Regulated vs OTC Markets: Structure, Purpose, and Practical Implications

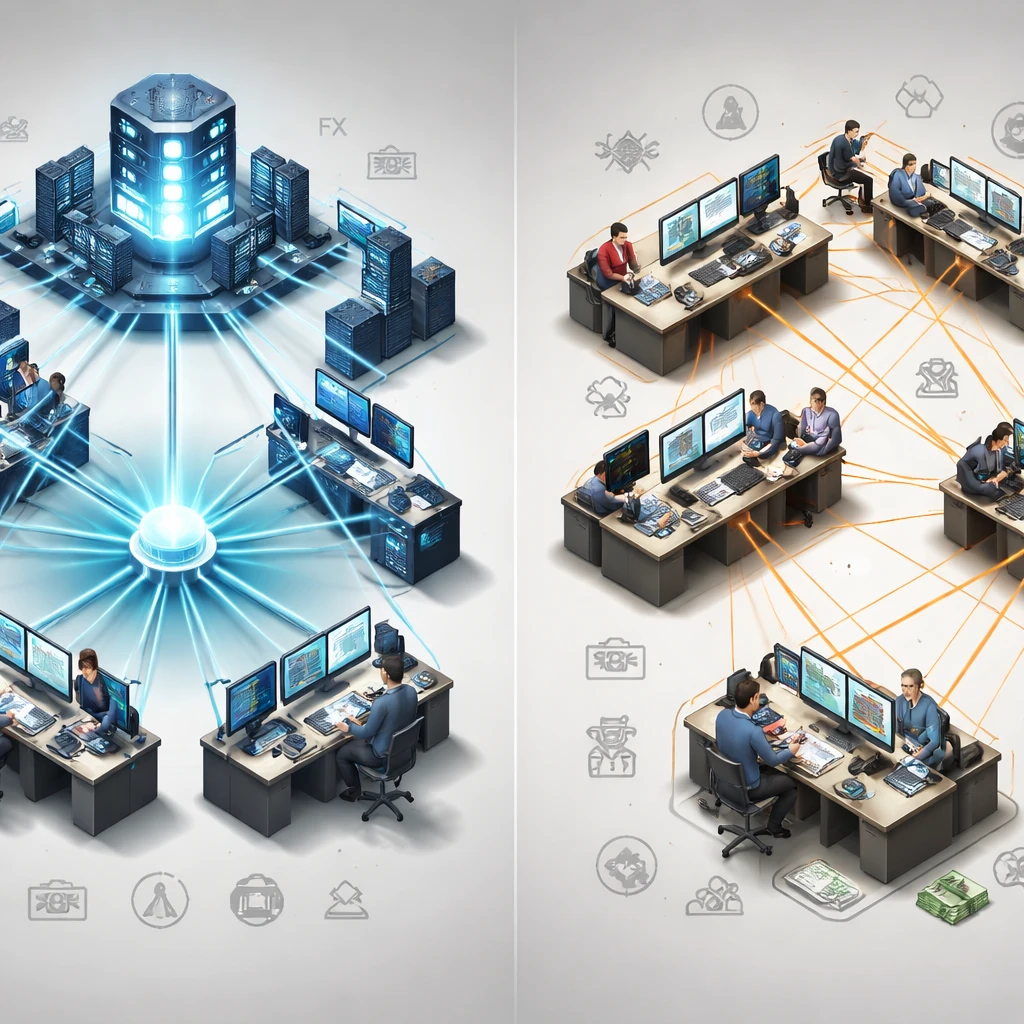

Market structure shapes how trades are executed, how prices are formed, and which risks fall to traders, brokers, and clearing institutions. Two broad architectures dominate modern finance: regulated exchange markets and over the counter, or OTC, markets. Both are integral to capital formation and risk transfer, yet they function differently in ways that matter for costs, transparency, and operational responsibilities.

This article defines regulated and OTC markets, describes how each operates in practice, explains why both exist, and illustrates the effects on real trade execution and management. The discussion uses examples from equities, bonds, foreign exchange, and derivatives without recommending particular instruments or tactics.

What Is a Regulated Market?

A regulated market is a centralized trading venue, commonly an exchange, that operates under an explicit rulebook approved by a competent authority. In the United States, equity exchanges such as the New York Stock Exchange and Nasdaq are regulated by the Securities and Exchange Commission, with additional oversight by self-regulatory organizations like FINRA. Futures and listed options trade on exchanges supervised by the Commodity Futures Trading Commission, with the National Futures Association acting in a self-regulatory role.

Key characteristics include:

- A central limit order book where buy and sell orders rest and match according to price-time priority or a closely related protocol.

- Standardized contracts for listed derivatives, and listing standards for equities and exchange-traded products.

- Transparent pre-trade quotes and post-trade reporting, with consolidated or widely disseminated market data.

- Clearing through a central counterparty that novates matched trades, manages margins, and handles default procedures.

Because the rulebook is public and enforcement is robust, participants can rely on consistent execution procedures, standardized tick sizes, and clear mechanisms for corporate actions and contract settlement. Surveillance systems monitor trading behavior, and market outages or errors are handled under established protocols.

What Is an OTC Market?

Over the counter markets encompass trading that occurs bilaterally between counterparties or through dealer networks without a central order book. The term describes an execution model rather than an absence of regulation. OTC activity can be heavily regulated, especially in derivatives and fixed income, yet it remains decentralized and negotiation driven.

Core features include:

- Price formation via dealer quotes, request-for-quote workflows, or voice negotiation, often facilitated by electronic platforms.

- Customizable terms, especially in derivatives and private placements, which allows tailored maturities, coupons, or payoff structures.

- Counterparty credit risk borne bilaterally unless the trade is centrally cleared after execution.

- Post-trade reporting regimes that vary by jurisdiction and asset class, with less pre-trade transparency than exchange markets.

OTC markets support instruments that do not fit a standardized exchange format, facilitate large transactions that might move a public order book, and connect participants through dealer balance sheets. Electronic venues such as Tradeweb, MarketAxess, and Bloomberg facilitate quoting and negotiation in many OTC instruments while preserving the bilateral nature of the trade.

Why Do Both Structures Exist?

Regulated exchanges and OTC networks co-exist because they solve different problems. Exchanges excel at standardized, high-frequency trading with broad participation. Their transparent pricing and central clearing reduce information frictions and counterparty risk. OTC markets excel at customization and discretion. They allow institutions to execute large or unusual trades with reduced market impact and to negotiate terms that align precisely with funding or risk management needs.

The trade-off centers on standardization versus flexibility. Standardization promotes deep order books, narrow spreads, and automated clearing. Flexibility enables bespoke maturities, coupons, or payoff features, as well as the potential for differentiated pricing based on credit quality or collateral terms. Regulation calibrates both spaces to promote fairness and stability, but it does not try to make them identical.

How Regulated Markets Work in Practice

On a modern exchange, orders flow to a central limit order book. Participants submit market orders to trade immediately against resting liquidity or limit orders to trade at specified prices. Matching engines apply deterministic rules such as price-time priority, and market data feeds disseminate best bids, best offers, and executed trades at high frequency. Market makers may be obligated to quote continuously in certain products, and designated market makers can have responsibilities during auctions or volatility interruptions.

Clearing is integral. After a trade matches, a clearinghouse novates the transaction, becoming the buyer to every seller and the seller to every buyer. The clearinghouse collects initial and variation margin, marks positions to market, and maintains default funds. This structure compresses the web of bilateral exposures into standardized obligations to a central institution, reducing counterparty risk while concentrating risk management within the clearing ecosystem.

Settlement follows jurisdictional cycles. In the United States, most securities transactions moved to T+1 settlement in 2024, which shortens the time between trade execution and legal transfer of ownership. Listed derivatives use exchange-specific settlement procedures, such as daily variation margin for futures and clearinghouse conditions for physical or cash delivery.

How OTC Markets Work in Practice

In OTC markets, the core workflow is bilateral. A participant requests quotes from one or more dealers, negotiates price and size, agrees on terms, and receives a confirmation. For standardized OTC instruments, an electronic platform can automate parts of this process, yet pricing remains quote driven rather than order book driven. For bespoke derivatives, documentation sets the legal framework, often under a master agreement with annexes that specify collateral and closeout mechanics.

Clearing in OTC markets can take two forms. Many swaps, indices, and credit default swaps are subject to central clearing mandates in several jurisdictions. These trades are executed bilaterally then submitted to a central counterparty for novation. Other OTC trades remain uncleared and rely on bilateral margin, netting, and credit support arrangements. Operationally, participants exchange collateral, reconcile valuations, and manage lifecycle events such as resets, coupon payments, or early terminations.

Post-trade transparency varies. In the United States, corporate bond trades are reported to TRACE, providing near real-time prints to the public. In the European Union, MiFID II and MiFIR impose detailed trade reporting and transparency obligations, including deferrals for large transactions. Pre-trade data in OTC markets is often limited to dealer runs or indicative quotes distributed to clients.

Price Discovery and Transparency

Price formation on exchanges reflects the interaction of many public orders, which produces a visible best bid and offer and a transparent history of trades. Depth at each price level can be disseminated, and auction mechanisms help concentrate liquidity at the open and close. The transparency supports benchmarking, transaction cost analysis, and surveillance.

OTC price discovery is more fragmented. Dealers post indicative levels, but firm quotes are often tailored to the client and size. Large trades can clear privately to avoid moving observable prices. Post-trade reporting helps anchor valuations across the market, yet pre-trade transparency usually remains limited to the bilateral negotiation or a request-for-quote screen. The result is a quote driven environment where spreads can be wider for less liquid instruments, and pricing may reflect a dealer’s inventory and balance sheet costs.

Counterparty Risk, Clearing, and Collateral

Counterparty exposure is handled differently across the two structures. On exchanges, the central counterparty stands between buyers and sellers, supported by margin, default funds, and waterfall procedures. The risk is mutualized and managed under well-defined rules that apply to all clearing members. Participants focus on market risk and liquidity, with counterparty risk concentrated at the clearinghouse.

In OTC markets, exposure depends on the credit of the bilateral counterparty unless the trade is subsequently cleared. Legal frameworks such as an ISDA Master Agreement and a Credit Support Annex specify netting, collateral posting, eligible collateral types, haircut schedules, and valuation dispute processes. For uncleared derivatives, regulators in many jurisdictions require two-way initial and variation margin between large financial entities. In foreign exchange, settlement risk can be mitigated through payment-versus-payment services such as CLS, which coordinate cash movements to reduce the risk that one party delivers while the other fails.

Execution Mechanics and Workflow

Trade execution steps differ in practical ways across venues:

- On exchange, a participant submits an order through a broker or a member, the matching engine executes the order, the trade is confirmed electronically, and the clearinghouse assumes the counterparty role. Market data shows the execution almost immediately.

- In OTC, a participant solicits quotes, selects a dealer, negotiates price and terms, receives a bilateral confirmation, and manages collateral and lifecycle events. If the instrument is subject to clearing, novation to a central counterparty occurs after execution, often within minutes.

These differences influence post-trade tasks. Exchange trades typically flow into straight-through processing with standard identifiers and clearing messages. OTC trades may require bespoke static data, documentation checks, and ongoing valuation and collateral management.

Regulatory Oversight and Reporting

Regulation seeks fair, orderly, and efficient markets while managing systemic risk. Exchanges operate under direct oversight by securities or derivatives regulators, with extensive surveillance, audit trails, and error-handling rules. Best execution obligations, order handling rules, and short sale regulations shape behavior in equities. Futures and listed options face position limits, large trader reporting, and clearing standards.

OTC markets are regulated through reporting and risk rules rather than a central order book. Examples include trade repositories for derivatives, transparency regimes such as TRACE for U.S. corporate bonds, and clearing and margin mandates under laws like Dodd-Frank in the United States and EMIR in the European Union. Many OTC venues operate as regulated trading systems or multilateral facilities even though price formation remains bilateral.

Access and Investor Protection

Access differs by product and venue. Retail investors typically access exchange-traded equities, exchange-traded funds, and listed options through brokers that are exchange members or have routing agreements. OTC trading in complex instruments, such as bespoke derivatives, usually requires institutional documentation, credit approval, and risk controls. Some OTC equities trade on platforms operated by the OTC Markets Group in the United States, with tiers that reflect disclosure levels and eligibility standards. Regulators impose suitability and conduct rules, and certain products are restricted to professional clients in many jurisdictions.

Liquidity, Trade Size, and Transaction Costs

Liquidity on exchanges arises from a continuous interaction of public orders and designated market makers. The presence of a central book can produce narrow spreads in heavily traded instruments. Transaction costs are a mix of explicit charges, such as commissions and exchange fees, and implicit costs, such as spread and market impact. The transparency of the book allows for measurable slippage analysis.

OTC liquidity often resides with dealers that carry inventory and intermediate between buyers and sellers. For small and standard transactions, spreads may be wider than on exchanges. For very large transactions, however, OTC execution can reduce visible market impact by allowing a negotiated block at a single price. Costs include the negotiated spread, platform fees if applicable, and the opportunity cost of negotiating time. Transparency into the full cost is inherently lower, which places more emphasis on robust trade reporting and post-trade analytics.

Operational Responsibilities and Risks

Operational requirements follow the market structure. Exchange trades usually rely on standardized symbol conventions, centralized clearing instructions, and automated allocation systems. Breaks and mismatches are relatively rare and are governed by uniform error policies.

OTC trades require greater attention to documentation and lifecycle management. Confirmations specify customized terms, including day count conventions, business day calendars, and settlement mechanics. Collateral calls must be processed accurately and on time. Disputes over valuation can arise in periods of market stress, so bilateral agreements include detailed dispute resolution timelines. Institutions often maintain collateral management and valuation teams to meet these obligations.

Real-World Contexts and Examples

Equities provide a clear contrast. Shares of widely followed companies trade primarily on regulated exchanges with robust pre-trade transparency and continuous two-sided quotes. Some smaller or foreign-domiciled companies trade OTC in the United States, where disclosure requirements differ by tier. The differences affect data availability, liquidity, and the mechanics of trade execution and settlement.

Corporate bonds trade mostly OTC. A portfolio manager typically requests quotes from several dealers for a specific CUSIP, executes with one dealer at a negotiated size, and sees the trade reported to TRACE shortly thereafter. Large blocks can be worked privately or executed with limited dissemination deferrals under applicable rules.

Foreign exchange is predominantly OTC. A corporate treasurer hedging expected revenues may enter a forward contract with a bank under a master agreement. Pricing reflects spot rates, forward points derived from interest rate differentials, and credit terms in the collateral agreement. Alternatively, standardized FX futures exist on regulated exchanges, which offer central clearing and transparent pricing but require standardized contract sizes and expiration cycles.

Derivatives illustrate the hybrid landscape. Futures and listed options are standardized and centrally cleared on exchanges, which provides transparent order books and daily margining. Interest rate swaps and many credit derivatives trade OTC using standardized documentation, with many products now subject to central clearing mandates. Uncleared bespoke options, structured notes, and total return swaps remain in the bilateral sphere, with tailored terms that cannot be replicated precisely by listed contracts.

Comparing Venue Types Across Asset Classes

It is helpful to organize the landscape by asset class, noting that specific practices vary by jurisdiction and product design:

- Equities: Primarily exchange-traded with centralized order books and public quotes. Off-exchange trading can occur on alternative trading systems that are regulated, as well as in OTC equities with varying disclosure tiers.

- Fixed income: Predominantly OTC with dealer intermediation. Electronic RFQ platforms and streaming quotes have increased transparency, and many jurisdictions mandate post-trade reporting.

- Foreign exchange: Mostly OTC across spot, forwards, and swaps, with settlement risk mitigated by specialized utilities. Exchange-traded FX futures and options provide standardized alternatives.

- Commodities: Physical markets often operate OTC through brokers and bilateral contracts. Financial commodities also trade via exchange-listed futures and options.

- Derivatives: A split between exchange-traded, standardized derivatives and OTC derivatives that range from standardized to highly bespoke, with varying clearing requirements.

Implications for Trade Execution and Management

Understanding market structure helps anticipate execution steps and downstream obligations. On exchanges, a focus on order type selection, market data quality, and clearing member relationships typically suffices operationally. Straight-through processing and uniform settlement cycles allow highly automated workflows.

In OTC markets, attention shifts to dealer selection, documentation, valuation methodologies, and collateral processes. Settlement instructions must be confirmed bilaterally, and life cycle events require active monitoring. Large or bespoke transactions can require additional internal approvals and risk assessments, particularly when counterparty exposure is material or when the trade affects liquidity buffers.

Regulatory reporting obligations also differ. Exchange trades feed into centralized audit trails and are captured by exchange and broker reporting systems. OTC trades may require submission to trade repositories, transaction reporting under regulations such as MiFID II, or public dissemination through mechanisms like TRACE. Failing to meet reporting timelines or data quality standards can trigger regulatory issues, so operations teams consider these requirements part of routine trade management.

Risk Considerations

Market risk arises in all venues, but the distribution of other risks differs. In exchange markets, the central counterparty reduces bilateral default risk at the cost of concentrated exposure to the clearing ecosystem, mitigated by robust margining and default management. In OTC markets, counterparty, legal, and operational risks are more prominent because of bilateral credit exposure, customized terms, and collateral management. Liquidity risk can also diverge, with exchange products often liquid during market hours and OTC products relying on dealer balance sheets and inventory conditions.

Valuation practices must match the market structure. Exchange-traded instruments generally use closing auction prices or midpoints from transparent books. OTC instruments rely on dealer quotes, observable transaction prints, or model-based valuations calibrated to market data. Accounting, risk measurement, and performance attribution depend on consistent and well-governed valuation methods.

Why Market Structure Matters

Whether a product trades on a regulated exchange or OTC shapes the entire trading lifecycle. It affects how quickly orders can be executed, how visible pricing is to the broader market, who bears counterparty risk, what collateral moves after the trade, and how results are reported. Institutions often participate in both structures because diversified portfolios include a mix of standardized and bespoke exposures. The task is to understand the rules of each venue, align processes with those rules, and maintain controls that are appropriate to the associated risks.

Key Takeaways

- Regulated exchange markets centralize orders, standardize contracts, and rely on central clearing, which promotes transparency and reduces bilateral counterparty risk.

- OTC markets are decentralized and negotiation driven, offering flexibility in size and terms but placing more emphasis on bilateral credit, documentation, and collateral management.

- Price discovery is public and order driven on exchanges, whereas OTC price discovery is quote driven with varied pre-trade transparency and mandated post-trade reporting in many jurisdictions.

- Operational workflows differ meaningfully, with exchange trades favoring standardized straight-through processing and OTC trades requiring lifecycle management, valuations, and margin operations.

- Both structures exist because they solve different problems, balancing standardization and transparency against customization and discretion across asset classes.