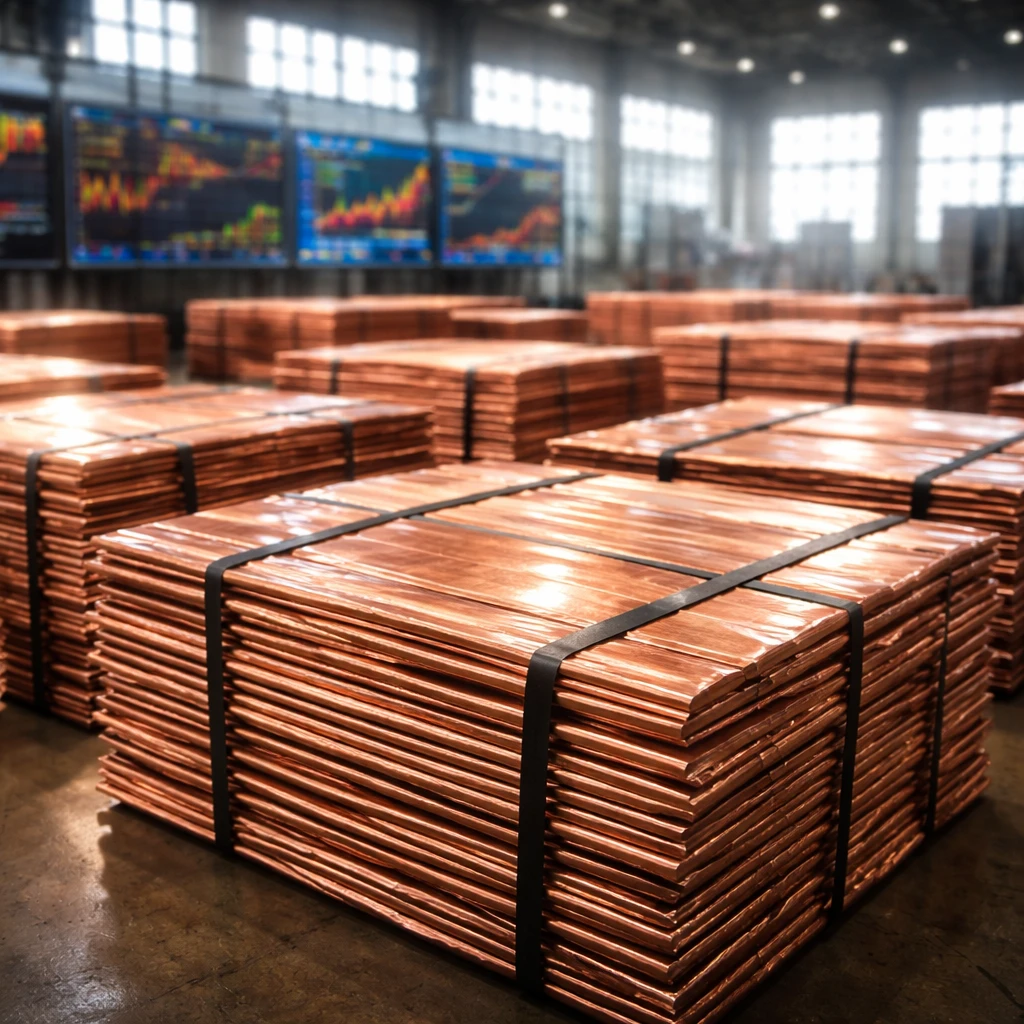

On Wednesday, copper prices rebounded after a steep fall the day before, bolstered by concerns over limited stockpiles beyond the United States, even as market participants remained uncertain about whether demand can sustain this momentum. The benchmark three-month copper contract on the London Metal Exchange (LME) rose by 0.4%, reaching $12,796 per metric ton as of 1700 GMT, recovering from a 1.6% loss recorded the previous Tuesday. Notably, the metal had touched an all-time high of $13,407 just a week earlier.

Neil Welsh, who oversees metals at Britannia Global Markets, commented that despite ongoing volatility in the broader base metals sector, inherent supply limitations continue to support price levels. Illustrating the intensity of current supply-demand dynamics, the premium for immediate copper delivery over the three-month forward contract surged above $100 per ton on Tuesday. However, this indicator reversed to a $23.50 per ton discount on Wednesday, signaling fluctuating immediate demand.

Market analysts expressed reservations about the sustainability of the recent price resurgence. Dan Smith, managing director at Commodity Market Analytics, highlighted nervousness stemming from global geopolitical maneuvers, particularly in light of U.S. President Donald Trump's warnings about imposing tariffs on European allies in relation to Greenland. Smith described the mid-morning 1.6% rise in copper prices as possibly short-lived, with his trading algorithms advising a sell position.

China, the preeminent global consumer of copper, also shows signs that elevated prices are tempering demand. The Yangshan copper premium, a key indicator of Chinese appetite for imported copper, fell to its lowest level in nearly a year and a half at $22 per ton. Though China's macroeconomic conditions appear robust, Smith noted that excessively high copper prices risk undermining consumption levels if unchecked. Supporting this, China exported 96,000 tons of refined copper in December — a drop of approximately one-third from the previous month's record shipments, although still over five times the volume from the prior year.

Other metals displayed varied performances on the LME. Tin prices surged by 3.9% to $51,000 per ton, influenced in part by regulatory action against illicit mining activities in Indonesia. Nickel advanced 2.3%, reaching $17,995 a ton. Meanwhile, aluminum modestly gained 0.5% to $3,124, zinc edged up 0.2% to $3,178.50, and lead decreased by 0.2% settling at $2,024.