First Brands announced on Monday that it has started winding down specific components of its North American footprint, namely its Brake Parts, Cardone and Autolite units, while keeping its other businesses in the region and operations outside North America active as it searches for purchasers for those assets.

The company said the wind-down does not extend to its remaining North American businesses or to its international operations, which remain operational as the firm continues to evaluate potential buyers and other strategic options.

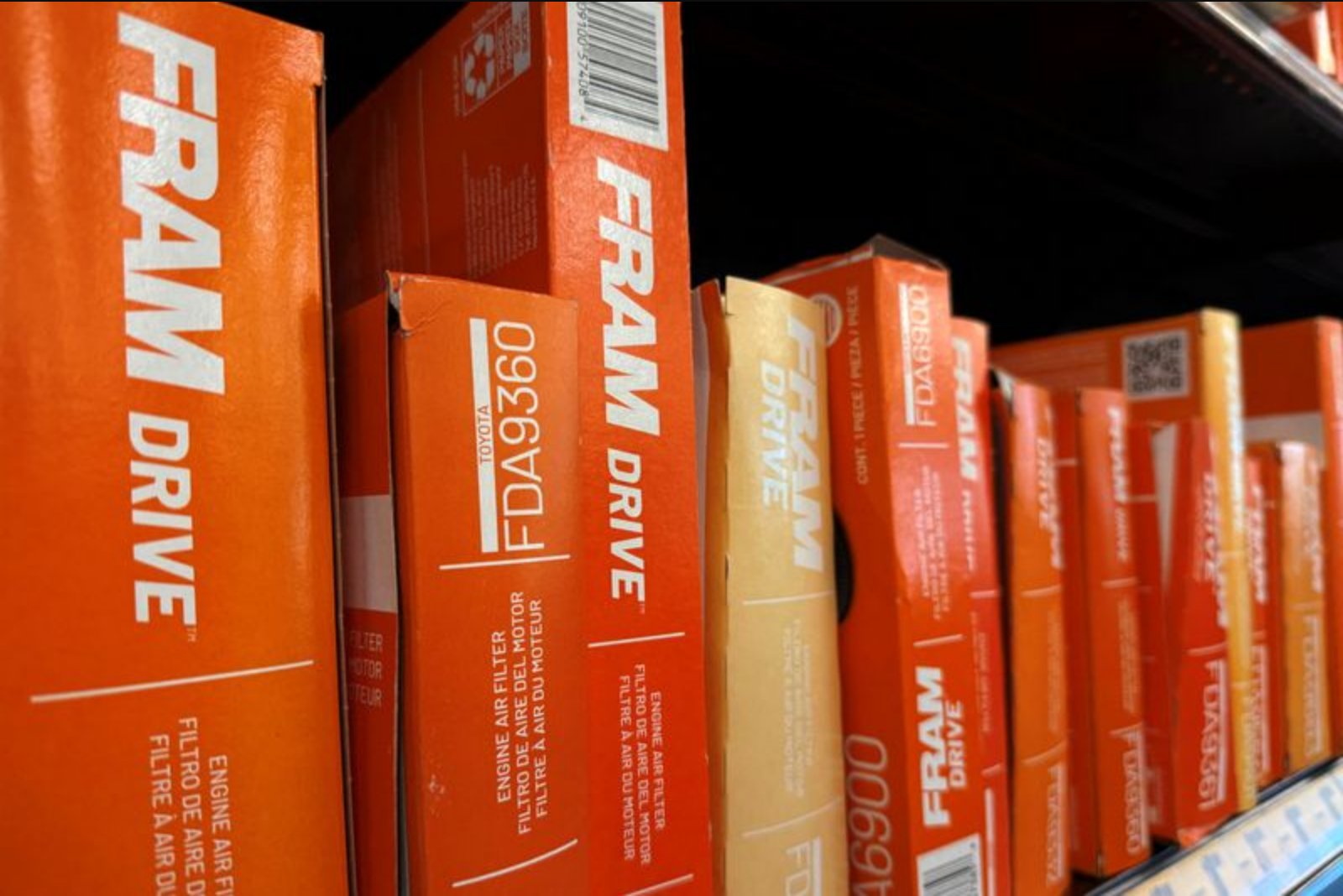

First Brands is an auto parts supplier producing filters, brakes and lighting systems. The company filed for Chapter 11 bankruptcy protection in late September 2025 after becoming burdened by substantial debt accrued through rapid acquisitions and deteriorating financial performance.

A U.S. bankruptcy judge ordered a $7 million independent investigation last year after allegations emerged that First Brands had misused third-party financing for customer invoices. That probe remains a material element of the company’s bankruptcy backdrop.

"Over the past several months, we explored all available options to secure funding and advance the sale process for the Brake Parts Inc., Cardone, and Autolite businesses," said Charles Moore, interim CEO of First Brands.

Earlier this month the company initiated a formal marketing process to sell the business either as a single entity or in separate pieces as part of its Chapter 11 exit strategy. The effort to find buyers and narrow operations is being supported by a team of advisers - Weil, Gotshal & Manges is providing legal counsel, Lazard is acting as investment banker, Alvarez & Marsal is serving as financial adviser, and C Street Advisory Group is handling strategic communications as the company reduces certain business lines.

Observers say the unraveling at First Brands underscores mounting pressure across the auto-parts and financing ecosystem, where companies carrying heavy leverage have faced distress. The company’s difficulties come amid a broader pattern in the sector, with other heavily indebted firms such as subprime auto lender Tricolor Holdings having collapsed, highlighting how aggressive borrowing and nontransparent financing arrangements can push companies toward insolvency.

As First Brands narrows its active operations to enable asset sales, the company has emphasized that selected lines and international units will remain in operation while potential buyers are sought. The ongoing investigation and the firm’s debt load are likely to be central considerations for any prospective acquirers.

First Brands’ stated approach is to maintain continuity where possible while marketing the selected units for sale and pursuing options to emerge from Chapter 11.