Why Stop Losses Exist

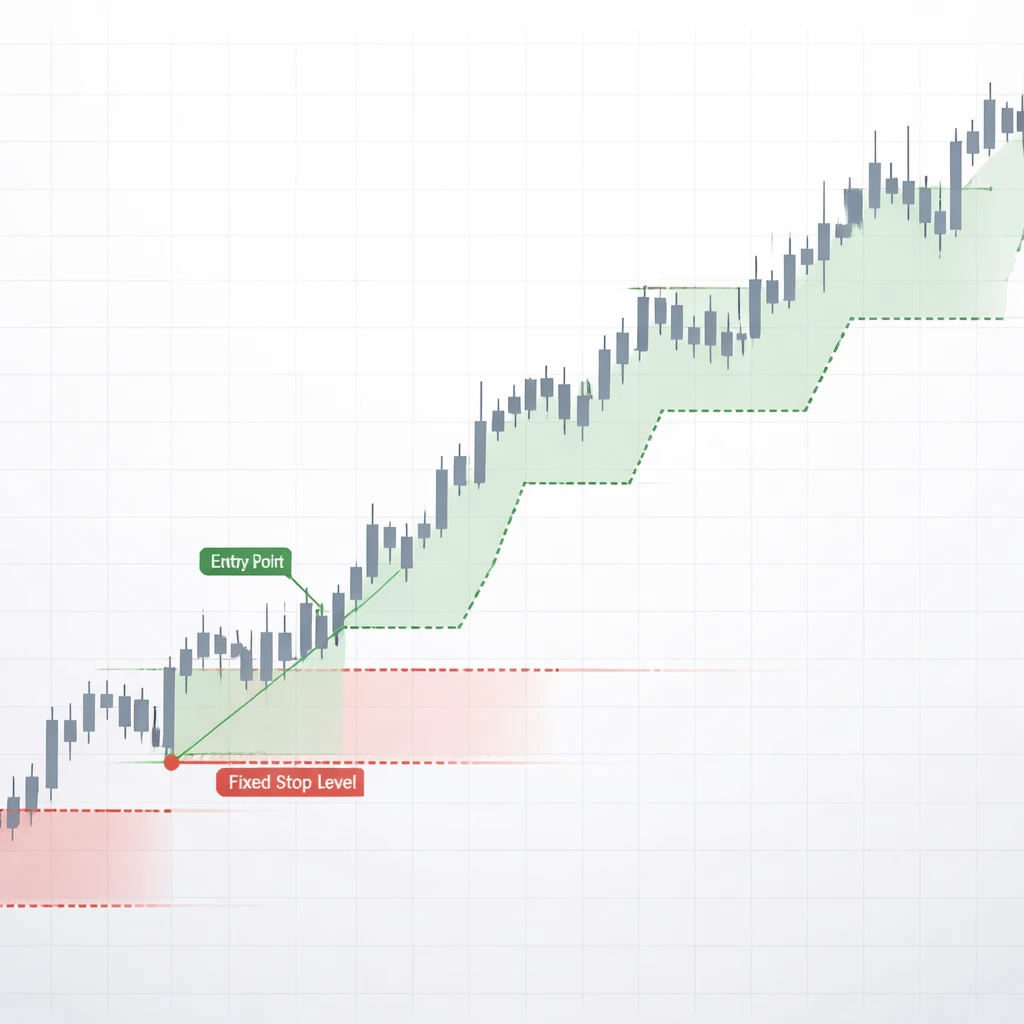

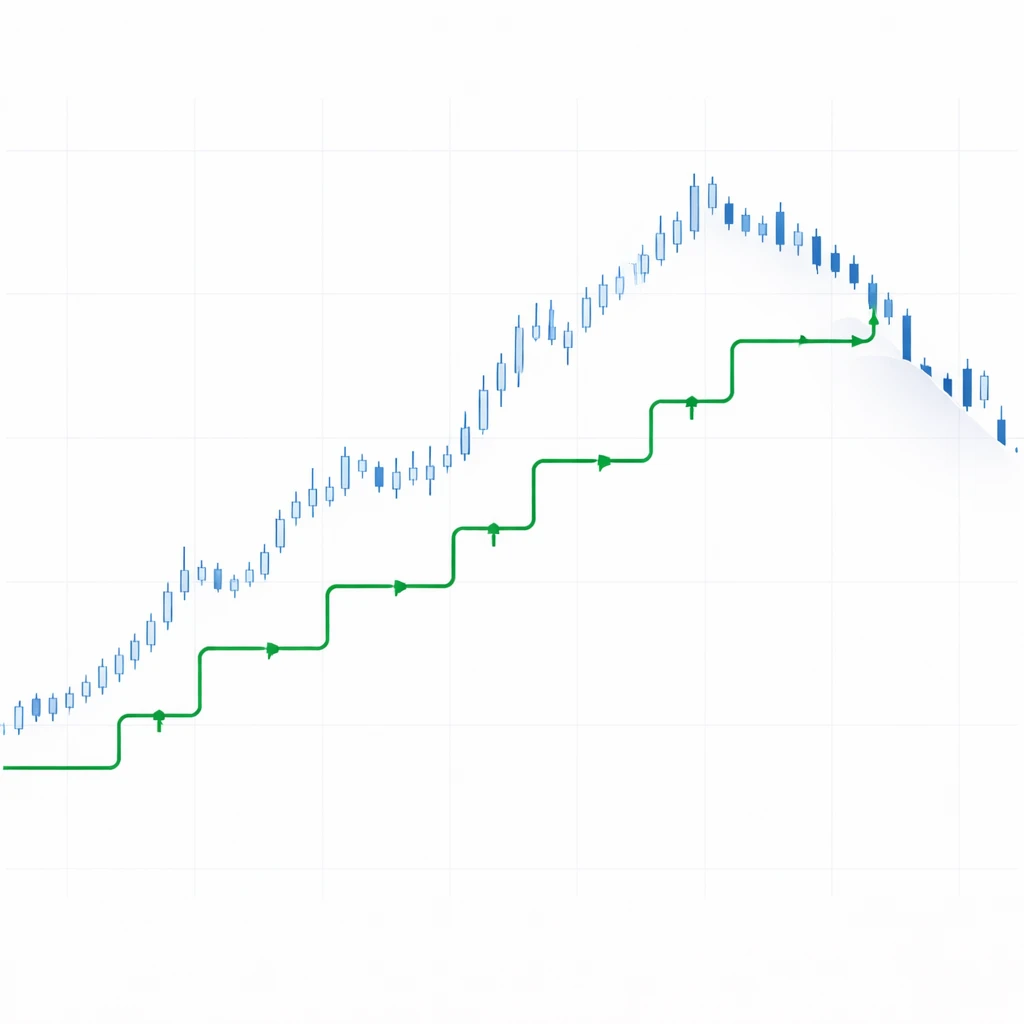

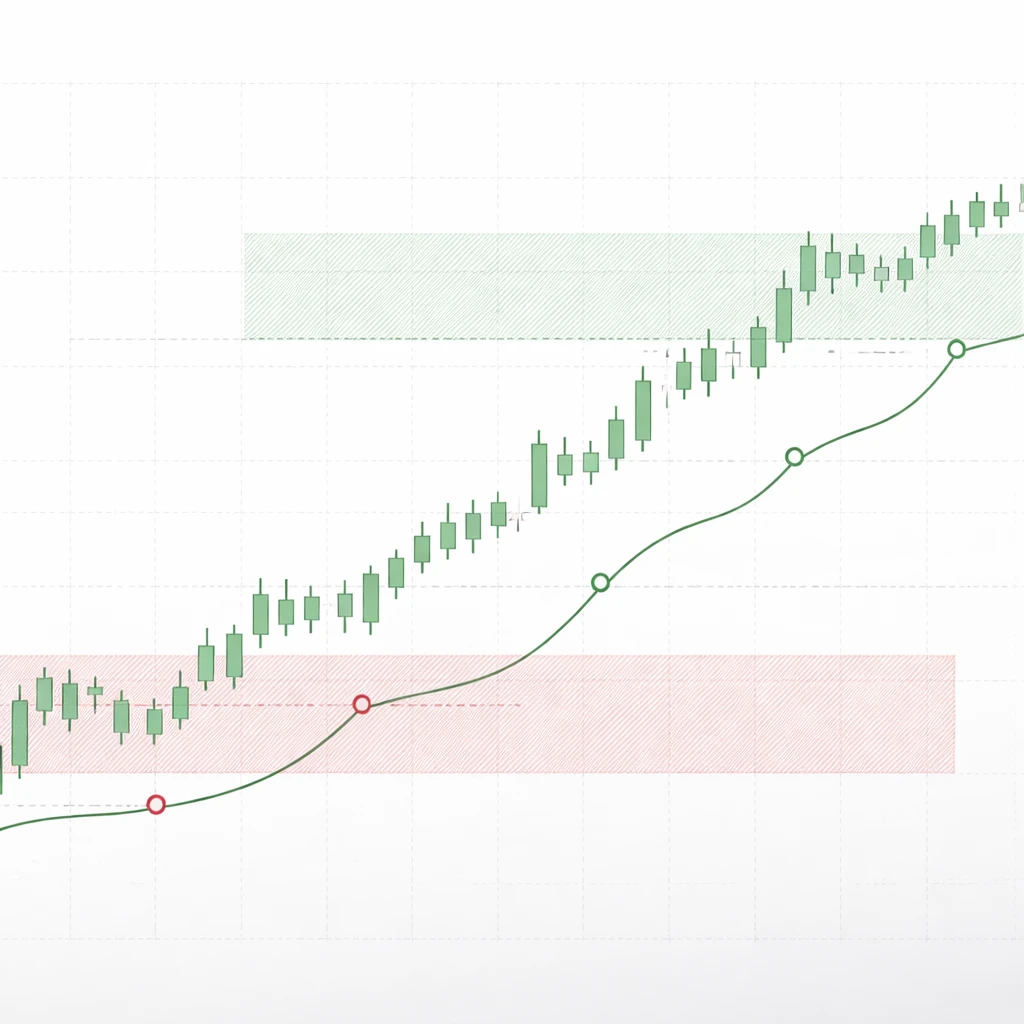

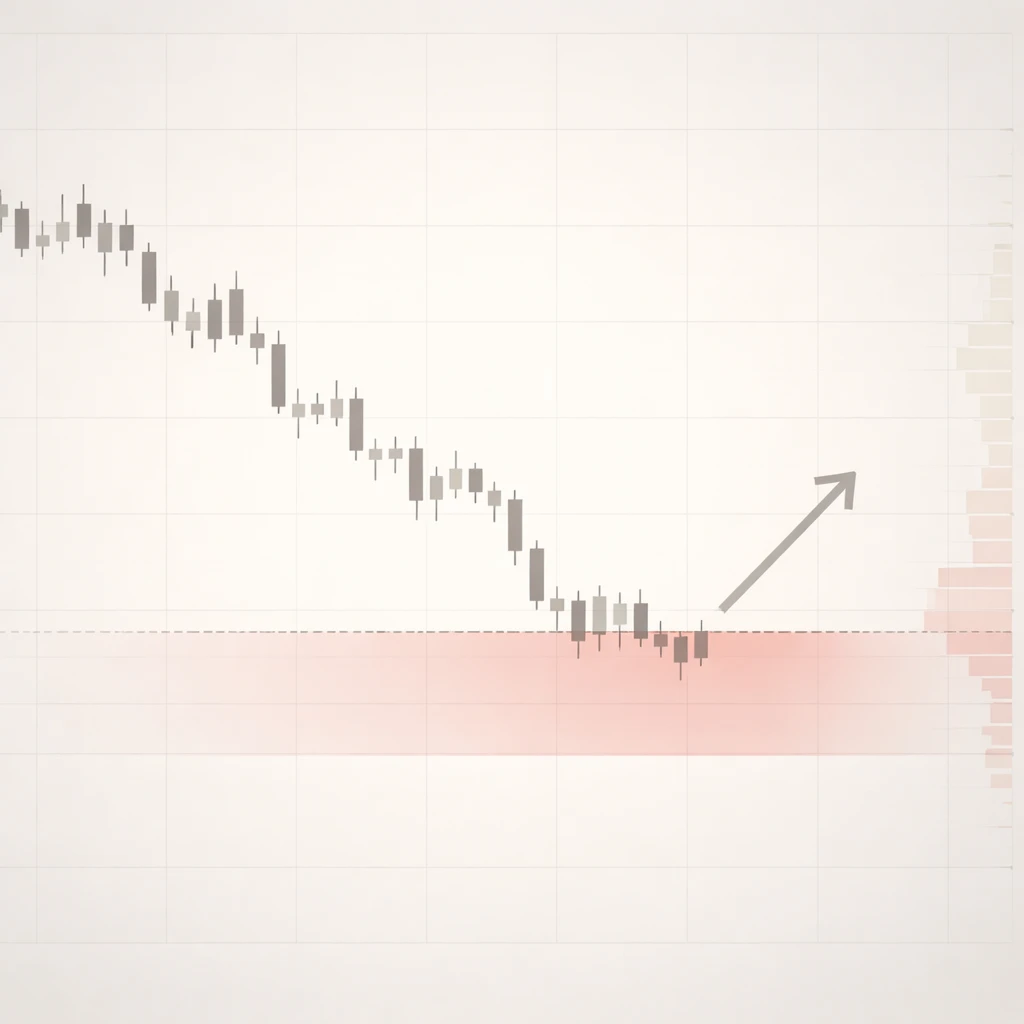

An academic explanation of why stop losses exist in trading, how they protect capital and survivability, and where traders frequently misunderstand or misuse them. The article clarifies the governance role of exits, practical implementation issues, and portfolio-level implications without offering recommendations or setups.