What Is a Market Trend?

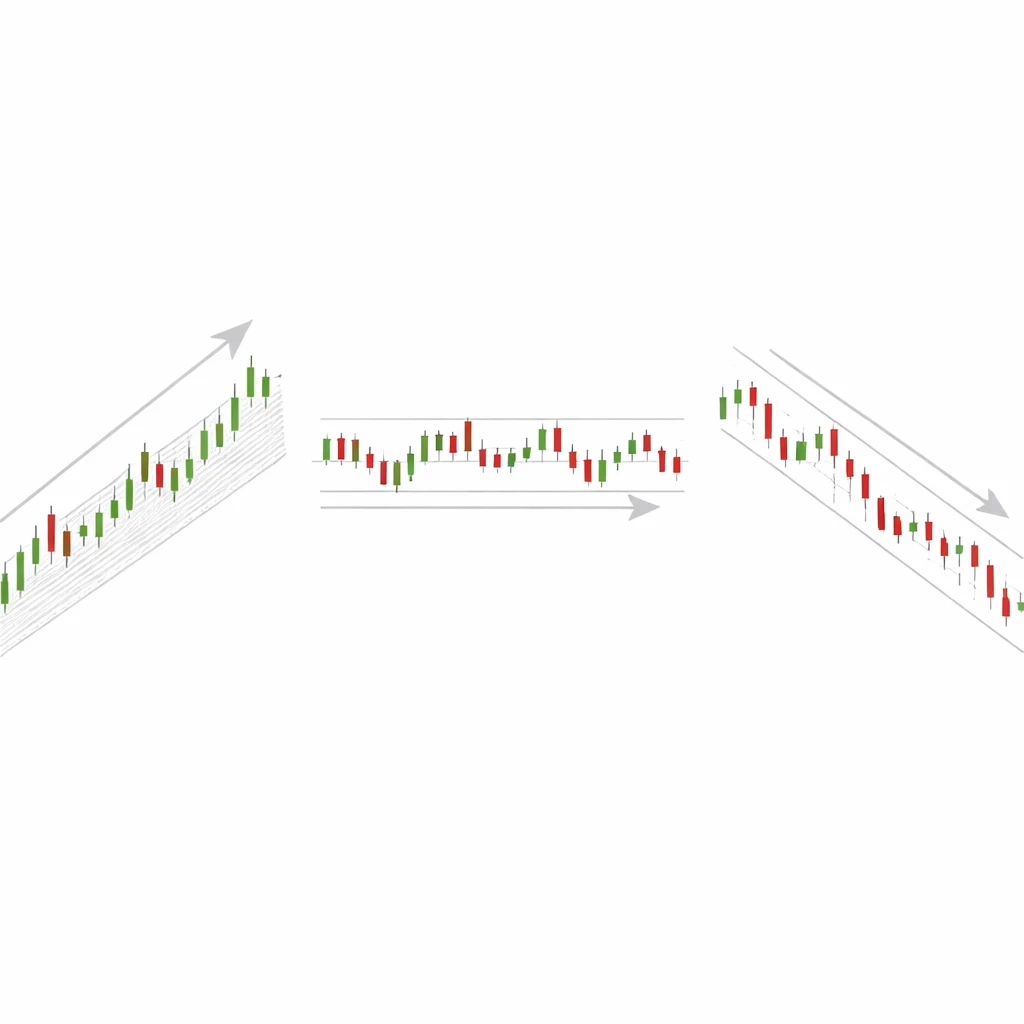

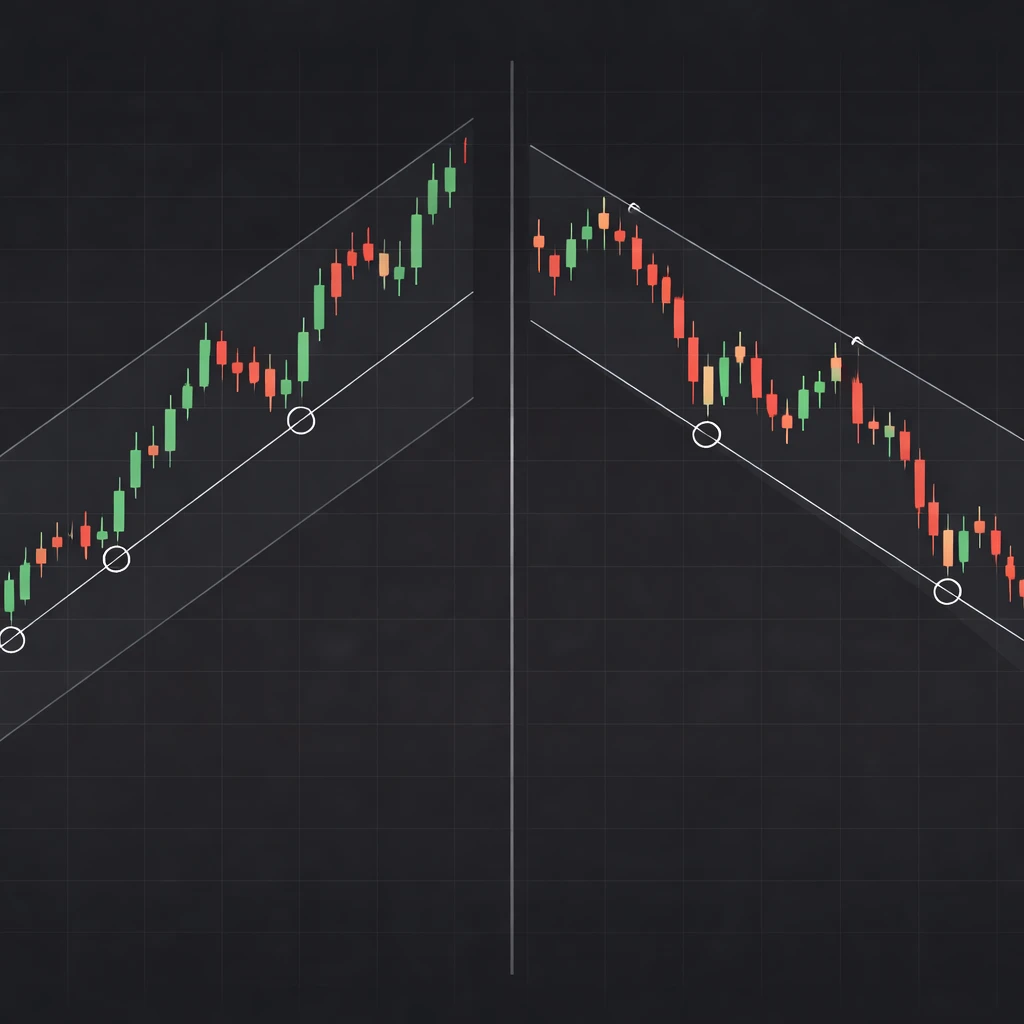

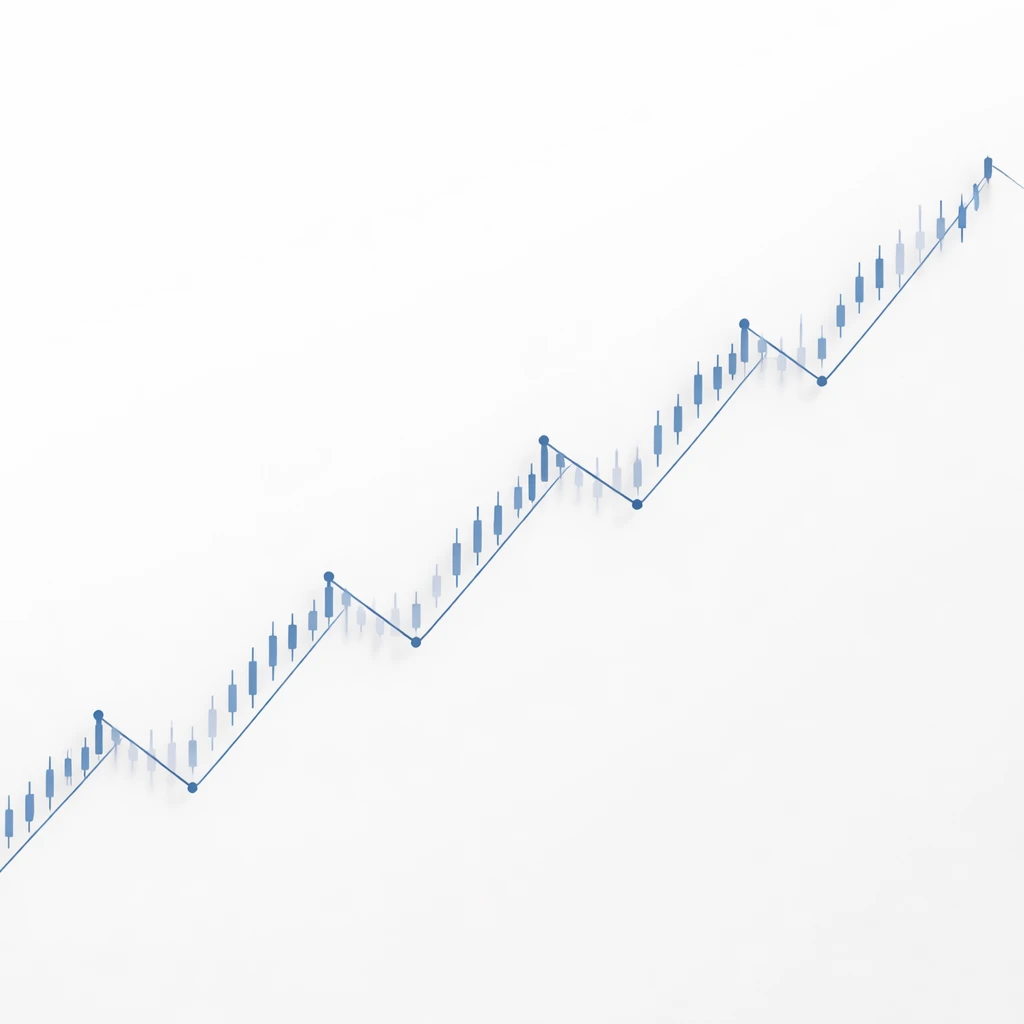

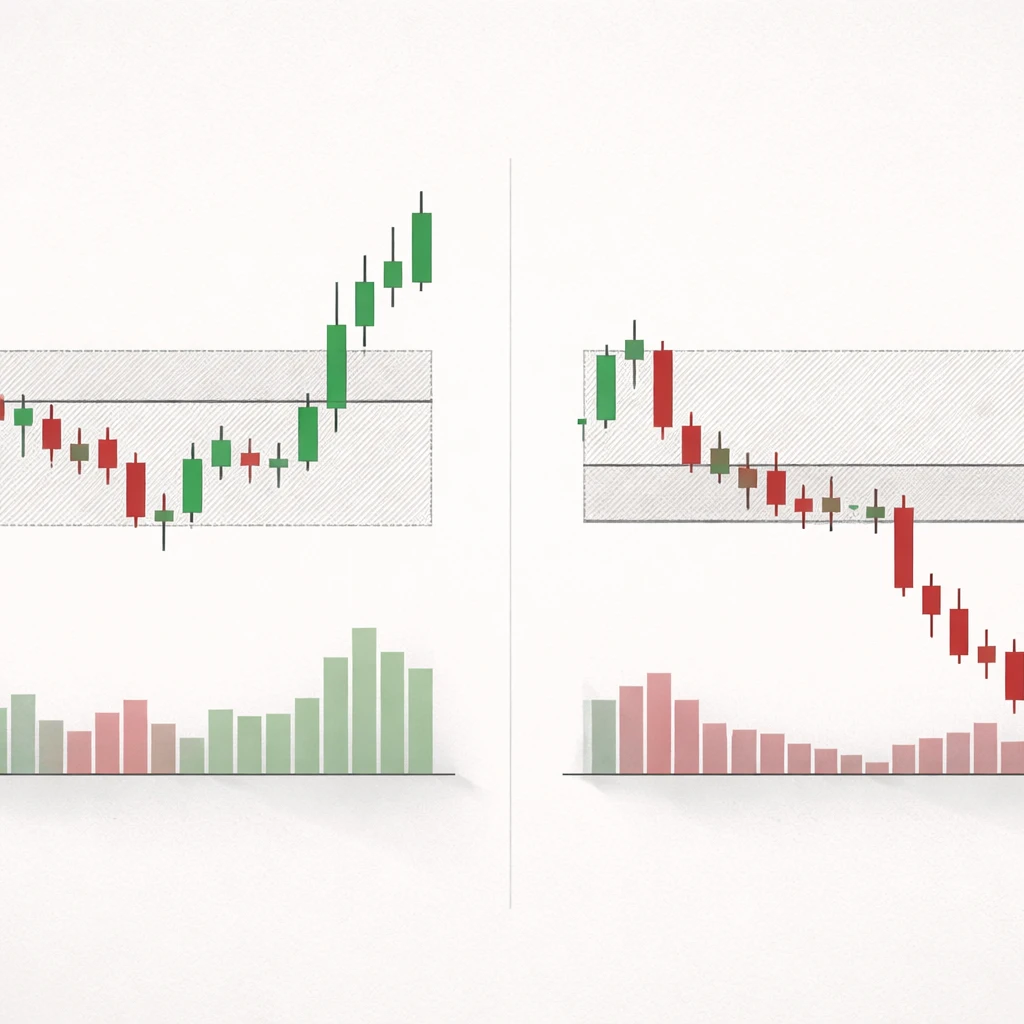

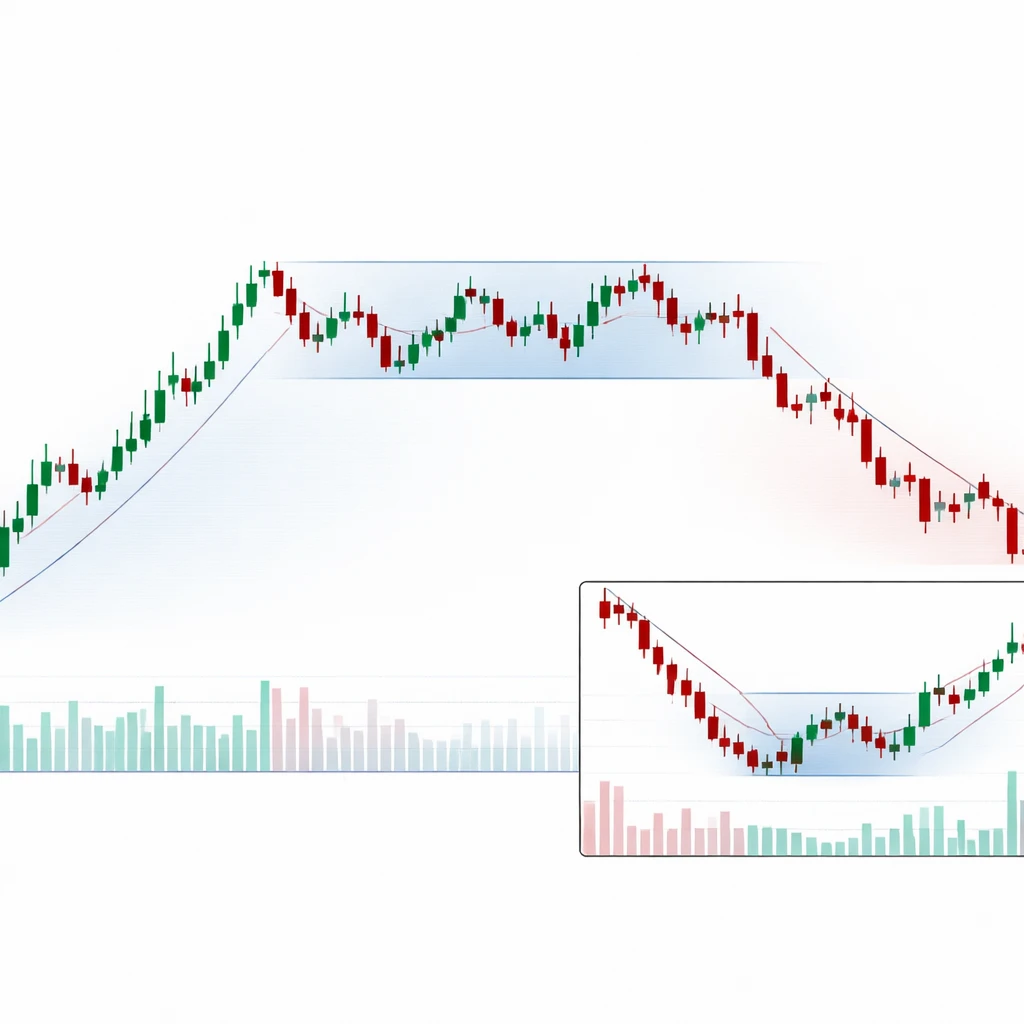

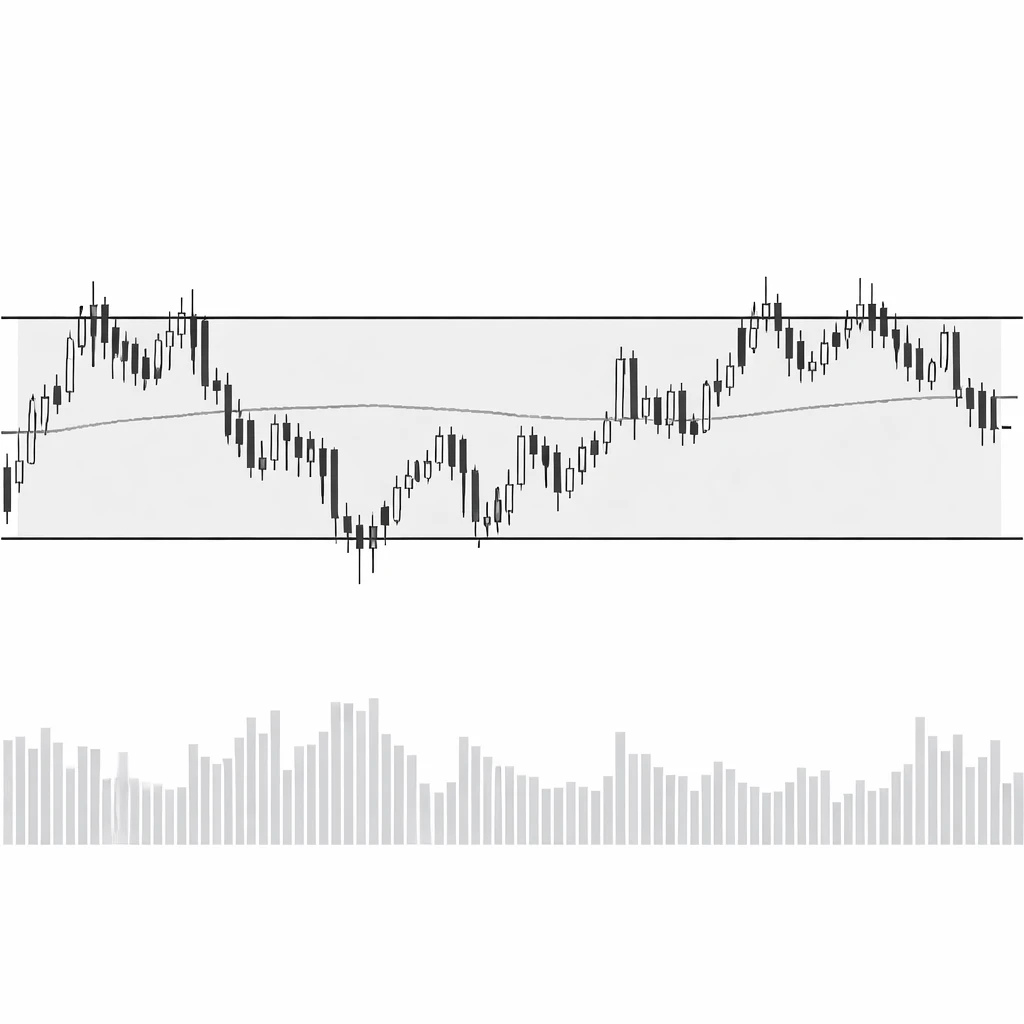

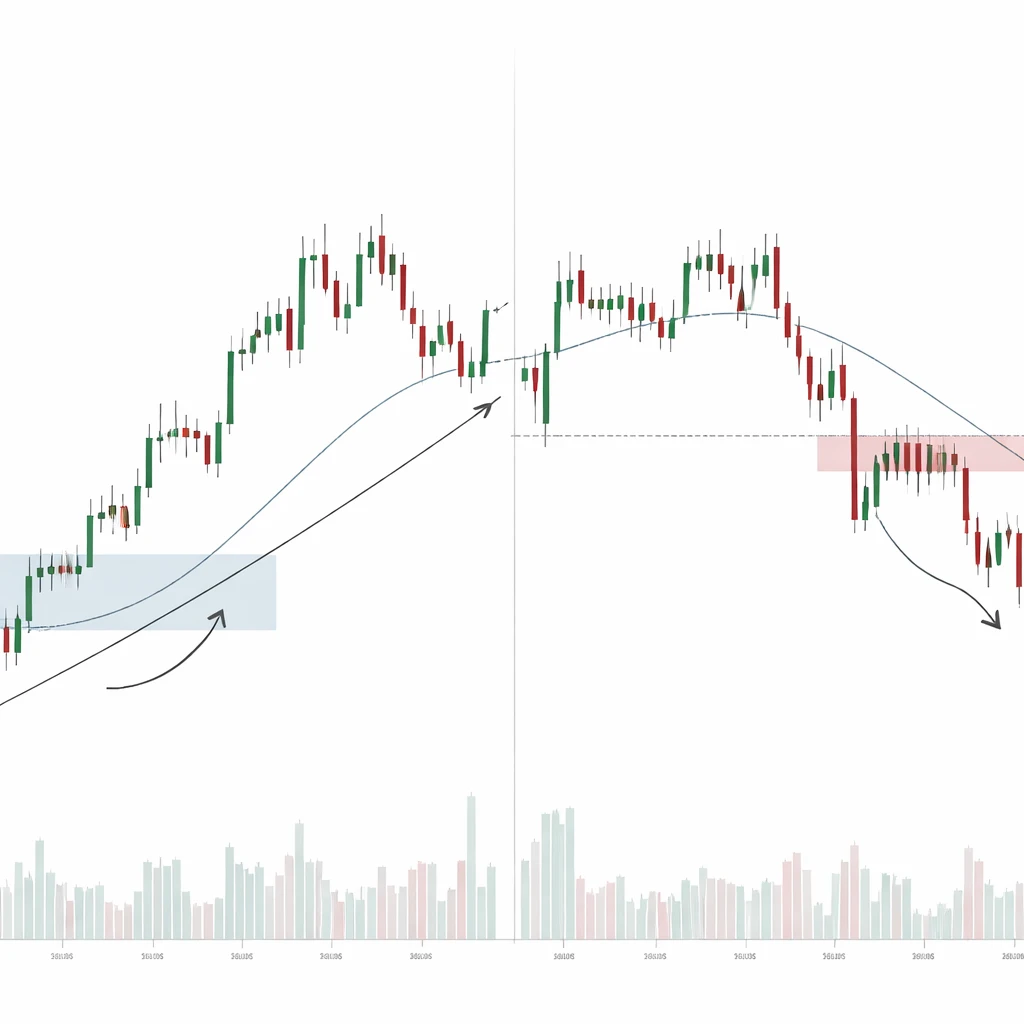

A market trend is the directional tendency of price over a defined timeframe, observed through sequences of swing highs and lows. This article explains how trends appear on charts, how they relate to market structure, why they matter for interpretation, and how to study them without relying on trading signals.