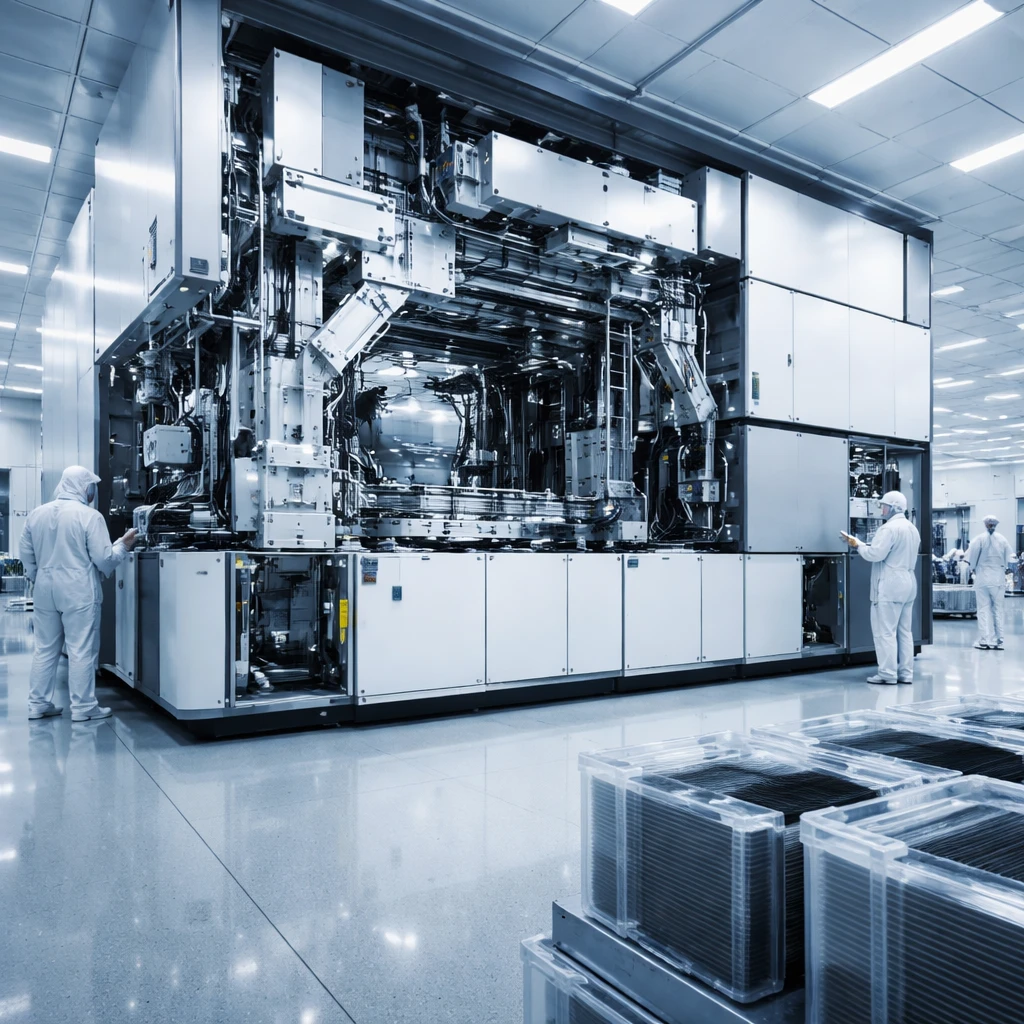

Stifel Lifts Lam Research Target to $280 Citing Strong WFE Outlook

Stifel raised its price target on Lam Research to $280 from $250 and kept a Buy rating after the company reported stronger-than-expected fiscal results and guidance. Lam posted robust revenue and growth metrics, and management projects industry wafer fabrication equipment (WFE) spending of $135 billion in calendar 2026. Multiple brokerages have inc…