What Is Diversification?

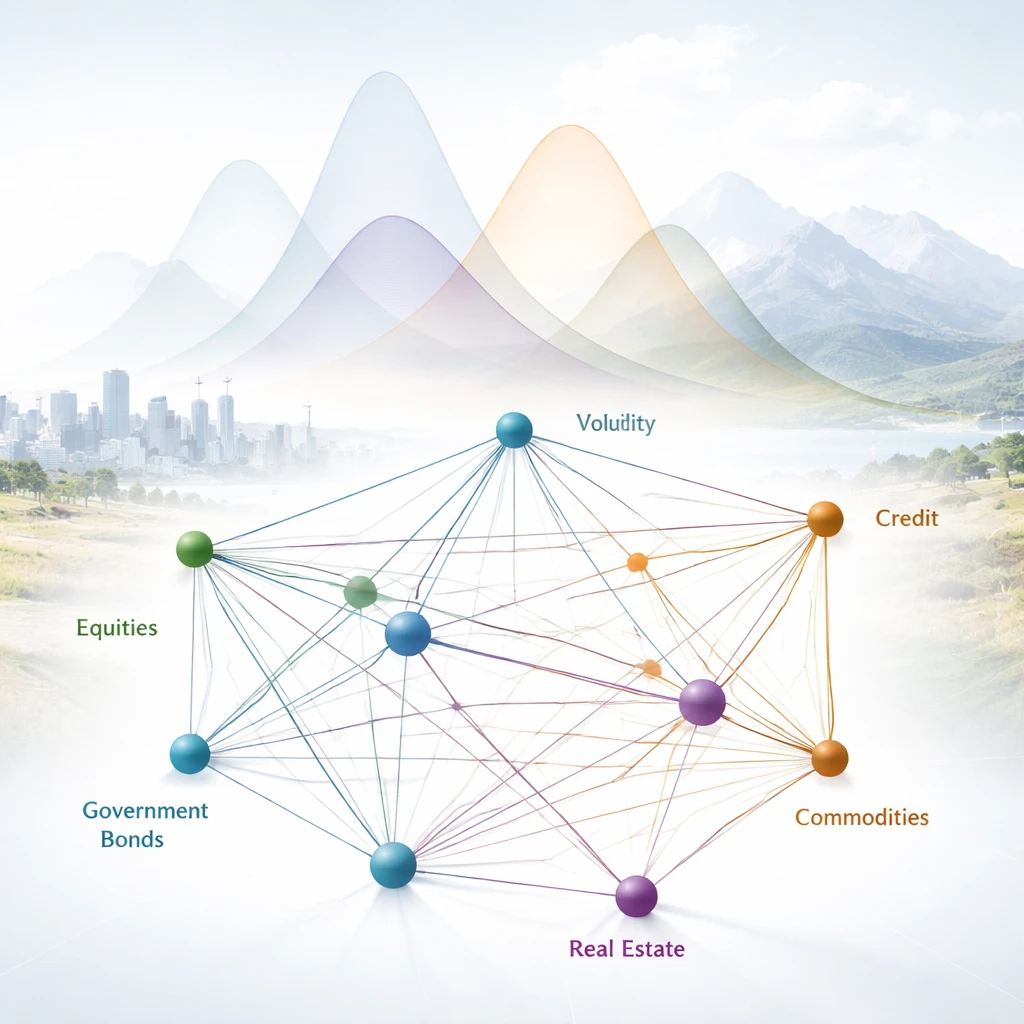

Diversification is the practice of combining assets that do not move in lockstep to reduce the volatility of portfolio returns without proportionally reducing expected long-term growth. This article defines diversification, shows how it works at the portfolio level, explains why it matters for long-horizon planning, and situates the concept in real…