JPMorgan recently updated its outlook on Intel Corporation (NASDAQ: INTC), raising the price target to $35 from $30. Despite this increase, the firm maintains an Underweight rating on the stock. Intel’s shares, trading at $54.32, currently exceed JPMorgan’s adjusted target and hover just below their 52-week high of $54.60, as indicated by InvestingPro data.

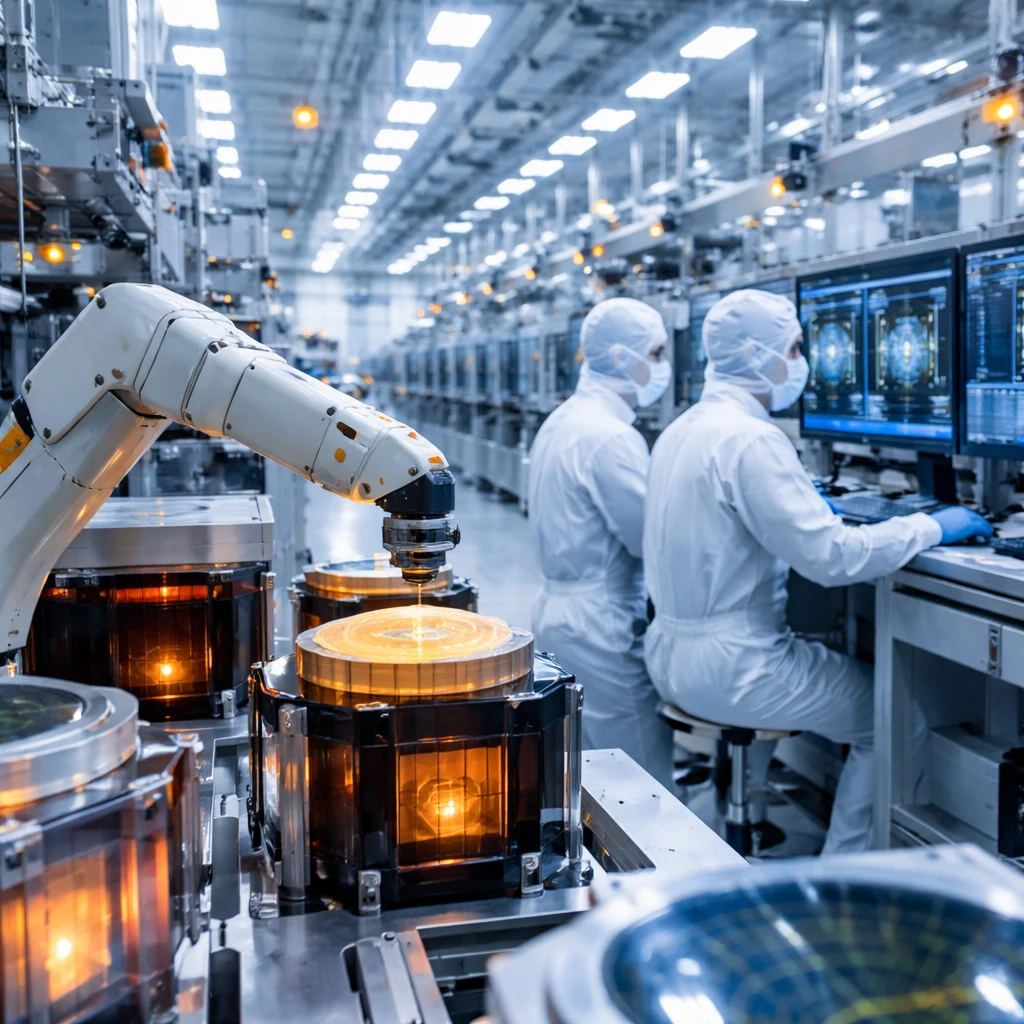

The investment bank attributes Intel’s solid performance to heightened demand for server central processing units (CPUs), an area where Intel has faced challenges meeting demand due to limited internal wafer fabrication capacity. These supply constraints are expected to begin easing in the second quarter, driven by Intel's strategic reallocation of wafers from its Client Computing Group to serve its Data Center and Artificial Intelligence segment, alongside ongoing improvements in manufacturing yields.

This transition occurs amid impressive market returns for Intel, with InvestingPro noting a 151.8% price appreciation over the past year and a 131.3% increase within the last six months. JPMorgan highlighted that to address evolving demand, Intel is streamlining its server CPU product roadmap, concentrating on its premium Diamond Rapids and Coral Rapids offerings and accelerating product launches to counteract potential market share erosion to AMD.

Conversely, the outlook for Intel’s Client division appears more restrained. Supply shortages affecting memory and storage components are anticipated to hamper growth in the personal computer (PC) sector. As a result, JPMorgan forecasts Intel’s overall revenue to grow in the low-to-mid single-digit percentages year-over-year by 2026, with increased server CPU sales offsetting declines in client segments.

Gross margins at Intel are expected to improve gradually through 2026, aided by rising sales volumes and enhancements in 18A technology yields. However, JPMorgan projects these margins to barely reach 40% by the end of that year. InvestingPro analysis points to Intel currently being overvalued relative to its Fair Value estimates, with a notably elevated price-to-earnings (P/E) ratio of 1200 and an enterprise value to EBITDA (EV/EBITDA) multiple of 27.15.

JPMorgan also recognized the potential for improvement within Intel’s Foundry business, particularly in advanced packaging and emerging process nodes. Nevertheless, the firm expressed reservations about further market share losses in Intel’s product lines and questioned the traction of Intel’s external foundry model, which has yet to secure significant customer adoption. Financially, Intel retains a moderate leverage profile with a debt-to-common equity ratio of 0.44, affording some stability as it confronts these operational challenges.

Additional analyst commentary following Intel’s recent earnings reflects mixed sentiment. RBC Capital downgraded Intel’s price target from $50 to $48, maintaining a Sector Perform rating, highlighting a weaker-than-expected forecast for the first quarter of 2026. Contrastingly, Mizuho raised its price target from $41 to $48 despite Intel’s revenue guidance of $12.2 billion falling short of consensus estimates pegged at $13.3 billion. Similarly, Evercore ISI elevated its price target from $41.10 to $45 with an "In Line" rating, citing a combination of mixed quarterly outcomes and guidance slightly under expectations due to persistent supply constraints.

Deutsche Bank lifted its price target from $35 to $45 following a strong fourth-quarter 2025 report, with revenues beating estimates by roughly 3%. The bank noted, however, expected revenue for the first quarter of 2026 to decline by 11% on a sequential basis. Meanwhile, Bank of America Securities reiterated an Underperform rating with a $40 price target, voicing concerns about Intel’s capacity to maintain a robust, profitable competitive position.

These varied perspectives underline an uncertain near-term trajectory for Intel, balancing strong revenues and stock performance against supply challenges and competitive pressures, particularly in the client segment and external foundry initiatives.