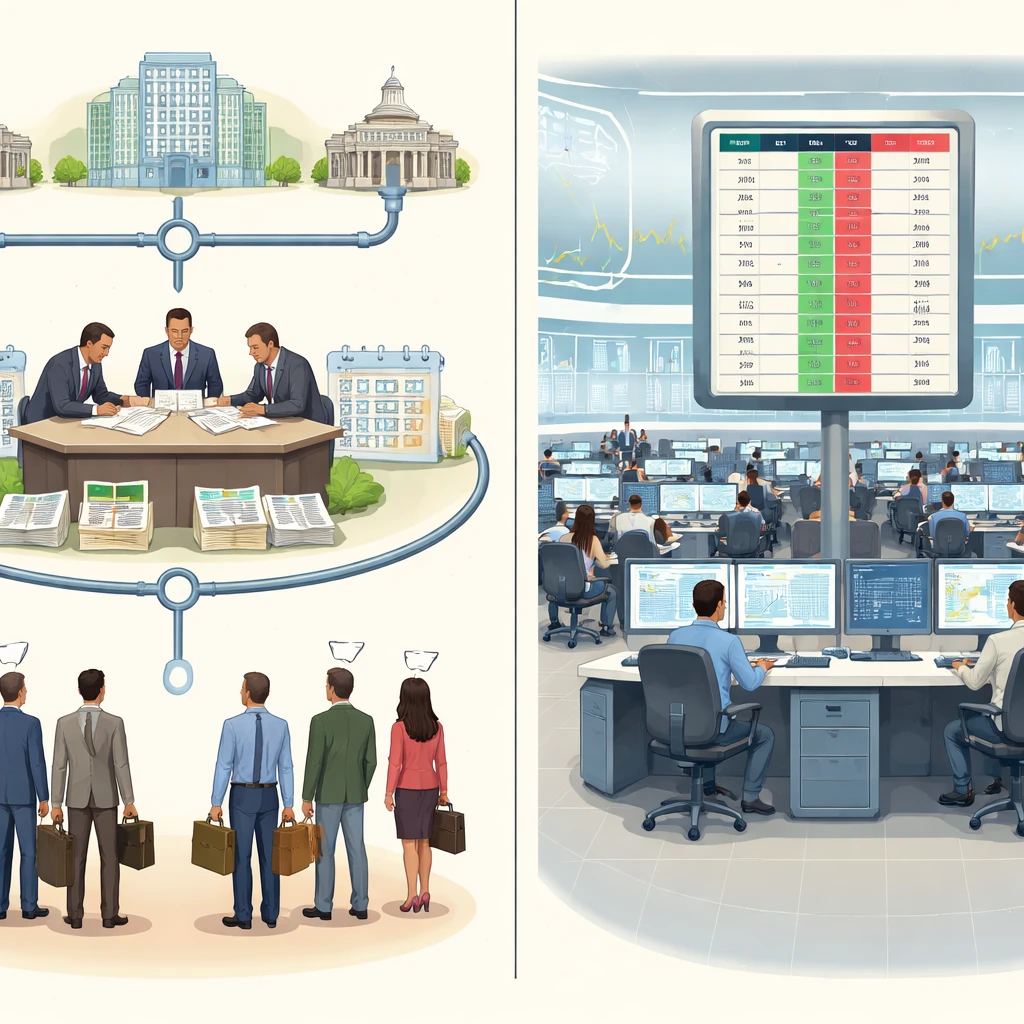

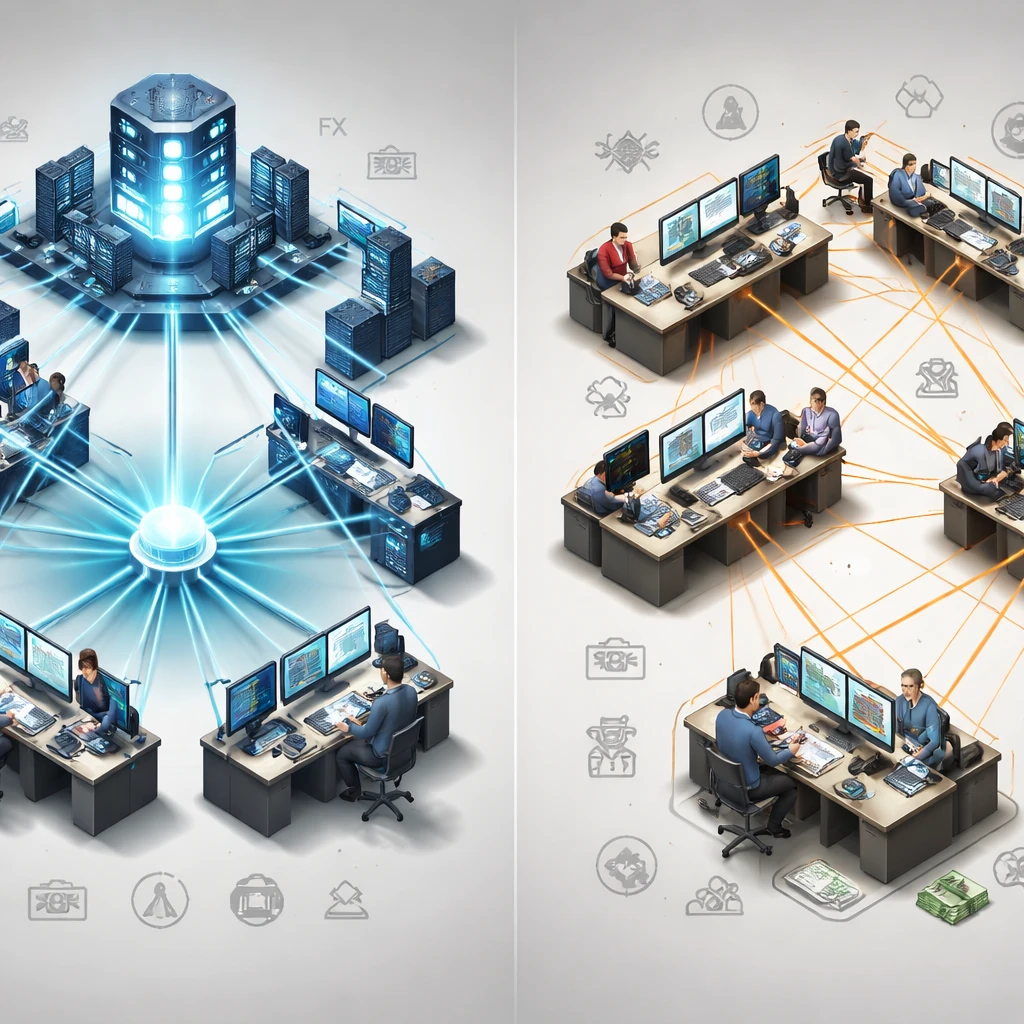

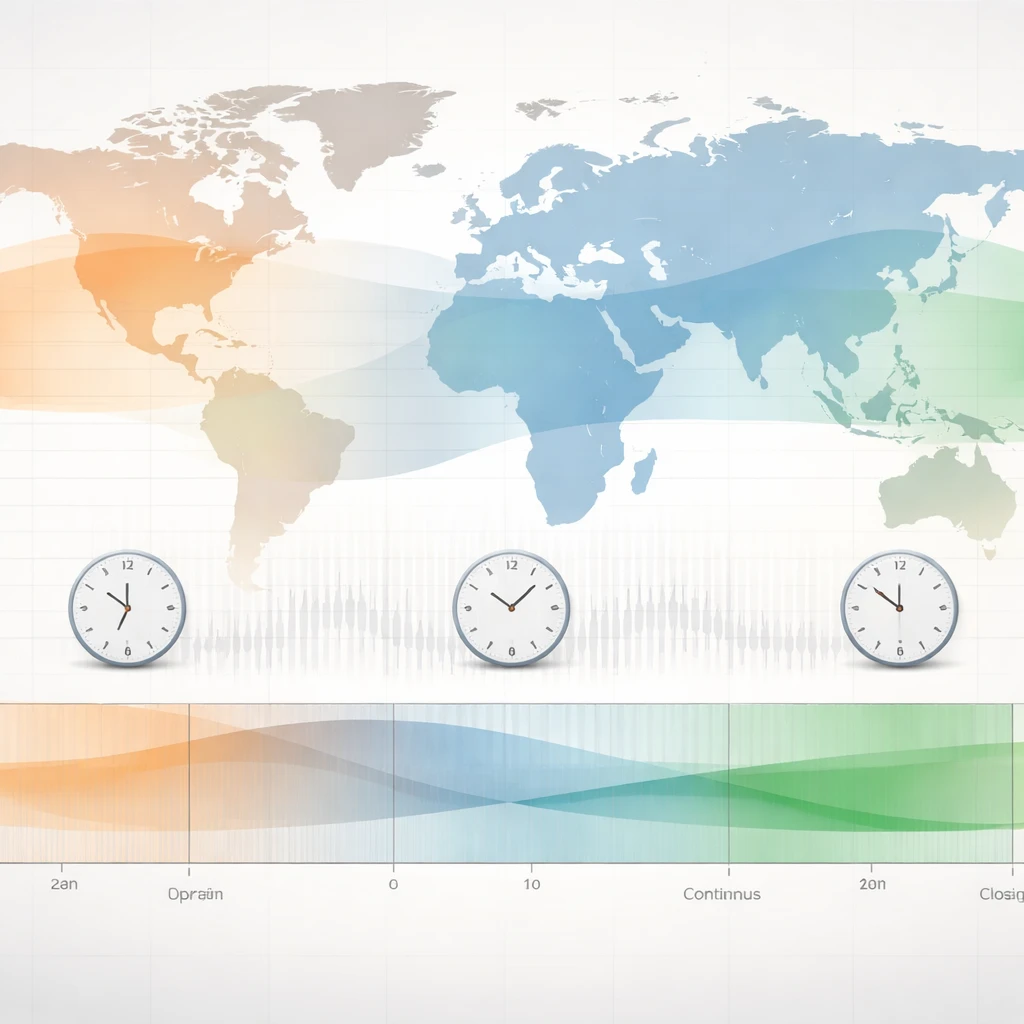

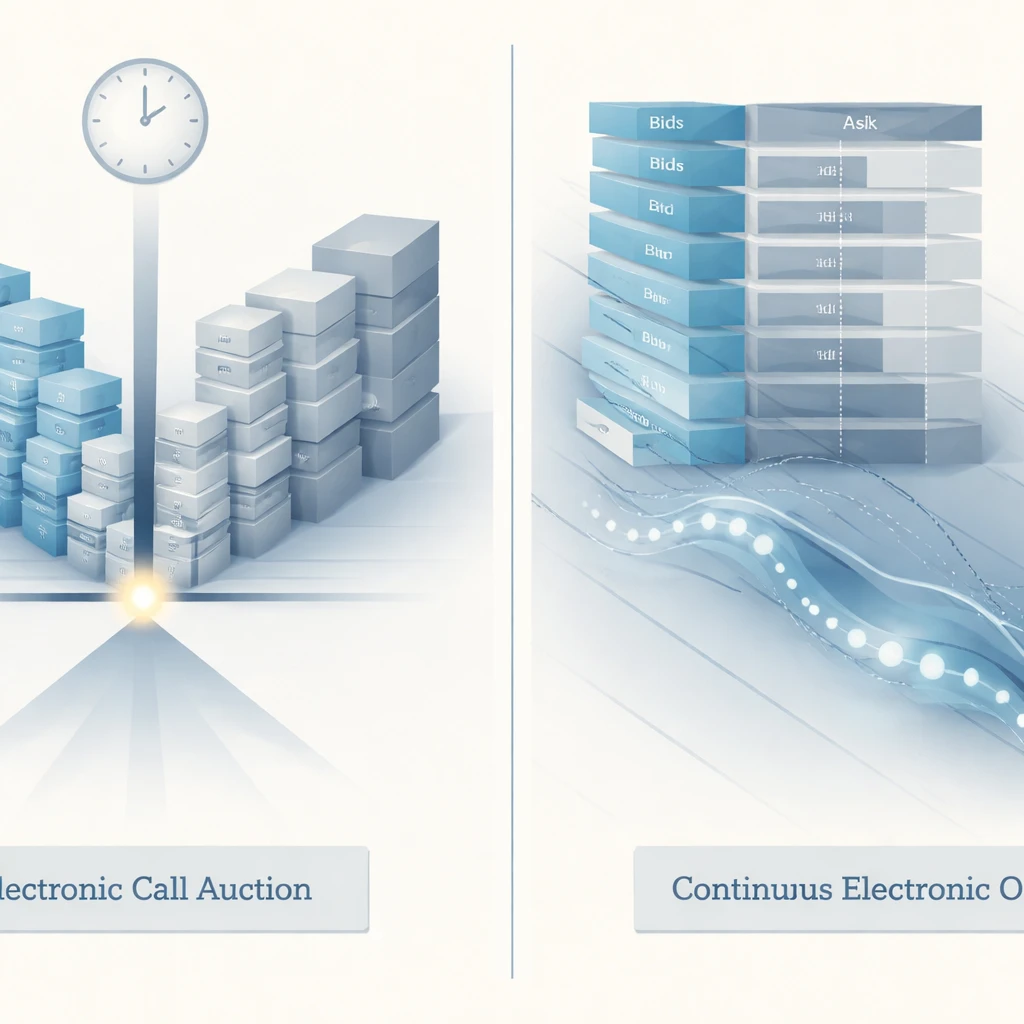

Market Participants Explained

A structured explanation of who participates in financial markets, why they exist, and how their interactions shape liquidity, price formation, and real-world trade execution and management across venues and instruments.','content':'Financial markets are not a single decision maker. They are ecosystems where many distinct actors meet to transfer ri…