Overview

Expiration is one of the defining features of listed options. Every option contract ceases to exist after a specific date, and the legal rights embedded in that contract either convert into an exercise or assignment outcome, or they vanish. The expiration date is therefore central to pricing, risk management, and the operational workflow that connects exchanges, clearinghouses, and brokerage firms. Understanding what the expiration date is, why the market standardizes it, and how it functions across different products provides essential context for interpreting option quotes and for reading post-trade confirmations and account statements.

This article focuses on the concept of expiration dates within listed options markets. It defines the term, situates it within the broader market structure, explains the rationale for fixed maturities, and illustrates how expiration plays out in real-world contexts. It does not present trading strategies or investment recommendations.

What Is an Expiration Date?

An option is a contract that grants the holder the right, but not the obligation, to buy or sell an underlying instrument at a specified price, subject to defined terms. The expiration date is the final date on which those contractual rights are valid. After expiration, the option no longer exists. Whether the option converts into a position in the underlying or into a cash flow depends on the contract’s settlement terms and whether it is in-the-money at the relevant cutoff.

Several related time markers surround expiration:

- Last trading day. The final session in which the option can be bought or sold on an exchange. For many equity and exchange-traded fund options in the United States, this is the regular market session of the stated expiration Friday, subject to holiday adjustments and product-specific schedules.

- Exercise deadline. The cutoff by which a clearing member must submit exercise instructions to the clearinghouse if the option is exercisable. Brokers may require earlier client deadlines to meet clearing timelines.

- Settlement time. The point at which the clearinghouse determines whether options are automatically exercised and how assignments are distributed. Equity options that are physically settled typically result in delivery or receipt of shares, whereas many index options settle in cash.

These time markers are all anchored by the expiration date but are distinct in their function. The last trading day dictates when secondary market trading ends. The exercise deadline governs how rights convert into obligations. Settlement is the clearinghouse’s formal processing of those outcomes.

Why Do Expiration Dates Exist?

Finite maturity is a foundational element of modern derivatives markets. Expiration dates exist for several reasons:

- Contract standardization. A market can support liquidity when contracts are interchangeable. Standardizing maturities concentrates trading activity in a manageable set of dates, which improves price discovery and reduces transaction costs.

- Risk containment. Open-ended obligations complicate margining and default management. Fixed maturities allow the clearinghouse to project and limit exposures, close out positions naturally, and recycle collateral as contracts roll off.

- Valuation structure. Option pricing depends on the time remaining to expiration. Time value is a measurable, diminishing input, which allows models and risk systems to anchor calculations to a concrete horizon.

- Operational certainty. Corporate actions, economic releases, and index rebalancings occur on known schedules. Fixed expiration dates allow exchanges and clearinghouses to coordinate settlement mechanics with those schedules.

In short, expiration dates make options tradable at scale by bounding the life of the contract and by organizing market activity around predictable deadlines.

How Expiration Fits Into Market Structure

Listing cycles and contract maturities

Exchanges list option series with specific strikes and expiration months. Market operators and the clearinghouse coordinate a schedule that balances choice with concentration of liquidity. The framework typically includes:

- Monthly expirations. Standard maturities that occur each month. In the United States, the traditional monthly equity option has its last trading day on the third Friday of the month, adjusted earlier if that day is a market holiday.

- Weekly expirations. Short-dated series that expire on days within the month other than the standard monthly date. These have expanded significantly, providing a finer maturity grid.

- Quarterly expirations. Contracts expiring near the end of calendar quarters. These can align with index rebalancing or corporate reporting cycles.

- Long-dated series. Contracts with maturities extending one to several years, often branded as LEAPS in the United States. They give market participants exposure to longer horizons within a listed, standardized format.

The listing schedule is dynamic. Exchanges add or remove individual expirations and strikes based on demand, regulatory rules, and system capacity. Regardless of the granularity, every listed series is defined by its expiration date and its settlement convention.

Exercise styles and settlement conventions

Two exercise styles dominate listed options:

- American style. The holder can exercise on any trading day up to the exercise deadline on expiration. Many equity and ETF options use American style and are physically settled into the underlying shares when exercised.

- European style. The holder can exercise only at expiration. Many index options use European style and are cash-settled based on an official settlement value calculated by the exchange.

Exercise style is independent of geography. It is a contractual term that governs when the right may be exercised. Settlement can be physical, where shares change hands at the strike price, or cash, where the in-the-money amount is paid or received. The expiration date is when these features intersect to determine outcomes.

Last trading day, exercise cutoffs, and automatic exercise

Listed options terminate according to a detailed timetable. Trading stops in the secondary market at the last trading day close. After that point, exercise instructions, if permitted, are routed by clearing members to the clearinghouse. In many jurisdictions, an exercise-by-exception procedure applies: in-the-money contracts are automatically exercised at expiration unless a clearing member instructs otherwise. The common threshold in the United States is one cent in-the-money, although brokers can set alternative operational thresholds for client accounts.

Automatic exercise promotes operational reliability by preventing accidental lapses of value. At the same time, holders and writers remain subject to assignment processes coordinated by the clearinghouse. These processes allocate resulting obligations to short positions in accordance with standardized rules such as random selection at the clearing member level.

Clearing, assignment, and margin closeout

Clearinghouses sit at the center of expiration processing. They novate every trade, becoming the buyer to every seller and the seller to every buyer. On expiration they determine which contracts convert into exercises and assignments, then net obligations across clearing members. Margin frameworks reflect these lifecycles. As contracts near expiration, margin requirements can rise for short positions because price sensitivity increases in the final days and hours. Once expiration is processed, positions that were long options expire worthless if out-of-the-money, and short options either lapse with no further obligation or become assignments. Settlement of cash or delivery of shares follows standard cycles for the underlying market.

The Calendar of Expiration

Monthlies, weeklies, quarterlies, and long-dated series

The modern options calendar offers multiple layers of maturities:

- Standard monthly equity options typically stop trading on the exchange at the close of regular trading on the third Friday of the month. Clearing processes occur after the close. If the third Friday is a market holiday, the relevant deadlines shift to the preceding business day.

- Weekly options provide additional maturities that end on non-standard Fridays and, in some markets, on other weekdays. These series concentrate activity around particular corporate or macroeconomic dates without requiring a full monthly cycle.

- Quarterly options align with calendar quarter endings. They can coincide with index rebalances or fiscal reporting periods, which influences how exchanges plan settlement procedures.

- Long-dated options extend maturities beyond a year. Their expiration schedule is less dense, but the same principles apply: a fixed expiration date, standardized exercise style, and a defined settlement mechanism.

All of these series coexist. Liquidity tends to concentrate in near-term expirations, but longer maturities serve participants needing defined horizons further into the future.

Equity options and index options

Expiration mechanics differ between equity-linked and index-linked contracts.

Equity and ETF options are often American style and physically settled. Trading ends at the close of the last trading day. If an option finishes in-the-money at expiration, exercise converts into a long or short share position at the strike price, with standard equity settlement cycles for the share delivery. Automatic exercise conventions typically apply based on closing prices or other official prints.

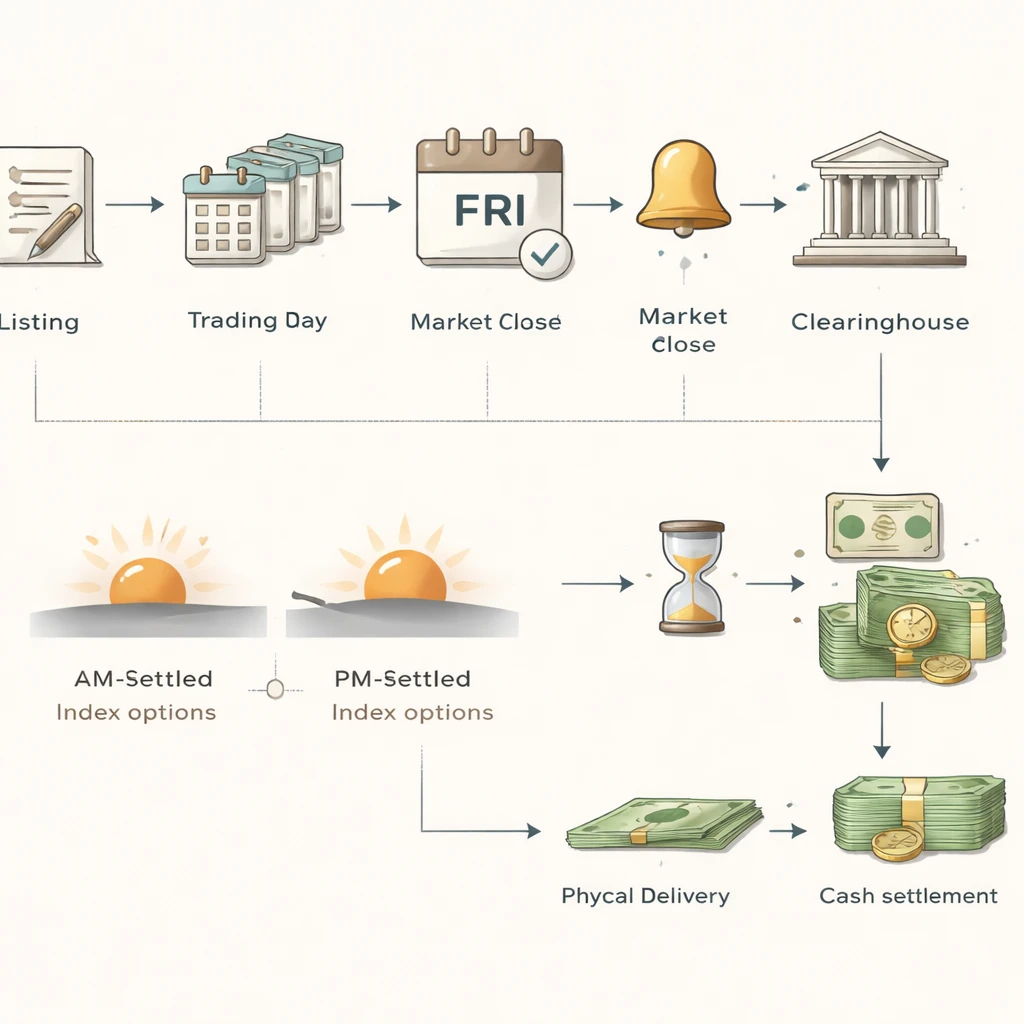

Index options are frequently European style and cash-settled. Two settlement modes are common:

- PM settlement. The settlement value is based on closing prices of the index components on the expiration day. Trading ends by the close of that session.

- AM settlement. The settlement value is based on opening prices of the index components on the expiration morning. For AM-settled index options, the last trading day is usually the business day before the expiration date because the settlement calculation uses next-morning opening prices. During the opening auction, the exchange computes a special settlement value, and cash payments are determined from that figure.

Product specifications published by exchanges identify whether a contract is AM or PM settled, physically or cash settled, and the exact timing of last trade and exercise cutoffs.

Holidays, market disruptions, and special cases

Occasionally, holidays or market disruptions affect the expiration schedule. If the standard expiration day falls on an exchange holiday, the last trading day and exercise deadlines shift to the previous business day. In rare cases of trading halts or extraordinary events, exchanges and clearinghouses may announce special procedures to ensure orderly settlement. Corporate actions such as stock splits or special dividends can lead to adjusted contracts with modified strikes or deliverables, but the expiration date for the series typically remains intact unless specifically revised in an official notice.

Pricing and Risk Around Expiration

Time is a central variable in option pricing. As expiration approaches, the profile of option values changes in ways that are visible in quotes and risk measures:

- Time decay. The extrinsic value of an option declines as the expiration date approaches. The rate of decay accelerates in the final days for many contracts. This feature is a mechanical consequence of the finite life of the option.

- Gamma and price sensitivity. Near expiration, small changes in the underlying price can produce larger changes in an option’s delta. That heightened sensitivity can be seen in the rapid movement of short-dated option premiums when the underlying security moves by modest amounts.

- Implied volatility dynamics. Short-dated implied volatilities often respond strongly to scheduled events that are expected to occur before expiration, such as earnings announcements or economic data releases. After the event passes, implied volatility for the expiring series can normalize quickly.

- Settlement focus. For cash-settled index options, the method of calculating the official settlement value can matter more than the last trade price. For example, an AM-settled index option may derive its payoff from opening prices that differ from premarket indications or from the previous day’s close.

These behaviors arise from the mathematical structure of options with finite horizons. They do not imply a specific course of action, but they do explain why trading interest and quoted spreads often change as the clock runs down to expiration.

Real-World Context and Examples

A basic equity option timeline

Consider a physically settled American-style call option on shares of a company. The contract lists with an expiration specified as the third Friday of a given month. Trading is active for several weeks. On the expiration Friday, secondary market trading for that option series ends at the close of the regular session. After the close, the clearinghouse applies exercise-by-exception. If the call finishes in-the-money based on the official closing price, it is automatically exercised unless a contrary instruction has been submitted by the clearing member. The result is a share position at the strike price that settles on the standard equity settlement cycle. If the call finishes out-of-the-money, it expires with no deliverable or cash flow.

On the short side, a trader who had written the call is subject to assignment if the option is exercised. The clearinghouse allocates assignments to clearing members, who then assign customer accounts according to their published procedures. The assignment results in a short sale delivery obligation or the sale of shares already held in the account, depending on the account’s existing positions.

A cash-settled index option example

Now consider a European-style cash-settled option on a broad equity index with AM settlement. The last trading day is the business day before the stated expiration, because the settlement value will be derived from opening prices on the expiration morning. After trading ends on the prior day, positions remain open but cannot be traded. On the morning of expiration, the exchange calculates a special settlement value based on the first reported prices of all index constituents. That value may differ from the previous day’s close if component stocks open at new levels. The option’s in-the-money amount is computed from that official settlement value, and the clearinghouse processes the resulting cash flows.

This example shows why the expiration date is more than a calendar label. It governs which prices matter for final settlement, which in turn affects how risk is measured as the final hours approach.

Dividends and early exercise context

Expiration also interacts with corporate event timing. For American-style equity options, the opportunity to exercise before expiration exists. One context in which early exercise occurs is around cash dividends, because exercising a call prior to the ex-dividend date can affect who receives the dividend on the underlying shares. The decision to exercise early has trade-offs that depend on interest rates, remaining time value, and dividend size, and it is handled at the account level by the holder through their broker’s procedures. The key point for expiration is that the option’s finite life creates a last date on which such decisions are relevant.

Operational and Recordkeeping Implications

Expiration drives several operational outcomes in customer accounts. These are standardized by the clearinghouse but executed through brokers’ systems:

- Automatic exercise notifications. Brokers typically inform clients of the possibility of automatic exercise and provide cutoff times for submitting contrary instructions. Deadlines can be earlier than the clearinghouse deadline to allow processing.

- Assignment processing. After the clearinghouse allocates assignments, brokers update account positions to reflect delivered or received shares in the case of physical settlement, or cash credits and debits for cash-settled contracts.

- Statements and confirmations. Post-expiration activity appears on trade confirmations and monthly statements, including symbols of expired series, quantities, and resulting positions. This documentation references the expiration date as the event date.

- Corporate action adjustments. If an underlying stock undergoes a split or special distribution before expiration, the deliverable of existing options may be adjusted. Expiration still occurs on the listed date unless an official notice states otherwise, but the unit of settlement may differ from the original 100-share convention.

Participants should consult their broker’s published calendars and the exchange’s product specifications to confirm the exact schedules that apply to a given contract, since timelines can vary by product and jurisdiction.

Common Misconceptions and Clarifications

Expiration date versus last trading day. The expiration date is the legal end of the contract’s life. The last trading day is the last session in which the contract can be bought or sold on the exchange. For many equity options these coincide on the same calendar day, but for some AM-settled index options the last trading day precedes the expiration date by one business day.

European style does not mean European venue. European exercise style is a contractual term that restricts exercise to expiration. It does not refer to where the option trades. Many European-style options trade on North American exchanges, and vice versa.

Saturday processing. Historically, certain equity options were processed over the weekend after the last trading day. Today, trading typically ends on Friday, and many operational steps occur after the close. Some official processing conventions still reference a weekend date for legacy reasons, but holders cannot trade after the exchange closes on the last trading day.

Expiration does not imply forced liquidation for long options. A long option that is out-of-the-money at expiration usually expires worthless, which means it disappears without creating a new position. In-the-money long options can be exercised automatically depending on the rules in effect, potentially creating a position in the underlying for physically settled contracts or a cash flow for cash-settled contracts. Short positions face the corresponding assignment outcomes.

Where Expiration Dates Sit in the Broader Market Structure

Expiration dates are integrated into a larger institutional framework:

- Exchanges list the contracts, publish specifications, and manage trading halts and auctions, including special opening or closing procedures that are relevant for settlement calculations.

- Clearinghouses guarantee performance, net positions, coordinate exercise and assignment, and publish operational calendars that define deadlines and processing sequences.

- Regulators oversee the rules governing listings, margin standards, and customer disclosures related to expiration and exercise procedures.

- Market data providers disseminate official closing prices and settlement values that anchor exercise-by-exception and cash settlement computations.

This infrastructure allows options with thousands of strikes and maturities to be processed reliably, even when trading volume spikes on expiration dates.

Intersections With Other Market Dates

Option expiration often interacts with other scheduled dates:

- Index rebalancing. Index providers adjust constituent weights on set schedules, sometimes near month- or quarter-end. If an index option is PM-settled on such a day, closing prints used for settlement may reflect rebalance flows.

- Corporate earnings and guidance. For equity and ETF options, earnings announcements sometimes fall near a weekly or monthly expiration. Implied volatilities can reflect the expected information release before the expiration cutoff.

- Dividend and record dates. Ex-dividend dates affect the economics of exercising certain American-style options before expiration. The recordkeeping systems of brokers and clearinghouses are designed to handle the timing of entitlements for exercised and assigned positions.

These intersections do not change the definition of expiration, but they can influence prices and the sequence of operational steps around the expiration date.

Reading Product Specifications

Each listed option has a product specification published by the listing exchange. The specification identifies the underlying, contract multiplier, strike conventions, exercise style, settlement method, last trading day, and expiration date. It may also note special features such as AM settlement, special opening quotation calculations, or nonstandard deliverables for adjusted series. When interpreting an option chain, the expiration column reflects the dates defined in those specifications, and the daily price action is tied to the schedule they set.

Summary of the Concept

The expiration date ends the option’s legal life. It ties together the last moment of tradability, the final opportunity to exercise, the path to assignment, and the settlement of cash or shares. Exchanges and clearinghouses define and enforce the timetable so that the thousands of series in the market can be processed in a predictable, transparent way. Pricing behavior near expiration reflects the mathematics of options with limited time remaining and the operational mechanics of settlement in either physical or cash form.

Key Takeaways

- Every listed option has a fixed expiration date that terminates the contract’s rights and obligations.

- Expiration schedules are standardized to support liquidity, risk management, and orderly clearing, with monthlies, weeklies, quarterlies, and long-dated series.

- Exercise style and settlement method determine what happens at expiration, including whether delivery is physical or cash and whether exercise can occur before expiration.

- Last trading day, exercise deadlines, and automatic exercise are distinct but related milestones anchored to the expiration date.

- Index and equity options can follow different expiration and settlement conventions, including AM or PM settlement that affects which prices determine final outcomes.