Mean reversion across asset classes refers to the tendency for relationships between different markets to fluctuate around a relatively stable long-run level, then partially or fully revert after deviations. The idea does not claim that a single asset drifts back to a fixed price. Rather, it focuses on pairs or groups of assets whose interaction is anchored by institutional, macroeconomic, or structural forces. The strategy aims to identify temporary dislocations between related markets and to benefit if those divergences normalize.

In practice, the mean is not a universal constant. It may depend on the sample period, the state of the economy, and the instruments used to represent each market. Mean reversion strategies that span asset classes must be explicit about which relationship they target, how they estimate its typical level, and where risk is controlled when conditions change.

Core Idea and Definitions

Mean reversion across asset classes operates on spreads or relative value constructs. A spread is a transformation of two or more asset prices, returns, or yields that yields a series with its own history and variability. The simplest form is a difference or ratio, such as an equity index future minus a government bond future after proper scaling, or an exchange rate minus a commodity price sensitivity estimate. If the spread displays stationarity in levels, or at least weaker trends and more predictable short-horizon reversals, it can be a candidate for reversion-based signals.

Several definitions are common:

- Level mean reversion: The spread oscillates around a rolling or long-run average.

- Residual mean reversion: After regressing one asset on another (or on a set of factors), the residuals behave like a mean-reverting series.

- Cointegration-based mean reversion: A linear combination of nonstationary prices forms a stationary spread. Deviations from that equilibrium are expected to revert.

Across asset classes, the equilibrium often reflects fundamental constraints. Examples include balance sheet hedging by commodity producers, rebalancing by liability-driven investors linking equities and bonds, or central bank policy that ties interest rate expectations to currency behavior. None of these mechanisms guarantee reversion at a specific horizon, yet they can create a tendency for extremes to compress.

Economic and Behavioral Logic

Several drivers help explain why cross-asset relationships can exhibit mean reversion:

- Flow-based anchors: Large institutional mandates, such as pension rebalancing, can pull asset weights toward targets. When one asset class rallies relative to another, flows may counter the move at the margin.

- Hedging and supply responses: Commodity users and producers hedge at varying horizons. When the commodity price diverges from currency or credit conditions, hedging flows can lean against extremes.

- Policy reaction functions: Interest rate expectations shape currencies and government bond markets. If one market moves ahead of the other, subsequent policy communication or data can reduce the gap.

- Behavioral overshoot: Fear and exuberance can push relative prices beyond what fundamentals support. As information diffuses, excess premia often compress.

These forces are intermittent. The same relationships can trend for extended periods during regime shifts. A mean reversion framework must therefore emphasize measurement and risk containment rather than assumptions of automatic reversal.

What Is Being Measured

Designing a cross-asset mean reversion strategy starts with precise measurement. The following building blocks are typical:

- Choice of instruments: Futures, forwards, total return indices, and liquid ETFs offer different exposures, roll mechanics, and cost structures. The instrument set determines what is feasible at realistic liquidity.

- Spread construction: Common transformations include differences, ratios, log ratios, and residuals from a regression. For example, one might regress an equity index return on an interest rate change to estimate sensitivity, then analyze the residual as a candidate mean-reverting series.

- Normalization: Rolling z-scores are a practical way to compare deviations across time. A z-score is the deviation of the spread from its rolling mean divided by its rolling standard deviation. The window length selects a compromise between responsiveness and noise.

- Scale alignment: Since equities, bonds, commodities, and currencies differ in volatility, align units before combining. This can be done via beta scaling from regressions, or by volatility-normalizing each leg.

- Regime filters: Many cross-asset spreads revert more reliably in calm environments than during crisis phases. Filters based on realized volatility, credit spreads, or macro uncertainty indices can condition participation.

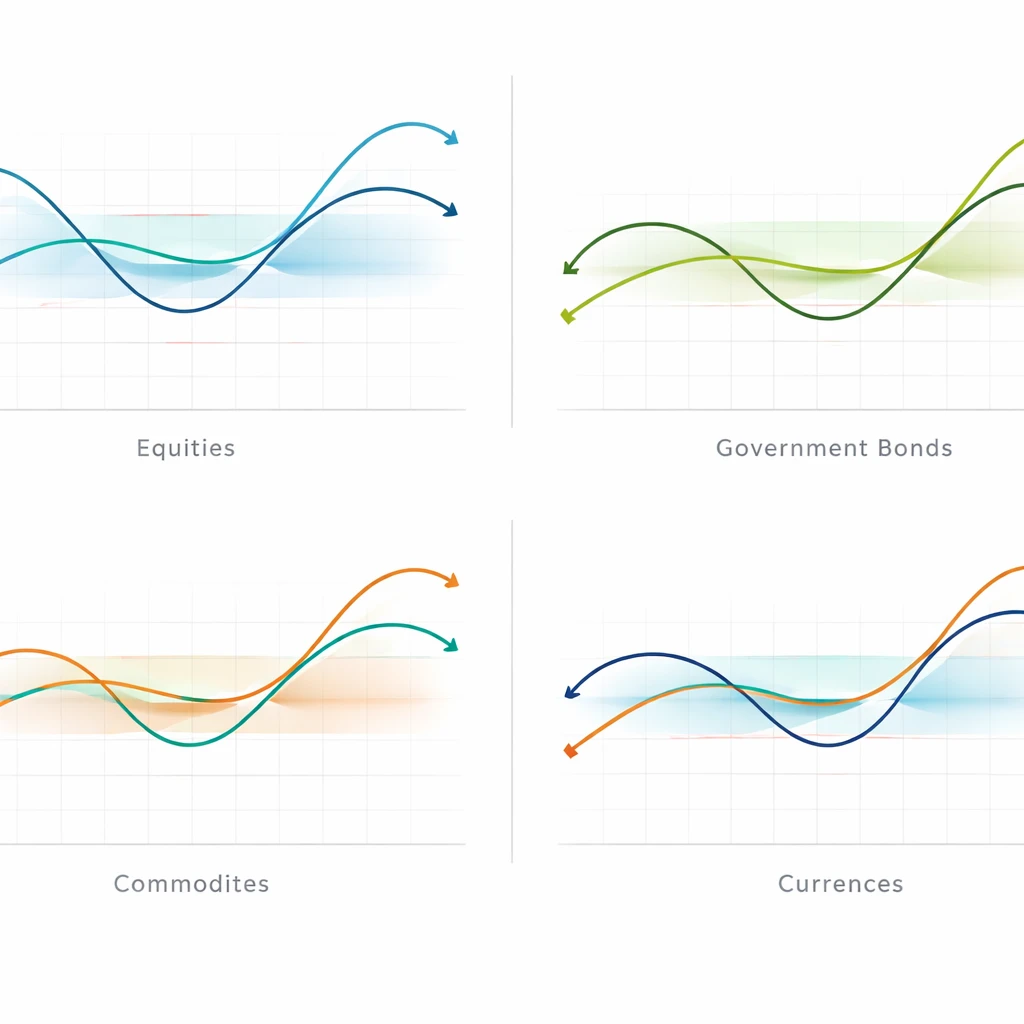

Forms of Cross-Asset Mean Reversion

1. Equity and Bond Interactions

Equities and duration-sensitive assets often respond differently to growth and inflation news. Over short windows, extreme equity drawdowns can coincide with bond rallies. When the equity-bond co-movement overshoots historical patterns, the spread between equity and bond returns may compress later as risk appetite stabilizes. A system can track a normalized equity minus bond spread and monitor unusual gaps relative to its own history.

2. Currency and Commodity Links

Commodity-linked currencies often maintain partial relationships with particular commodity prices, sometimes through trade balances and investment flows. If the currency depreciates substantially more than the commodity price decline would suggest, the residual may mean-revert after the initial shock fades. The reverse can also occur when futures curves embed transitory risk premia that later compress.

3. Rates and Currency

Interest rate expectations influence exchange rates through relative yield differentials. If a currency moves too far relative to shifts in short-rate expectations, subsequent policy communications, data releases, or risk sentiment may close the gap. Residuals from regressions of currency returns on rate differentials create a spread where deviations can be tracked for normalization.

4. Cross-Commodity Relative Value

Closely related commodities sometimes diverge because of idiosyncratic supply disruptions, logistics, or seasonal inventory dynamics. When the divergence reflects temporary bottlenecks rather than lasting structural change, spreads can mean-revert as inventories rebalance and arbitrage channels reopen. Estimating the typical differential with proper seasonality adjustment is essential.

5. Volatility and Underlying Assets

Option-implied volatility often reacts faster than underlying prices. The spread between implied and realized volatility can widen during stress and narrow as conditions settle. A relative value view can be formed between volatility-linked instruments and the associated asset, although instrument constraints, convexity, and carry costs require careful modeling.

Integrating Mean Reversion into a Structured System

A repeatable process benefits from clear rules and modular components. The following framework is widely used by systematic researchers and portfolio engineers. It avoids precise trade instructions and focuses on method.

Data and Preprocessing

- Instrument selection: Choose liquid representations of each asset class with sufficient history. Futures often provide continuous exposure with rolling, but rolls must be modeled explicitly.

- Sampling frequency: Many cross-asset relationships are noisy intraday and clearer at daily or weekly horizons. Choose a frequency that reflects real execution ability and cost.

- Alignment and holidays: Time zones and exchange holidays create asynchronous prints. Align timestamps to a consistent close and interpolate carefully when one leg is closed.

- Corporate actions and rolls: Account for dividends in total return indices and for futures roll yields. Mis-specified rolls create false signals that appear as mean reversion.

Signal Construction

- Spread definition: Build a spread that reflects the hypothesized linkage. For instance, estimate the beta of a currency to a commodity over a rolling window, then compute the residual as the spread series.

- Normalization: Compute a z-score of the spread relative to a rolling mean and standard deviation. Include a minimum history requirement to reduce instability at start-up.

- Regime conditioning: Enable signals only when volatility, liquidity, or macro uncertainty metrics fall within predetermined ranges. Conditioning can reduce exposure to breakdowns during stress.

- Signal decay: Mean reversion signals typically weaken as the spread normalizes. Apply decaying weights as the z-score moves toward zero or as time since signal initiation increases.

Position Sizing and Portfolio Aggregation

- Volatility targeting: Scale positions so that each spread contributes a similar ex ante risk. This avoids concentration in inherently volatile pairs.

- Cross-asset netting: When multiple spreads include the same instrument, net exposures to control unintended directional bets.

- Capacity and liquidity: Use conservative turnover assumptions and incorporate market impact estimates. Cross-asset spreads can require simultaneous orders across markets with different depth profiles.

Execution Considerations

- Instrument choice: Futures are often more capital efficient but impose margin and roll management. ETFs can simplify operations yet add management fees and potential tracking differences.

- Order timing: Align execution to liquid windows for each leg. Staggered closes can introduce temporary signals that vanish at the next open.

- Slippage modeling: Incorporate spread-dependent slippage and realistic bid-ask costs. Mean reversion strategies can suffer when slippage scales with signal magnitude.

Risk Management Considerations

Cross-asset mean reversion relies on relationships that are stable only until they are not. Robust risk management acknowledges that some deviations reflect genuine structural change rather than temporary noise.

- Exposure limits: Cap gross and net exposures per asset class and per spread. Limit leverage and enforce diversification across distinct relationships.

- Stop mechanisms: Use statistical halts rather than purely price-based stops. Examples include halting new signals when realized volatility doubles relative to a baseline, or when correlation between legs collapses below a threshold over a validation window.

- Time stops: If a spread does not normalize within a pre-specified time horizon, reduce or remove exposure. Lingering trades can accumulate financing and roll costs.

- Structural break detection: Monitor rolling betas, cointegration tests, and regime indicators. If parameters drift beyond tolerance bands, suspend or recalibrate the relationship.

- Drawdown controls: At the portfolio level, impose drawdown-based de-risking rules. At the component level, track contribution to drawdown to prevent a single spread from dominating losses.

- Tail events: Stress test to historical crises and hypothetical shocks. Consider gap risks across time zones and the possibility that both legs move adversely.

High-Level Example Workflows

Example 1: Equity Index and Government Bond Future

Suppose a system examines a daily spread constructed from a broad equity index future and a government bond future. The spread is defined as the equity return minus a beta-weighted bond return where the beta is estimated over a rolling window. The residual is standardized as a z-score relative to its rolling mean and standard deviation. When the z-score is unusually positive or negative, the system records that the relationship has deviated from typical co-movement. Participation is conditioned on market liquidity and a volatility filter that disables signals during acute stress.

Position sizing follows volatility targeting. The system assigns risk budgets so that this spread contributes a fixed proportion of expected portfolio volatility. If the z-score returns toward zero within a set horizon, the system gradually reduces exposure according to a decay schedule. If the z-score persists or amplifies beyond allowable limits, the strategy reduces risk or pauses signals to protect capital.

This example highlights the essential elements rather than specific trades. It relies on a stable yet flexible definition of the equity-bond linkage, on standardized deviations, and on rules that curtail exposure when the relationship appears to be changing.

Example 2: Currency and Commodity Link

Consider a spread between a commodity-linked currency and a benchmark commodity future. A regression estimates the currency’s sensitivity to commodity returns. The residuals form a spread series that is standardized to produce deviations comparable across time. The system updates the sensitivity parameter on a rolling basis to accommodate slow structural drifts, such as evolving trade patterns or policy changes.

During a sudden commodity shock driven by transient logistics issues, the currency may initially overshoot. If liquidity and volatility filters permit, the system treats a large standardized residual as a potential dislocation. If the logistical constraints ease, hedging flows normalize, and the commodity curve stabilizes, the residual often compresses. The system then unwinds exposure as the deviation shrinks or after the maximum holding period is reached. If the residual does not compress, the relationship might have changed, and the system reduces or suspends participation.

Testing and Evaluation

Mean reversion strategies are sensitive to data choices and methodological details. Robust evaluation practices help separate genuine effects from artifacts.

- Out-of-sample validation: Reserve meaningful segments of time for validation. Rotating walk-forward tests offer a practical compromise between parameter learning and performance assessment.

- Transaction cost modeling: Include commissions, bid-ask spreads, and market impact that scales with trade size. Sensitivity tests under higher cost assumptions are informative.

- Alternative specifications: Test variations in window lengths, normalization methods, and spread definitions. Prefer configurations that perform consistently across variants rather than a single optimized choice.

- Robust statistics: Examine performance conditional on volatility, liquidity, and macro regimes. Distinguish outcomes during stress from calm periods.

- Capacity analysis: Estimate slippage at realistic sizes. Cross-asset spreads may encounter depth constraints, especially in stress regimes when many participants pursue similar trades.

- Risk diagnostics: Track maximum drawdown, tail loss metrics, and turnover. Pay close attention to clustering of losses when mean reversion weakens.

Common Pitfalls and Practical Considerations

- Look-ahead and survivorship bias: Ensure that only information available at the time is used. For index proxies, include delisted instruments and historical constituents where possible.

- Asynchronous trading hours: Align observations carefully across time zones. A currency market may react to information while a commodity market is closed, creating temporary divergences that reverse at the next open.

- Roll artifacts: Poorly handled futures rolls can create artificial mean reversion. Use consistent roll methodologies and account for calendar effects.

- Nonstationarity: A spread that appeared stable historically can trend for extended periods after policy changes or technological shifts. Structural breaks should trigger model review.

- Crowding risk: Popular relative value trades can become crowded. During stress, funding and margin pressures force concurrent unwinds that amplify losses.

When Mean Reversion Weakens

Mean reversion can weaken or invert in several situations:

- Regime shifts: Transitions in inflation dynamics, monetary frameworks, or trade regimes can permanently alter cross-asset relationships.

- Policy constraints: When policy rates approach lower or upper bounds, traditional linkages between rates, currencies, and risk assets can distort.

- Balance sheet stress: During funding strains, relationships may break as institutions prioritize liquidity. Models that rely on recent correlations can misfire.

- Technological or market structure changes: The rise of new trading venues, products, or regulations can shift the behavior of spreads.

Because of these risks, systematic processes benefit from adaptive elements. Parameter updates, rolling recalibration, and filters that reduce activity when diagnostics flag instability can protect against protracted breakdowns.

Portfolio Context and Interaction with Other Styles

Cross-asset mean reversion is often combined with other styles, such as time-series momentum, carry, or value signals. The rationale is that reversion strategies typically harvest a different pattern of returns and can diversify trend-following exposure. Combining signals requires careful attention to interaction effects. For instance, a reversion signal might lean against a recent move while a momentum signal supports it. A portfolio framework that weighs signals by their conditional reliability and correlation tends to be more stable than any single style operated in isolation.

Risk budgeting across spreads is crucial. A portfolio that mixes equity-bond residuals, currency-commodity links, and rates-currency differentials should monitor the shared factors that can cause correlated losses. Dynamic risk allocation that responds to changing correlations and volatility can reduce concentration in a single macro theme.

Implementation Details That Improve Robustness

- Half-life based decay: Calibrate signal decay to a target half-life measured in trading days. This creates predictable exposure reduction as time passes or as normalization proceeds.

- Outlier handling: Apply winsorization or robust statistics when estimating rolling means and standard deviations. Isolated jumps can distort normalization.

- Parameter stability tests: Prefer parameter ranges that deliver acceptable performance across subperiods. Sharp parameter sensitivity increases the chance of overfitting.

- Hierarchical risk limits: Combine per-spread, per-asset, and aggregate portfolio limits. This layering prevents a single theme from dominating risk.

- Independent monitoring: Separate research and risk oversight functions. Independent monitoring reduces model risk and improves discipline during drawdowns.

Interpreting Diagnostics

Ongoing monitoring should distinguish between healthy pullbacks and structural breaks. Several diagnostics are informative:

- Distributional checks: Compare current spread z-scores to historical distributions. Persistent shifts in central tendency or variance can signal changing dynamics.

- Cointegration stability: Re-test cointegration parameters over rolling windows. Weakening test statistics warrant smaller risk allocations or model revisions.

- Correlation breakdowns: If the underlying assets cease to move together in expected ways, reassess the economic thesis behind the spread.

- Turnover and cost drift: Rising turnover without improved efficacy may indicate noise chasing rather than signal improvement.

Conclusion

Mean reversion across asset classes is a disciplined approach to exploiting temporary dislocations in relationships shaped by macro forces, policy linkages, and institutional flows. The approach is statistical and process-driven. It begins with a clear definition of the spread, uses normalization to assess deviations, and embeds strict risk management to navigate regime shifts. Because the same drivers that generate opportunities can also produce crowded unwinds and structural changes, robust testing, conservative cost assumptions, and adaptive participation rules are essential. A well-built system treats reversion not as a guarantee but as a tendency that can be harvested thoughtfully when conditions are favorable.

Key Takeaways

- Mean reversion across asset classes targets the normalization of relationships between markets rather than fixed price targets for a single asset.

- Effective systems define spreads precisely, normalize deviations with rolling statistics, and condition participation on liquidity and regime indicators.

- Risk control is central, including exposure caps, time-based exits, structural break detection, and robust stress testing.

- Backtesting must include conservative cost and slippage modeling and emphasize out-of-sample validation and parameter robustness.

- Combining cross-asset mean reversion with other styles can improve diversification, provided interactions and shared risk factors are carefully managed.