Time decay, often referred to by the Greek letter theta, is the link between an option’s price and the passage of time. In a structured trading system, it can be incorporated as a repeatable source of carry, with clear rules to quantify exposure, monitor risk, and standardize decisions. Understanding what theta is, where it comes from, and how it interacts with other risk factors is indispensable before designing any strategy that relies on time to generate returns.

Defining Time Decay

An option’s price can be decomposed into intrinsic value and extrinsic value. Intrinsic value is what would remain if the option were exercised immediately. Extrinsic value is the premium over intrinsic value that reflects time to expiration, volatility, interest rates, and dividends. Time decay refers to the erosion of extrinsic value as the expiration date approaches, holding all else constant.

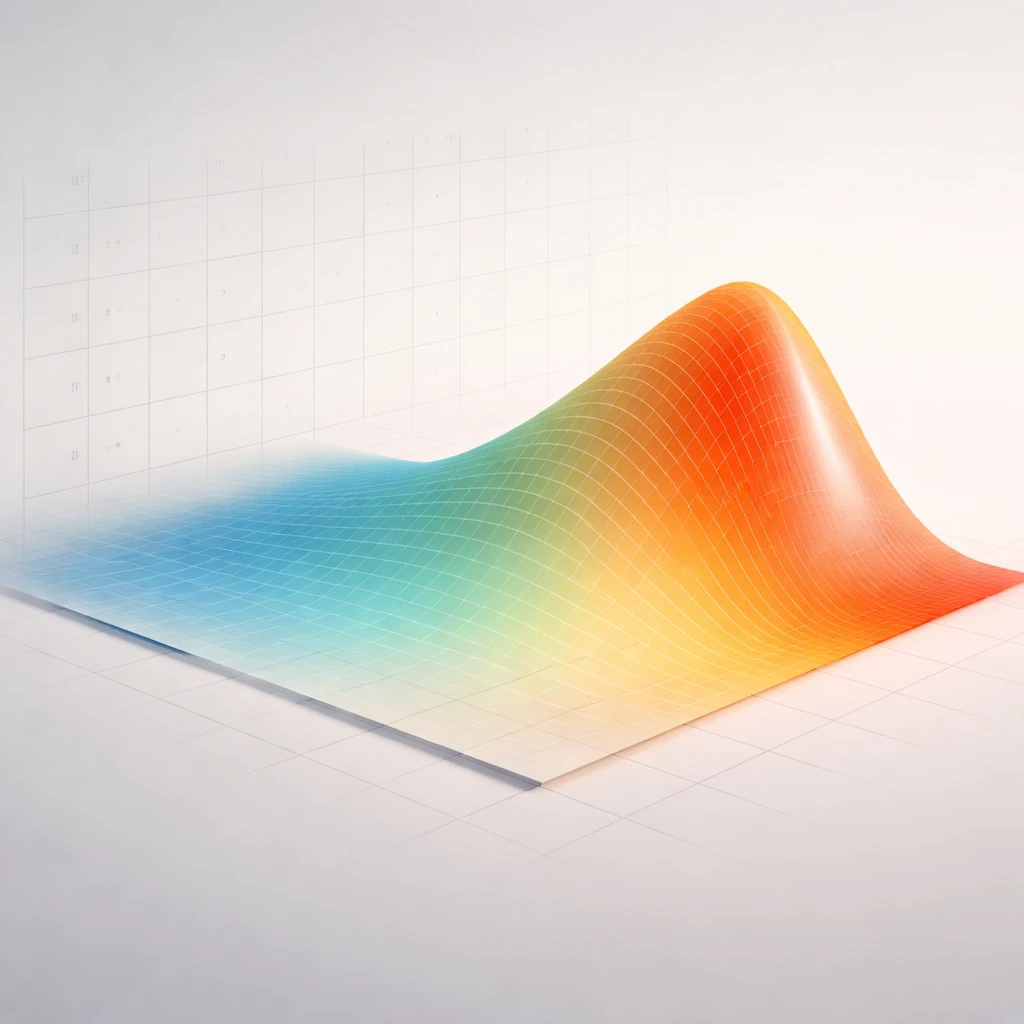

Theta measures the rate of change in the option’s price with respect to calendar time. Long options have negative theta because they lose extrinsic value as time passes. Short options have positive theta because they gain as the long counterparty loses value. This relationship is not linear. Decay accelerates as expiration draws near, especially for options near the money where extrinsic value is most concentrated.

The magnitude and sign of theta depend on moneyness, implied volatility, time to expiration, interest rates, and dividends. At the money options typically exhibit the largest absolute theta because a significant portion of their price is extrinsic. Deep in the money and far out of the money options have less extrinsic value and therefore a smaller theta in absolute terms. Short-dated options usually have higher daily theta per unit of premium than long-dated contracts, but they also carry higher gamma risk, which is addressed later.

Market practice values theta in calendar days. Weekend and holiday effects are usually incorporated before the market closes ahead of the nontrading period. The exact timing of this adjustment can vary, and it is not guaranteed to follow a fixed schedule. Traders who mark portfolios daily will typically see time decay reflected in end-of-day valuations rather than linearly spread across each day of the week.

Core Logic Behind Theta-Driven Strategies

Strategies that emphasize time decay operate on a simple idea. If the premium in options reflects a degree of uncertainty that exceeds what is subsequently realized, the extrinsic value that vanishes with time becomes a consistent source of profit for the seller. This is a form of insurance underwriting. The seller earns premium as compensation for bearing risk. The buyer pays premium to transfer risk and to secure convexity if large moves occur.

A theta-oriented strategy, however, is not simply about selling options. Option buyers can also structure positions where long options are partially financed by selling other options, creating positive net theta while maintaining defined directional or volatility exposures. Calendars and diagonals are common examples where a trader buys a longer-dated option and sells a shorter-dated option. The near-term option decays faster than the longer-dated one, which can produce a net positive theta profile, often alongside a net long vega exposure.

Two conceptual pillars support a repeatable theta framework:

- Carry and realized risk: The expected carry from theta must be weighed against the realized variability of the underlying. Premium collected is compensation for the distribution of future outcomes, not a free yield. Large moves can overwhelm weeks of gradual decay.

- Cross-Greek trade offs: Positions that are positive theta are commonly short gamma and short vega. This means adverse price jumps or volatility spikes can produce losses that more than offset accumulated decay. Positions with positive theta and long vega, such as many calendars, have different trade offs. They may benefit from volatility increases but carry other risks, such as sensitivity to term structure shifts.

The implication for system design is clear. A theta concept becomes a strategy only when the interactions with price moves, volatility changes, interest rate shifts, and dividends are mapped, bounded, and measured through rules.

Mechanics of Decay Across Maturities and Moneyness

Time decay is not uniform across the option surface. Several practical patterns appear consistently in liquid markets:

- At the money concentration: The largest extrinsic value tends to sit near the current price of the underlying. Theta is therefore largest in absolute terms near the money. As the underlying drifts away from the strike, extrinsic value falls and with it the absolute theta.

- Short-dated acceleration: Options close to expiration lose extrinsic value quickly. The resulting higher daily theta comes with higher gamma, which increases sensitivity to price changes.

- Term structure interaction: When longer maturities trade at higher implied volatility than near maturities, longer-dated options retain more extrinsic value, all else equal. Calendars and diagonals rely on these differences in decay pace and in implied volatility across maturities.

- Dividends and rates: For equity options that are American style, expected dividends can alter early exercise incentives. This changes the distribution of extrinsic value between calls and puts and affects theta near ex dividend dates.

These mechanics lead to practical consequences. A net short option position near the money and close to expiration can show attractive daily theta, yet the same position can be fragile to quick moves. Defined risk structures such as vertical spreads or iron condors trade some daily theta for a cap on worst case losses.

Embedding Time Decay in a Structured, Repeatable System

A structured system specifies what to trade, when to trade it, how much to trade, and how to manage it. The following components translate the time decay concept into a process that can be tested and executed repeatedly:

1. Objective and role in the portfolio

Clarify whether the strategy targets income-like carry, diversification, or hedging of other exposures. The role determines acceptable drawdown, turnover, and hedging choices. A carry-oriented theta strategy might prioritize steady premium collection with risk caps, while a diversification role might focus on structures that respond differently to volatility changes.

2. Universe and contract selection

Define which underlyings and expirations are eligible. Liquidity, spreads, borrow constraints for covered positions, and corporate action calendars affect execution quality and risk. Systems often restrict themselves to liquid index options or large-cap equities to reduce slippage and assignment frictions.

3. Strategy structures that express time decay

Several position templates rely on time decay, each with distinct Greek profiles and risk characteristics:

- Credit vertical spreads: Sell one option and buy another further out of the money to cap risk. Positive theta, typically short gamma and short vega. Losses are bounded by the width of the spread.

- Iron condors and iron butterflies: Combine a call spread and a put spread. Net positive theta with defined risk. Profit typically requires the underlying to remain in a range and for implied volatility not to rise materially.

- Calendars and diagonals: Buy the longer-dated option and sell the nearer-dated option at the same or a related strike. Net positive theta when the near leg decays faster. Often long vega, which can buffer losses if volatility rises.

- Covered calls and cash-secured puts: Use the underlying position to define risk. Time decay appears in the option premium received. These positions introduce assignment and corporate action considerations such as dividends.

- Butterflies: Debit and credit variants concentrate risk and reward near a target price. Net theta can be positive or negative depending on construction and time to expiration.

4. Entry filters and regime definitions

Because theta is intertwined with volatility and price movement, systems often define regimes rather than fixed rules that ignore context. Examples include higher or lower volatility regimes or the presence of scheduled events. The goal is consistency. A regime filter should be defined and measured in the research stage and then applied mechanically in production, rather than adjusted informally.

5. Position sizing and portfolio limits

Sizing converts a trade idea into a risk number. Many theta structures retain small daily gains with occasional larger losses. Sizing rules typically limit exposure per underlying, per expiration cluster, and across correlated instruments. Portfolios can also cap aggregate short gamma or aggregate theta to keep risk within quantitative boundaries. These limits reduce the chance that multiple positions respond adversely to the same market move.

6. Management, adjustments, and exits

Portfolio management determines how a system reacts to new information. Time based rules might close or roll positions with a fixed number of days to expiration remaining, primarily to control gamma risk and assignment risk. Risk based rules might reduce or exit positions when losses reach a predefined threshold or when the underlying breaches a risk boundary. Profit based rules can trim exposure when a position has retained a material portion of its maximum potential gain. Each rule should be tested for slippage sensitivity and for behavior in stress periods.

7. Execution and slippage controls

Options are sensitive to bid ask spreads, particularly for multi leg structures. Systems should specify limit order logic, acceptable partial fills, and a method to measure realized slippage against model assumptions. Thinly traded contracts can convert theoretical theta into lower or even negative realized carry after costs.

Risk Management Considerations

The attraction of time decay is clear. Premium appears to accrue with each passing day. The risks are equally real and must be embedded in the process.

Short gamma and adverse moves

Most positive theta positions are short gamma. When the underlying moves quickly, the position’s delta can change rapidly in an unfavorable direction. Near expiration this effect intensifies. Defined risk structures cap the loss from extreme moves but do not eliminate drawdowns. If the structure is undefined risk, explicit loss limits and stress tests are essential to prevent a single gap from overwhelming accumulated gains.

Vega exposure and volatility regime shifts

Short option structures are often short vega. A volatility expansion can increase option prices even if the underlying price is unchanged. This can offset or exceed the benefit of time decay. Conversely, calendar and diagonal spreads can hold net long vega. In that case, a volatility increase may help, but time decay in the long-dated leg is slower than in the short-dated leg and the net effect depends on term structure changes.

Event risk

Scheduled announcements such as earnings, macro releases, and policy decisions alter the distribution of returns. Implied volatility can rise into events and fall afterward, but the magnitude is uncertain. A repeatable system needs explicit rules for event handling, including whether to avoid initiating positions near known events, whether to reduce exposure, or whether to switch to defined risk structures ahead of binary outcomes.

Liquidity and assignment

Liquidity affects every stage of a theta strategy. Wider spreads and thin markets make it difficult to enter, adjust, and exit at modeled prices. American style equity options carry assignment risk. Early exercise tends to cluster around ex dividend dates for calls and around deep in the money puts when financing costs make it economical. Systems that cannot efficiently manage stock positions should avoid structures that easily lead to assignment.

Correlations and concentration

Positive theta across multiple positions can mask concentration. A market wide volatility shock can impact all positions simultaneously. Portfolio limits on sector and index concentration, as well as explicit caps on total short vega or short gamma exposure, reduce the chance of correlated losses.

Model risk and parameter drift

Theta is model dependent. Small changes in inputs such as implied volatility, dividends, or borrow costs can change the estimated daily decay. A robust system measures realized performance against modeled theta and flags deviations that persist. Overreliance on point estimates invites errors, particularly in quiet markets where sudden regime changes are most damaging.

High Level Examples of How Theta Operates

Example 1: Defined risk range selling

Consider a portfolio that sells defined risk spreads on both the call and put side in liquid underlyings. The design objective is to collect net premium with losses capped by the purchased wings. The daily mark to market shows positive theta when the underlying price remains within a predefined range and implied volatility does not surge. If the underlying drifts, the position’s delta is not fixed and may require adjustments or simply patience if the portfolio rules rely on range based exits. Approximately two to four weeks into the trade, the short options have typically lost a meaningful portion of their extrinsic value. The system may then take one of several pretested actions. It can close the position to realize the decay already earned. It can roll out in time to re establish positive theta within managed risk limits. Or it can reduce exposure if the underlying approaches a risk boundary. None of these require a view on the next day’s move. They require adherence to a process.

Example 2: Calendar structure with modest directional neutrality

In a calendar spread, a trader buys a longer dated option and sells a nearer dated option at the same strike. The position can be established slightly around the current underlying price to keep delta near zero at initiation. The near leg decays faster, generating net positive theta. If implied volatility rises broadly, the longer dated option can appreciate more than the near leg, which buffers risk. If volatility falls or the underlying drifts far from the strike, the position can lose value even as time passes. Time decay alone does not guarantee profits. The system’s rules might include a time based roll of the near leg before it reaches very short maturities, a risk based exit if the underlying moves beyond a defined percentage of the strike, or a switch to a different strike if the underlying re anchors near a new price level.

Example 3: Covered call overlay on a stock position

A portfolio that holds shares can sell call options at strikes above the current price to collect premium. The position’s theta is positive because the call option decays with time. The trade off is that upside is limited above the strike until expiration or until the option is bought back. Near ex dividend dates, early assignment becomes more likely if the call is in the money. A structured approach specifies the dividend handling, the maximum percentage of shares overwritten, and the exit protocol if the underlying rallies quickly. Time decay is a contributor to return, but it is embedded within the total return of the stock plus the option overlay.

Measuring and Monitoring a Theta Strategy

A repeatable strategy treats measurement as part of the process rather than an afterthought. Several diagnostics are particularly informative for theta driven approaches:

- Aggregate Greeks: Monitor net portfolio theta, gamma, vega, and delta by underlying and by expiration cluster. A rising positive theta accompanied by a surge in short gamma may indicate elevated fragility to price jumps.

- Implied versus realized volatility: Compare the volatility levels embedded in prices at entry with subsequent realized volatility. Persistent differences validate or challenge the strategy’s premise about carry.

- Distribution of outcomes: Track not only win rate but also average gain and average loss. Many theta strategies have high win rates with occasional larger losses. Expectancy is the correct metric, not win rate alone.

- Drawdown behavior: Evaluate historical and scenario drawdowns by volatility regime. Recovery times matter because prolonged stress can lead to forced deleveraging that undermines the strategy’s mechanics.

- Transaction costs and slippage: Record quoted spreads, achieved prices, and rejected orders. Small edges can disappear when costs are underestimated.

Common Misconceptions and Practical Nuances

Several recurring misconceptions can distort expectations:

- Time decay is not linear: The daily theta listed on a screen is a snapshot for current conditions. As the underlying moves or volatility shifts, tomorrow’s theta will differ. Near expiration, gamma changes quickly and can reverse a position’s sign of theta after a large move.

- High daily theta is not all that matters: Comparing absolute theta amounts without considering potential loss magnitude is incomplete. A position with lower daily theta but defined risk may be superior for many system designs.

- Weekend decay is not free: Markets tend to price weekend time before the market closes. A perceived jump in profit on Monday morning is often just the accounting of decay that was already reflected on Friday’s close.

- Cheap short dated options are not inherently better: Very short maturities can look attractive on a percentage basis. They also carry sharp gamma and event sensitivity. Systems often prefer a window of maturities where the trade off between theta and gamma aligns with tested rules.

- Rolling is not a profit engine by itself: Rolling forward to keep positive theta can be useful, but only when rules ensure that additional premium received is adequate compensation for the new risks undertaken.

Integrating Time Decay with Discipline

Time decay can be a steady and measurable component of an options strategy. The key is discipline. Theta is earned in exchange for exposure to price jumps, volatility shifts, and changes in term structure. Well designed systems specify when to carry that exposure and how to bound it. They rely on pretested rules for entry timing, risk limits, adjustments, and exits. They measure outcomes carefully and adapt when market structure evolves. In this way, time decay is not treated as an illusion of daily profits, but as a compensable risk that can be managed inside a coherent framework.

Key Takeaways

- Time decay is the erosion of extrinsic value and is captured or paid each day depending on whether the position is short or long options.

- Theta interacts with gamma and vega, so positive theta often comes with sensitivity to price jumps and volatility changes.

- Structured systems define eligible instruments, position templates, sizing limits, regime filters, and management rules to make theta exposure repeatable.

- Defined risk structures can trade some daily theta for bounded losses, which is often desirable in portfolios that limit tail risk.

- Measurement of aggregate Greeks, realized versus implied volatility, drawdowns, and slippage is essential for validating a theta based approach.