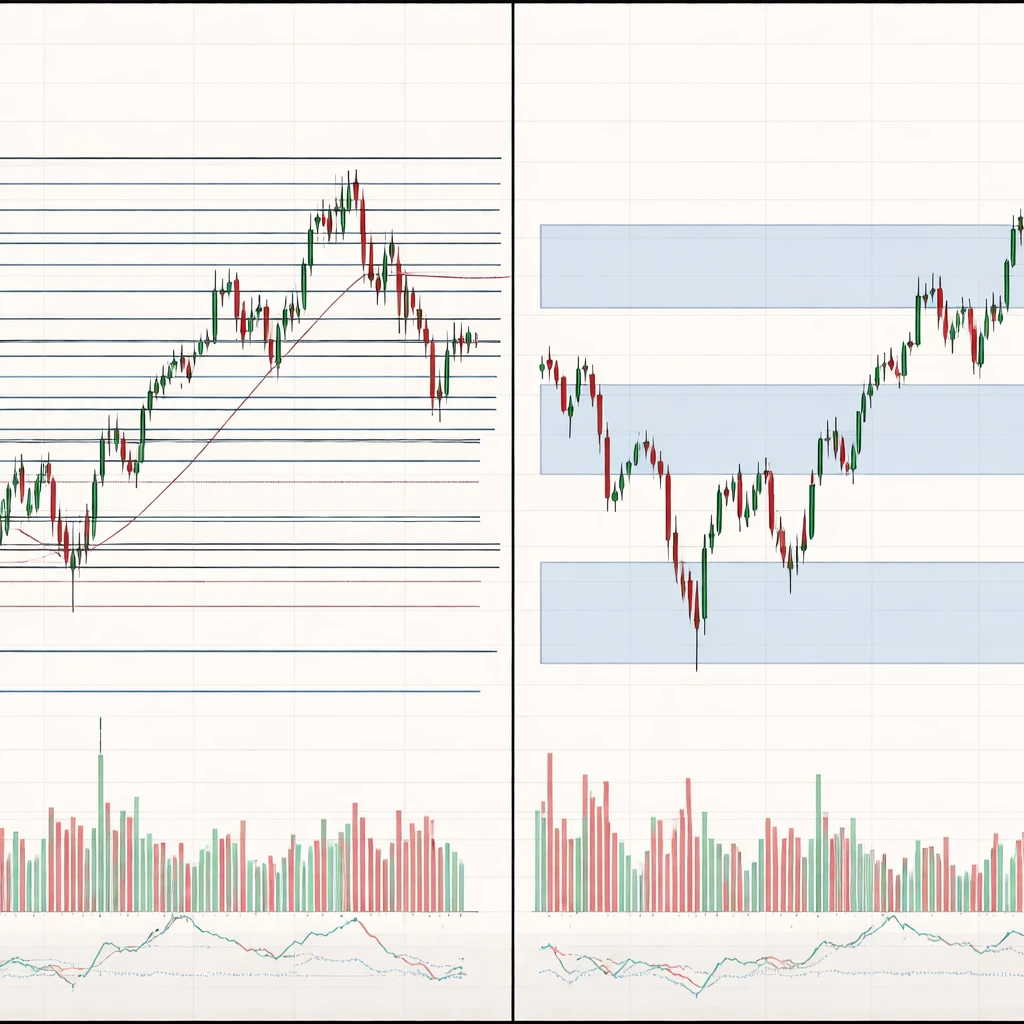

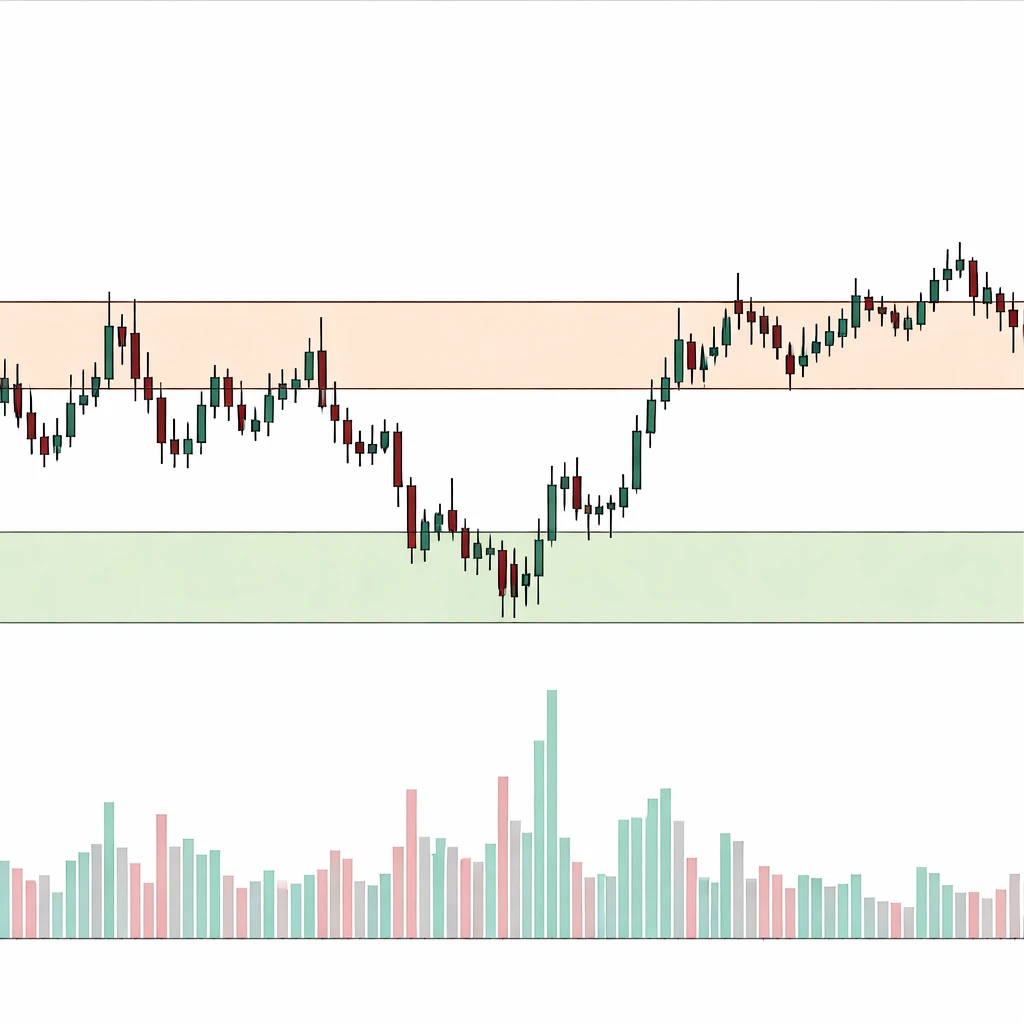

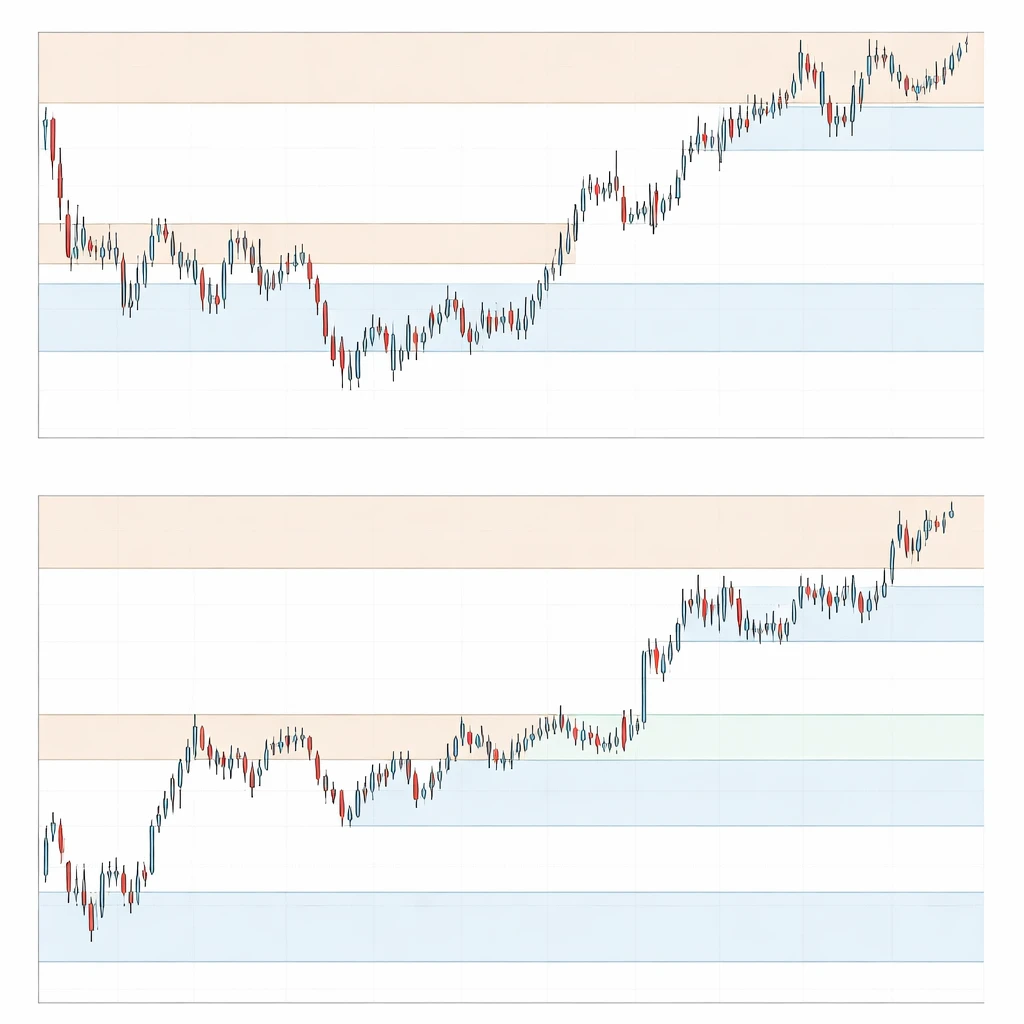

Timeframe Importance of Levels

An in-depth explanation of why support and resistance levels drawn on higher timeframes often carry greater interpretive weight, how this appears on charts, and how multi-timeframe levels help read market price behavior without prescribing strategies.