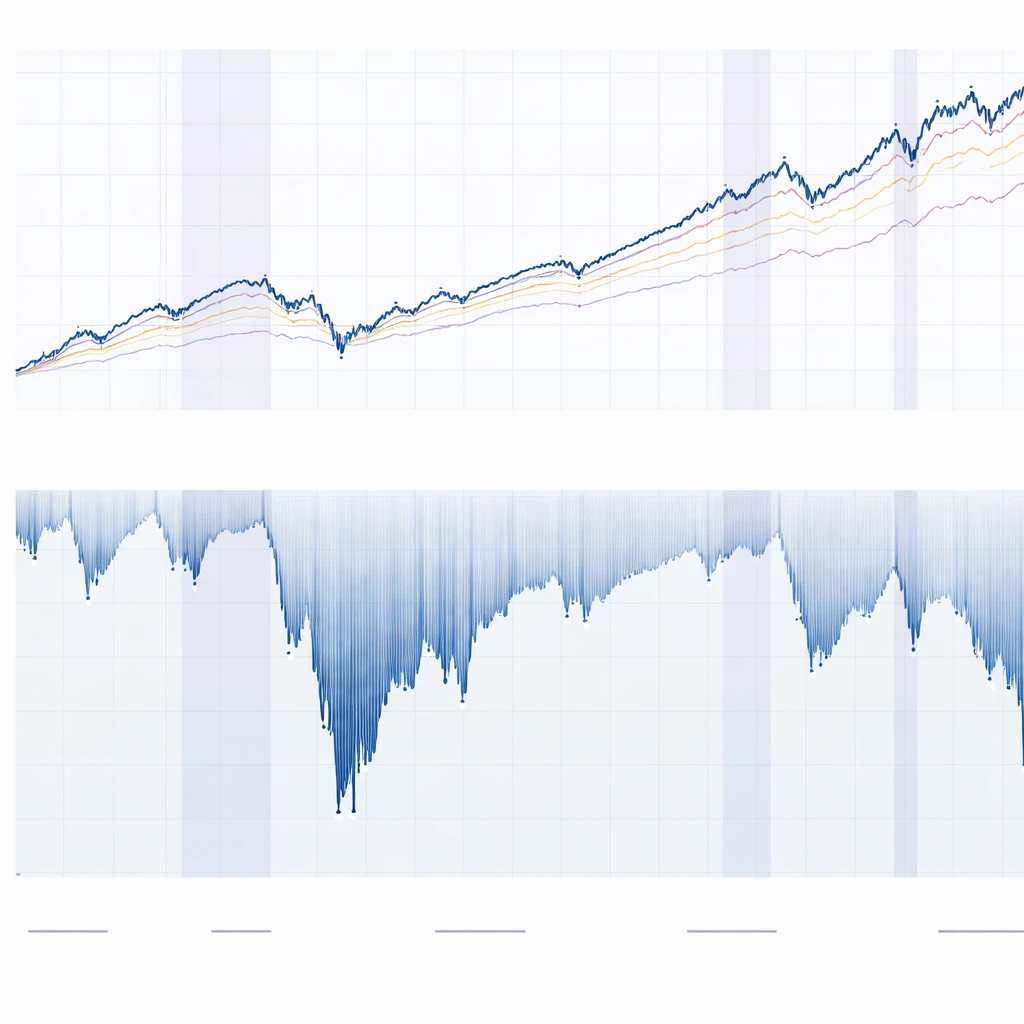

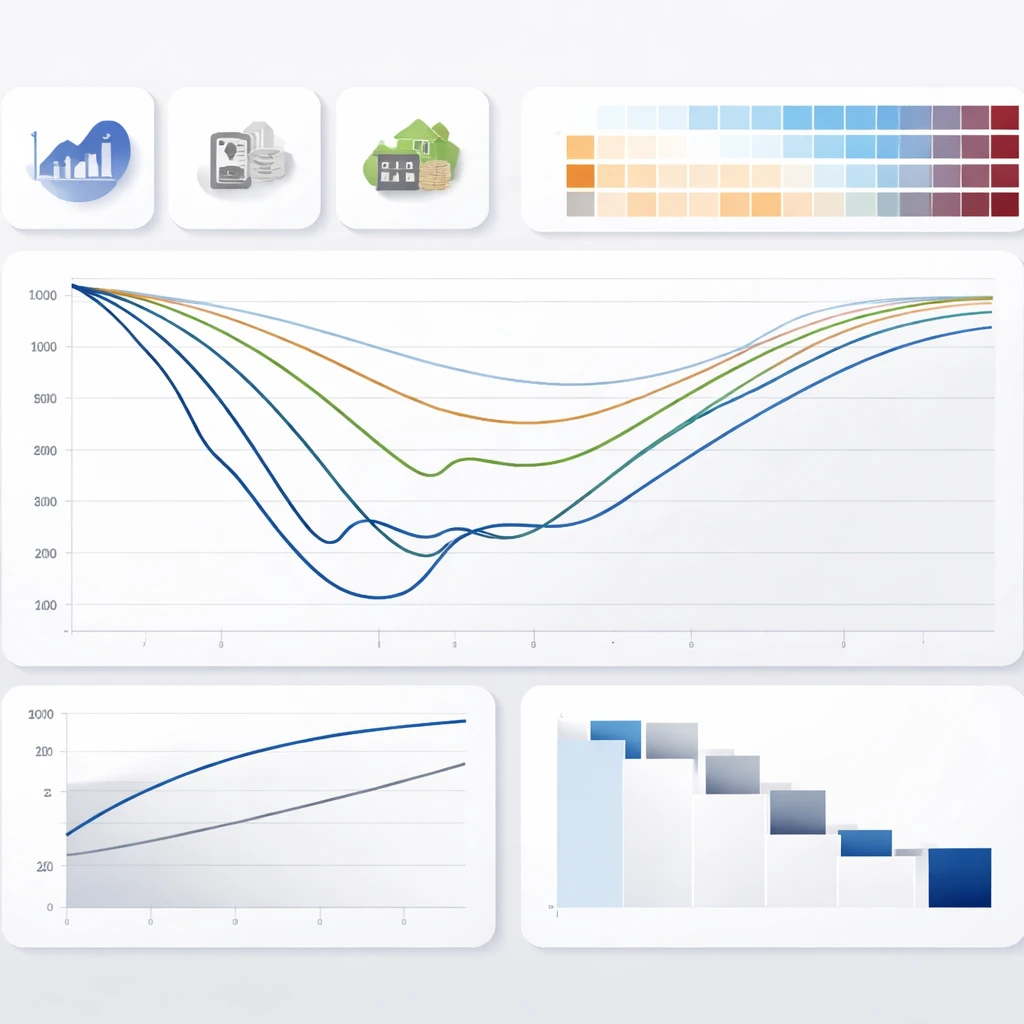

Portfolio Risk vs Trade Risk

A rigorous distinction between portfolio risk and trade risk clarifies how individual positions aggregate into overall variability, drawdown potential, and long-horizon capital stability. This article explains definitions, measurement approaches, and practical examples that show why the distinction matters for resilient portfolio construction.