Ray Michael Charles, who serves as senior vice president and chief legal officer at Micron Technology Inc (NASDAQ:MU), sold a total of 10,468 shares of common stock in a set of transactions on January 27, 2026. The sales were executed at prices between $401.16 and $415.65 per share, producing aggregate proceeds of $5,025,987.

The disposals were reported in a Form 4 filed with the Securities and Exchange Commission. That filing also shows that after these transactions Charles directly holds 74,675 shares of Micron common stock.

The reported sales were completed pursuant to a Rule 10b5-1 trading arrangement that Charles established on April 21, 2025.

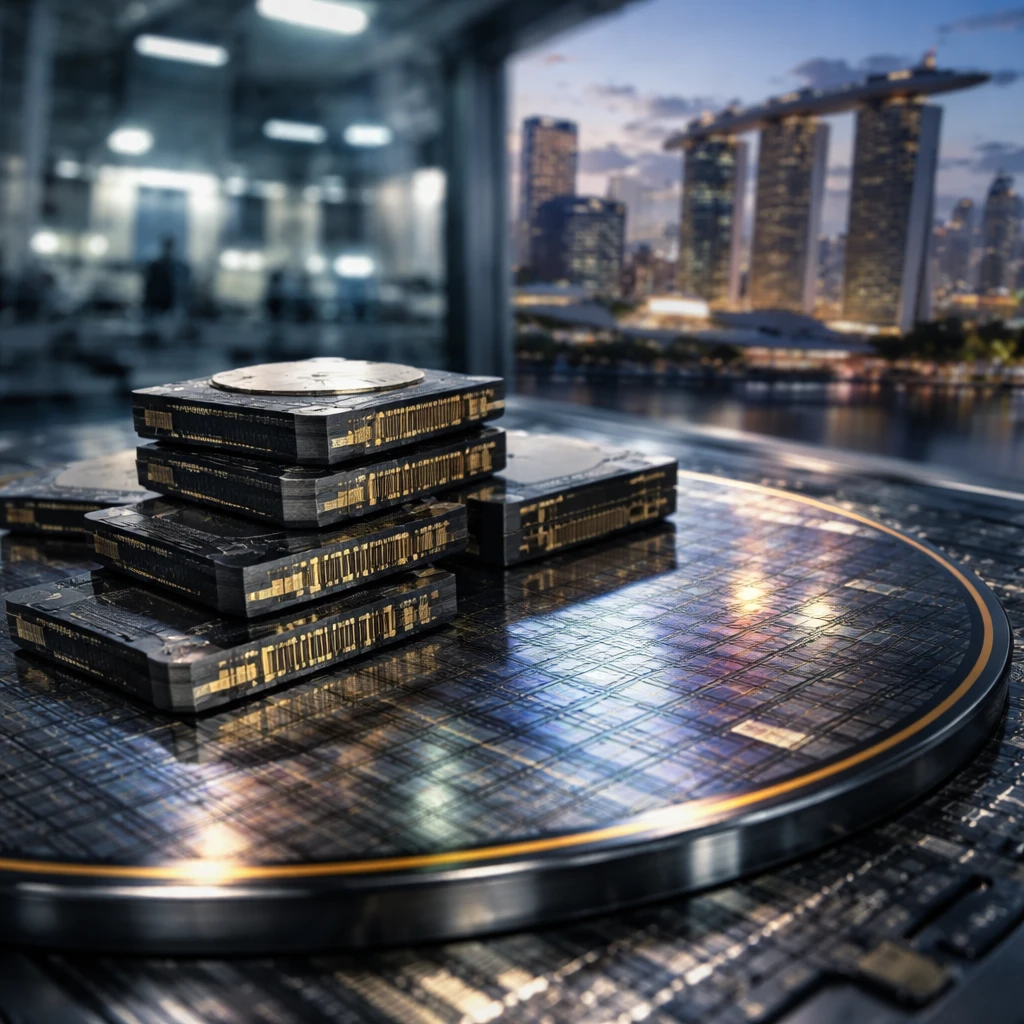

In addition to the insider transactions, Micron is preparing to announce a new investment to expand memory chip manufacturing capacity in Singapore, with an emphasis on NAND flash memory production. The planned capacity move is disclosed alongside a wave of analyst target increases that reflect shifting supply and demand dynamics in memory markets.

Several research firms have upped their price targets for Micron in recent coverage. Mizuho raised its target to $480, citing favorable pricing trends in both the DRAM and NAND markets that the firm expects will bolster Micron’s revenue and margins through 2026. HSBC moved its target to $500, attributing the revision to a rapid rise in DRAM prices. TD Cowen increased its target to $450 and pointed to worsening shortages in the memory market that are affecting industry capital expenditures. Stifel raised its target to $360 and noted that growth in AI cloud infrastructure is absorbing DRAM output and contributing to market shortages.

Taken together, these research actions and the disclosed Singapore capacity plans present a consistent analyst view that Micron is positioned to benefit from improving memory pricing and constrained supply in key product categories. The company’s insider disclosure and the timing of capacity investment plans were both documented in regulatory filings and recent analyst commentary.