Position sizing is the operational heart of risk management. It determines how much capital is put at risk in each trade and, by extension, how quickly a trading account can recover from losses or, conversely, how quickly it can suffer permanent impairment. Average True Range, or ATR, offers a systematic way to link position size to current market volatility so that risk per trade remains controlled across different instruments and regimes. ATR-based position sizing aligns a trade’s dollar risk with the distance to an exit, expressed in units of recent price variability, rather than with a fixed number of shares or contracts.

This article explains what ATR-based position sizing means, why it guards capital, how it is applied in practice, and where practitioners commonly stumble. It does not provide recommendations about what to trade or how to predict prices. The focus is on the risk arithmetic that supports long-term survivability.

What ATR Measures and Why It Matters

ATR is a volatility measure based on the “true range” of an instrument. True range captures the largest of three quantities for a given bar: high minus low, absolute value of high minus the previous close, or absolute value of low minus the previous close. Using the maximum of these three incorporates gap risk between bars. ATR is usually an exponential or smoothed moving average of true range over a lookback such as 14 periods.

ATR has two practical strengths for risk sizing. First, it is expressed in price units rather than squared units, so it can be applied directly to stop distances. Second, because it accounts for gaps, it generally responds to discontinuities that simple high-low ranges or close-to-close measures might miss. If one sizes positions relative to ATR, the per-trade risk scales with the instrument’s current variability. High volatility leads to smaller positions for the same risk budget. Low volatility leads to larger positions, with constraints as needed to avoid concentration.

Position Sizing Objectives

Position sizing serves several objectives tied to survivability.

- Keep dollar risk per trade within a predefined budget, often a fraction of account equity.

- Maintain consistency of risk across instruments with different prices and volatilities.

- Limit the impact of volatility regime changes on loss distribution.

- Provide a basis for portfolio-level aggregation of risk so that overall exposure can be constrained.

In any trade, the key elements are the entry price, the exit rule, and the maximum tolerable loss if the exit is reached. ATR connects the exit distance to recent volatility. If the exit is placed at a multiple of ATR below or above the entry, then the per-unit risk (for example, per share) equals that ATR multiple times the ATR value. The total position size then follows mechanically from the chosen dollar risk per trade.

Defining ATR-Based Position Sizing

ATR-based position sizing is the practice of determining the number of shares, contracts, or units to trade by setting a volatility-based stop distance as a multiple of ATR and dividing the planned dollar risk by that distance. The core idea is simple:

Position size = Planned dollar risk per trade ÷ (ATR multiple × ATR value × value per price unit)

The “value per price unit” translates price movement into currency. For a stock quoted in dollars per share, a 1.00 change equals 1 dollar per share. For a futures contract, one point may represent a fixed dollar amount. For a currency pair, one pip has a pip value that depends on contract size and quote currency.

Why ATR-Based Sizing Protects Capital

Market volatility is not constant. It clusters and shifts with macro conditions, liquidity, and news flow. A fixed number of shares or contracts can expose a portfolio to much larger dollar swings in turbulent periods than in calm ones. A fixed dollar stop distance has the opposite problem in quiet conditions, often creating exits that are too tight relative to normal noise. ATR-based sizing adapts risk to the environment by using today’s typical range as the yardstick.

Capital protection follows from three channels:

- Controlled loss magnitude. For a chosen risk budget, losses from a stopped-out trade are contained regardless of the instrument’s price level or current volatility, subject to gaps and slippage.

- Comparability across instruments. Two trades in very different markets can be structured to have similar risk if both use ATR-normalized exits and sizing.

- Resilience to regime changes. When volatility expands, the framework reduces position size automatically, lowering the probability that a cluster of adverse moves depletes capital quickly.

Computational Steps

Practitioners typically proceed in a few steps:

- Choose an ATR lookback and smoothing method, consistent with the bar interval used for entries and exits.

- Set an exit distance as a multiple of ATR, consistent with the intended holding period and the strategy’s tolerance for noise.

- Determine the planned dollar risk per trade. This is often a percentage of current equity, a fixed dollar amount, or a function of portfolio-level constraints.

- Translate the ATR distance into currency per unit and divide the risk budget by this value to obtain size. Apply rounding and minimum lot constraints.

- Check portfolio constraints, including exposure caps, correlation, and margin, then finalize the order size.

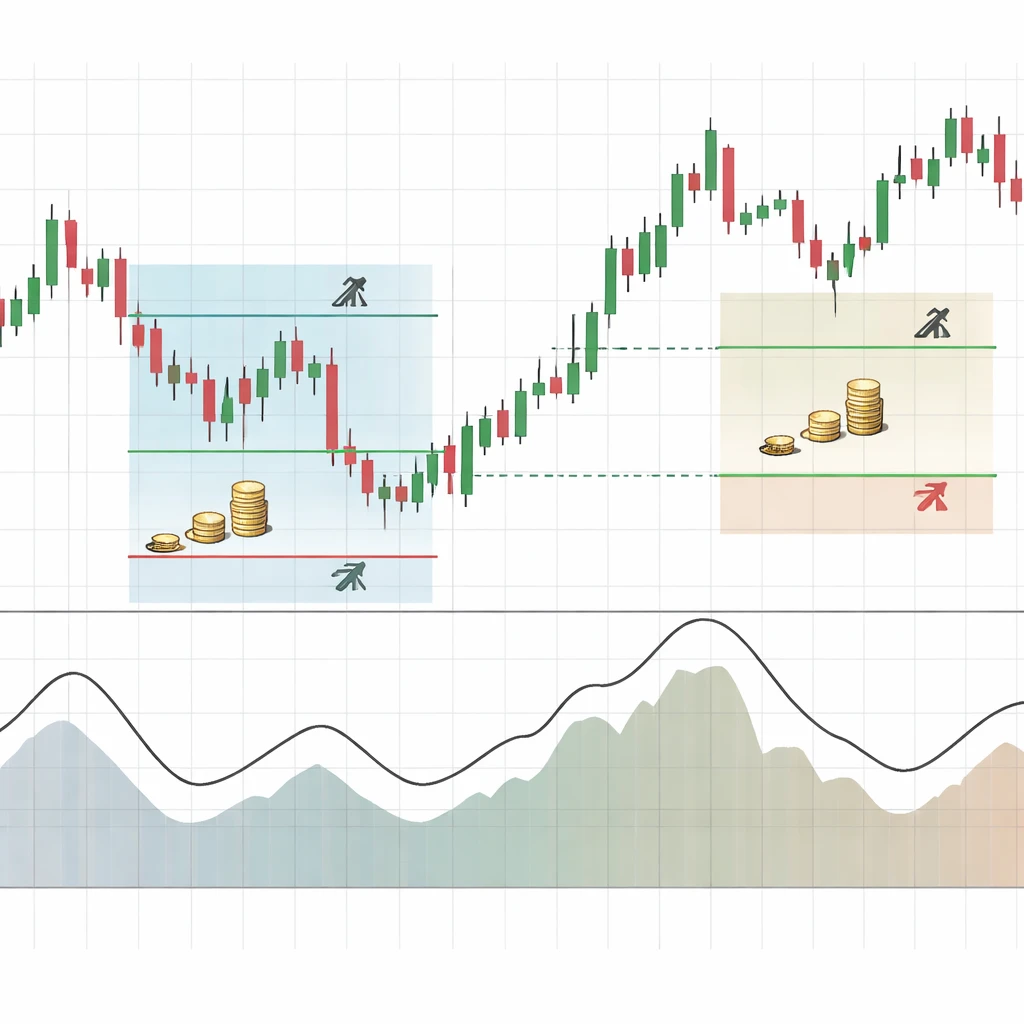

Illustrative Examples

Equity Example

Assume an account of 50,000 with a planned risk of 1 percent per trade, or 500. A stock trades at 60.00 with a 14-day ATR of 2.00. An exit is placed 1.5 times ATR from the entry. The exit distance is 3.00. The per-share risk is therefore 3.00, ignoring slippage and gaps. The position size is 500 divided by 3.00, which equals 166 shares after rounding down to avoid exceeding the risk budget. The notional exposure is about 9,960, which is roughly 20 percent of equity, but the modeled loss if the exit is reached remains near 500 before costs.

If volatility rises and ATR increases to 3.00 before the next opportunity, then the same exit multiple yields a 4.50 exit distance. With the same 500 risk budget, the size drops to 111 shares. Without changing the risk budget, the framework automatically reduces exposure when volatility expands.

Futures Example

Consider a futures contract with a point value of 50 per index point and a current ATR of 40 points. An exit at 1.0 times ATR gives a distance of 40 points, or 2,000 per contract. If the planned risk per trade is 1,000, a single contract would exceed the budget. A practitioner might use a smaller contract specification, such as a micro contract with a point value of 5 per point, which implies 200 per contract for the same distance. In that case, the position size would be 1,000 divided by 200, or 5 micro contracts. The logic is the same regardless of instrument details.

Foreign Exchange Example

Suppose EURUSD has an ATR of 0.0060 (60 pips) on the daily chart. For a standard lot of 100,000 units, a 1 pip move is approximately 10 in USD terms. A stop at 1.2 times ATR translates to 72 pips, or 720 per standard lot. With a 360 risk budget, the size becomes 0.5 standard lots, which can be implemented using mini or micro lots depending on the broker and execution venue. The per-trade risk is aligned with volatility rather than with a fixed number of lots.

Choosing an ATR Lookback

The ATR lookback should reflect the time horizon of the exit and the characteristic noise of the instrument. Shorter lookbacks react faster to changing conditions but produce more variability in position size. Longer lookbacks are more stable but can lag sudden shifts in volatility. Common choices include 14 or 20 periods for daily bars, with proportional adjustments for intraday bars. What matters is internal consistency. If entries and exits are evaluated on a particular bar interval, the ATR should be computed on that same interval unless there is a deliberate reason to use a higher timeframe.

Smoothing methods vary. Wilder’s original smoothing is common, as are simple moving averages or exponential moving averages of true range. Differences among these methods are typically smaller than the differences created by changing the lookback length. The chosen method should be applied consistently to avoid inadvertent regime shifts caused by indicator settings rather than market behavior.

Defining the Exit Distance

The exit distance in ATR-based sizing is a model parameter that encodes tolerance for adverse movement. Smaller multiples create tight exits, lower per-unit risk, and larger position sizes for the same risk budget. Larger multiples do the opposite. The exit distance should not be conflated with predictive power. It is a mechanical control on loss magnitude, not a forecast that the market will reverse before that distance is crossed.

Some practitioners use fractional multiples for scaling out or for non-linear exits, but the basic sizing formula remains anchored in the initial stop distance measured in ATR units. If exits are dynamic, for example trailing with ATR, the planned loss used for sizing should reflect the initial condition, not the hoped-for tightening of a later trailing stop that may or may not be reached.

Accounting for Gaps, Slippage, and Liquidity

ATR captures gaps in its definition of true range, but it does not eliminate gap risk. A price can jump across the exit level, resulting in a realized loss larger than modeled. Slippage and execution latency can also increase realized loss. Liquidity constraints may prevent filling the full order at the intended price, especially for larger size relative to average daily volume.

Practical implementations often introduce buffers:

- Execution cost allowance. Reduce the computed position size by a small percentage to account for slippage and fees.

- Liquidity filters. Limit size to a fraction of average daily volume or to a fixed number of notional units for thin markets.

- Gap contingencies. Stress test scenarios where the open is beyond the stop and measure the effect on drawdowns.

Portfolio-Level Considerations

Individual trades sized by ATR can still create concentrated portfolio risk if they are highly correlated. If several positions tend to move together during stress, the aggregate loss when multiple stops are hit can exceed the intended portfolio drawdown limits. To address this, portfolio overlays are useful:

- Correlation-aware scaling. Apply a reduction factor to sizes in clusters of correlated instruments.

- Aggregate risk caps. Limit the sum of planned losses across open positions to a fraction of equity.

- Volatility targeting. Adjust overall exposure so that the realized portfolio volatility remains within a predefined band.

ATR helps normalize risk across instruments, but it does not substitute for portfolio aggregation and correlation control.

Leverage, Margin, and Notional Exposure

ATR-based sizing limits loss per trade, not notional exposure. An instrument can have a small per-unit risk and yet permit large nominal exposure under margin rules. If the exit is far from the entry, per-unit risk rises and position size falls. If the exit is tight, the reverse occurs. In leveraged markets, notional exposure should be reviewed alongside loss-at-stop so that liquidation risk and margin calls do not arise from routine fluctuations.

Some practitioners set secondary constraints such as a maximum percentage of account equity per position, a cap on total gross or net exposure, or instrument-level limits. These constraints complement ATR-based sizing by addressing risks that the stop distance and ATR do not capture directly.

Dynamic Resizing vs. Static Sizing

After entry, ATR can change. Two broad approaches exist:

- Static sizing. Size is fixed at entry based on the then-current ATR and exit distance. No adjustments are made unless the position is closed and reopened.

- Dynamic resizing. Size is adjusted during the trade if ATR changes or if the exit distance trails with ATR. While this keeps risk per trade close to the initial budget, it introduces additional trades, costs, and potential execution risks.

Static sizing is simpler and avoids turnover. Dynamic resizing maintains tighter alignment with a risk budget but can amplify transaction costs and complexity. The choice should reflect the intended holding period, liquidity, and the stability of the ATR measure used.

Common Misconceptions and Pitfalls

- ATR predicts direction. ATR is descriptive, not predictive. It measures recent variability. Using ATR for sizing does not imply any edge in forecasting price moves.

- ATR equals the stop. ATR is the yardstick. The stop distance is a multiple of ATR set by the risk policy. Confusing the two can lead to systematically too-tight or too-wide exits.

- Ignoring unit conversions. Miscalculations often arise from mixing points, pips, ticks, and currency values. The value per price unit must be correct for the instrument.

- Over-reliance on a single lookback. A one-size-fits-all ATR length may not fit instruments with very different microstructure. Review whether the lookback aligns with holding period and liquidity conditions.

- Neglecting gaps and costs. Realized losses can exceed modeled losses when gaps or slippage occur. Position sizes should include a safety margin when appropriate.

- Scaling size after gains without recalibration. Increasing risk per trade after a run of wins, without a clear policy, can inadvertently raise the risk of a sharp drawdown when volatility expands.

- Look-ahead bias. Sizing decisions should use ATR values available at the decision time, not revised or end-of-day values that were not known when orders were placed.

Stress Testing and Scenario Analysis

ATR-based sizing provides a coherent framework, but it benefits from stress testing.

- Gap scenarios. Simulate adverse opens of one to three times ATR beyond the stop and estimate the resulting realized losses and equity curve impact.

- Volatility regime shifts. Examine periods where ATR doubled or halved in short order. Evaluate whether the sizing approach adapted quickly enough and whether additional constraints are needed.

- Liquidity compression. Analyze widened bid-ask spreads and thinner depth, particularly around news events, to estimate execution slippage relative to modeled stop fills.

- Portfolio clustering. Apply correlated drawdown scenarios to multiple positions sized by ATR to check portfolio-level loss containment.

Alternatives and Complements to ATR

ATR is not the only volatility proxy suitable for sizing. Standard deviation of returns, Parkinson’s range measure, and realized volatility estimates derived from intraday data are common alternatives. ATR’s advantage is its simplicity and the inclusion of gaps. Its disadvantage is that it does not distinguish between orderly range expansion and abrupt jumps, and it treats upside and downside ranges symmetrically. Depending on the market and the time horizon, a hybrid approach that blends ATR with other measures or uses multiple horizons can be justified, provided the implementation remains internally consistent and testable.

Implementation Details That Matter

- Data quality. Ensure that highs, lows, and closes are accurate and that corporate actions or contract rolls are handled properly. ATR is sensitive to incorrect ranges.

- Rounding and minimum size. Many instruments require integer quantities or specified lot sizes. Round down to avoid exceeding the risk budget and document the rounding policy.

- Time alignment. Compute ATR on the same session definition as the entry and exit logic. Mixing regular-hours and extended-hours data can distort true range.

- Currency conversion. For non-USD instruments, convert the per-unit risk into the account currency before computing size, and account for conversion fees where relevant.

- Execution venue effects. Different venues have different tick sizes, fees, and liquidity. These practical frictions affect realized risk and should be reflected in safety buffers.

Using ATR for Cross-Instrument Normalization

ATR-based sizing is especially useful when trading a diversified set of instruments. A 2 dollar ATR in a 20 dollar stock is different in relative terms from a 2 dollar ATR in a 200 dollar stock. By anchoring the exit to ATR and sizing by the resulting dollar risk, the method neutralizes these scale effects. The same idea extends to futures and currencies, where point values and pip values vary. The output is a position set in which each trade contributes a comparable planned loss if stopped, improving the consistency of the overall risk profile.

Capital Preservation and the Path of Returns

Two portfolios can have the same average return but very different paths. Large adverse outliers accelerate drawdowns, impair compounding, and increase the risk of ruin. ATR-based sizing does not eliminate outliers, but it reduces the chance that a normal run of volatility leads to oversized positions that turn typical losses into catastrophic ones. By adapting size to prevailing volatility, the approach helps maintain the shape of the loss distribution within bounds set by policy.

A Short, Practical Checklist

- Define a clear dollar risk per trade tied to account equity or a fixed amount.

- Select an ATR lookback and smoothing consistent with trading timeframe.

- Set an exit distance as a multiple of ATR and compute per-unit risk.

- Calculate size as risk budget divided by per-unit risk, adjust for lot constraints, and apply safety buffers.

- Review portfolio-level exposure, correlation, and margin before sending orders.

- Monitor realized losses versus modeled risk to validate the assumptions and buffers.

Frequently Asked Implementation Questions

How often should ATR be recalculated?

ATR is typically recomputed each bar as new data arrives. The sizing decision should use the ATR value available at the time the order is generated. For intraday trading, that might be based on the last completed bar; for daily trading, end-of-day ATR is common for orders executed on the next session.

What if ATR is extremely low?

Very low ATR can lead to large sizes for a given risk budget. Many practitioners cap maximum position size or impose a minimum ATR floor below which the size does not increase further. This prevents concentration in unusually quiet markets that can revert rapidly.

What if ATR spikes?

ATR spikes will shrink computed positions. If the spike reflects a temporary event, a stabilization period can be used before accepting the new ATR for sizing. Alternatively, multiple-horizon ATRs can be blended to smooth extreme one-off moves.

How do trailing exits interact with sizing?

Trailing exits can reduce realized losses if price moves favorably, but they should not be assumed in the initial sizing. The entry size should be determined by the initial planned loss. Any later tightening of the exit is a separate event.

Concluding Remarks

ATR-based position sizing converts a qualitative notion of volatility into a quantitative control on risk. It scales exposure so that losses from exits remain aligned with a predefined budget, despite different instruments and changing regimes. It is not a forecast, and it does not substitute for robust execution or portfolio oversight. When implemented carefully, with attention to unit conversions, liquidity, gaps, and correlation, it becomes a central component of a risk process focused on capital preservation and durability.

Key Takeaways

- ATR-based sizing links position size to volatility by tying exit distance to a multiple of ATR and sizing to a fixed dollar risk.

- It preserves capital by reducing size in high volatility and normalizing risk across instruments and price levels.

- Accurate unit conversion, liquidity buffers, and gap awareness are essential for realized losses to match modeled risk.

- Portfolio overlays such as correlation-aware scaling and aggregate loss caps complement trade-level ATR sizing.

- ATR measures variability, not direction, and should be applied consistently with the chosen timeframe and exit logic.