Introduction

Holding period is the length of time a position remains open. It begins with the execution of the opening trade and ends when the position is fully closed. Although deceptively simple, this interval shapes the risk you carry, the operational steps you must manage, and the costs you incur. Markets embed different frictions and rules across hours, days, and months. Understanding holding periods is therefore a foundation for accurate execution, realistic expectations about outcomes, and correct performance measurement.

Definition and Scope

At its core, a holding period is the elapsed time between an opening transaction and the corresponding closing transaction. For a long position in a stock, it starts when the first shares fill and ends when the last share is sold or otherwise disposed. For a short position, it starts when borrowed shares are sold short and ends when they are repurchased and returned. For derivatives, the concept maps to the life of the exposure rather than only to a single contract or option series. A position may be closed by an offsetting trade, by delivery at expiration, by exercise or assignment in options, or by maturity in fixed income instruments.

Two clarifications help in practice. First, partial fills and partial exits create lot-level holding periods. If an order fills in multiple pieces or if you scale out, each lot carries its own start and end time. Second, different stakeholders use different clocks. Operational teams often track wall-clock time in calendar days and hours. Risk reports frequently use trading days. Tax and regulatory frameworks may define holding period categories that have their own rules. The economic exposure exists as long as the position is open, regardless of the accounting convention layered on top.

Why Markets Care About Holding Periods

Holding period matters because time changes both the distribution of returns and the set of frictions attached to a position.

Risk accumulation and event exposure. Longer holding periods increase the chance of encountering market-moving events such as earnings announcements, policy decisions, index rebalances, or unexpected news. Shorter holding periods compress exposure to such events but can concentrate risk in execution quality and intraday liquidity.

Costs and carry. Some costs are paid on entry and exit, such as commissions and the bid-ask spread. Other costs accrue with time, such as financing on margin, stock borrow fees for short sales, fund expense ratios for certain products, and overnight swap points in foreign exchange. The relative weight of these costs shifts as the holding period changes.

Liquidity conditions. Liquidity is not constant across time of day or across the calendar. Opening auctions, midday lulls, and closing rotations each have distinctive fill probabilities and slippage patterns. Holidays and reduced trading sessions affect the feasibility of entering or exiting without significant market impact.

Governance and reporting. Many mandates and internal guidelines classify activities by typical holding period. Portfolio turnover, which is mathematically linked to average holding period, is often scrutinized by clients and regulators. Correctly measuring the interval between open and close is needed for accurate reporting, audit trails, and compliance checks.

How Holding Periods Work in Practice

The practical mechanics start at order entry and end when the position is flattened. The details in between determine what appears on statements and in risk systems.

Start time and partial fills. The opening time is the timestamp of the first executed lot, not the time the order was submitted. If an order works passively and fills over an hour, the earliest fill starts the holding period clock for that lot. Additional fills start their own clocks. Many systems will show a blended view for convenience, but lot-level timestamps drive precise calculations.

End time and scaling out. The closing time is the timestamp of the trade that removes the final lot of the position. If you exit in pieces, the clock for each lot stops at its own exit. A weighted average holding period across lots can be computed for reporting, but it is an aggregate of individual lot intervals.

Lot identification rules. When multiple entry prices exist, closing trades must be matched to lots. Brokers and accounting systems typically support methods such as FIFO, LIFO, or specific identification. The matching rule does not change the actual exposure interval for each lot, but it does determine which economic lots are considered closed at a given time and therefore which holding periods are realized.

Calendar time versus trading time. Some reports show calendar days held, others show trading days held. A position opened Friday afternoon and closed Monday morning has a short trading-day count and a long calendar-day count. The difference matters for event exposure and for costs that accrue over weekends or holidays.

Time zones and clocks. Global portfolios must align entry and exit timestamps across markets and time zones. Daylight saving time shifts can change the effective overlap of trading sessions and affect the practical holding interval. Accurate clock synchronization between order management systems and broker records prevents reconciliation errors.

Long and Short Positions

Long positions. For long cash equities or exchange-traded funds, corporate actions can occur during the holding period. Stock splits, special dividends, and rights offerings alter position size or cash flows. These do not reset the holding period clock, but they change the economics that unfold while the clock runs.

Short positions. Short sales require locating and borrowing shares. Borrow availability and fees can change while the position is open. Securities lenders can recall shares, which may force an early close. Dividends must typically be paid to the lender by the short seller, which creates a cash outflow if a dividend is recorded during the holding period. Daily mark-to-market on margin impacts available buying power and can trigger risk-based reductions or forced liquidations.

Derivatives and Structured Exposures

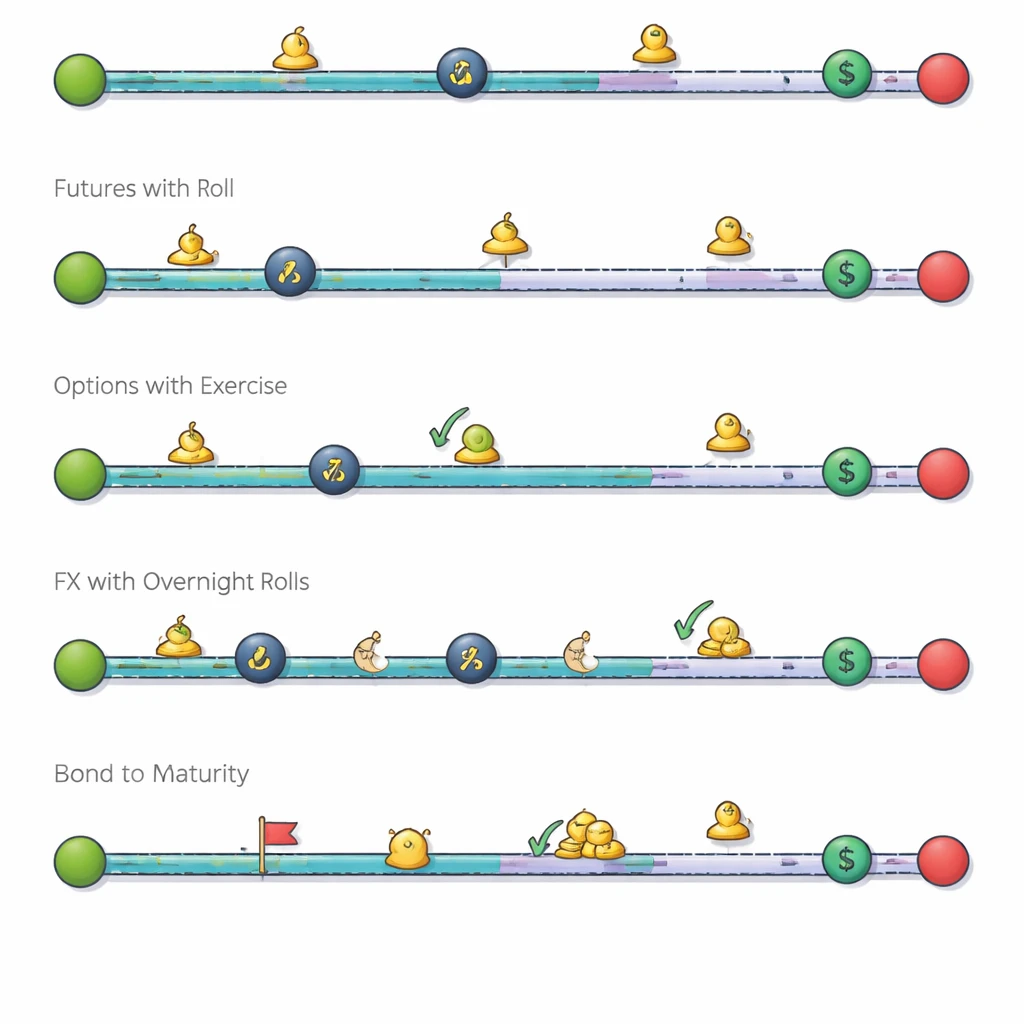

Futures. Futures are marked to market daily. The holding period runs from the first open purchase or sale to the offsetting trade. If exposure is maintained across expirations by rolling from one contract month to the next, the economic exposure is continuous, but the contract identifier changes. Many managers treat the roll as part of one extended holding period of the exposure, even though it appears as closing one contract and opening another.

Options. Options positions end by selling the option, by expiration, or by exercise or assignment. If a long call is exercised into the underlying stock, the option position ends and a new cash equity position begins. The subsequent holding period for the stock starts at the moment of exercise settlement. During the life of the option, time decay and other option sensitivities affect value, but the holding period still refers to the time the position remains open.

Foreign exchange spot. Spot FX positions typically settle on a T+2 basis. Positions rolled forward daily using swaps maintain continuous exposure even though the settlement date advances. Overnight financing charges or credits appear during the holding period and can be material for longer intervals.

Fixed income. Bonds have coupon payments and a maturity date. A hold-to-maturity approach ends the holding period at maturity, while an early sale ends it on the sale date. Callable bonds introduce the possibility of an unplanned end to the holding period if the issuer calls the bond before maturity.

Cash Flows During the Holding Period

Cash flows can occur while a position is open. Dividends, coupons, option premiums, and financing charges or credits all affect realized results without necessarily changing the start or end of the holding period. The correct accounting attaches these cash flows to the position that is open when they occur. For example, a dividend belongs to the holder of record on the record date, and a short seller typically owes a payment in lieu of dividend if short on that date. In futures, variation margin transfers cash daily, even though exposure may be unchanged.

Execution Considerations Across Holding Periods

Execution choices look different when the intended holding period is measured in minutes versus months. Short holding periods put more weight on microstructure details such as queue position, fill probability at the touch, and the impact of entering during thin liquidity windows. Longer holding periods elevate the importance of getting exposure established without excessive footprint, of managing corporate actions, and of maintaining borrow or financing arrangements over time.

Practical considerations include the following. Opening and closing auctions can concentrate liquidity and may reduce impact for larger trades. Midday periods often have lower depth. Scheduled announcements can widen spreads and reduce displayed size. For positions that will cross overnight, traders need to consider the possibility of gaps between the close and the next open, and whether contingency orders or risk limits are appropriate. Margin levels and concentration limits can change with volatility, which may shorten the feasible holding period if additional capital is not available. None of these items prescribe a tactic. They simply shape what must be managed during the time a position is held.

Costs That Accrue With Time

Some costs are one-time. Others scale with the length of the holding period.

One-time costs. Commissions, exchange fees, and the bid-ask spread are paid when entering and exiting. For very short holding periods, these costs dominate. As the holding period lengthens, their share of the total cost often shrinks relative to time-based charges.

Time-based costs. Margin financing is charged for each day that borrowed funds are used to hold a position. Securities lending fees for short positions accrue daily. In foreign exchange, rollover rates reflect interest differentials and are applied when positions are held overnight. Futures embed financing in prices but are marked to market daily, which affects cash usage during the holding period. Fund vehicles may have ongoing expense ratios that accrue while the position is held.

Roll and replacement costs. For exposures maintained through sequential contracts or series, rolling introduces additional transactions and potential slippage. The effective holding period of the exposure spans all legs. The accumulated roll cost is part of the economics of staying in the position over time.

Risk Exposure Across Different Durations

Time changes risk. Over very short intervals, price behavior reflects microstructure effects such as order book dynamics and temporary imbalances. Over days and weeks, scheduled events and news cycles become relevant. Over months, macroeconomic trends, funding conditions, and structural shifts in volatility can dominate.

Overnight and weekend risk. Markets can gap between sessions. Holding across the close introduces the possibility that price opens at a level far from the previous close. This can defeat intraday risk controls that rely on continuous trading. Weekend and holiday closures extend this effect.

Liquidity and depth. During stress, depth can vanish and spreads can widen. Positions with longer holding periods are more likely to encounter at least one such episode. Very short holding periods are less likely to face a liquidity shock but are more sensitive to immediate depth and short-term volatility.

Correlation drift. Hedging relationships that work over minutes may not hold over weeks. The longer a position remains open, the more likely relationships evolve, which affects multi-asset portfolios that rely on diversification or hedging overlays while positions remain active.

Instrument-Specific Nuances

Although the holding period idea is universal, implementation details vary by instrument.

Equities and ETFs. Settlement conventions are typically T+2 or T+1 depending on jurisdiction. Corporate actions can occur at any time. For synthetic exposures through swaps or contracts for difference, time-based financing terms are explicit and tied to the holding period.

Options. Time decay acts every day a position is held. Early assignment on short options can end a position before planned, or convert it into a different instrument, which starts a new holding period for the resulting exposure. Expiration dates hard stop the holding period unless the position is rolled.

Futures. Contract expiration dates require roll or exit. Price dynamics near expiration can reflect delivery mechanics and index rebalancing. Daily settlement affects cash but not the definition of the holding period itself.

Fixed income. Accrued interest builds while bonds are held. Callable features or sinking funds can end or alter the holding period if triggered.

Foreign exchange. Overnight swaps reflect interest rate differentials and calendar effects such as holidays and month-end. These are directly tied to the length of time the position is maintained.

Examples in a Real-World Context

Example 1: Same-day round trip in cash equities. A trader buys 1,500 shares at 10:03 and sells all shares at 15:55 on the same trading day. The holding period is measured in hours. Costs are dominated by the entry and exit spread, commissions, and any intraday market impact. There is no exposure to overnight gaps. Execution quality is the primary determinant of outcome because price variance over a few hours can be limited relative to costs in some names.

Example 2: Multi-day position with scaling. A position is opened with 800 shares on Monday morning and 700 more on Tuesday afternoon. On Thursday, 600 shares are sold, and the remainder is exited the following Monday. The Monday lot has a holding period from Monday morning to its respective sale timestamps. The Tuesday lot has a shorter holding period. If the trader reports an average holding period for the position, it will be a size-weighted average of the two lot intervals. Dividends declared with a record date during the week would be credited to the open long position. If a stock split occurred on Friday, share counts adjust but the holding period clocks continue.

Example 3: Futures exposure maintained through a roll. A long position in the front-month crude oil future is held for seven trading days, then rolled to the next month and held for another 23 trading days before exit. The exposure to crude oil spans 30 trading days. The holding period at the contract level is seven days for the first contract and 23 for the second. The roll introduces two additional transactions and a price differential that contributes to total return. Margin is posted throughout. Variation margin creates daily cash flows but does not close the position.

Example 4: Options position that converts into stock. A long call option on a stock is exercised the day before expiration. At exercise, the option position ends and a new long stock position begins. If the stock is sold two weeks later, the holding period for the option was the time between purchase and exercise. The holding period for the stock was two weeks. Payout profiles changed at the exercise event, and so did the accounting for the passage of time.

Example 5: Short sale across a dividend. A trader sells short 2,000 shares two weeks before the ex-dividend date and covers the position three days after the ex-date. The position is open for roughly 17 calendar days. During this period, a payment in lieu of dividend is typically owed. Borrow fees accrue daily. If borrow availability tightens and a recall occurs, the position might need to be closed earlier than planned, changing the realized holding period.

Performance Measurement and Holding Period

Performance reports use holding period to frame results correctly.

Holding period return. A common measure is holding period return, or HPR. For a single-lot position with no intermediate cash flows, HPR equals the ending value minus the beginning value, divided by the beginning value. When cash flows occur during the holding period, they are included at the time they occur. The key is that the return is tied to the time the position was open and reflects only the economics experienced during that interval.

Annualization caveats. Transforming a short holding period return into an annualized figure requires assumptions about compounding and the stability of market conditions. Short intervals can produce extreme annualized numbers that are not meaningful. Long intervals may span shifts in volatility regimes and financing conditions, which makes simple annualization mechanical rather than informative. Good reports show the raw holding period and the return realized during it, then provide context rather than relying on transformations.

Portfolio turnover and average holding period. Turnover is closely related to holding period. A portfolio with high turnover necessarily has a shorter average holding period. Many institutions monitor turnover for cost control and to align practices with stated investment style. The link is not one-to-one for every asset class, but as a rule, more frequent position changes imply shorter holding periods.

Factors That Influence Chosen Holding Periods

Market participants operate under constraints and objectives that make some holding periods more practical than others. Time availability, operational capacity, and access to liquidity windows can shape feasibility. Financing costs, borrow stability, and counterparty arrangements can make longer or shorter holding intervals attractive or impractical. Information relevance often decays over time. If a thesis rests on a catalyst that resolves within days, stretching the holding period for weeks changes the nature of the risk. In contrast, exposures tied to multi-quarter developments require enough time to capture the intended effects.

Capacity and market impact also matter. Larger position sizes often require more time to enter and exit without undue impact, which can lengthen the practical holding period even if the thesis horizon is shorter. Regulatory or client guidelines may set boundaries around typical holding periods through turnover limits or minimum holding expectations. None of these elements dictate a strategy. They describe the environment that determines what a given market participant can execute and maintain.

Operational and Compliance Considerations

Reliable recordkeeping starts with accurate timestamps for all fills and exits. Order management systems should maintain an audit trail that identifies which closing trades map to which opening lots. Reconciliations against broker statements catch discrepancies in holding period calculations, especially when corporate actions or time zone differences are involved.

For some accounts, guidelines prohibit certain holding period profiles or require justification for rapid turnover. Internal controls may flag positions that cross key calendar boundaries such as month-end or quarter-end. These controls exist because costs, reporting, and risk attribution often change at such boundaries. When instruments convert form, such as options exercises or futures deliveries, operations teams should confirm that holding period tracking transitions correctly to the new instrument.

Common Pitfalls

- Confusing calendar days with trading days, which can understate or overstate exposure to non-trading periods.

- Ignoring time-based costs like financing and borrow fees, which can dominate results for longer holding periods.

- Mismatching closing trades to lots, which distorts realized holding periods and performance attribution.

- Overlooking corporate actions or settlement events that occur while a position is open.

- Assuming continuous liquidity and not planning for the possibility of forced exits due to margin or borrow recalls.

Concluding Perspective

Holding period is not merely a label for style. It is an operational variable that governs how risk, cost, and logistics unfold from the first fill to the final exit. Once defined clearly and tracked at the appropriate level of detail, it becomes a practical tool for planning execution, anticipating frictions, and reporting results with accuracy. Whether a position lasts minutes or months, the same core elements apply. Identify when exposure starts, record what happens while it is open, and know precisely when and how it ends.

Key Takeaways

- Holding period is the elapsed time between opening and closing a position, tracked at the lot level when entries and exits are partial.

- Time affects both risk and cost, including exposure to events, financing, borrow fees, and liquidity conditions.

- Different instruments introduce specific mechanics, such as futures rolls, option exercise or assignment, and FX rollovers.

- Accurate performance measurement relies on correct holding period tracking, especially when cash flows occur during the interval.

- Operational discipline around timestamps, lot matching, and corporate actions prevents errors that distort reported holding periods.