Raymond James has updated its valuation on Intuitive Surgical (NASDAQ:ISRG), increasing its price target from $603 to $615, while affirming an Outperform rating on the company known for its robotic surgical systems. This revised price target implies a potential upside relative to Intuitive Surgical’s then-current share price of $525.81. However, according to InvestingPro metrics, the stock is trading above what is considered its Fair Value, supported by a high price-to-earnings (P/E) ratio of 69.6.

The adjustment comes in the wake of Intuitive Surgical’s fourth-quarter financial results, which the investment firm recognized for better-than-anticipated profitability and earnings, surpassing earlier company pre-announcements. The firm underscored Intuitive’s sustained strong gross profit margin at 66.38%, alongside an impressive 22.18% growth in revenue over the past year.

Additionally, Raymond James noted that Intuitive Surgical is offering enhanced transparency regarding its ION robotic-assisted platform and articulated more clearly the expanding prospects for its refurbished Xi surgical systems (referred to as Xi-R) in ambulatory surgery centers and international territories. This increased disclosure has prompted the firm to revise upwards its financial forecasts for Intuitive Surgical, reflecting expectations for continued growth.

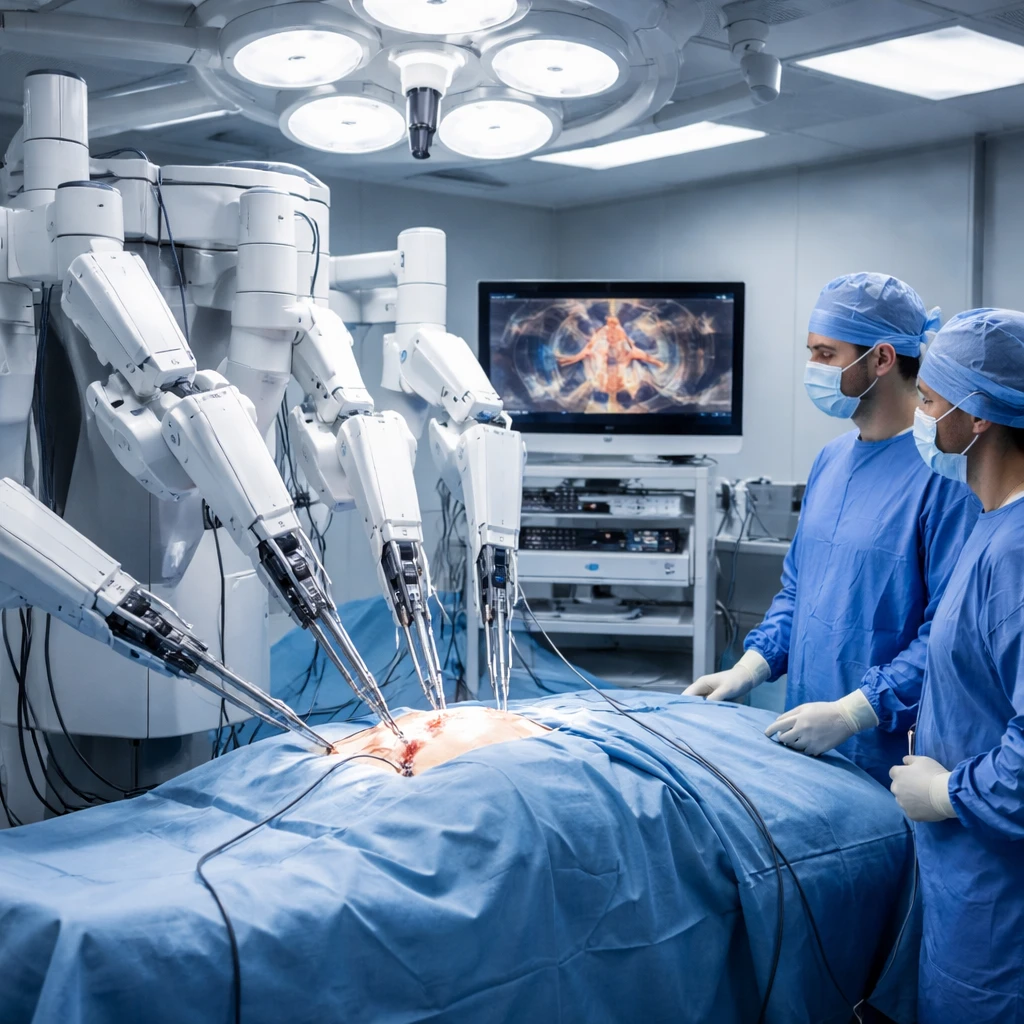

The analyst continues to see the introduction of the da Vinci 5 (dV5) robotic system as a compelling investment theme underpinning the positive rating. The momentum was further supported by Intuitive Surgical’s Q4 2025 earnings report, where earnings per share (EPS) of $2.53 significantly beat the consensus estimate of $2.26. The company also outperformed in revenue, registering $2.87 billion versus the $2.75 billion projected, marking a 19% year-over-year revenue increase with approximately 20% growth in systems revenue.

Significantly, the company reported over 300 da Vinci 5 system placements in the quarter, a 26% jump from the previous quarter, highlighting strong adoption of the new generation surgical system.

Following these results, other analysts have adjusted their outlooks as well, each reflecting alternative perspectives on the company's trajectory. Bernstein SocGen Group raised its target price to $750 and kept an Outperform stance, optimistic following Intuitive’s quarterly performance. Conversely, Evercore ISI trimmed its price target to $550 but maintained an “In Line” rating, reflecting a more cautious view despite the company’s strong Q4 results.

It is notable that Intuitive Surgical made a $70 million contribution to the Intuitive Foundation, which lowered earnings by an estimated 15 cents per share. Despite this, the company delivered a 14% increase in EPS, surpassing consensus expectations by 12%.