Trend following across asset classes is a systematic approach that seeks to participate in persistent price movements in a broad set of markets, including equities, government bonds, commodities, and currencies. The method is rule based, repeatable, and designed to minimize discretionary decisions. It does not forecast economic outcomes. Instead, it reacts to observable price behavior that meets predefined criteria for trend persistence. A well built cross asset trend program aims to diversify sources of return, smooth the path of outcomes, and maintain discipline across varying market regimes.

This article outlines the definition and logic of multi asset trend following, discusses how to structure a repeatable system, addresses key risk management considerations, and provides a high level operational example. It does not include trade recommendations, exact signals, or specific price levels.

Defining Trend Following Across Asset Classes

Trend following is a rules based approach that allocates more capital to assets showing upward price persistence and less, or negative exposure, to assets showing downward price persistence. It can be implemented on a single market, but the cross asset version extends the concept across diverse instruments so that no single market dominates outcomes.

In practice, a trend is defined by sustained directional movement rather than short term noise. While many indicators can capture this behavior, the essence is simple. If prices have been advancing in a sufficiently consistent manner, the system expresses positive exposure. If prices have been declining in a sufficiently consistent manner, the system expresses negative exposure or reduced weight depending on mandate and instrument set. The rules that detect such persistence are fixed in advance, are transparent to the operator, and are applied uniformly across the trading universe.

What Counts as a Trend

Different mathematical tools can point to the same underlying concept of persistence. Common families include moving average based comparisons, breakout criteria relative to past ranges, and slope estimates of smoothed prices. The choice of tool is secondary to the discipline of applying it consistently, avoiding overfitting, and ensuring it is compatible with the liquidity and volatility characteristics of each market.

Why Multiple Asset Classes

Single market trends can be intermittent. By spanning equities, sovereign bonds, commodities, and currencies, the system increases the chance that at least some markets exhibit directional persistence at any given time. For example, commodity prices may trend during supply shocks, currencies may trend around changes in relative monetary policy, and bond prices may trend during extended rate cycles. A portfolio that can express exposures across all of these has a broader set of potential opportunities and lower concentration risk.

The Core Logic of Cross Asset Trend Following

The logic behind trend following rests on three pillars. First, market prices sometimes move in persistent ways because new information is incorporated gradually and because significant participants adjust exposures over time. Second, the strategy does not attempt to predict turning points. It follows price behavior and accepts that entries and exits will lag. Third, breadth across assets and time horizons mitigates the variability of outcomes from any single signal or market.

Persistence and Delayed Reaction

Trend systems accept that the earliest portion of a move is often missed. The aim is to capture the middle of sustained moves while controlling downside during periods of noise. This creates a trade off. The system sacrifices precision in return for systematic discipline and repeatability. Over multiple markets and long horizons, this discipline can convert prolonged directional moves into a diversified return stream.

Time Horizons and Signal Families

Trend can be measured over shorter or longer horizons. Shorter horizons respond quickly but may be more sensitive to noise. Longer horizons respond slowly but may be more robust during choppy periods. Many implementations blend horizons so that the portfolio holds exposures that reflect both recent and intermediate behavior. Signal families may include moving average comparisons, price breakouts relative to prior ranges, or regressions of price on time to estimate slope. Parameters are selected in advance and applied uniformly.

Diversification by Market and Timeframe

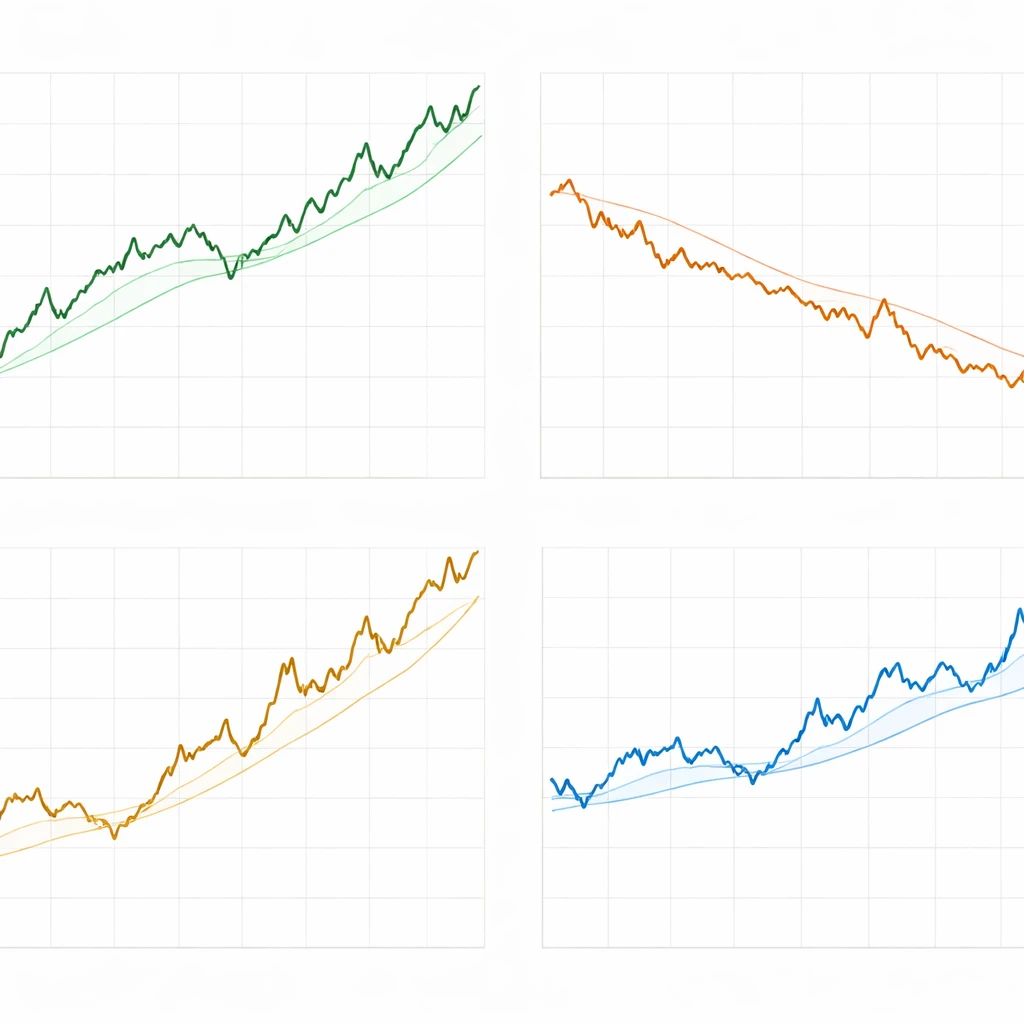

Diversification operates along two dimensions. Across markets, the system allocates to equities, bonds, commodities, and currencies, and often to multiple contracts within each category. Across timeframes, it combines slower and faster trend measures. The combination reduces reliance on any single condition. When equity trends stall, commodity or currency trends may persist, and when fast signals whipsaw, slower signals can stabilize exposure.

Convexity and Behavior in Stress

Trend following often behaves in a convex manner. Losses are bounded by risk limits and cuts in exposure when trends reverse. Gains can accumulate during extended moves. During market stress, correlation patterns frequently shift, and bonds, currencies, or certain commodities can trend strongly. A diversified trend portfolio can behave differently from traditional long only allocations during such periods, though it is not guaranteed to profit and remains subject to its own risks.

Building a Structured, Repeatable System

A robust trend following program is a process. It defines the tradable universe, data standards, signal construction, position sizing, portfolio aggregation, execution, and oversight. Each component is codified and tested before live use, then monitored for drift or degradation.

Universe Selection and Data Standards

The universe typically spans liquid instruments that represent major global markets. Futures contracts, forward FX, and highly liquid exchange traded funds are common choices because they provide efficient exposure and established trading infrastructure. Inclusion criteria often consider liquidity, historical continuity, contract specifications, roll mechanics, and the availability of clean pricing data. Data handling addresses corporate actions for equities, continuous contract stitching for futures, and consistent calendars across regions.

Signal Design at a High Level

Signals translate price history into directional exposure. Without specifying formulae, the process includes selecting a family of trend measures, specifying lookback windows and update frequency, and setting filters to avoid unusually noisy states. Filters may include volatility thresholds, minimum move criteria, or liquidity screens. The key is simplicity and discipline. Overly complex signals are prone to overfitting, while simple signals can remain stable across changing regimes.

Position Sizing and Volatility Scaling

Position sizing attempts to balance risk contributions across markets. A direct allocation by notional value would overweight inherently volatile assets and underweight stable ones. Volatility scaling addresses this by sizing positions inversely to recent volatility so that each market contributes a comparable amount of risk. The scaling measure, such as recent average true range or standard deviation, is pre specified. Leverage can be used at the portfolio level to target a desired risk level, subject to risk constraints and margin requirements.

Portfolio Aggregation and Risk Budgets

After generating preliminary positions, the system aggregates them and applies portfolio level constraints. Typical elements include per market risk caps, per asset class risk budgets, net exposure constraints, and correlation aware adjustments. Some implementations use risk parity concepts to equalize the contribution of asset classes, while others allow exposures to float within guardrails. Correlation models help avoid unintentional concentration, for example simultaneously large positions in highly correlated equity indices.

Rebalancing Cadence and Operational Workflow

Rebalancing determines how often positions are updated. More frequent updates keep the portfolio aligned with signals but raise turnover and costs. Less frequent updates reduce costs but introduce tracking error to the intended signal. A practical workflow includes scheduled data checks, signal calculation, pre trade risk assessment, order generation with size caps and price impact controls, and post trade reconciliation. Documentation and audit trails are part of a professional process.

Risk Management Considerations

Trend following does not eliminate risk. It reshapes it. A structured program makes risks explicit, measures them, and constrains them within predefined limits. The following considerations are central.

Market Risk and Drawdowns

All trend systems experience drawdowns. Losses commonly arise in range bound markets where signals whipsaw. They can also arise when trends reverse suddenly. Drawdown controls include per position risk limits, portfolio level loss thresholds, and exposure caps. Some teams monitor realized drawdown against historical expectations to detect unusual conditions that may warrant a formal review of the system.

Whipsaw and Regime Shifts

Whipsaw is the sequence of small losses that occur when price oscillates without direction. While unavoidable, its impact can be mitigated through diversification across markets and timeframes, modest filters that suppress signals during extreme noise, and careful transaction cost management. Regime shifts, such as transitions from low volatility to high volatility environments, can require recalibration of risk targets, although the core signal logic remains unchanged in disciplined implementations.

Liquidity, Slippage, and Capacity

Implementation quality directly affects realized performance. Illiquid instruments can amplify slippage and widen bid ask spreads. Capacity limits may be reached when order sizes become large relative to average daily volume. Pre trade liquidity checks, participation rate caps, and the use of volume weighted execution schedules can reduce impact. For futures, contract rolls should be planned to balance roll yield, liquidity in the front versus next contracts, and calendar constraints.

Leverage, Margin, and Financing

Because position sizes are volatility scaled, the portfolio may employ leverage to reach a target risk level. Leverage introduces constraints related to margin, financing costs, and potential funding stress during adverse moves. Systems should specify margin buffers, stress test leverage under historical shocks, and track financing costs as an explicit component of expected returns.

Model Risk and Parameter Robustness

Model risk arises when rules perform poorly out of sample because they were tuned to idiosyncrasies in historical data. To mitigate this, designers prefer simple rules, out of sample testing, and cross validation across markets and periods. Ensembles that blend related signal variants can reduce dependence on any single parameter. Stability checks monitor whether live performance remains consistent with pre launch expectations when adjusted for realized costs and volatility.

Correlation Breakdowns and Concentration

Correlations vary through time. During stress, assets that usually diversify one another can move together. Portfolio construction should incorporate correlation estimates but avoid over reliance on any single estimate. Limits on sector, region, or factor concentration can help prevent overexposure to a single theme, such as a broad growth equity trend, that surfaces across multiple indices.

Operational and Implementation Risk

Operational risks include data errors, stale quotes, misaligned contract specifications, and order routing failures. Mitigations include redundant data sources, validation rules that detect outliers, pre trade checks against reference prices, and reconciliation procedures after execution. Clear documentation, change control, and periodic audits support reliability and maintainability.

High Level Example of How the Strategy Operates

The following example illustrates process without specifying exact signals or prices. Consider a multi asset portfolio that trades liquid futures on major equity indices, developed market government bonds, industrial and precious metals, energy, agricultural commodities, and major currency pairs via futures or forwards. The system updates once per day.

Setup and Initial State

The portfolio defines a risk target expressed as an annualized volatility range and a maximum drawdown threshold for review. Each market has a volatility based position limit and a cap on its percentage contribution to portfolio risk. A set of trend measures, predefined and validated, translates price history into directional scores. The system blends several horizons to form a combined signal for each market and scales the desired position using recent volatility so that more volatile markets receive smaller notional weights.

At the start of a month, bond prices have been declining persistently, several commodities have been rising, and equity indices are mixed. Currency trends are modest but present in a few pairs. The combined signals reflect these conditions.

Trend Expansion Scenario

Over subsequent weeks, commodity prices extend their upward movement while bonds continue to weaken. The system increases exposure to commodities and maintains negative exposure to bonds within pre defined risk caps. Equity indices begin to show more consistent behavior and the system gradually adjusts their exposure. Correlation estimates rise among equities but remain moderate between commodities and bonds, so the portfolio risk budget is still balanced.

Transaction costs are tracked daily. Turnover increases in commodities due to faster price changes, which triggers a cost monitor but remains within limits. A scheduled roll from the front month crude oil contract to the next is executed using a volume based schedule to manage impact. The volatility target is maintained by adjusting notional exposure as realized volatility shifts.

Choppy Regime Scenario

Later, markets enter a range bound period. Signals begin to flip more frequently in several equity indices and in a few commodity contracts. The system reduces position sizes automatically through volatility scaling as realized volatility increases. Filters that require a minimum level of persistence suppress signals in the noisiest markets. Whipsaw losses appear, but they are distributed across markets and containable within the portfolio level drawdown bounds.

A governance process compares realized drawdown to the distribution observed in backtests and out of sample tests. The drawdown is within expectations, so no override is triggered. The system continues to execute its rules, while risk reports flag any market that contributes an outsized share of the losses for further review of data, execution, or structural changes.

Ongoing Monitoring and Governance

Risk and performance reports are produced on a fixed schedule. They include current exposures, risk contributions by market and asset class, realized and forecast volatility, stress test results, slippage estimates, and turnover. Any breach of limits initiates a predefined workflow that may include halting new orders, reducing positions, or invoking a model validation review. Documentation, version control for code, and clear responsibilities help maintain consistency and reduce operational drift.

Measuring and Evaluating Performance

Evaluation should be consistent with the objectives and risk profile of the system. Trend following seeks to convert persistent price moves across markets into a diversified return stream. Metrics and analyses are chosen to determine whether this objective is being met in a controlled manner.

Return and Risk Metrics

Common metrics include annualized return, volatility, Sharpe ratio, and maximum drawdown. Additional diagnostics such as skewness and tail risk measures help characterize how the strategy behaves during large market moves. Since the strategy is designed to hold risk exposures dynamically, realized volatility and drawdown paths are as important as aggregate returns. Stability of these measures across subperiods and market regimes is a sign of robustness.

Attribution by Asset Class and Signal

Attribution decomposes returns into contributions from each asset class, each market, and each horizon or signal family. The goal is not to reward individual trades, but to understand whether diversification across classes and signals is functioning as intended. For example, one might observe that commodities contributed strongly during supply driven moves, while currencies contributed during pronounced policy divergence, and bonds contributed negatively during rate increases but positively during disinflationary periods.

Costs and Turnover

Realized costs include commissions, exchange fees, financing, and market impact. Trend following can be cost intensive if implemented with very fast signals or in less liquid markets. A well calibrated cadence and liquidity aware execution keep costs within planned ranges. Monitoring turnover by market identifies where small parameter changes could improve efficiency without altering the strategic profile.

Backtesting Standards

Backtests should use clean and survivorship bias free data, apply realistic cost estimates, and include slippage models that respond to volatility and volume. Parameter choices should be frozen before viewing test results for the full period, or validated using out of sample windows and cross validation. Sensitivity analyses explore how modest changes in parameters affect outcomes, and whether ensembles produce more stable performance. Walk forward evaluations, where parameters are fixed on past data and then applied to subsequent unseen periods, help assess robustness.

Variations and Extensions

Trend following is a framework that admits several consistent variations. The choice among them depends on mandate, instruments, and operational constraints.

Long Only Versus Long Short

Long only implementations are typical when using cash equities or certain funds that cannot be shorted. These systems vary exposure between higher and lower weights rather than flipping to negative exposure. Long short implementations, common with futures and forwards, can express both sides of trends. The long short approach allows the portfolio to benefit from downtrends in certain markets while uptrends occur elsewhere.

Physical Funds Versus Derivatives

Futures and forwards provide capital efficiency and ease of going short, but they introduce roll and financing considerations. Exchange traded funds simplify custody and tax treatment in some jurisdictions but may introduce tracking error, management fees, and restrictions on shorting. The instrument choice affects execution, costs, and the risk monitoring required to maintain the desired exposures.

Overlay Approaches

Some mandates treat trend following as an overlay that adjusts exposure on top of a strategic allocation. For example, a portfolio might maintain a core weighting to equities and bonds while allowing a trend overlay to tilt exposure up or down within rules and limits. The overlay approach requires careful aggregation of risk so that the combined exposures remain within tolerance.

Adaptive Trend Filters

Adaptive designs vary their responsiveness based on market conditions. Examples include adjusting the weight on faster signals when realized volatility is low and liquidity is high, or increasing reliance on slower signals when volatility rises. Adaptation is rule based and validated in testing. It is not discretionary market timing.

Common Misconceptions

Several misconceptions can distort expectations for trend following.

- It is not a prediction model. It reacts to price behavior and therefore accepts lag.

- It is not designed to win in every month or quarter. Performance depends on the presence of trends and on costs.

- It is not risk free in crises. While it may behave differently from traditional portfolios, it remains exposed to correlation shifts, execution risk, and reversals.

- Complexity is not inherently better. Simple, transparent rules often perform as well as highly tuned models once costs and stability are considered.

- Diversification is not static. Market structure evolves, so the universe and risk model should be revisited within a documented governance process.

Key Takeaways

- Cross asset trend following is a rule based framework that seeks to participate in sustained price movements across equities, bonds, commodities, and currencies without forecasting.

- Diversification across markets and time horizons, combined with volatility based position sizing, is central to stable implementation.

- Risk management addresses whipsaw, drawdowns, leverage, liquidity, and correlation shifts with predefined limits and monitoring.

- Operational discipline, including data standards, execution workflows, and governance, is as important as signal design.

- Evaluation focuses on return distribution, drawdown behavior, costs, and attribution, with robust testing to avoid overfitting.