Overview

Piper Sandler has reiterated an Overweight rating and a $500.00 price target on Tesla (NASDAQ:TSLA) in the wake of the company's fourth-quarter earnings call. The research firm described the call as "fascinating," drawing attention to a set of strategic moves that position Tesla farther into autonomous mobility and robotics development.

Strategic shifts highlighted on the call

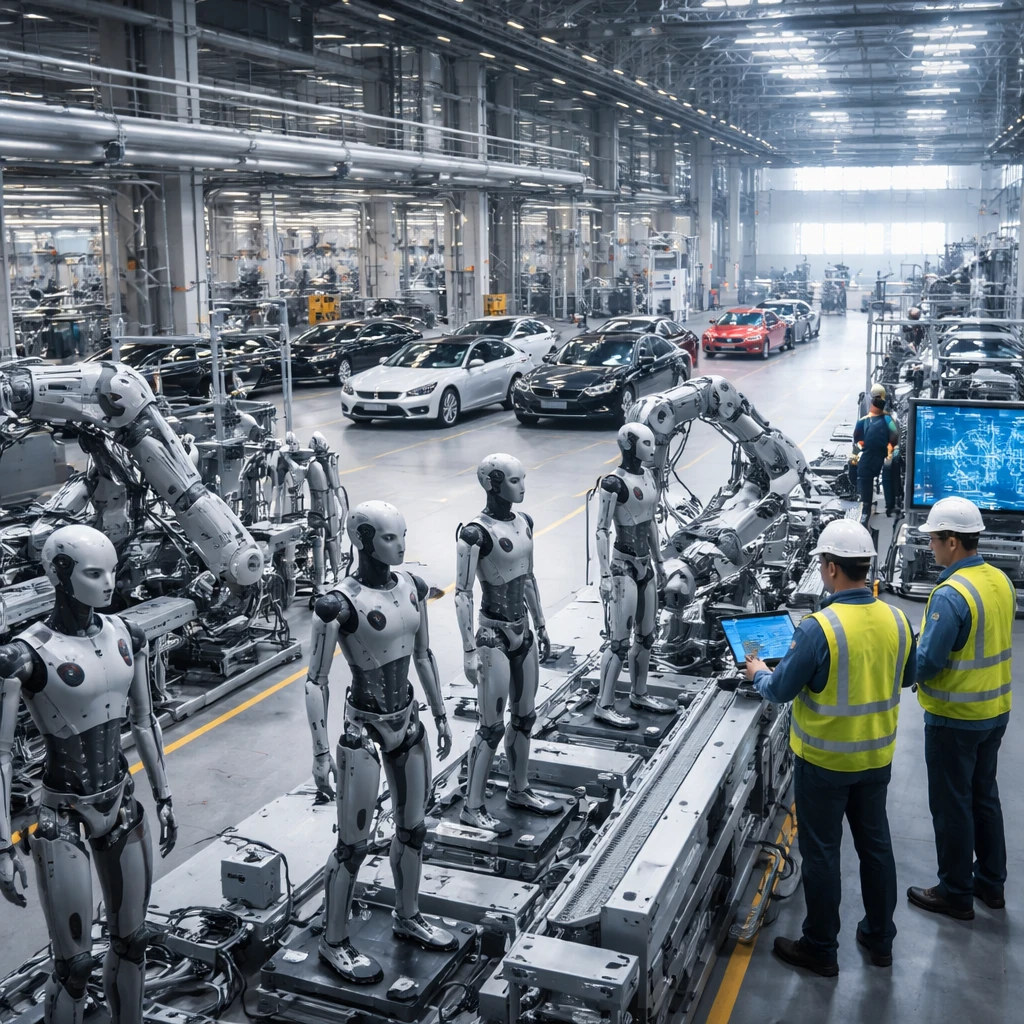

During the call, Tesla formalized a pivot that shifts emphasis toward Full Self-Driving (FSD) subscriptions and humanoid robotics. Management said it will discontinue the Model S and Model X product lines and repurpose the manufacturing space previously dedicated to those vehicles for humanoid robot production. That decision was presented as part of a broader refocus on autonomous capabilities and robotic platforms.

Capital allocation and balance sheet context

Tesla outlined an ambitious capital expenditure plan for 2026 amounting to $20 billion. Piper Sandler and other analysts noted that this figure is roughly double Tesla's typical spending level and represents approximately 44% of the company's current cash balance as reported. InvestingPro data cited in the reporting shows Tesla holds more cash than debt and carries a current ratio of 2.07, indicating its liquid assets exceed short-term obligations.

Autonomous vehicle and robo-taxi expansion targets

On the operational front, Tesla set an aggressive timeline for scaling its autonomous vehicle fleet. The company said it is targeting monthly doubling of its robo-taxi fleet, which it currently reports at 500 units, and aims to introduce robo-taxi services in seven additional cities within the next five months. The presentation placed clear emphasis on growing recurring-revenue streams through FSD subscription disclosures.

Analyst reaction and market implications

Piper Sandler noted that the initial market response to the announcements could be muted in the near term. Still, the firm expressed a view that Tesla's shares could appreciate by year-end if the company achieves even half of its stated objectives. This assessment sits alongside a range of analyst estimates: InvestingPro data referenced a spread of price targets for Tesla from $130 to $600, and it was reported that 10 analysts recently raised their earnings expectations for the upcoming period.

Other broker notes

The discussion of Tesla's strategic direction has prompted varied responses across the sell-side. UBS lifted its target to $352 while retaining a Sell rating, citing the company's plan to double capital expenditures to roughly $20 billion in 2026 in support of artificial intelligence ambitions. Canaccord Genuity adjusted its price target to $520 from $551 and kept a Buy rating as it revised its valuation model based on updated 2028 earnings estimates. Barclays reiterated an Equalweight rating with a $360 target, calling the planned phase-out of the Model S and Model X symbolically important even though those models are projected to represent only 2% of Tesla's volume in 2025.

Additional firms also maintained previous stances: Needham held its rating at Hold while recognizing disciplined execution in Tesla's core auto business and progress in AI initiatives; Oppenheimer reiterated a Perform rating and pointed to ongoing investments in a vertically integrated supply chain that it expects will require several years to fully implement.

What this means for markets and stakeholders

The combination of a large near-term capital program, a shift toward recurring-revenue products such as FSD subscriptions, and a drive into robotics raises distinct considerations for investors, suppliers and service providers across automotive manufacturing, AI development and supply chain operations. Piper Sandler’s view that partial delivery on these plans could still support share appreciation underscores how the investment community is weighing execution risk against the potential upside of Tesla’s strategic redirection.

Note: This article presents the details and analyst responses as conveyed on the Q4 call and in subsequent analyst commentary. It does not introduce additional facts beyond those reported during the call and in the analyst notes.