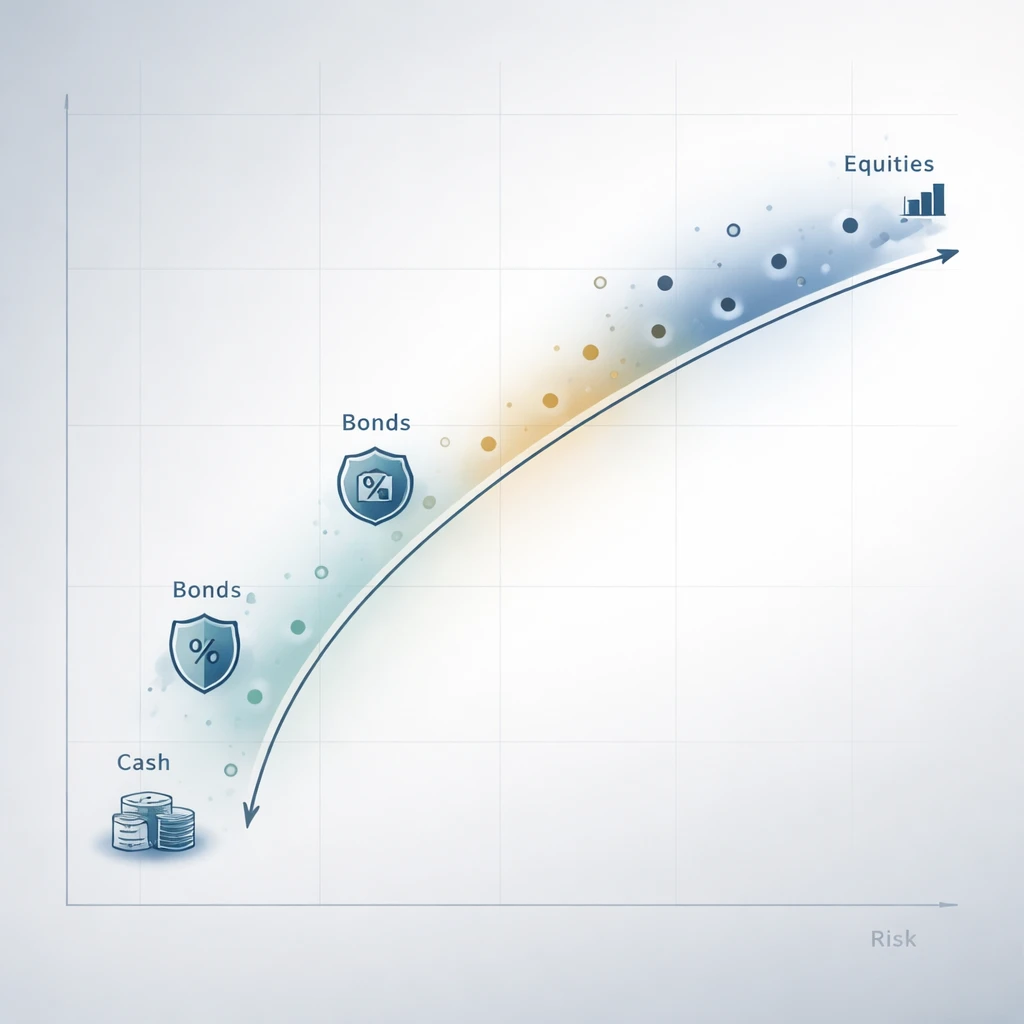

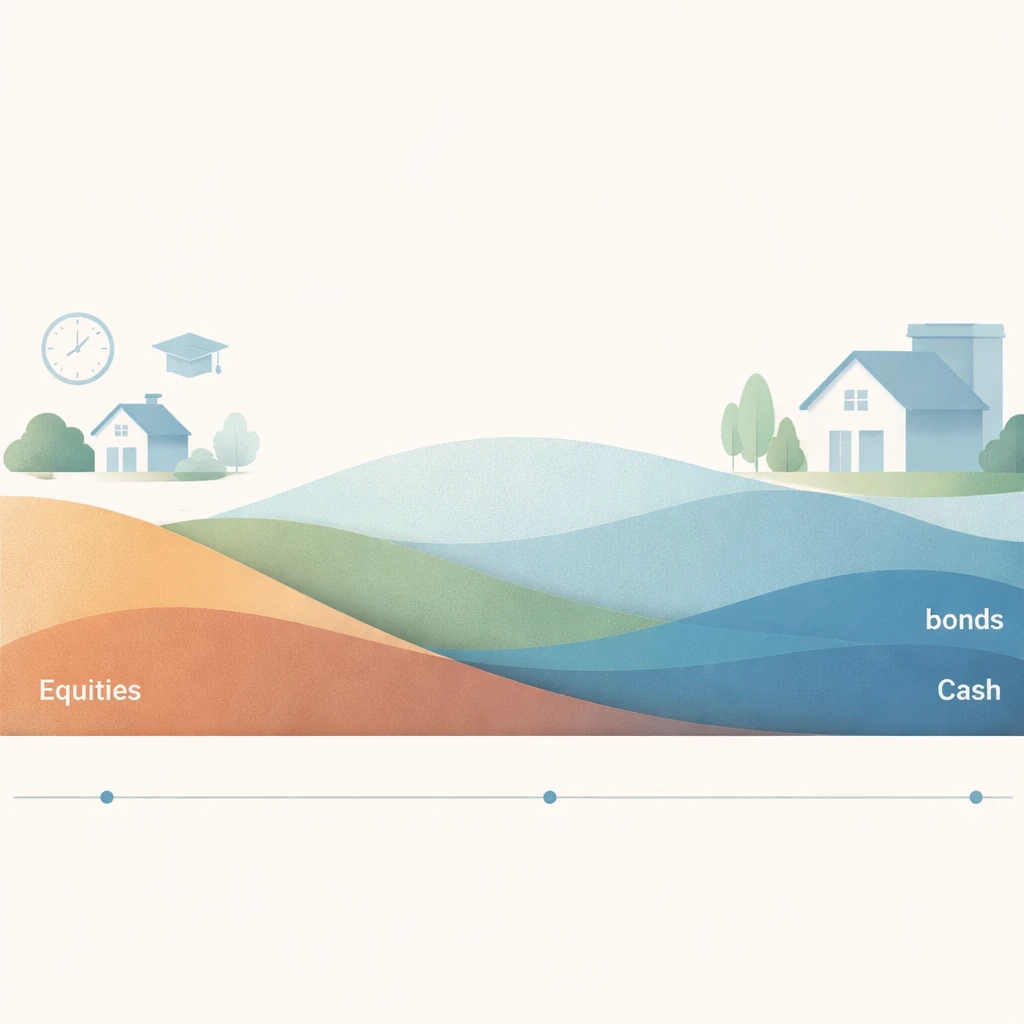

What Is Asset Allocation?

Asset allocation is the disciplined process of dividing a portfolio across asset classes to balance growth, income, risk, and liquidity under real-world constraints. This article defines the concept, explains its portfolio-level application, and situates it within long-term capital planning using practical examples.