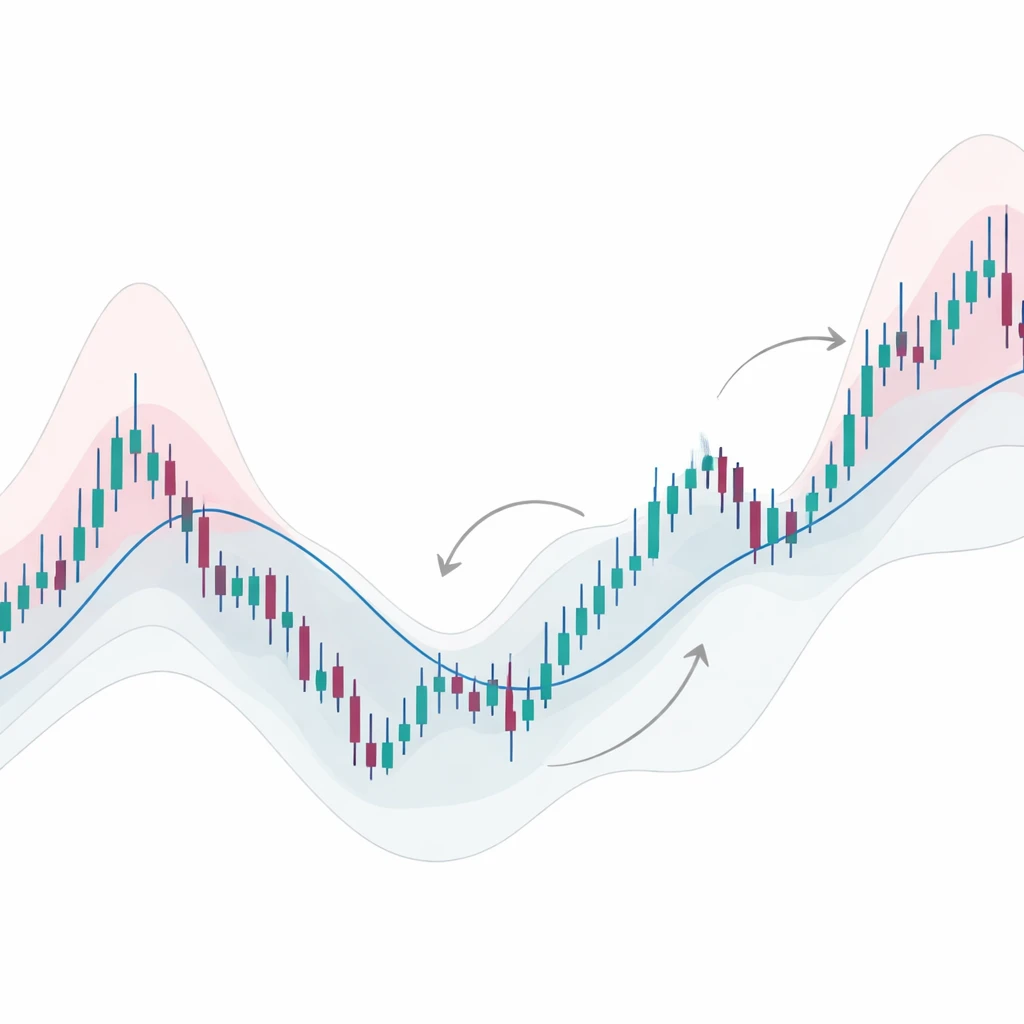

What Is Mean Reversion?

Mean reversion is the idea that prices or spreads deviate from a typical level and later move back toward it. This article defines the concept, explains its logic, shows how it fits into structured trading systems, and outlines risk management considerations with practical, high-level examples.