The Swiss National Bank pushed back on any suggestion it manipulates the Swiss franc after the U.S. Treasury kept Switzerland on a watch list of jurisdictions meriting closer scrutiny for potential currency management.

In its most recent assessment, the U.S. Treasury said it is expanding monitoring of foreign exchange actions, explicitly including interventions that aim to resist either depreciation or appreciation of a currency relative to the dollar. The Treasury did not level a direct charge of manipulation at any major trading partner, but indicated Switzerland met two of the three technical criteria used to identify potential currency manipulation.

The Treasury report quantified Swiss foreign exchange operations at roughly $7 billion over the 12 months to June 2025 and described those interventions as "relatively modest." That figure and the assessment of criteria are central to why Switzerland remains on the watch list alongside nine other economies, including China, Japan, and Korea.

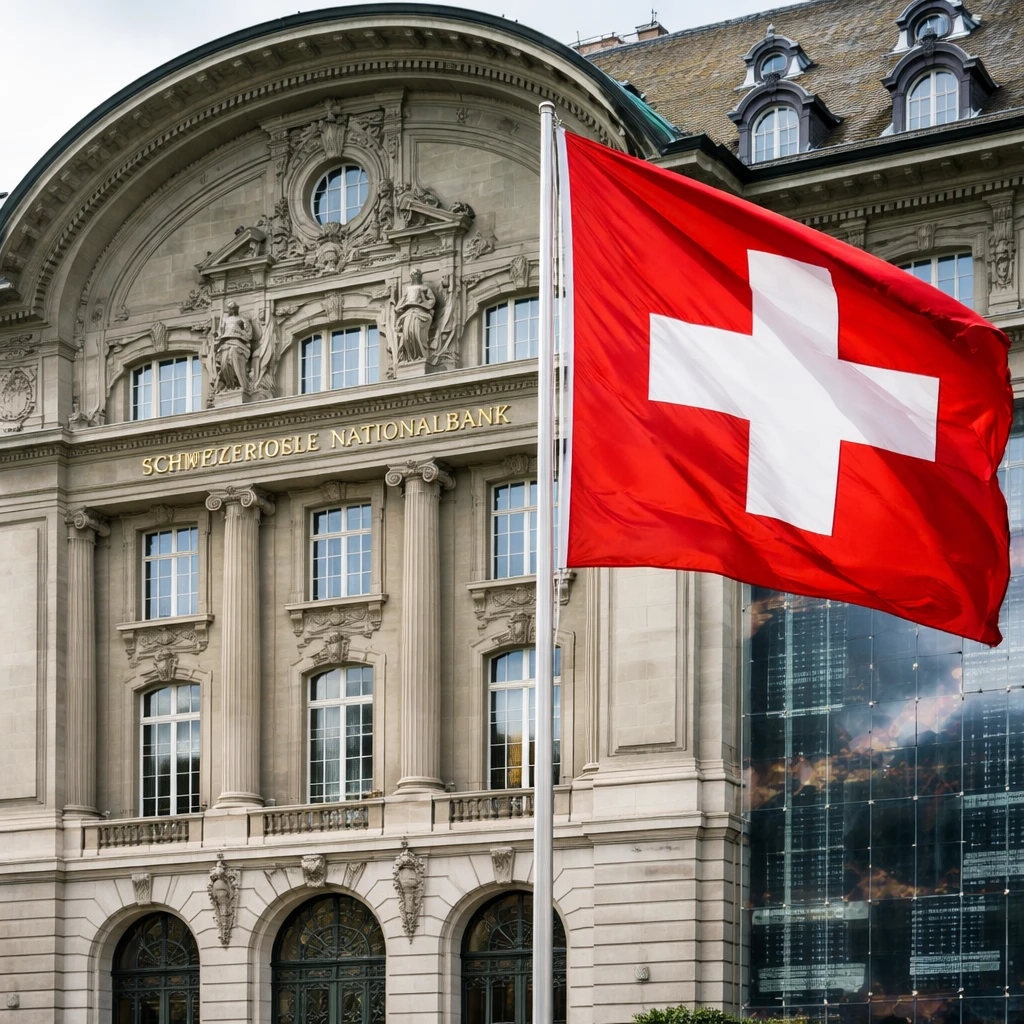

Responding to the Treasury's decision, the SNB issued a direct denial: "The SNB does not engage in any manipulation of the Swiss franc. It neither seeks to prevent balance of payments adjustments nor to gain unfair competitive advantages for the Swiss economy." The central bank emphasized that its policy actions are not intended to obtain trade advantages.

The SNB also said it is continuing discussions with U.S. authorities to explain Switzerland's economic circumstances and the objectives of its monetary policy. In reiterating its position, the bank pointed to a September joint statement in which the U.S. Treasury recognized that foreign exchange interventions can be important for the SNB to achieve its inflation control goals.

Switzerland's placement on the watch list reflects the Treasury's decision to retain a heightened monitoring posture toward a set of countries where certain technical thresholds were met, rather than an explicit accusation of misconduct. The SNB's statement and its ongoing engagement with U.S. officials underscore a diplomatic and technical exchange aimed at clarifying policy intent and economic context.

Background: The U.S. Treasury is intensifying surveillance of foreign exchange behavior, covering interventions that counter both depreciation and appreciation against the dollar. Switzerland met two of three criteria; interventions were estimated at about $7 billion in the 12 months to June 2025 and called "relatively modest."

SNB response: The central bank said it does not manipulate the franc and that it neither seeks to prevent balance of payments adjustments nor to gain unfair trade advantages. It remains in contact with U.S. officials and cited a joint September statement noting the role interventions can play in meeting inflation objectives.