UBS adjusted its price target for Intel Corporation (NASDAQ: INTC) upward to $52 from its previous recommendation of $49, while maintaining a Neutral stance on the stock. This adjustment follows a remarkable 151.8% rise in Intel’s share price over the last 12 months, including a notable 15.7% gain just in the previous week. Analysis from InvestingPro highlights that the current relative strength index (RSI) positions Intel as overbought, suggesting the stock might be trading above its intrinsic fair value.

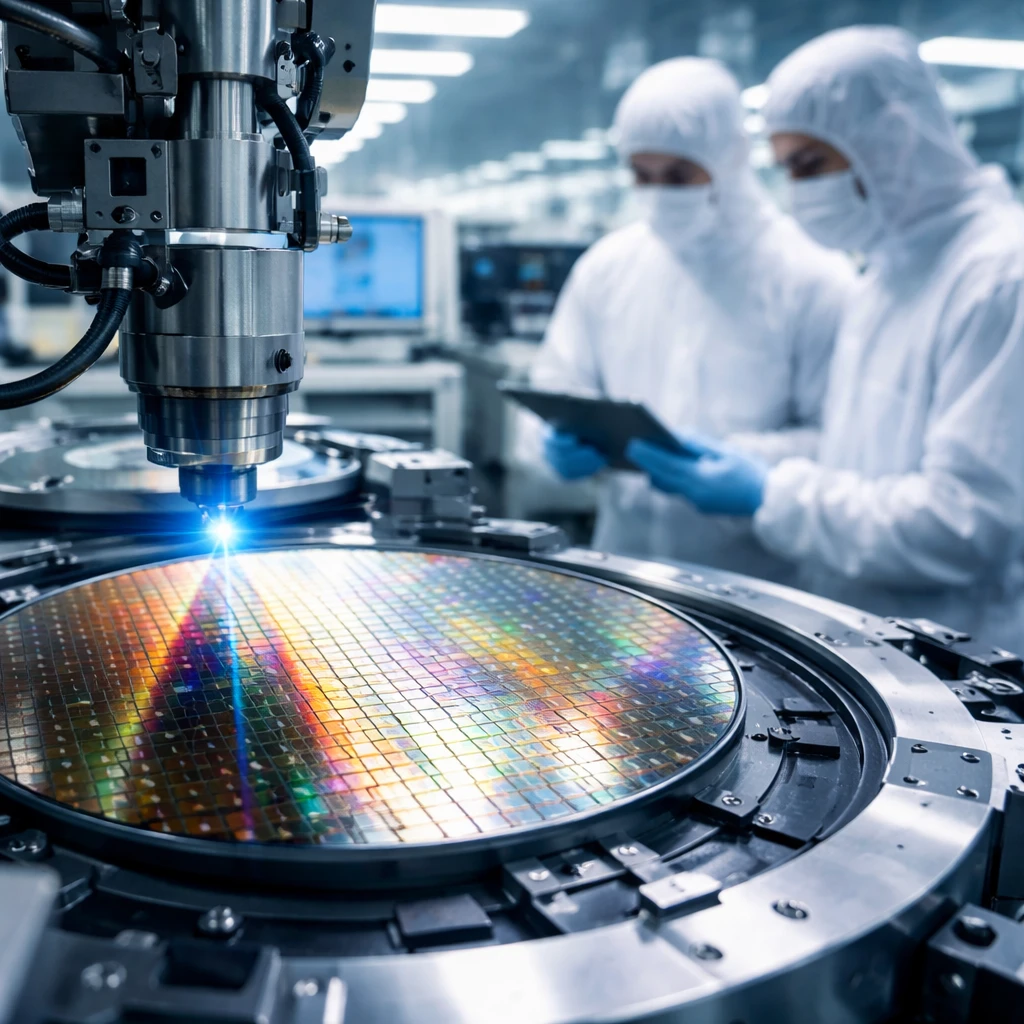

UBS flagged production capacity constraints that Intel is currently facing, particularly in the first quarter. These limitations hamper the company's ability to meet growing demand for server CPUs. IBM’s server shipments mainly consist of Sapphire Rapids and Emerald Rapids processors, both fabricated using Intel 7 technology, which is confronting inherent challenges related to manufacturing yields.

Concerns voiced by UBS include Intel's potential to miss substantial AI-driven growth in the server market due to these supply bottlenecks and worsening structural disadvantages in comparison to competitor AMD. Additionally, while improvements in Intel’s personal computer product roadmap are evident, the overall PC market is projected to contract this year, exacerbated by high memory prices, reducing the potential positive impact.

Financially, Intel continues to generate profits with $53.4 billion in revenue over the last twelve months, though this figure reflects a slight 1.5% decline during the period.

UBS’s increased price target reflects a heightened expectation that Intel will finalize external foundry agreements later this year, following the anticipated launch of its 14A production design kit. Target customers referred to include major players such as Nvidia, Apple (notably for its M-Series chips), Amazon, and potentially a high-end consumer technology product.

However, UBS remains prudent regarding Intel’s earnings capacity. Approximately 50% of additional profitability is expected to be allocated to funds Apollo and Brookfield due to existing financing contracts. The transition to the 18A process technology is projected to improve foundry margins but may exert pressure on product-specific margins.

Intel's recent quarterly report revealed strong fourth-quarter results, with revenues reaching $13.7 billion and adjusted earnings per share at $0.15, both exceeding analyst estimates of $13.4 billion and $0.08 respectively. A significant contribution to this performance came from Intel’s Data Center and AI segment.

Following these developments, Stifel elevated its price target to $42 while retaining a Hold rating, Benchmark increased its target to $57 and maintained a Buy rating, and Truist Securities raised its price target to $49, emphasizing robust Data Center and AI revenue streams.

Conversely, Intel’s forecast for the first quarter fell short of consensus expectations due to ongoing supply shortages and high operating costs. Bernstein preserved its Market Perform rating with a $36 target, recognizing strong quarterly results but pointing to supply obstacles. TD Cowen kept its Hold rating with a $50 target, noting that recent stock market gains were driven more by future anticipation than current operational fundamentals.

These varying analyst perspectives illustrate a complex sentiment surrounding Intel’s stock, despite the company’s recent operational successes and strategic initiatives.