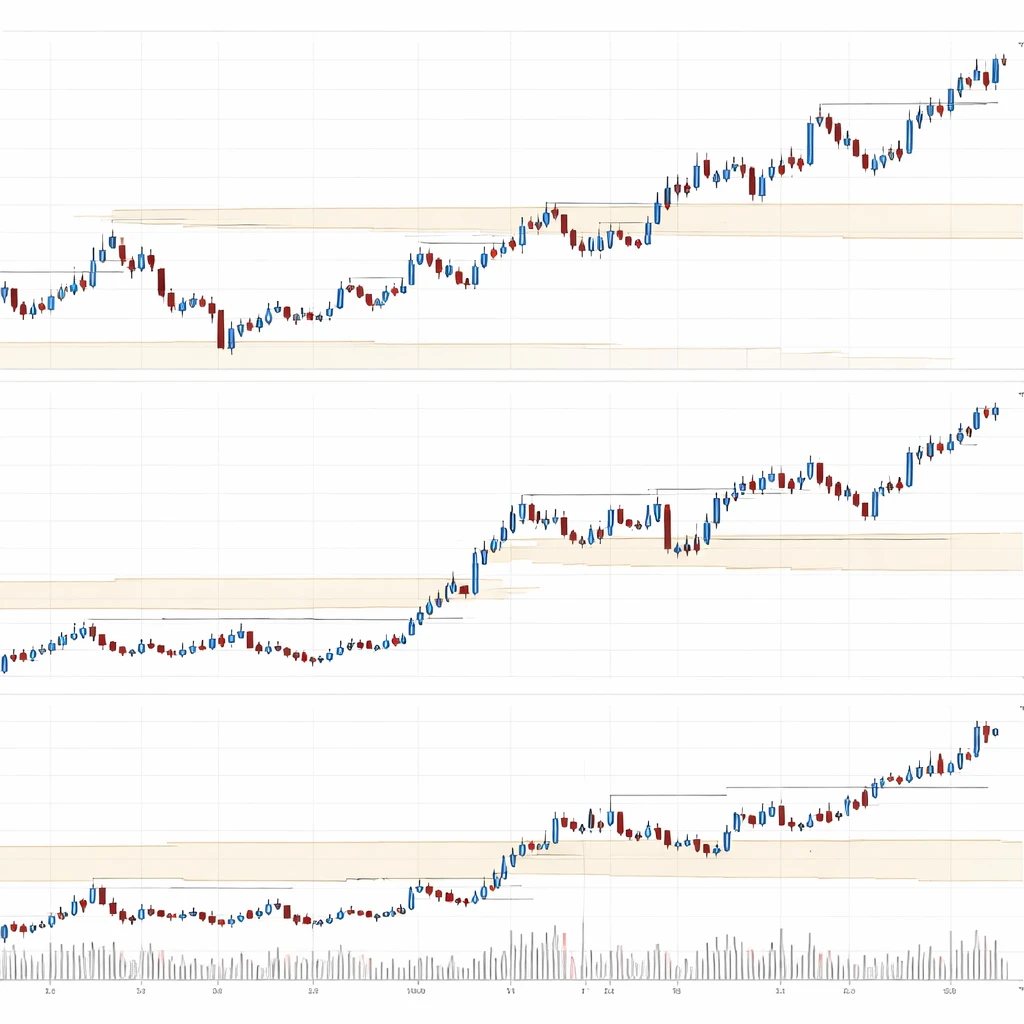

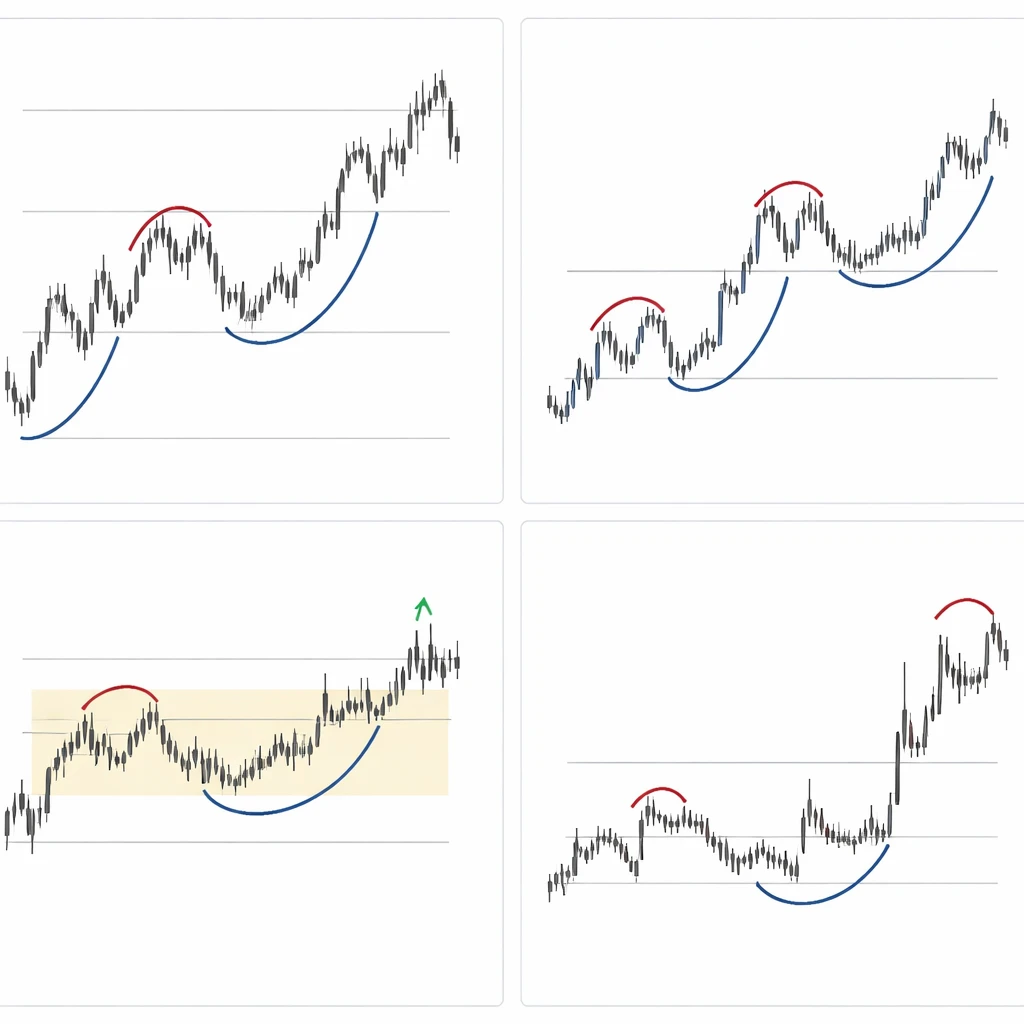

Multiple Timeframe Structure

An in-depth explanation of multiple timeframe structure in technical analysis, showing how trend and market structure interact across chart horizons and how this perspective clarifies context, risk concentration, and price behavior without prescribing trades.