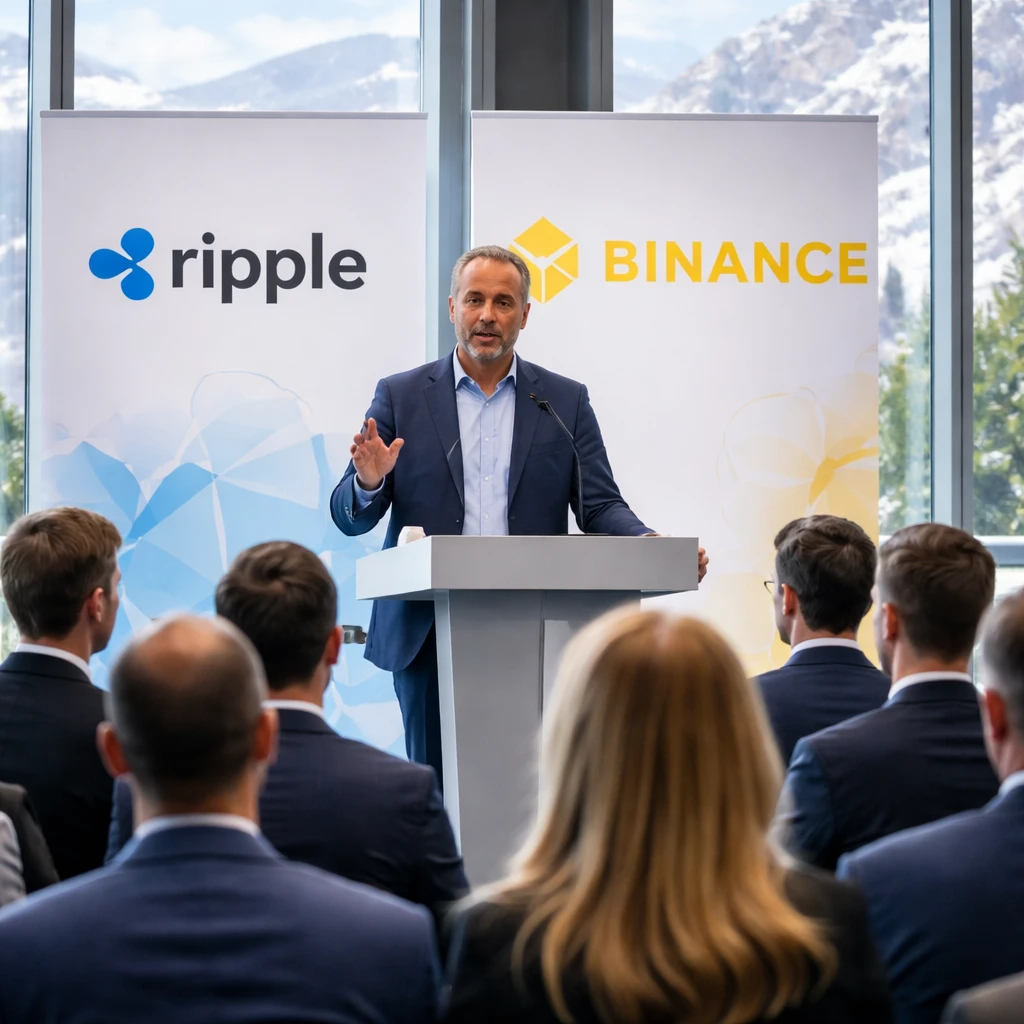

At a recent CNBC forum held in Davos, Brad Garlinghouse, the CEO of Ripple, conveyed strong confidence that Binance—recognized as the world's largest cryptocurrency exchange—will eventually re-establish its presence within the United States.

Garlinghouse highlighted the substantial size of the U.S. market and recalled Binance's previous significant role there in past years. He stated, "It’s a very large market, and not that many years ago, they were a material player." He further explained that Binance's capitalistic and innovative characteristics drive the company to penetrate expanding markets and sustain growth.

Binance withdrew from U.S. operations in 2023, a move coinciding with a $4.3 billion settlement reached with the Department of Justice. This agreement included the company's former CEO, Changpeng Zhao, pleading guilty to criminal allegations tied to inadequate anti-money laundering controls.

Previously on the same day in Davos, Binance co-CEO Richard Teng referred to the U.S. as "a very important marketplace" while signaling that Binance's strategy regarding a U.S. return remains cautious and observational for the time being.

Garlinghouse noted that Binance resuming business in the U.S. might heighten competition and broaden market participation. He remarked that Binance’s global fee structures are generally lower than those currently encountered by U.S. customers, implying that their return could lead to reduced pricing and a positive effect on market accessibility.

Adding context, a Bloomberg article from December indicated that Binance was deliberating its potential U.S. market reentrance. Such developments have broad implications for cryptocurrency exchanges, trading platforms, and digital asset investors considering the competitive environment and pricing trends.