Trend following across timeframes is a structured approach that evaluates price trends at multiple horizons and requires those horizons to corroborate one another before a system acts. The central idea is straightforward. A primary trend defines context, an intermediate trend refines that context, and a short-term trend provides timing and risk framing. By stacking these layers, the trader builds a systematic process that is less sensitive to noise on any single timeframe and more consistent with the broader directional state of the market.

Definition and Scope

Trend following across timeframes is a rules-based method for identifying and participating in directional moves that persist across different horizons. It does not try to forecast turning points. Instead, it seeks to confirm that a directional bias is present at a higher level, validate that bias at an intermediate level, and then use a lower level to structure the trade management mechanics. The approach can be applied to many liquid instruments, including equities, futures, currencies, and exchange-traded funds, and it can be adapted to long-only or long-short rule sets.

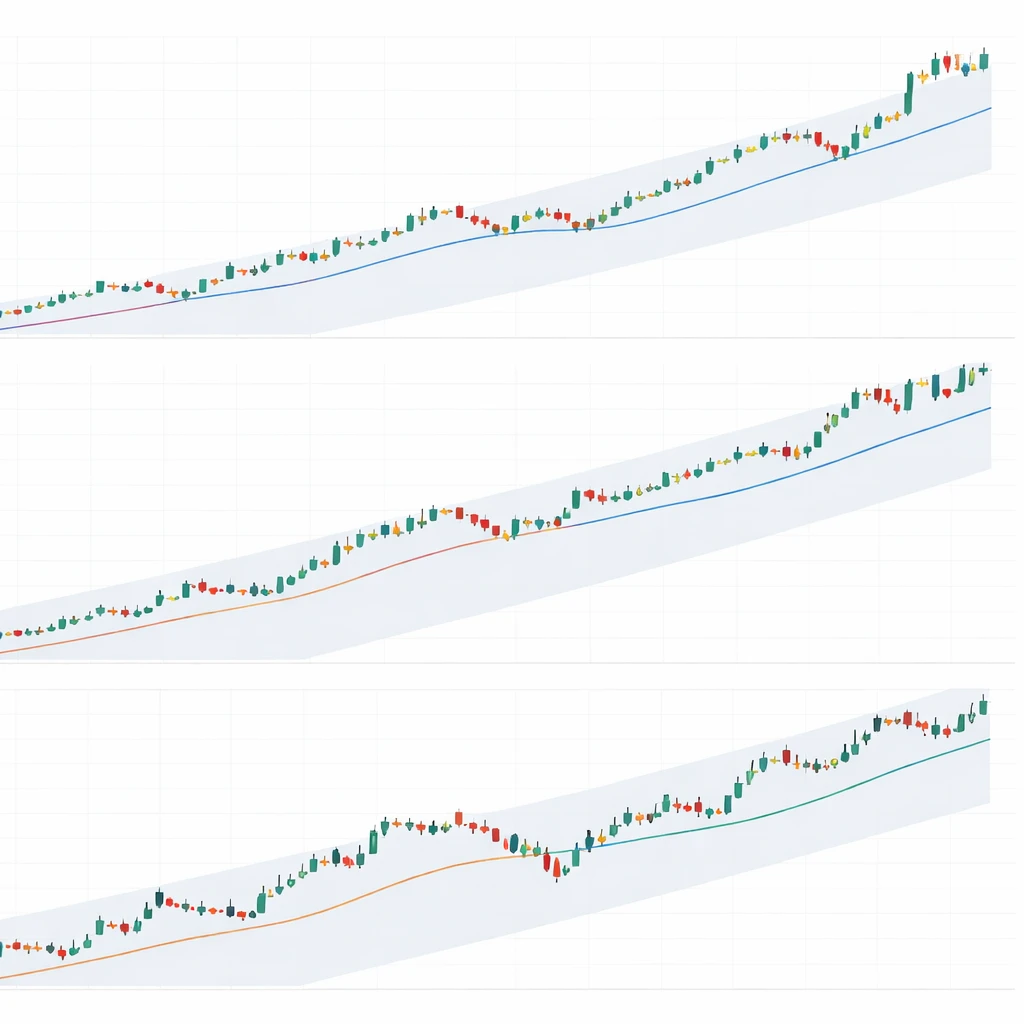

For clarity, consider a three-tier structure. A higher timeframe, such as weekly or monthly, sets the dominant regime. An intermediate timeframe, such as daily, checks that the move is unfolding in a consistent way. A lower timeframe, such as four-hour or one-hour, is used for precise execution and for defining stop distance and position sizing inputs. The exact time intervals are design choices that depend on the market, holding period objectives, and data availability.

Core Logic of Multi-Timeframe Trend Following

Timeframe Hierarchy

The hierarchy separates strategic direction from tactical mechanics. The higher timeframe asks a simple question: is the market broadly advancing, declining, or range-bound. The intermediate timeframe asks whether pullbacks, consolidations, and breakouts are consistent with the higher trend. The lower timeframe focuses on structure and risk definition. This separation limits the influence of lower-timeframe noise on directional decisions and gives the system a repeatable sequence for processing information.

Identifying Trend Conditions on Each Timeframe

Trend conditions can be defined through price structure, moving-average slope, channel behavior, or breakout rules. The key is internal consistency. A system should describe a trend in the same way on every timeframe, even if the parameters differ. For example, if moving averages are used, the higher timeframe might evaluate slope and distance, the intermediate timeframe might require price to remain above a smoothing filter after a retracement, and the lower timeframe might monitor short-term pullbacks within that aligned state. Alternatively, pure price structure can be used, such as a sequence of higher highs and higher lows for uptrends and the opposite for downtrends. Regardless of the method, the logic has to be explicit and testable.

Alignment and Sequencing

Alignment means the higher timeframe signals a trend, and the intermediate timeframe does not contradict it. Sequencing means action on the lower timeframe follows the higher and intermediate cues rather than leading them. A simple template is often sufficient: establish the higher timeframe state, confirm on the intermediate timeframe with a less noisy criterion, and rely on the lower timeframe only for execution and risk framing when the first two conditions are already satisfied. This top-down order is what makes the method systematic and reduces discretion.

Why Multiple Timeframes Improve Structure

Noise Reduction

Any single timeframe can generate misleading signals, especially when volatility clusters or when markets shift from trend to range. By requiring agreement across horizons, the method filters many false indications that occur at the execution level during countertrend fluctuations. If the higher timeframe is flat or conflicting, the method withholds action, which limits exposure to directionless conditions where trend-following rules tend to underperform.

Execution Precision and Risk Control

Even when a trend is strong, entries and exits executed solely on the higher timeframe can have wide risk footprints. The lower timeframe provides local structure for defining approximate distance to recent swing points, volatility estimates, and the cadence of trailing logic. This improves the ability to calibrate position size relative to measured risk without relying on a single, coarse horizon. The result is a more consistent mapping between trend conviction and actual exposure.

Designing the System Components

Market Universe and Data Considerations

Multi-timeframe systems require synchronized data across horizons. The chosen instruments should have sufficient liquidity, stable trading hours, and accessible historical data at all required intervals. When the timeframes cross market sessions, rules for handling gaps, session boundaries, and data stitching need to be explicit. A consistent time zone and holiday calendar should be enforced to avoid alignment errors that create look-ahead bias.

Indicators and Price Structure

Trend definitions should be simple and robust. Moving averages, breakouts, Donchian channels, and higher-highs or lower-lows logic are commonly used because they are transparent and defensible. Complexity can be added through volatility filters or regime switches, but every added rule should be justified by economic logic or by a clear statistical improvement that persists out of sample. It is often beneficial to pair a trend definition with a volatility measure, such as true range, that feeds into position sizing and trailing logic, rather than allowing the trend definition to perform both roles.

Alignment Rules and Tolerances

Alignment rarely means perfect synchronicity across all horizons at all times. Tolerance rules are needed. A typical approach is to treat the higher timeframe state as persistent. Minor countertrend movement on the intermediate timeframe does not immediately negate the bias unless certain thresholds are breached. Likewise, the lower timeframe may fluctuate around a level without implying a change in the strategic view. Building reasonable buffers and minimum-hold conditions reduces whipsaw and forces the system to respect the stickiness of trends.

Action Logic Without Precision Signals

While exact signals are outside scope, the general mechanics are straightforward. When the higher timeframe indicates an uptrend and the intermediate timeframe confirms, the lower timeframe can define a manageable risk window by referencing recent swing structure or short-horizon volatility. If the higher timeframe turns neutral or opposite, the system withdraws that bias, and the lower timeframe is no longer used for trend-following actions. Everything flows from the hierarchy, not from isolated patterns.

Risk Management Considerations

Risk management is central to trend following. Profit distributions are often skewed, with a large share of cumulative return contributed by a small number of extended trends. This shape requires consistent control of losses during non-trending periods and disciplined scaling of exposure when trends are favorable.

Position Sizing

Position size can be linked to measured volatility so that risk, rather than nominal units, is held approximately constant. Volatility-based sizing helps keep losses more uniform when the system is wrong and reduces concentration in extremely volatile regimes. Some systems also adapt size to the degree of multi-timeframe alignment. For instance, full alignment across all chosen horizons can justify regular size within the framework, while partial alignment can imply a smaller default exposure or no action, depending on tested rules.

Risk Framing and Protective Stops

Protective logic should reflect both the trend definition and the timeframe stack. Initial stop distance can be informed by lower-timeframe volatility or by recent swing structure, but the invalidation of the trade idea belongs to the higher timeframe. Trailing logic often benefits from slower instruments, such as a higher-timeframe channel or average, to avoid exiting on routine fluctuations. This decouples short-term noise from the trend thesis. The method requires clarity about when a change on the intermediate or higher timeframe nullifies the setup, as opposed to a simple pullback that is part of a normal trend.

Risk of Correlated Positions

If the system is applied to a portfolio, exposures can cluster. Trends often align across related assets. Risk caps at the sector, factor, or asset-class level can prevent hidden concentration. A volatility target at the portfolio level, combined with correlation-aware scaling, is a practical way to control total risk while allowing individual positions to follow their rules.

Drawdown Control and Regime Shifts

Trend-following systems usually experience drawdowns during range-bound markets and during abrupt regime shifts. Multi-timeframe alignment reduces, but does not eliminate, this risk. A systematic drawdown protocol can pause new actions, reduce risk, or switch to a neutral stance when recent performance suggests that the current regime is unfavorable to trend rules. The key is to define these controls objectively before testing and to evaluate their impact on long-run outcomes.

High-Level Example: Weekly, Daily, and Intraday Workflow

Consider a liquid index future. The system uses a weekly chart to define the dominant regime, a daily chart to confirm the trend and manage pullbacks, and a one-hour chart to structure risk. The weekly level evaluates whether price is above a long smoothing filter with a positive slope, or whether weekly price structure has recorded higher highs and higher lows in recent weeks. The daily level asks whether pullbacks have respected a mid-range filter or a prior breakout level. The hourly level monitors consolidation and local volatility to frame approximate risk distance.

When weekly and daily conditions agree on direction, hourly structure is used to find a window where risk can be defined with modest distance to a nearby structural reference. If the daily chart loses alignment, the system no longer relies on the hourly horizon for trend-following actions. If the weekly chart loses alignment, the entire directional thesis is considered invalid until the higher timeframe restores a trend. No precise prices are required to understand this workflow. The emphasis is on the order of decisions and the separation of roles across timeframes.

Testing and Evaluation

Avoiding Look-Ahead Bias

Multi-timeframe backtests must emulate the causal sequence of information. The higher timeframe signal should be computed only from data that would have been available at the time, and the lower timeframe should not use future bars within a higher bar for decisions. Implementation details matter. For instance, if the weekly state is computed at the close, the system can only treat that state as active after that close is known. Any other treatment inflates historical performance in ways that will not replicate in live conditions.

Transaction Costs, Slippage, and Liquidity

Shorter horizons increase the frequency of actions and sensitivity to costs. Testing should incorporate realistic commissions, spread assumptions, and expected slippage that depend on time of day, volatility, and instrument liquidity. If the lower timeframe is very short, its potential precision can be overwhelmed by friction. Designers often test multiple lower horizons and choose the coarsest interval that retains the intended risk control while keeping costs manageable.

Walk-Forward and Robustness

Parameters chosen on a single historical sample can overfit. A walk-forward procedure or cross-validation over non-overlapping segments helps detect specification risk. Robust systems show similar behavior across nearby parameter values and across different, but related, instruments. Multi-timeframe alignment tends to be more robust than single-horizon rules because it relies on broad features of price behavior rather than on precise thresholds.

Interpreting Performance Metrics

Trend-following performance often features a low to moderate hit rate with a positive payoff ratio. The win distribution can include a few extended runs that dominate results. Evaluation should consider maximum drawdown, time under water, tail dependence with major market moves, and the impact of risk scaling. Since alignment filters reduce trade frequency, average trade metrics may improve while total count declines. The question is whether the risk-adjusted profile, after costs, aligns with the objectives of the system designer.

Practical Pitfalls

Several issues recur when implementing trend following across timeframes. First, parameter proliferation. It is tempting to assign different values to each timeframe and add exceptions. This can increase apparent historical performance while reducing true robustness. Second, mis-specified alignment. If the higher timeframe flips too easily, the system becomes reactive and loses the benefit of trend persistence. If it flips too slowly, the system can remain exposed during clear regime reversals. Third, inconsistent clocking between horizons. Decisions can inadvertently use data from a higher timeframe bar that has not yet completed. Every rule should specify when a bar is considered final and when a state change becomes eligible for action.

Another common pitfall is ignoring market microstructure. Lower timeframes can be affected by opening auctions, lunch-hour illiquidity, or news events. Even if the higher and intermediate horizons are well specified, execution around these microstructure features can generate slippage and variance that invalidates backtests. Explicit windows that avoid poor liquidity or elevated spreads, if justified by evidence, can make outcomes more dependable.

Variations and Extensions

The concept admits many variations. Some systems adapt the number of timeframes based on volatility. In low-volatility environments, a two-level stack may suffice, while in high-volatility environments a third level can improve discipline. Other systems rotate the anchor timeframe by instrument. For broad equity indices, monthly anchors may be appropriate, while for rates or currencies a weekly anchor may be more responsive. Another variation uses a breakout on the intermediate timeframe to trigger eligibility only when the higher timeframe is supportive, while the lower timeframe governs risk and scaling.

There are also approaches that treat alignment probabilistically rather than as a binary state. For instance, the system can compute a trend score on each timeframe and combine the scores into a composite measure with weights that favor the higher horizon. Limits on exposure can then be tied to the composite score. This framework helps unify signals when definitions differ across instruments and allows incremental adjustments without discrete switches that can be sensitive to noise.

Operational Workflow

A disciplined routine supports multi-timeframe systems. The workflow typically includes pre-session evaluation of higher and intermediate timeframe states, a scheduled update when those bars complete, and rule-bound monitoring of the lower timeframe for risk framing. Documentation is valuable. Recording alignment states, any protective levels, and the rationale tied to the rules builds a dataset for later review. Over time, the practitioner can compare realized slippage, holding periods, and volatility estimates to backtested assumptions and refine implementation details while keeping the core logic intact.

Illustrative Scenario Without Signals

Imagine a basket of liquid futures. The system designates weekly as the anchor, daily as confirmation, and one-hour as execution. Over a quarter, the weekly chart maintains a rising structure. The daily chart shows several pullbacks that hold above a mid-term filter. During one such pullback, hourly volatility compresses and then expands, keeping risk estimates within a manageable range relative to the system's sizing framework. The system participates during this window because all three levels align according to the predefined criteria. Later, as the daily chart loses structure and the weekly slope flattens, the system withdraws eligibility and returns to a neutral state until alignment restores.

Integrating Drawdown Protocols

Because alignment reduces trade count, drawdowns can be punctuated by long periods of inactivity. This has psychological and statistical implications. A drawdown protocol can define thresholds for reducing risk or pausing new actions after a sequence of losses or after a decline in a rolling performance metric. These rules should be simple and should not depend on knowledge unavailable in real time. Their purpose is to avoid compounding errors during regimes that are historically unkind to the strategy, such as choppy, range-bound markets where alignment rarely persists.

Documentation and Governance

A multi-timeframe system benefits from written governance. The document should state the purpose of each timeframe, the precise definition of trend at each level, the alignment logic, and the risk protocols. It should also include a change log that records any parameter updates, the reason for the change, and the testing evidence that supports it. Governance reduces ad hoc modifications that often degrade live performance. It also clarifies what constitutes a legitimate improvement versus a cosmetic curve fit.

Expectations and Behavior

Trend-following systems can spend significant time in drawdown even when they are healthy. The multi-timeframe variant trades less frequently than single-horizon strategies. In return, it seeks higher selectivity and cleaner alignment. The trade-off is reduced activity and potentially longer waiting periods. Patience is part of the design. Evaluation should consider whether the realized cadence and holding periods are acceptable for the operational context, including capital constraints, reporting cycles, and oversight requirements.

Bringing It Together in a Repeatable System

Trend following across timeframes becomes repeatable when its components are tightly defined. Each timeframe has a clear role. The higher timeframe diagnoses regime. The intermediate timeframe verifies that the regime is active. The lower timeframe frames risk and handles tactical mechanics. Alignment acts as a gatekeeper. Risk management scales exposure and limits losses. Testing protocols enforce scientific discipline. Documentation and monitoring close the loop by comparing real-world outcomes to expectations. The method remains adaptable across instruments because its logic depends on relative behavior rather than on instrument-specific idiosyncrasies.

Key Takeaways

- Multi-timeframe trend following separates strategy into context, confirmation, and execution layers, which reduces noise and enforces discipline.

- Alignment rules act as a gate, allowing actions only when higher and intermediate horizons agree, while the lower horizon frames risk rather than direction.

- Risk management should link position size and protective logic to volatility and structure, with portfolio-level controls for correlation and drawdown.

- Robust testing requires proper sequencing of information, realistic costs, and walk-forward validation to limit overfitting.

- Expect lower trade frequency and periods of inactivity in exchange for improved selectivity and potentially more stable risk-adjusted outcomes.