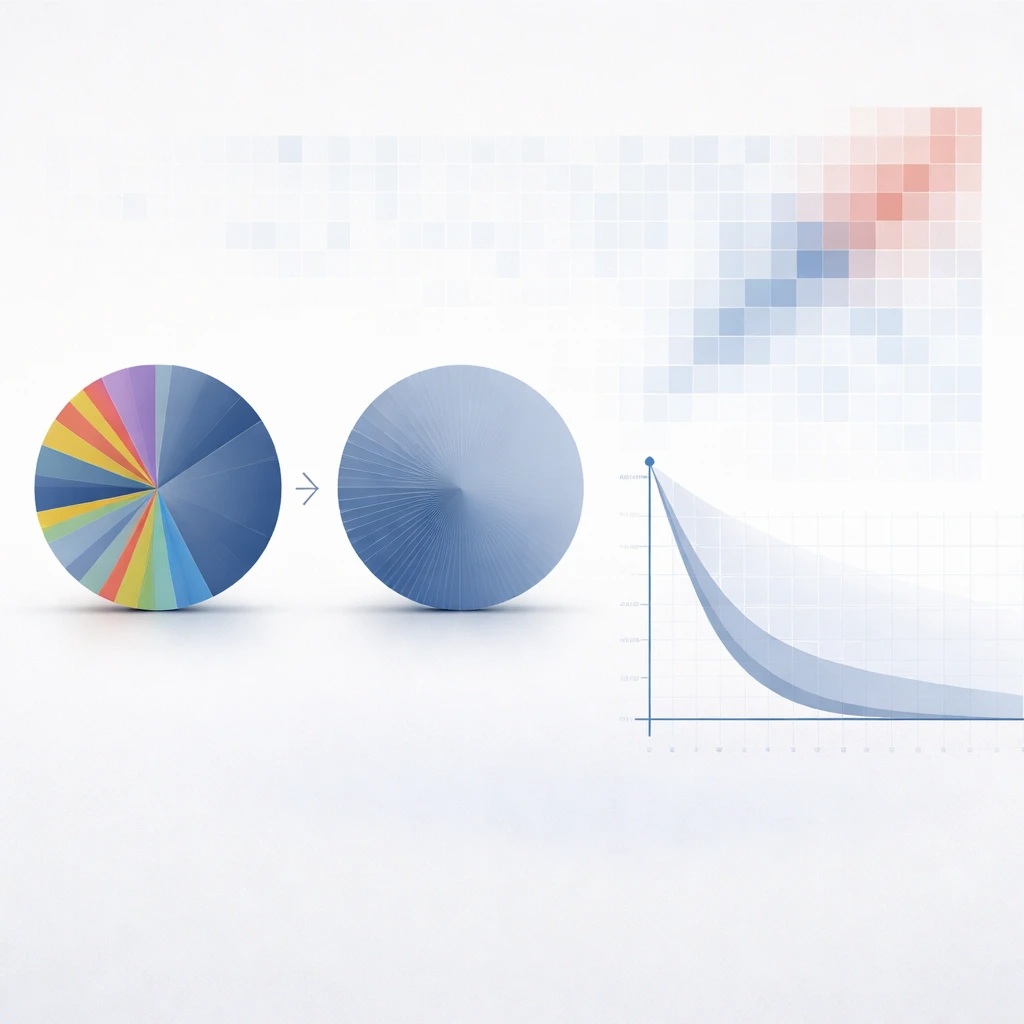

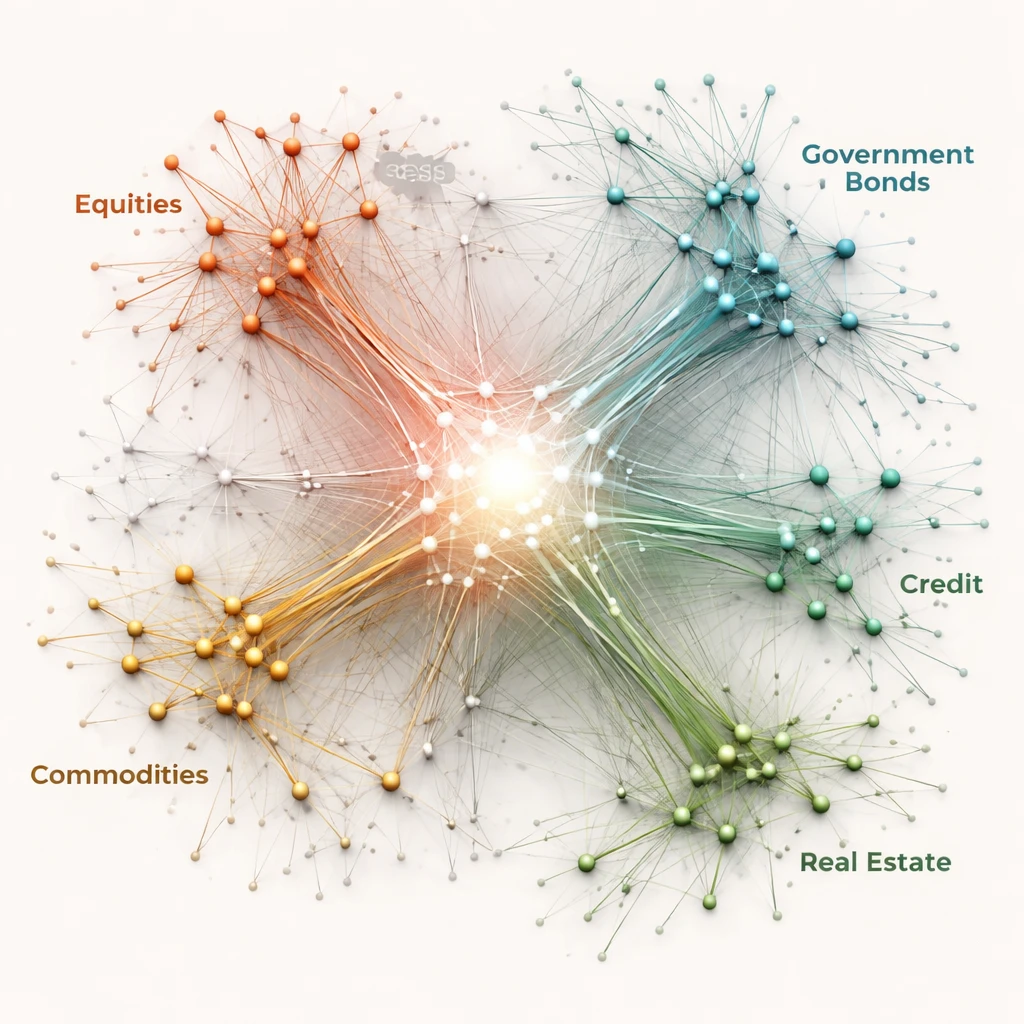

Over-Diversification Risks

An in-depth examination of how diversification can be carried too far, why excessive breadth dilutes risk control and potential value, and how the issue appears in real-world multi-asset portfolios over long horizons. The article clarifies definitions, portfolio-level mechanics, and practical diagnostics without offering investment advice.