Advanced Micro Devices Inc. (NASDAQ:AMD) saw its stock fall Friday following reports that the company’s MI450-series AI accelerators may be running behind schedule. Early intraday trading showed declines of up to 6%, though losses were later reduced to roughly 3%.

Initial coverage attributing the potential delay was reported by SemiAnalysis. Those assertions were quickly challenged by Wells Fargo analyst Aaron Rakers, who said his team’s work does not support the suggestion the MI450 program is behind schedule.

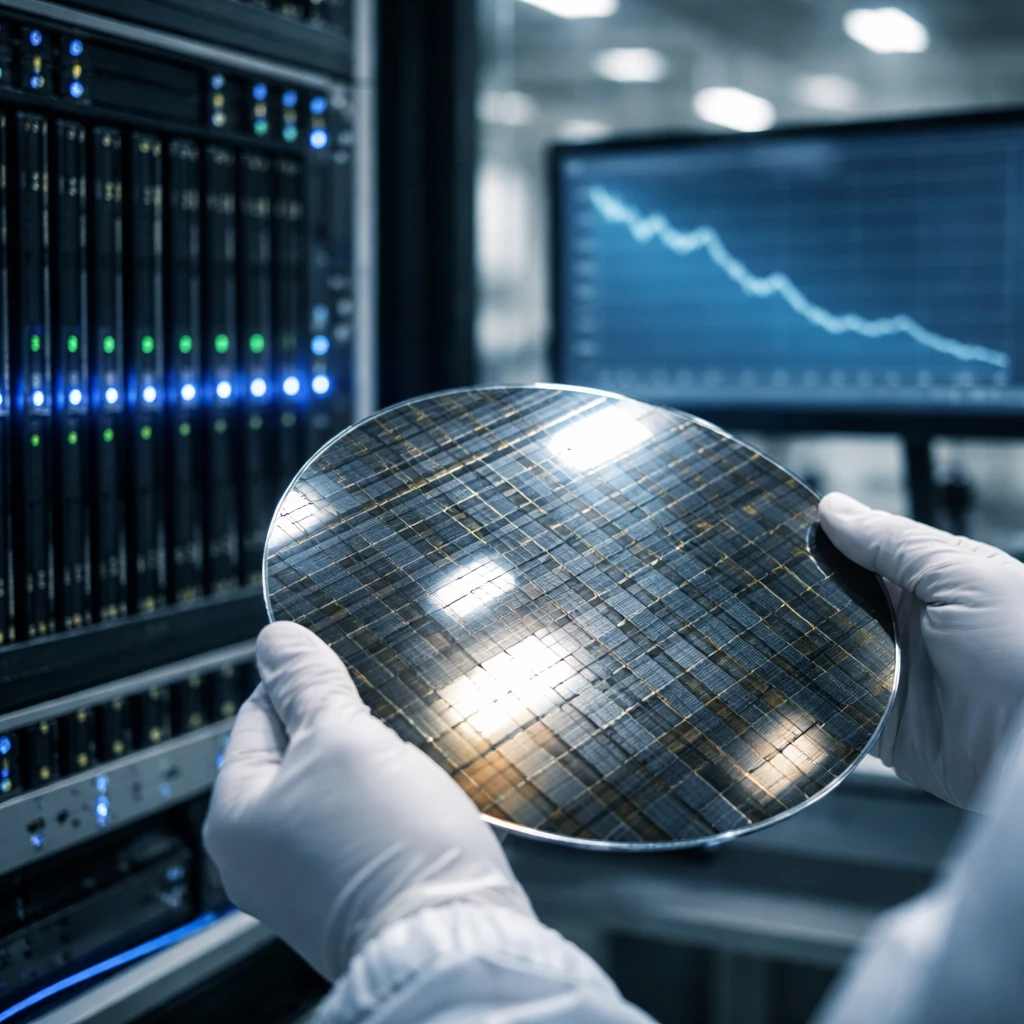

Rakers told investors that AMD’s work on TSMC’s N2 (2nm) process node remains on track. He cited completed tape-out activity and the shipment of Venice EPYC processor samples that use the same N2 process node as the planned MI450-series accelerators. The analyst emphasized the importance of the N2 node to AMD’s next-generation AI accelerator roadmap.

Wells Fargo expects AMD to restate its confidence in the MI450-series timing during the company’s upcoming quarterly earnings report next week. AMD has previously signaled that volume production of the MI450-series is planned to start in the second half of 2026, with the bulk of shipments expected in the fourth quarter of 2026 to customers that include OpenAI and Oracle.

Despite the stock pullback on Friday, Rakers remained constructive on AMD’s outlook, describing the market reaction as a potential buying opportunity. He continues to forecast strong server business results, expecting AMD to report server revenue above $38 billion, and reiterated the company’s stated path toward exceeding $35 billion in data center GPU revenue by 2027.

Context on analysis services mentioned

The article previously referenced AI-driven stock selection services that review companies across financial metrics. That content described tools which evaluate firms monthly and highlighted examples of previous notable returns on some selected names. The inclusion of those service descriptions does not change the factual account of AMD’s stock movement or the analyst commentary outlined above.