Market structure describes how price organizes itself over time through swings, ranges, and transitions between trending and non-trending states. The phrase market structure across assets extends this idea to a cross-asset perspective. It asks whether the same structural principles that describe an equity index also describe a currency pair, a crude oil future, a government bond future, or a crypto token, and how the microstructure of each market shapes what appears on a chart. This article defines market structure in technical terms, shows how it appears on charts, and discusses how a cross-asset view can sharpen interpretation of price behavior without drifting into trade prescriptions.

Defining Market Structure

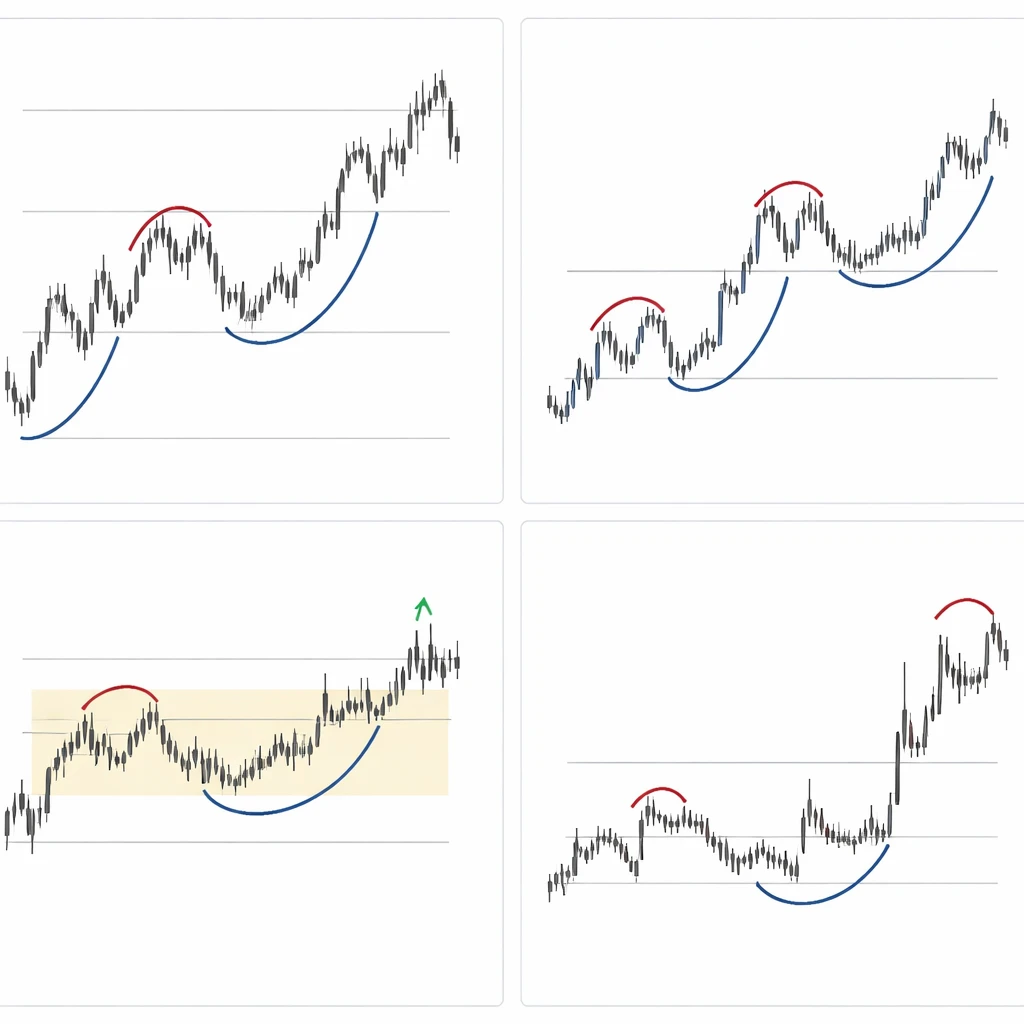

At its core, market structure is a description of the sequence and organization of price swings. Technical analysis typically begins with the identification of swing highs and swing lows. A swing high is a pivot where an advance stalls and is followed by a decline. A swing low is a pivot where a decline stalls and is followed by an advance. The relative position of successive swings gives a working definition of trend and range.

Common structural states include the following:

- Uptrend. A series of higher highs and higher lows, often organized into impulsive advances separated by corrective pullbacks.

- Downtrend. A series of lower lows and lower highs, also organized into impulsive declines with corrective rallies.

- Range. Price oscillates between a relatively stable high boundary and low boundary, with failed attempts to trend beyond those limits.

- Transitional zones. Structures such as bases, tops, or volatile consolidations that interrupt a prior trend. These zones often concentrate information about future directional bias, regardless of whether they resolve in continuation or reversal.

Within this framework, technicians monitor two transitional ideas. A break of structure refers to price moving beyond a prior swing that had defined the current state. For example, an uptrend facing a decisive move below its most recent higher low signals a possible structural shift. A change of character refers to a noticeable alteration in the behavior of swings themselves. This might mean volatility expands, retracements deepen, or overlaps increase, indicating that trend quality is weakening even before a formal break.

Market structure is fractal. The same logic appears on monthly, daily, and intraday charts, although the speed and noise level differ. A daily uptrend can coexist with a choppy intraday range. Recognizing the timeframe of the structure under review is essential for consistent interpretation.

How Market Structure Appears on Charts

Most charting approaches reveal market structure with some combination of candlesticks or bars, swing annotations, and simple visual aids. A few recurring features help readers translate charts into structural descriptions.

Impulse and correction. Impulsive legs travel farther with relatively shallow pullbacks and strong closes. Corrective legs travel shorter distances, often showing overlapping candles and hesitant closes. In a healthy uptrend, impulsive buying waves eclipse the depth and speed of interim selling.

Boundaries and acceptance. In ranges, price spends time building acceptance around a median. Areas near the upper and lower edges display rejection behavior, often with tails and failed follow-through. Over time, many ranges become recognizable as rectangles or slightly sloping channels.

Gaps and sessions. Equities, exchange-traded funds, and some futures display opening gaps caused by overnight information. Gaps can distort the visual continuity of swings and often act like structural markers. Markets that trade nearly 24 hours, such as major currency pairs, present fewer gaps, so structural transitions appear as continuous sequences instead of jumps.

Volatility clustering. Periods of quiet trading often sit next to periods of violent price discovery. Structural labels gain or lose meaning depending on volatility. A range during quiet conditions may be a narrow box. The same range in high volatility may be a wide band where swing highs and lows are farther apart and short-lived.

Technical indicators can describe structure without dictating it. A moving average can summarize the mean path and slope of price. A trendline can connect successive swing lows or highs. These aids do not define the structure, but they often make the structure easier to read.

Why a Cross-Asset Lens Matters

The language of market structure is portable. Higher highs and higher lows describe an index, a currency pair, or a commodity. Yet the way structure expresses itself depends on microstructure, participant mix, and the economic role of each asset. A cross-asset lens improves interpretation by helping the reader expect and account for these differences.

Consider four dimensions where asset class matters.

Trading hours and session effects. Equities concentrate liquidity in a regular session with an opening auction, intraday lunch lull, and closing rotation. This session rhythm introduces gaps, spurts of directional flow at the open and close, and frequent reversals at midday. Major FX pairs trade around the clock on business days, cycling through Asia, Europe, and North America. Structural breaks in FX often appear during handoffs between these sessions. Cryptocurrency trades continuously through weekends, so structural features can form during hours when other assets rest.

Liquidity and depth. Deep markets tend to print cleaner trend legs with smaller slippage and fewer extreme wicks, while thinner markets display exaggerated tails and erratic gaps. A thin altcoin can produce dramatic overshoots that would be unusual on a treasury future.

Participant motives. Hedgers, speculators, market makers, and asset allocators create distinct flows. Commercial hedging is prominent in commodities, while macro funds and corporates shape FX. Retail participation is more visible in single equities and some crypto tokens. These differences influence the persistence of trends, the frequency of mean reversion, and the reaction to news.

Event calendars and seasonality. Economic releases, earnings cycles, inventory reports, and rollover dates create predictable windows where structural breaks cluster. Crude oil often reacts to inventory data midweek. Equity indices respond to earnings seasons and index rebalances. Rates markets align with central bank meetings. The structures that form around these events are not random, even though the outcomes vary.

Structural Characteristics by Asset Class

Equities and Equity Indices

Equities are characterized by session gaps, earnings-related jumps, and a strong index influence on constituents. On a daily chart, an index uptrend often consists of stair-stepping advances punctuated by shallow pullbacks that respect prior swing lows. The cleanest uptrends appear during broad risk-on periods with declining credit spreads and supportive macro conditions. Inside the day, many equities show a morning impulse, midday consolidation, and late-day resolution. Swing highs formed at the open may differ in quality from swing highs formed at midday because liquidity and participant mix change throughout the session.

Gaps complicate structure reading. A break of structure via a gap can occur without any trading at intermediate prices. Technicians often treat unfilled gaps as structural markers that define the narrative of a move. Corporate actions such as splits and dividends require adjusted charts to maintain structural continuity over long horizons.

Foreign Exchange

FX pairs typically trade 24 hours from Monday through Friday, which reduces gaps and highlights session transitions. Structural breaks often coincide with the overlap between European and North American sessions where liquidity peaks. Trends in FX can be persistent when supported by interest rate differentials and policy divergence, yet intraday noise is common because order flow is distributed across many venues.

Ranges are a frequent FX feature. Extended periods of oscillation around a fair value are interrupted by sharp repricings around central bank communications. False breaks out of established FX ranges are well known, so confirmation by sustained time beyond a level often matters for structural interpretation.

Commodities and Futures

Commodity futures integrate physical market dynamics, storage constraints, and seasonal patterns. Structural regimes can align with planting and harvest cycles in grains, shoulder seasons in energy demand, or weather-driven shocks. On charts, this often appears as recurring ranges during predictable parts of the year, punctuated by impulsive repricings when supply or demand conditions change.

Futures roll adds a structural wrinkle. Contract transitions require continuous price series to preserve historical structure. Open interest migration can temporarily distort intraday structure as traders shift positions. Many commodity futures exhibit sharp tails during thin overnight sessions, followed by cleaner structures during primary pit or electronic hours when liquidity concentrates.

Rates and Government Bond Futures

Rates markets display discrete steps around economic data and central bank meetings. Daily structure often shows long quiet stretches interrupted by sudden repricings when policy expectations shift. Trend segments can be orderly due to deep liquidity, but structural breaks frequently align with calendar events such as inflation releases or policy statements. Volume and open interest around these events can help describe the quality of structural transitions.

Cryptoassets

Crypto trades continuously with a participant base that blends retail, proprietary firms, and offshore venues. Structural patterns form during weekends and off-hours when other assets are closed. Charts frequently show long wicks that test levels with limited follow-through, reflecting shallow depth and rapid changes in liquidity. Sharp repricings appear around exchange-specific events or network headlines, and ranges can persist until a sudden expansion of volatility clears trapped positions.

Interpreting Structure Across Timeframes

Price action is nested. A weekly uptrend may contain a daily range, which contains a 1-hour downtrend inside a corrective leg. A practical reading of structure respects this nesting by assigning roles to each timeframe.

On the higher timeframe, identify the prevailing state: uptrend, downtrend, or range. Note the key swing highs and lows that define this state. On the working timeframe, inspect how swings interact with those higher-timeframe reference points. For example, a daily range that sits near the upper boundary of a weekly uptrend frame will communicate different risk and opportunity than a daily range resting at the lower boundary.

Structure also evolves. Early in a trend, pullbacks are usually shallow and brief. Mid-trend, pullbacks deepen and overlaps increase. Late in a trend, volatility expands and failed breakouts become more frequent. On charts this appears as a progression from clean, impulsive legs to choppier sequences with more overlap and hesitation. Recognizing this evolution improves interpretation, regardless of the asset in question.

Cross-Asset Confirmation and Divergence

A cross-asset view compares structures in related markets. If an equity index prints a series of higher highs and higher lows while high yield credit indices are stuck in a range with lower highs, that contrast may indicate underlying fragility in the equity structure. If crude oil forms a multi-month base and later breaks out while energy equities remain capped by prior swing highs, the divergence can be a signal about the transmission of commodity price changes to corporate valuations.

In FX, a strong uptrend in the dollar index can coincide with downtrends in commodity currencies. In rates, a break of structure in short-dated yields can precede or coincide with transitions in longer-dated bond futures. In crypto, a broad-based expansion where multiple large-cap tokens make higher highs together often differs meaningfully from a narrow advance where one token trends while others remain in ranges.

These relationships do not provide mechanical rules. They provide context. Structural alignment across related assets tends to reinforce the interpretation of a prevailing regime. Structural divergence invites caution and a search for the reason behind the disconnect, whether it is timing, liquidity, or a fundamental catalyst that has not yet propagated.

Chart-Based Illustrations

The following examples describe how structure appears without prescribing trades. The numbers are illustrative and focus on reading rather than outcome.

Example 1: Equity index with a weekly uptrend and a daily range. Imagine a weekly chart of a major index printing five successive higher highs and higher lows. The slope of a simple moving average is upward, and the last major swing low sits well below current price. On the daily chart, the same index has moved sideways for 20 sessions between a defined upper boundary and a lower boundary that coincides with the prior daily swing low. Intraday attempts to break higher fade quickly, and downside probes are rejected near the lower boundary. The weekly uptrend provides the broader frame, while the daily range suggests a pause where acceptance is building. On a chart, you would mark the weekly swing low, the daily range boundaries, and note the lack of follow-through beyond either edge.

Example 2: FX pair in a prolonged range with session-driven probes. Consider a currency pair that has traded between 1.0800 and 1.1100 for six weeks. Most sessions feature modest mean reversion, but during the overlap of European and North American hours, range edges are tested. Several false breaks occur with quick rejections back into the range. A sustained close beyond the boundary during high liquidity hours would carry more weight than a brief overnight spike. On the chart, arrows highlighting repeated failures at the same level would convey the stability of the range despite frequent tests.

Example 3: Commodity future rotating through a seasonal band. A grain future spends much of the spring oscillating within a seasonal band. Swing highs cluster near a price that also served as resistance in prior years. Sharp declines appear after weather updates, but each time the market returns to the central zone. Volume concentrates near the center of the band, and tails appear near the edges during thinner sessions. The structure reads as a wide range with event-driven excursions.

Example 4: Crypto token with weekend structural volatility. A large-cap crypto token trends upward on the daily chart, but many decisive swing breaks happen during weekend hours. Several long wicks penetrate prior highs and lows, then reverse quickly as liquidity changes. Later in the week, a cleaner break holds during peak activity, marking a more stable transition. The chart displays a sequence of higher lows with intermittent whip-like tests on thin liquidity.

Volume, Open Interest, and Structure

Volume and open interest provide descriptive context for structure where data are available. In equities, strong advances with expanding volume can indicate enthusiastic participation. In futures, an uptrend accompanied by rising open interest suggests that new positions are entering rather than old positions simply transferring. During ranges, volume often concentrates near the middle of the range where both sides transact. Near edges, volume can dry up just before a decisive move or spike as a test fails. These are descriptive observations that color how a structural state is perceived.

Not all markets offer the same quality of volume data. Spot FX volume is fragmented across venues, so analysts often rely on futures proxies or tick activity. Crypto volume varies across exchanges. In such cases, the structure of price itself remains the primary tool, with volume as a supporting note rather than a definitive arbiter.

Identifying Structural Breaks Without Overfitting

False breaks occur everywhere, but their frequency and shape depend on the asset. In thick, widely followed indices, a structural break on daily or weekly charts often sticks if it is associated with a fundamental shift, such as a change in policy expectations. In thinner or more speculative instruments, breaks can overshoot and reverse quickly.

A disciplined reading of structure distinguishes between the first incursion beyond a level and sustained acceptance beyond it. On charts, that distinction shows up as time spent above or below the broken level, the degree of overlap on subsequent bars, and whether the break is supported by continued impulsive action. The emphasis is on the behavior after the break, not the label itself.

Common Pitfalls in Cross-Asset Interpretation

Several errors recur when readers transplant structural ideas across markets without adjusting for context.

Ignoring session structure. Applying intraday patterns from equities directly to FX often fails because the drivers of impulsive moves differ. The equity open and close matter a great deal. FX transitions align with cross-border session overlaps.

Neglecting contract mechanics. Futures rollover and contract-specific dynamics can distort continuity. Using continuous adjusted charts helps preserve a coherent structural history.

Over-generalizing volatility. A 2 percent daily range in a single stock can be ordinary. The same magnitude in a major bond future is noteworthy. Structural labels must scale with the volatility norms of the asset.

Confusing correlation with causation. Cross-asset divergences are informative, but they do not mechanically predict outcomes. They invite investigation into whether a structural lag, liquidity issue, or distinct catalyst explains the difference.

Forgetting the timeframe stack. A clean intraday trend inside a messy daily range is not a contradiction. It reflects nesting. Misreading occurs when structural judgments jump across timeframes without context.

A Practical Workflow for Reading Structure

The following workflow organizes chart reading into a sequence that respects cross-asset differences. It is not a trading plan and does not imply specific actions.

- Choose the frame. Select the higher timeframe that governs the narrative. Mark the key swing highs and lows that define the prevailing state.

- Note volatility and liquidity features. Identify session gaps, weekend activity, or thin periods. Adjust expectations for the smoothness or choppiness of swings accordingly.

- Describe the current state. Uptrend, downtrend, or range. Label the most recent structural tests and whether acceptance developed beyond them.

- Map the nesting. Relate the working timeframe to the higher frame. Observe whether the working structure sits near an edge, a midpoint, or a prior congestion zone.

- Cross-asset context. Where relevant, compare structure in related assets. Look for alignment or divergence that informs the regime characterization.

Applications Without Prescriptions

Market structure across assets enriches interpretation rather than dictating outcomes. It helps a reader distinguish a healthy advance from a tiring sequence, a contained range from a regime on the verge of transition, and a lone structural break from a market-wide repricing. It also clarifies why the same price pattern can behave differently in two assets. A triangle that resolves cleanly in a liquid index might morph into a whipsaw in a thin commodity. The difference is not the label but the market beneath it.

Finally, the cross-asset perspective encourages humility about precision. Structural descriptions are models of organization. They compress complex flows into simple labels. The value lies in consistent reading and comparison, not in certainty. When combined with knowledge of the asset’s microstructure, calendar, and participant base, market structure becomes a disciplined way to organize price behavior across the investment universe.

Key Takeaways

- Market structure is the organized sequence of swing highs and lows, with trends, ranges, and transitions that repeat across timeframes.

- A cross-asset lens recognizes that the same structural labels express differently due to trading hours, liquidity, participant motives, and event calendars.

- Charts reveal structure through impulse and correction, boundaries and acceptance, session gaps, and volatility clustering.

- Comparing structures across related markets provides context, highlighting alignment and divergence without implying mechanical signals.

- A disciplined workflow focuses on timeframe, volatility, nesting, and cross-asset context to interpret price behavior without prescribing trades.