Risk Management

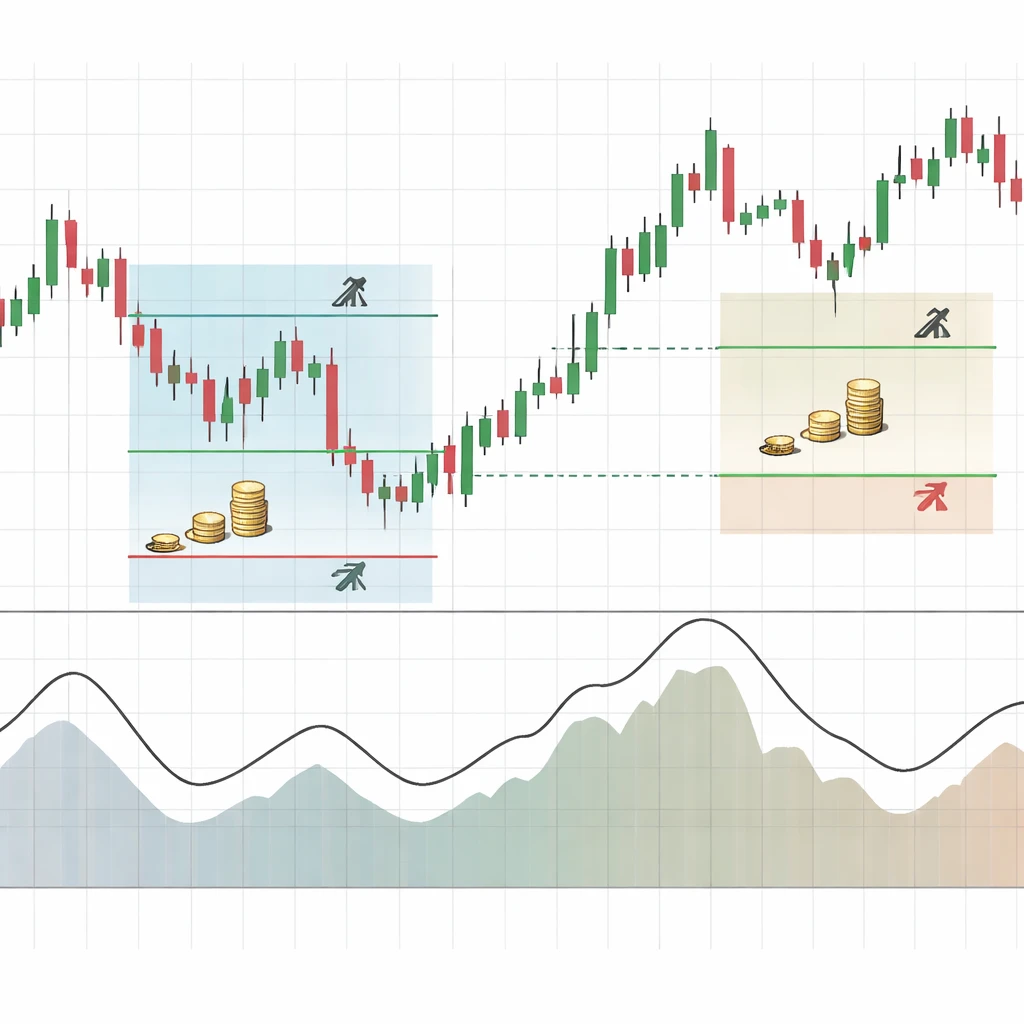

Core principles focused on protecting capital, managing downside risk, position sizing, drawdowns, and maintaining long-term survivability in the markets.

You will learn: The core concepts in this topic, common misconceptions, and how professionals think about the subject.

Educational content only. Not financial advice.

What you will get from this topic

- Clear definitions and real-world context

- Practical examples without trade recommendations

- Common mistakes to avoid

- A progression from basics to deeper understanding

Scopes in Risk Management

Position Sizing

Determining how much capital to allocate per trade based on risk tolerance.

Explore ScopeRisk / Reward Analysis

Evaluating trade setups based on potential upside versus downside.

Explore ScopeDrawdowns & Capital Preservation

Handling losses, drawdowns, and long-term capital survival.

Explore ScopePopular in Risk Management

What Is Position Sizing?

Position sizing is the systematic determination of how many units of a security to buy or sell so that each trade’s potential loss remains within a predefined risk limit. It is central to capital preservation, controls drawdowns, and underpins long-term survivability across changing market conditions.

Why Position Size Matters More Than Entry

Position size governs risk exposure, drawdowns, and survivability more than the exact entry price. This article explains how sizing controls loss magnitude, stabilizes variance, and protects capital when markets behave unpredictably, with practical examples and common pitfalls.

Percentage Risk Models

Percentage risk models size positions by risking a fixed fraction of current equity on each trade. This article defines the approach, explains why it supports capital protection and long-term survivability, and illustrates practical implementation details along with common pitfalls to avoid.

Position Sizing and Account Size

A rigorous explanation of how position sizing interacts with account size to control risk, reduce the probability of ruin, and support long-term survivability. Includes clear definitions, practical calculations, and common pitfalls to avoid without offering investment advice or trade recommendations.

ATR-Based Position Sizing

A clear, practical explanation of ATR-based position sizing, how it controls per-trade risk by adapting to market volatility, and the operational details and pitfalls that matter for long-term survivability in trading systems.

Fixed Dollar Risk Explained

Fixed dollar risk sets a predefined cash amount you are willing to lose on any single position, then sizes the trade so that a stop-out approximates that loss. This article explains the concept, why it matters for capital protection and long-term survivability, and how it is applied in practice across different instruments, including common pitfalls to avoid.

Ready to begin?

Start with the first scope to build a clean foundation, then move forward in order.

Start Position Sizing