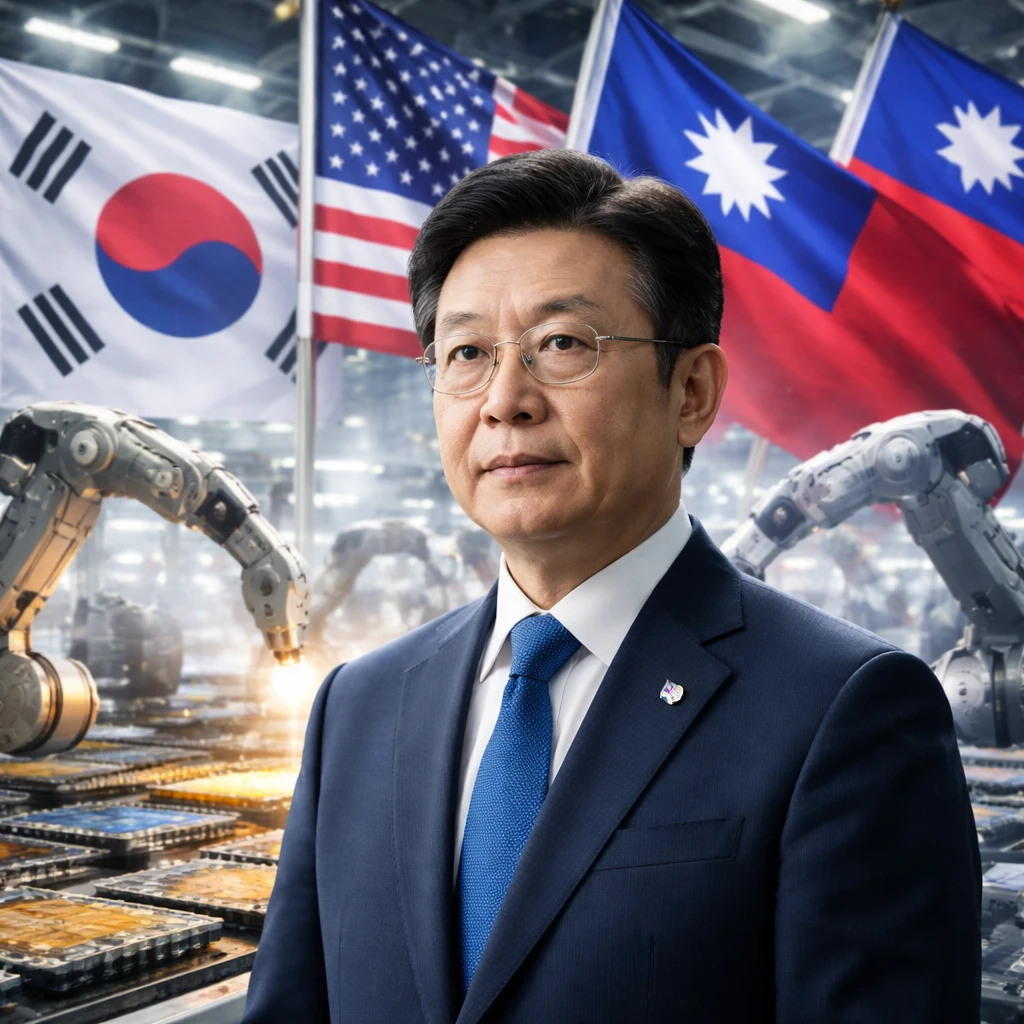

President Lee Jae Myung of South Korea addressed concerns on Wednesday regarding the potential imposition of elevated U.S. tariffs targeting semiconductor imports from South Korean and Taiwanese companies. He indicated that while such tariffs might be considered, they would primarily result in higher prices for chip products in the American market rather than significantly disadvantaging South Korean exporters.

Commerce Secretary Howard Lutnick had mentioned that semiconductor manufacturers from South Korea and Taiwan could face tariffs reaching as high as 100% unless they agree to increase production within the United States. President Lee responded by emphasizing the dominant market role these companies play. Given their control of approximately 80 to 90 percent of the semiconductor market, Lee pointed out that imposing such a tariff would overwhelmingly transfer the cost burden to U.S. consumers through price increases rather than penalizing the manufacturers.

Notably, South Korea’s leading firms, Samsung Electronics and SK Hynix, and Taiwan’s TSMC each hold crucial positions in global semiconductor sectors—Samsung and SK Hynix in memory chips, and TSMC in contract chip manufacturing. Lee also mentioned that South Korea has existing safeguards under its trade agreement with the U.S. designed to prevent its semiconductor companies from falling behind competitors like Taiwan’s due to such tariffs.

Reflecting South Korea’s robust export environment, the nation recorded a record-high total export value of $709.4 billion in 2025, marking a 3.8% increase from the prior year. This growth was buoyed by a significant 22% rise in semiconductor shipments, driven largely by demand in artificial intelligence investments. Chips exported to the United States accounted for 8% of the country’s semiconductor exports totaling $173.4 billion, with China remaining the largest customer, followed by Taiwan and Vietnam.

Turning to currency matters, President Lee commented on the recent weakening of the South Korean won. Authorities anticipate the won will strengthen against the U.S. dollar to approximately the 1,400 level within one to two months. Nonetheless, Lee cautioned that South Korea’s domestic policies alone may not suffice to stabilize foreign exchange markets given the correlation between the won and the depreciation of the Japanese yen. He suggested that, in relative terms, the won’s performance has been better than that of the yen.

Concerning the domestic equity market, Lee noted that despite South Korea’s stock market having experienced a remarkable 76% rise last year—making it the best performer worldwide—it remains undervalued in comparison to its growth.

On the diplomatic front, President Lee detailed ongoing efforts to encourage a resumption of dialogue between North Korea and the United States. He highlighted the utility of a practical approach toward North Korea, emphasizing benefits associated with halting the country's production and exportation of nuclear materials and ceasing the development of intercontinental ballistic missiles (ICBMs). Nonetheless, he expressed skepticism about North Korea completely abandoning its nuclear weapons program, noting the country’s capacity to produce enough nuclear material for 10 to 20 weapons annually.

Despite attempts by Lee and former U.S. President Donald Trump, North Korea has so far declined efforts to rekindle talks, with discussions having stalled since 2019 over issues including sanctions relief and denuclearization measures.

Additionally, Lee stressed the critical importance of maintaining a clear separation between religious institutions and government affairs. He advocated for strict enforcement and punishment against any breaches of this principle. Currently, South Korea’s National Assembly is examining legislation to establish a special prosecutor tasked with investigating the Unification Church’s political involvement, and deliberating whether to extend investigations to the Shincheonji Church of Jesus. Han Hak-ja, head of the Unification Church (now known as the Family Federation for World Peace and Unification), is presently on trial for allegedly attempting to bribe the wife of former President Yoon Suk Yeol and another close associate, charges which Han denies.