Overview

Wolfe Research increased its price target on Corning Inc. (NYSE:GLW) to $130.00 from $100.00 and retained an Outperform rating after the companies disclosed a significant supply relationship with Meta. Wolfe's action follows its analysis of a multiyear agreement that it values at up to $6 billion for fiber, cabling, and connectivity solutions.

Revenue impact and deal sizing

According to Wolfe Research's read of the announcement made Tuesday, the Meta arrangement is sizable enough to more than double Corning's annual sales to Meta - up from an estimated $400 million per year to roughly $1 billion per year. Wolfe frames the potential agreement as a material demand source for Corning's optical business and a catalyst for raising the firm's price target.

Manufacturing and risk mitigation

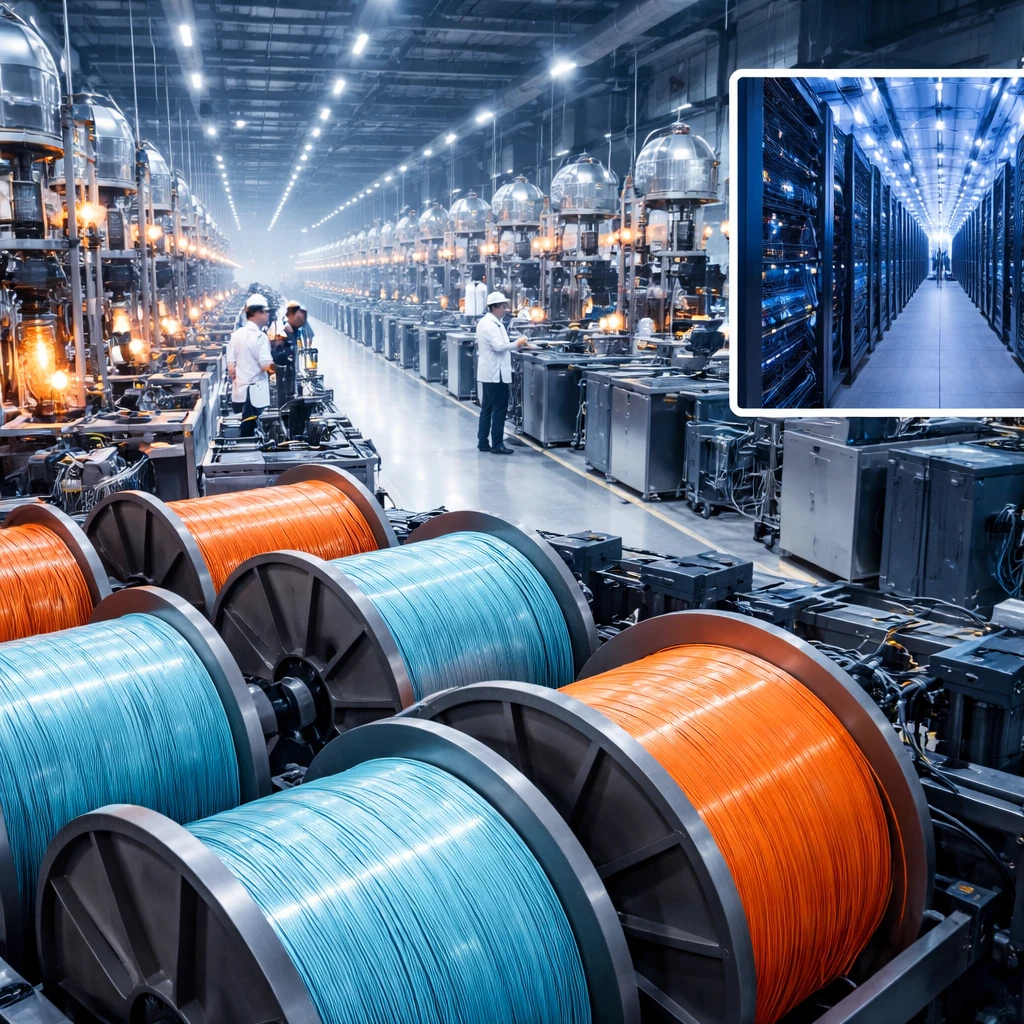

Wolfe also highlighted how Corning is structuring customer relationships to lower expansion risk in its fiber production. The research note indicates Corning is seeking contractual protections such as take-or-pay provisions, customer-funded capital expenditures, or customer deposits tied to manufacturing capacity builds.

Other customers and returns expectations

Wolfe pointed to Microsoft as another plausible candidate for comparable arrangements, noting an existing collaboration with Corning on Hollow Core Fiber. The research firm reported that Corning targets operating its Optical segment at a mid- to high-teens return on invested capital, with incremental investments expected to generate returns in the 20s.

Q3 2025 results and market reactions

Corning reported third-quarter 2025 results showing adjusted earnings per share of $0.67, marginally above Wall Street's $0.66 projection. Revenue for the quarter reached $4.27 billion versus an expected $4.24 billion. In the wake of the Meta agreement, Corning said it will support expanded manufacturing in North Carolina, where Meta will be a key customer under the multiyear supply arrangement.

Following the announcement, select brokerages updated their stances. Mizuho reiterated an Outperform rating and kept a $97 price target, while UBS raised its target to $109, citing robust growth in Corning's optical segment as data center demand expands.

Valuation context

The shares have already delivered a pronounced run: Corning stock has gained roughly 95% over the past year and was trading at $110.63 at the time of the report. That level sits well above InvestingPro's Fair Value estimate, a contrast Wolfe's upgrade notes alongside the positive business developments.

Implications

The combination of a large customer commitment, contractual protections tied to capacity builds, and the potential for additional hyperscaler relationships underpin Wolfe's more bullish financial outlook for Corning's optical business. At the same time, independent valuation measures referenced in the note suggest the shares may be trading at a premium to fair value despite the operational momentum.

Key takeaways

- Wolfe Research increased Corning's price target to $130 from $100 and maintained an Outperform rating following a sizable supply arrangement with Meta.

- The deal is analyzed as potentially up to $6 billion and could raise Corning's annual revenue from Meta from about $400 million to roughly $1 billion.

- Corning reported Q3 2025 results topping estimates, and other brokerages have adjusted their targets and ratings in response to optical segment momentum.

Risks and uncertainties

- Valuation risk: Despite the commercial gains, the stock's approximate 95% year-over-year rise and trading level above InvestingPro's Fair Value estimate suggest possible overvaluation in the market - a risk for equity investors in industrials and materials sectors.

- Execution and financing risk: Corning's approach to de-risking fiber capacity with take-or-pay terms, customer-financed capex, or deposits indicates dependency on contractual execution and customer funding - relevant to manufacturing, supply-chain, and capital-intensive segments.

- Customer concentration risk: A multiyear, large-scale relationship with a major data center operator makes Corning's optical growth sensitive to the customer's deployment plans and data center demand cycles, affecting the telecom and data center supply chains.