is wagering that lower prices will stimulate substantially higher volumes. GLP-1 medicines also address type 2 diabetes, which factors into some aggregate market projections.

BMO analyst Evan Seigerman said his view is that companies in the space can absorb pricing pressure from generic entrants. TD Cowen’s forecast for combined diabetes and obesity drug sales stands at $139 billion globally and could increase if direct-to-consumer demand offsets price declines, according to analyst Michael Nedelcovych.

Morningstar analyst Karen Andersen expects obesity-related revenue to surpass $100 billion, but she observed that pricing pressure has brought forward a revenue shortfall that many had anticipated would occur in 2027 rather than 2026. "We’ve already got pretty steep discounts built into our model," she said.

Portfolio manager Markus Manns at Union Investment, which holds positions in both Novo and Lilly, said uncertainty remains high because numerous potential competitors are still early in development and because potent oral therapies are only beginning to reach the market. "In a few weeks we will at least have a better idea about the potential of orals," he said, "and whether they are expanding the market or just taking market share from injectables."

Context on investment research and tools

The question of whether to buy Eli Lilly shares has been posed in some investment tools and commentary. One investment product referenced in market materials evaluates LLY alongside thousands of companies using algorithmic metrics designed to highlight candidates based on fundamentals, momentum and valuation. That product offers a view on whether LLY appears in certain model strategies but the underlying analysis and its historical performance were presented as part of promotional content in market literature.

Analysts and investors emphasize that the coming months - including regulatory decisions on oral formulations and updated corporate outlooks - will be important in clarifying how pricing, volume and competition combine to shape long-term revenue for GLP-1 obesity therapies.