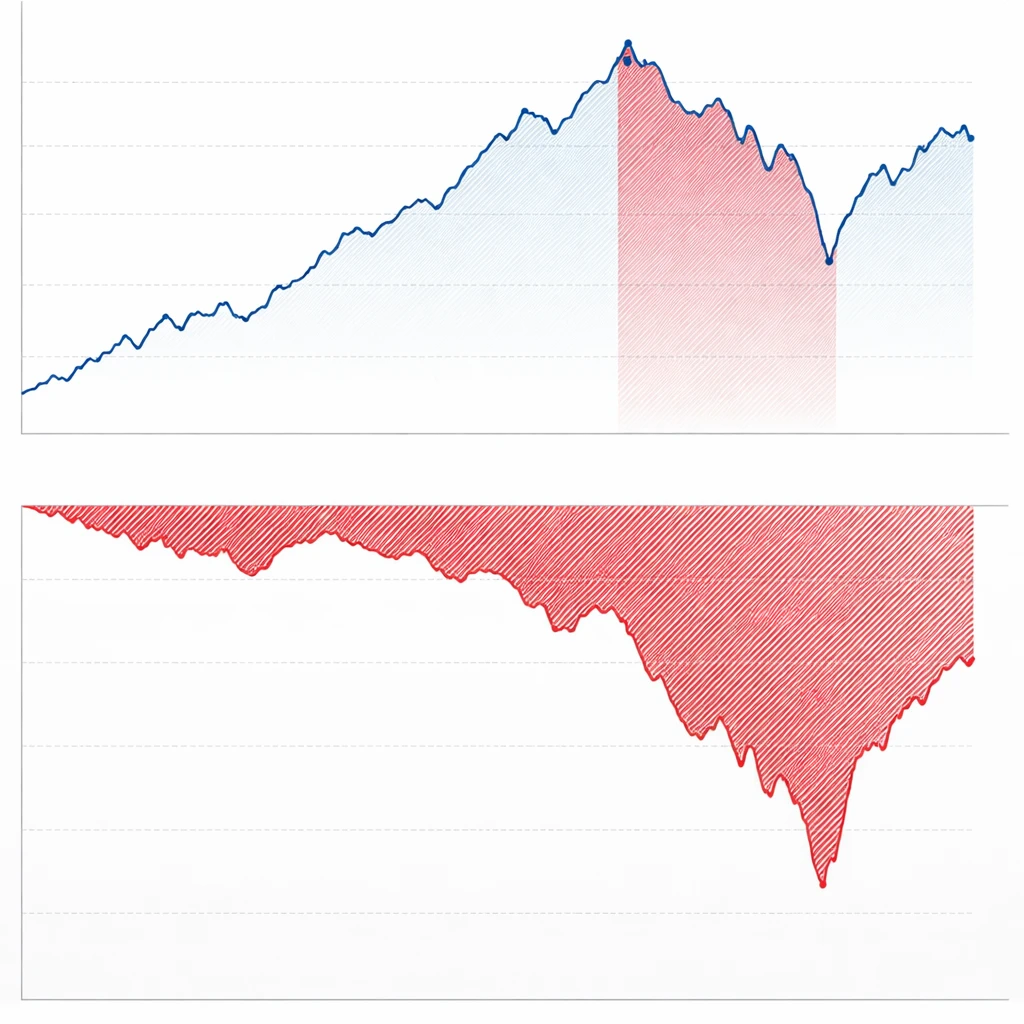

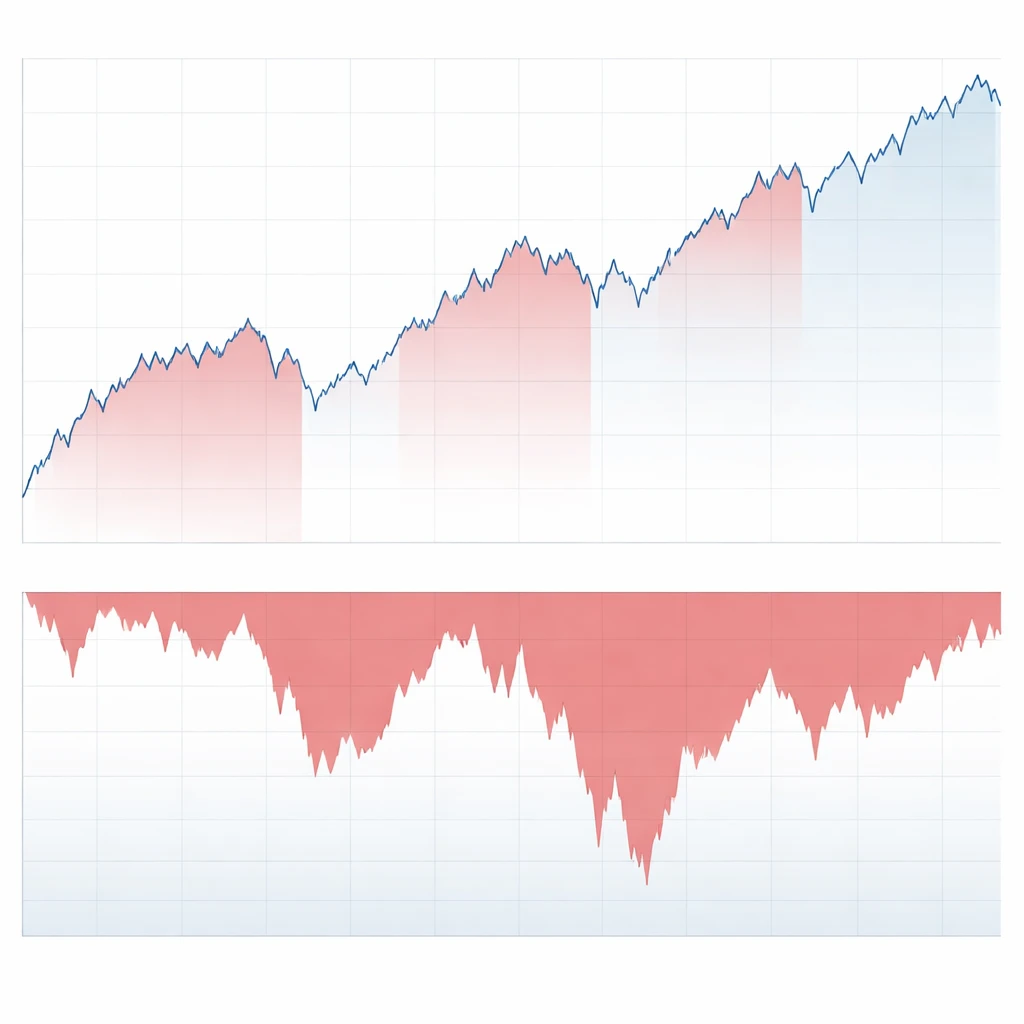

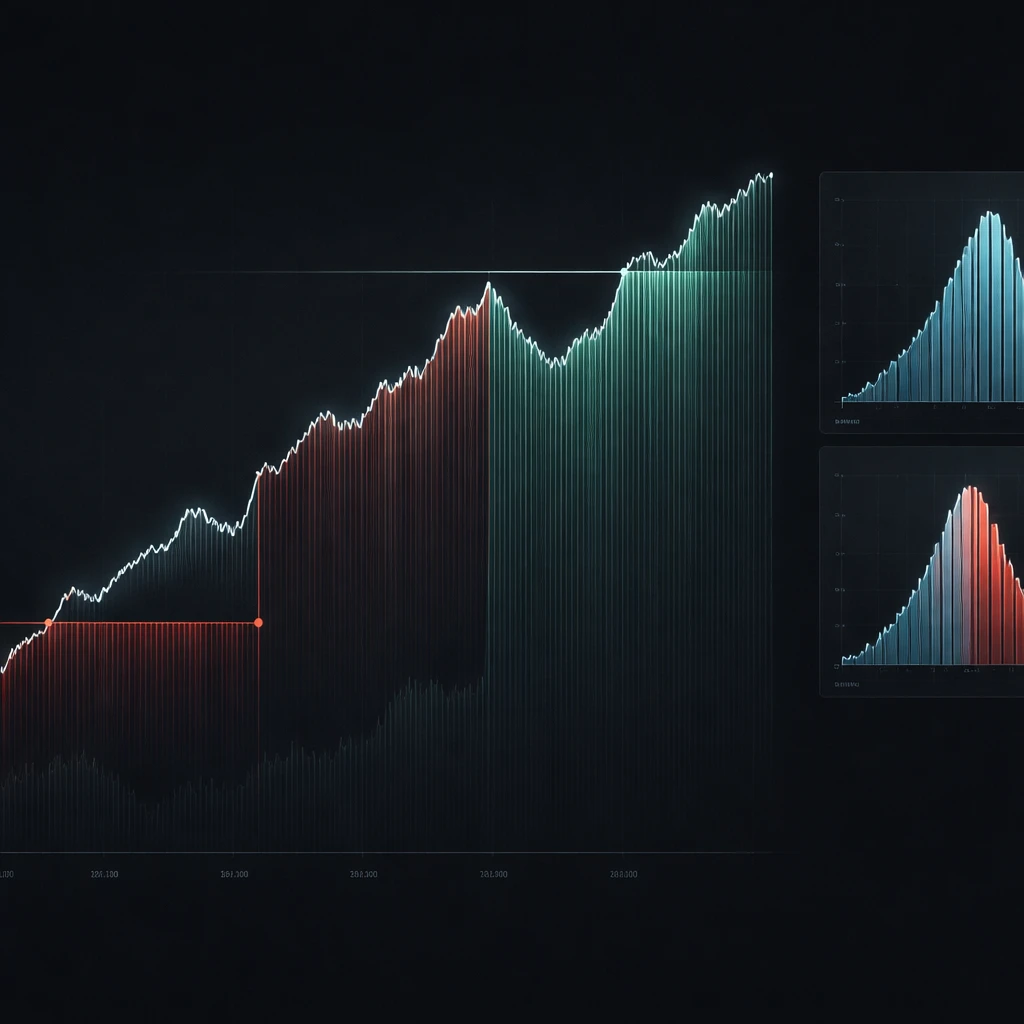

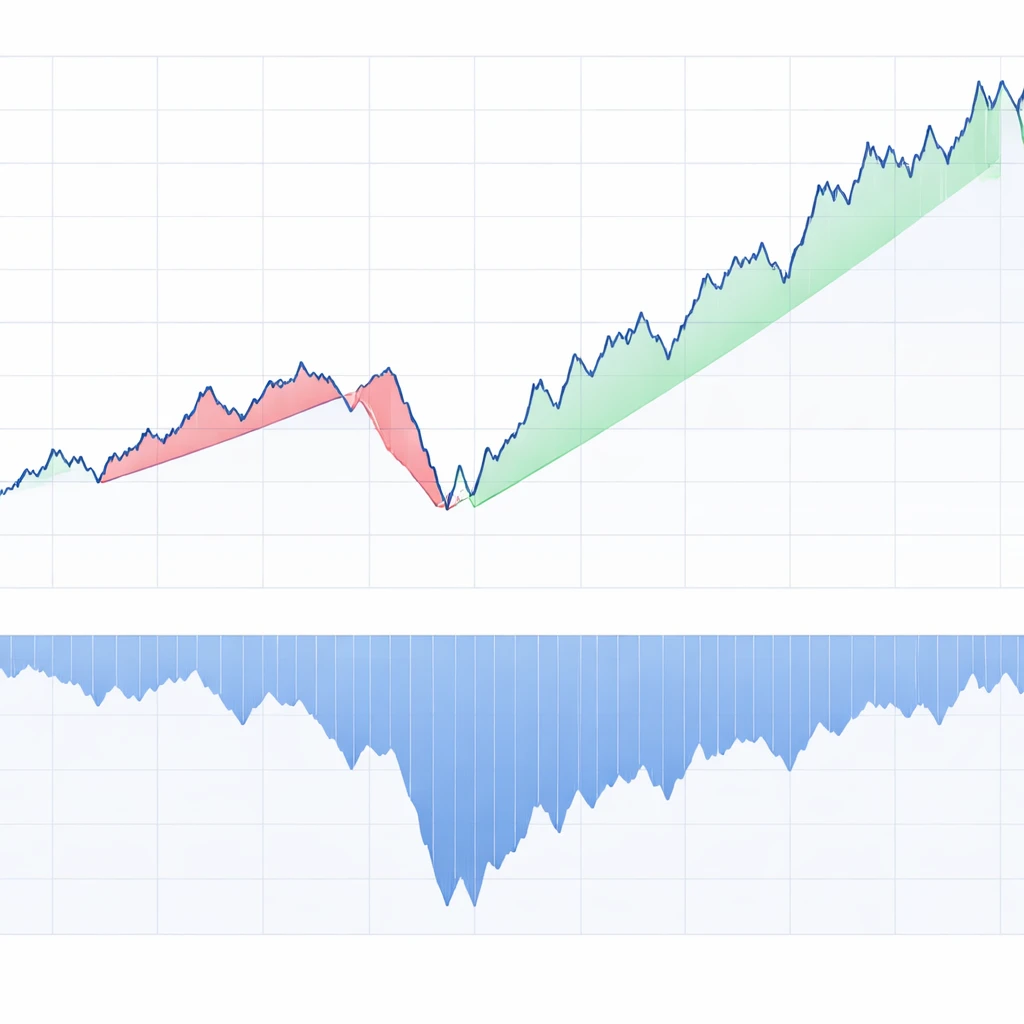

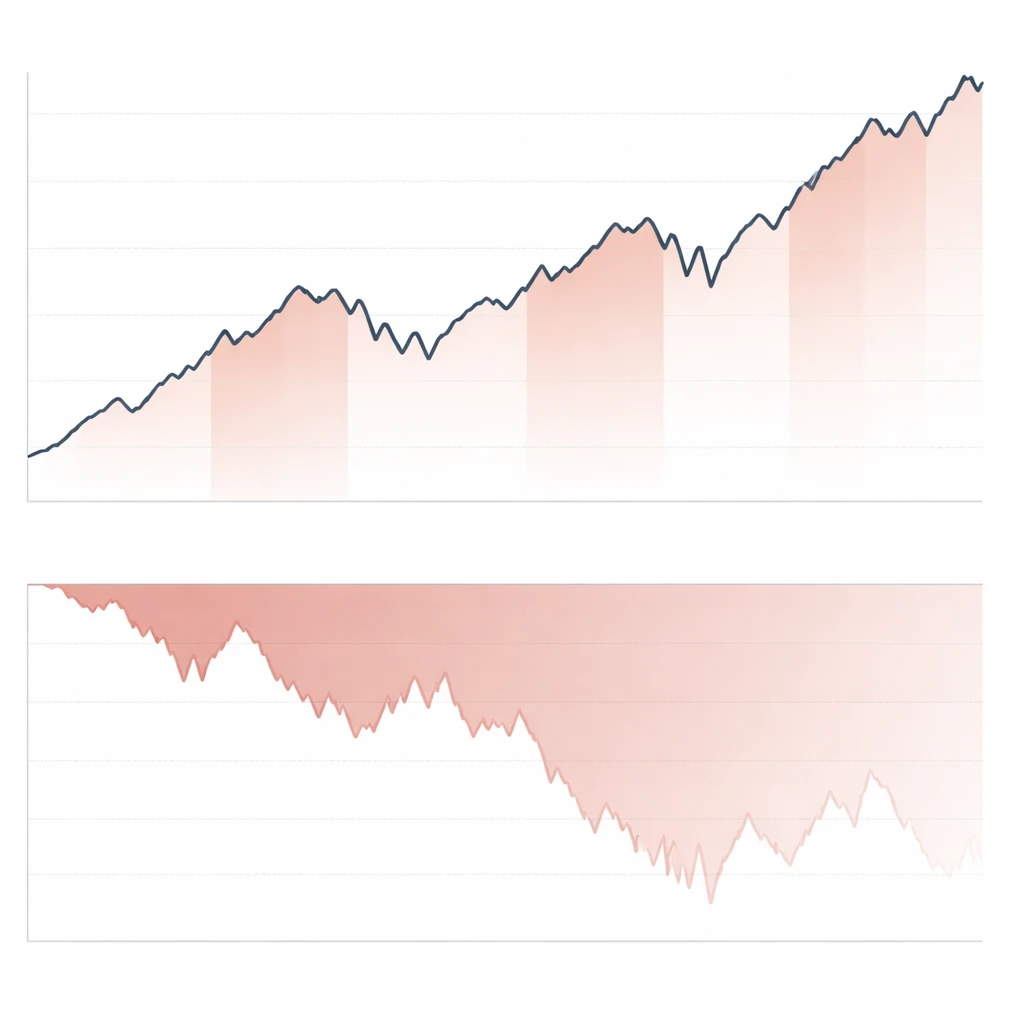

What Is a Drawdown?

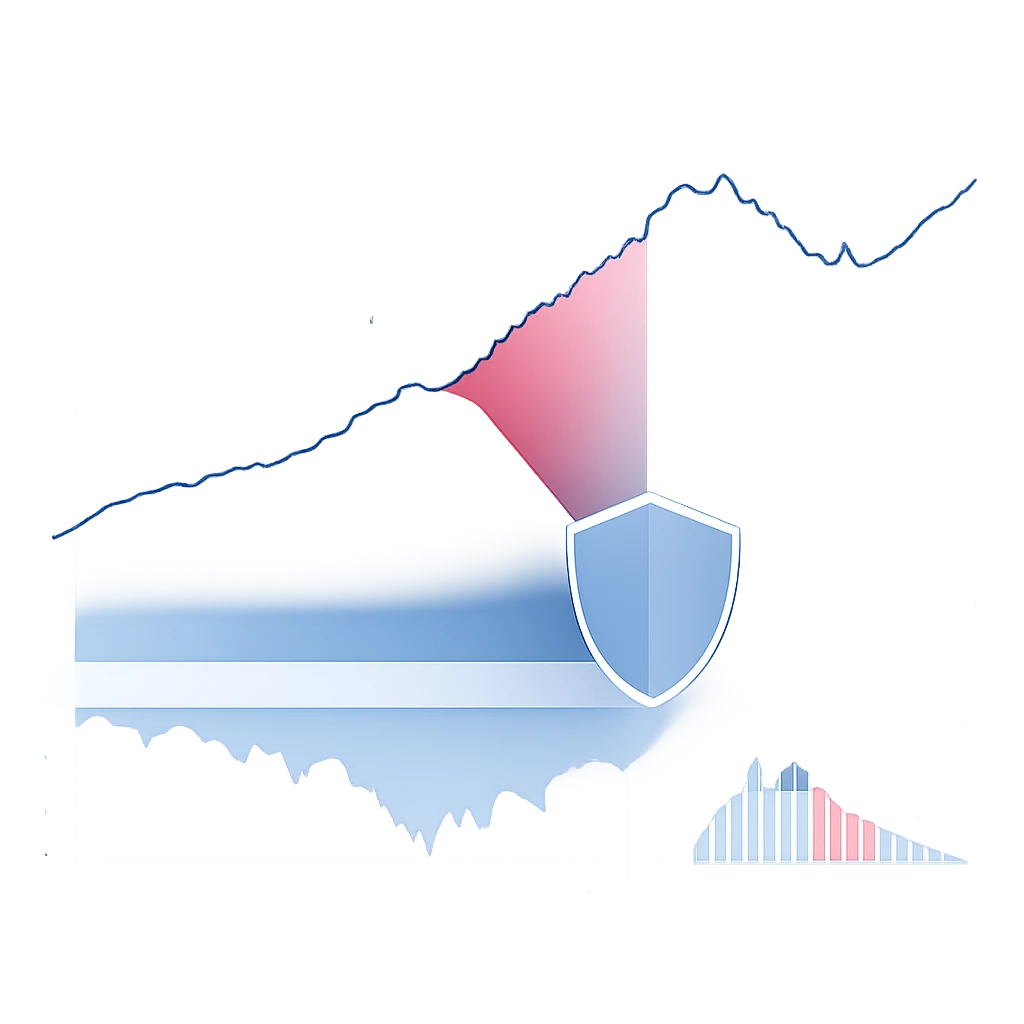

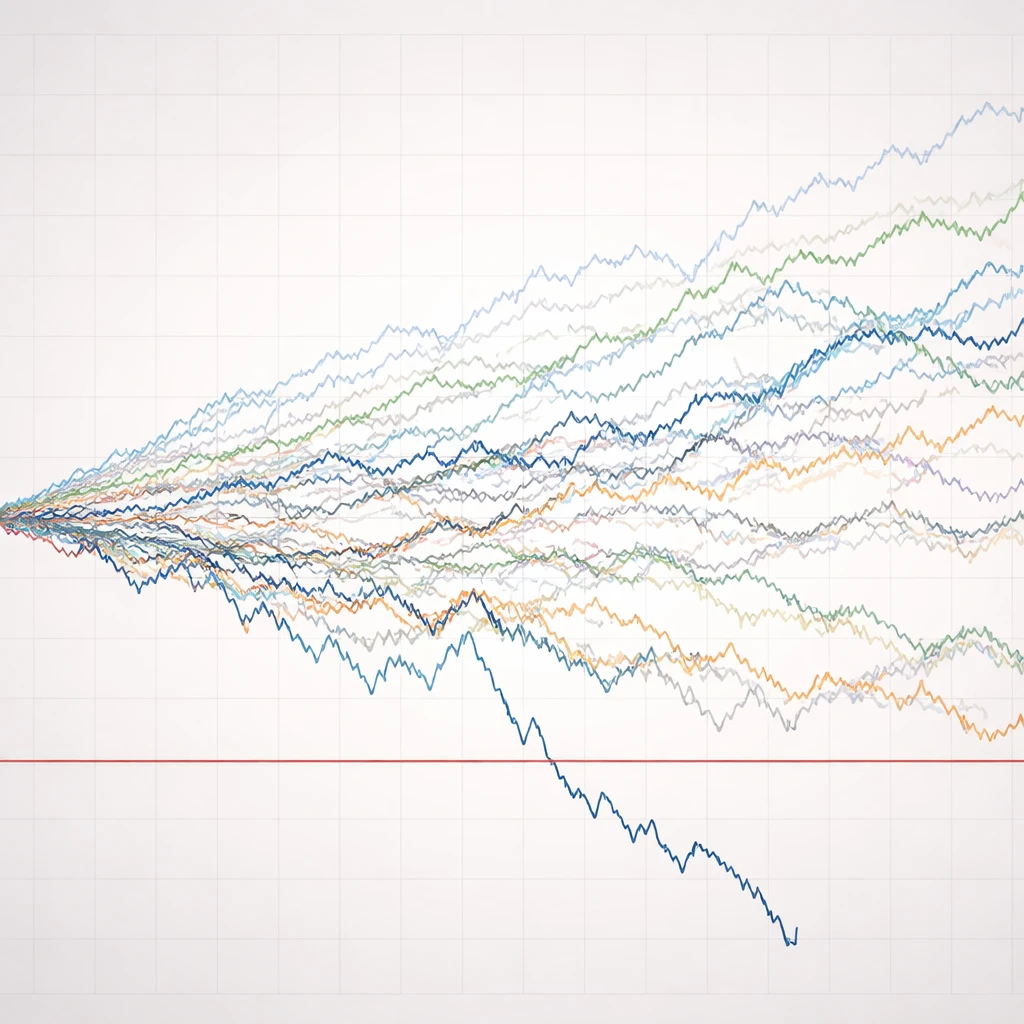

A clear, practical explanation of drawdowns, why they matter for capital preservation, how to measure them, and how they appear in real trading. Includes common misconceptions and governance considerations without recommending strategies or trades. It focuses on risk control and long-term survivability.