Assignment and exercise sit at the center of how standardized options function. They turn a derivative contract into a definitive transaction by either transferring the underlying asset or paying a cash amount. These mechanisms are not add-ons. They define the rights and obligations that distinguish an option from a mere price bet. Understanding how and why assignment and exercise occur is essential to interpreting option payoffs, the legal structure of the market, and the operational steps that occur at expiration or before it.

Definitions and core ideas

Exercise is the act by which the holder of an option chooses to invoke the contract right. For a call, exercise gives the holder the right to purchase the underlying at the strike price. For a put, exercise gives the holder the right to sell the underlying at the strike price. In American-style options, exercise is permitted on any trading day up to and including expiration. In European-style options, exercise can occur only at expiration.

Assignment is the process that identifies which option writer will fulfill the corresponding obligation when an option is exercised. If a call is exercised, a writer who is short that call series is assigned and must deliver the underlying and receive the strike price. If a put is exercised, a writer who is short that put series is assigned and must purchase the underlying at the strike price.

In standardized equity options in the United States, one contract typically controls 100 shares. Index and futures options may be cash settled. The clearinghouse codifies the deliverable and the settlement method in the contract specifications.

Where assignment and exercise fit in market structure

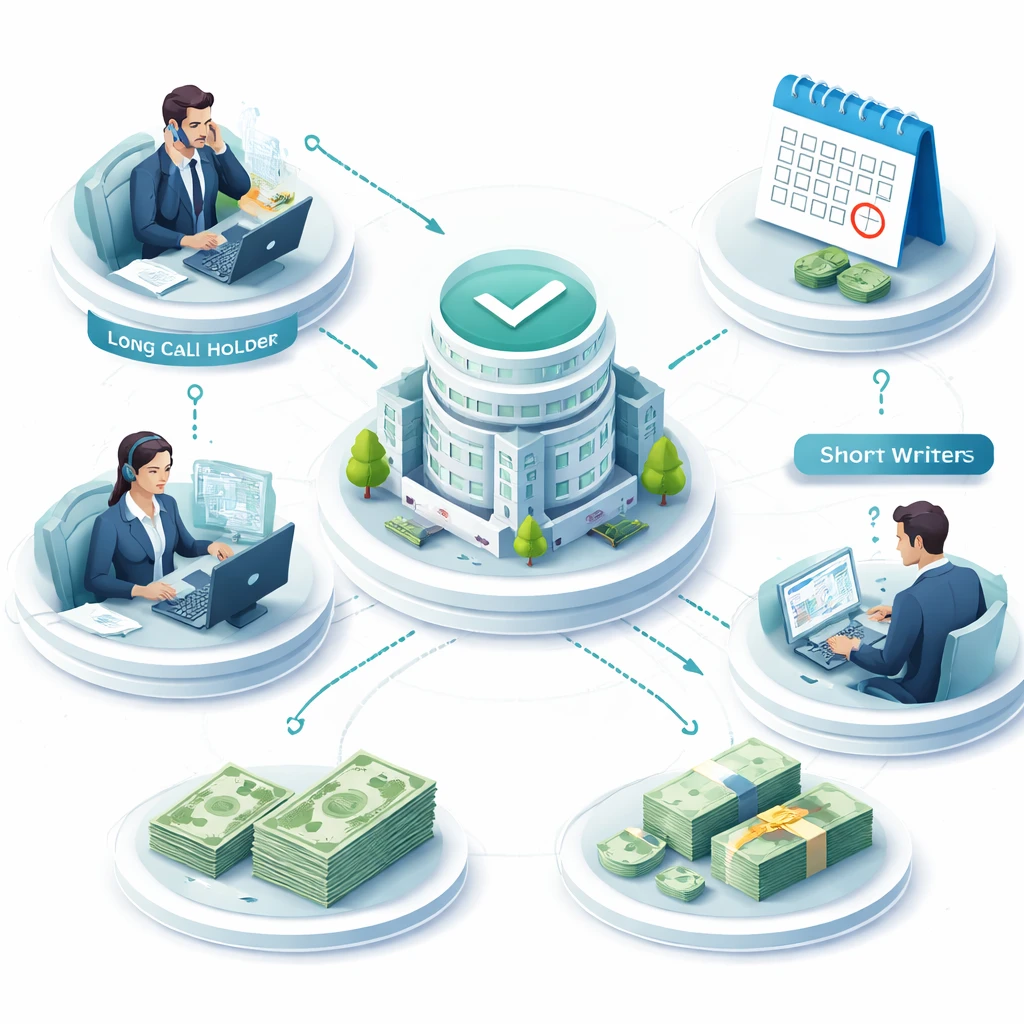

Options trade on exchanges but are supported by a centralized clearinghouse that stands between buyers and sellers. In the United States, the Options Clearing Corporation acts as the counterparty to every cleared options trade. When a long holder exercises, the clearinghouse processes the exercise and then allocates the resulting assignment to a clearing member that represents one or more short positions in the same series. The clearing member then assigns the obligation to a specific account according to its internal assignment method, which may be random or a method that is economically equivalent to random allocation.

This structure removes direct bilateral credit exposure between the original buyer and seller. The clearinghouse novates the trade, guarantees performance, standardizes settlement, and enforces contract terms. Exercise and assignment are the mechanisms that convert the option into the underlying transaction or cash flow, allowing the clearinghouse to complete the lifecycle of the contract.

Why these mechanisms exist

Options would not be enforceable without a defined path from a right to a transaction. Exercise and assignment provide that path. They serve several functions in the broader market.

First, they make the legal rights and obligations real. The buyer can compel a transaction at the strike price and the seller is obligated to perform if assigned. Second, they connect derivative values to underlying markets through deliverable settlement or cash settlement. This connection is important for price convergence at expiration and for arbitrage relationships such as put-call parity. Third, they create a framework for hedging and risk transfer. A covered writer who owns the underlying can satisfy assignment with inventory. A put writer who holds cash can fund purchase obligations. Even though specific trading strategies are outside the scope here, the existence of exercise and assignment is what enables such hedges to be well defined. Fourth, they support orderly markets across corporate actions. Adjusted deliverables after stock splits or special dividends maintain the integrity of contract rights through exercise.

Operational mechanics of exercise

Exercise can be initiated by the long holder through a brokerage instruction. The instruction flows from the customer to the broker, then to the clearing member, and finally to the clearinghouse, which processes the exercise. Brokers set customer cutoffs that are earlier than the clearinghouse deadline, and these cutoffs can vary. Operational deadlines matter most near expiration.

In standardized U.S. equity options, the clearinghouse uses an exercise-by-exception process at expiration. Under this process, options that are in the money by at least a small threshold, commonly one cent, are typically exercised automatically by the clearing member on behalf of customers, unless contrary instructions are provided. Firms may set different thresholds or policies. This automation reduces missed exercises due to operational oversight, but it also means a holder should be aware that an in-the-money position may be exercised even if the holder does not submit an instruction.

Exercise triggers settlement. For physically settled equity options, exercise of a call results in a purchase of shares at the strike price per contract unit, and exercise of a put results in a sale of shares at the strike price. The resulting stock transactions settle on the standard equity settlement cycle. In the United States this is currently T+1 for equities, which means the share and cash movements complete on the business day after the exercise date. For cash-settled options, such as many index options, the clearinghouse calculates a final settlement value and credits or debits cash accordingly, typically also on T+1 for U.S. markets.

Exercise may incur fees. Brokers may charge an exercise or assignment fee, and exchange or clearing costs may be embedded in commissions. Fee schedules vary by firm and product.

Operational mechanics of assignment

When an exercise reaches the clearinghouse, the clearinghouse allocates the assignment to one or more short positions in the same series held by clearing members. The allocation method at the clearinghouse level is designed to be fair and unbiased across clearing members. The clearing member then assigns the obligation to an individual account using a method disclosed in its account agreements, often random or pro rata. The short position holder does not control when assignment occurs if a counterparty chooses to exercise, except in European-style contracts where early exercise is not permitted.

Assignment results in a binding transaction. A short call assignment obligates the assigned account to deliver the contract-specified number of shares in exchange for the strike price. A short put assignment obligates the assigned account to purchase the contract-specified number of shares at the strike price. The stock leg settles on the equity settlement cycle. If the account lacks sufficient shares or cash at assignment, the broker will handle the settlement through borrowing, funding, or liquidation policies defined in the account agreement, subject to margin rules.

Early assignment is possible in American-style physically settled options any trading day before expiration if a holder exercises. Early assignment is often observed around dividend dates, when exercising a deep in-the-money call can be economically sensible for the call holder because the stock is expected to pay a dividend. Mechanical details aside, the important point is that short option positions can be assigned before expiration and should be understood as obligations that can be triggered at any time while the market is open and the contract is eligible for exercise.

Physical settlement and cash settlement

Settlement terms differ across products.

Physically settled equity options deliver or receive shares. One standard contract corresponds to 100 shares unless adjusted. After exercise, the long call holder receives shares against payment of the strike price, and the assigned short call delivers shares and receives the strike proceeds. The long put holder delivers shares and receives the strike proceeds, and the assigned short put receives shares and pays the strike price.

Cash-settled options, common in broad-based index products, pay the intrinsic value in cash rather than exchanging the underlying. The final settlement value is calculated using a defined index methodology. Some index options settle using a special opening quotation based on opening prices of the index components at expiration, while others use closing prices. The contract specifications identify whether the option is American or European style and whether it settles to a morning or closing reference. Exercise creates a cash flow equal to the settlement value minus the strike for calls, or the strike minus the settlement value for puts, floored at zero.

Examples

Equity call exercise and assignment

Suppose a trader holds a long American-style call on XYZ with a strike of 50 that controls 100 shares and expires this Friday. On Thursday, XYZ closes at 57. By default, the call is in the money by 7 per share. If no contrary instruction is given and the broker follows exercise-by-exception based on a one cent threshold, the call is likely to be exercised automatically at expiration.

When exercised, the clearinghouse assigns the obligation across short positions held by clearing members. One short call writer is assigned. On settlement day, the long call holder pays 5,000 dollars and receives 100 shares, and the assigned short call writer delivers 100 shares and receives 5,000 dollars. The short writer who does not own shares at the time of settlement will have the broker borrow shares to deliver, according to the broker's procedures and margin rules.

Equity put assignment before expiration

Consider a trader who is short a put on ABC with a strike of 30. ABC declines to 28 several days before expiration. A long put holder exercises early. The clearinghouse allocates the assignment, and the short put is selected. The assigned account must purchase 100 shares at 30, a total of 3,000 dollars, even though the market price at that moment is 28. On the settlement date, the shares are delivered to the short put writer's account and 3,000 dollars is paid out. The option position is closed because the contract was fulfilled. From that moment, the account holds the shares and is exposed to the market movement of ABC.

Cash-settled index option settlement

Assume a European-style index call with a strike of 4,000. The contract is cash settled and uses a special opening quotation for final settlement. At expiration, the official settlement value is published at 4,050. The intrinsic value is 50. The long call exercises automatically. The assigned short call writer owes 50 multiplied by the contract multiplier, typically 100, resulting in a 5,000 dollar cash debit. The long call holder receives a 5,000 dollar cash credit. No exchange of index units occurs because the contract specifies cash settlement.

Expiration day mechanics and price risk

Near expiration, option holders and writers face unique operational and price risks related to exercise and assignment. An equity option that closes slightly in the money may be exercised automatically, triggering a stock position on the next business day. Between the market close and the time the broker submits final instructions, after-hours price changes can alter the economic desirability of exercise. As a result, brokers allow contrary exercise instructions, subject to their deadlines, so that holders can choose not to exercise even if the option is slightly in the money, or to exercise an option that is slightly out of the money if they consider the post-close price move relevant.

For index options that settle to a special opening quotation, the risk profile differs. The final settlement value is calculated from opening prices of constituents, which can diverge from the prior day's close. The option's terminal cash flow may therefore reflect opening auction dynamics rather than the previous close. This is not a flaw. It is an explicit contract term designed to incorporate a standardized reference price for the index.

A phenomenon known as pin risk can occur for physically settled options with strikes near the underlying's closing price. If the stock closes close to the strike, holders and writers cannot be certain which contracts will be in the money after final calculations or after late prints are considered. Some holders may exercise, others may not. Short writers can be assigned on some positions but not others, and the resulting stock position on the next day may be different from what was expected at the close.

Early exercise and economic drivers

American-style options allow early exercise, but early exercise is not common for out-of-the-money or at-the-money contracts because there is no immediate intrinsic gain to realize. Early exercise is more often observed in deeply in-the-money options under specific conditions. Several drivers are noteworthy.

Dividends matter for calls on dividend-paying stocks. A call holder who exercises just before an ex-dividend date becomes a shareholder of record and is eligible to receive the dividend. If the present value of the dividend exceeds the time value forgone by exercising early, early exercise can be rational for the call holder. This is a reason why short calls can be assigned ahead of ex-dividend dates when they are sufficiently in the money.

Interest rates and financing costs can influence early exercise for both calls and puts. Carrying the underlying versus holding the option has different cash flow profiles. When rates are sufficiently high or low, the relative cost of carry can tilt the balance toward early exercise for certain contracts. Hard-to-borrow conditions can also affect exercise behavior in securities that are difficult to short or borrow.

These are economic explanations for behavior, not recommendations. The main point is that assignment risk exists throughout the life of an American-style option, not only at expiration.

Corporate actions and adjusted deliverables

Stock splits, mergers, spin-offs, and special dividends can change the deliverable of an equity option. The clearinghouse issues circulars that describe how contracts are adjusted to preserve economic equivalence. An option that once represented 100 shares at a given strike may, after an event, represent a different number of shares, a basket of shares plus cash, or another deliverable defined by the adjustment. The contract symbol may change to reflect the adjusted terms. Exercise and assignment under adjusted contracts deliver the adjusted package rather than the original 100 shares.

Because adjustments can introduce fractional share deliverables or mixed cash and stock components, settlement after exercise may involve unusual amounts. The clearinghouse and brokers compute these amounts according to the circulars. The existence of adjustments does not alter the mechanics of exercise and assignment. It only changes what is delivered.

Margin, funding, and settlement flows

Short option positions are margined because assignment creates obligations to deliver securities or pay cash. When assignment occurs, the obligation converts into a standard securities transaction, such as a stock purchase or sale, with its own margin and financing requirements. For example, after a short put is assigned in a margin account, the account may carry a stock position financed according to equity margin rules. After a short call is assigned and the account does not hold shares, the account may be short stock subject to short sale rules and borrow availability. These funding and margin flows are operational, not advisory. They are part of the conversion from derivatives exposure to cash and securities exposure through assignment.

Recordkeeping and confirmations

Exercise and assignment are recorded with formal confirmations. A long holder who exercises receives an exercise confirmation, and an assigned short holder receives an assignment confirmation. The account's trade history will show the resulting stock or cash transactions with settlement dates. Statements will reflect fee entries, if any, and position changes. Accurate recordkeeping ensures that the lifecycle of the option is traceable for reconciliation and compliance purposes.

Common misconceptions

Several misconceptions can cloud understanding of exercise and assignment.

First, some assume assignment only happens at expiration. That is false for American-style physically settled options. Early assignment can occur any trading day that exercise is allowed. Second, some believe that assignment is targeted or punitive. In reality, allocation rules are systematic. The clearinghouse allocates to clearing members, and members allocate to accounts using pre-disclosed methods that are designed to be fair. Third, many assume an out-of-the-money option cannot be exercised. It is unusual but not forbidden for American-style options. A holder can submit an exercise instruction regardless of moneyness. Whether a broker permits contrary exercise policies at expiration or requires additional steps for unusual cases is procedural, not a change to the contract right. Fourth, some assume automatic exercise at expiration is guaranteed to match economic intent. While exercise by exception is designed to reflect intrinsic value, brokers permit contrary instructions because post-close price moves or transaction costs can justify deviating from the default.

Differences across asset classes

Not all options settle into shares. Many options on futures, for example, are physically settled into a futures contract rather than cash or equity. Exercise of a call on a futures contract creates a long futures position at the strike, and a put creates a short futures position. The futures position then follows its own margining and settlement rules. Some currency options and some single-stock options in non-U.S. markets use cash settlement conventions. Contract specifications always define the settlement type, exercise style, multiplier, and deliverable.

Practical implications for market participants

Assignment and exercise transform options into stock or cash transactions with standard settlement timing. This transformation affects operational workflows for brokers, clearing firms, and clients. It influences how inventory is sourced or delivered, how financing is arranged, how tax reporting is structured under local regulations, and how corporate actions flow through derivative positions. Even without taking a view on strategies, a functional understanding of these mechanisms reduces the chance of surprises when options reach expiration or when holders act earlier.

Real-world context

Consider a quarterly expiration in a broad market decline. Many put holders end up in the money. A portion exercise at expiration through the clearinghouse's automatic process. Short put writers receive assignment notices over the weekend or on expiration evening, depending on broker processes. On the next business day, accounts that were short puts now hold shares and have paid the strike price, even if the market opens lower. Brokers reconcile thousands of such assignments through automated systems. At the same time, call writers on dividend-paying stocks may have been assigned early during the week due to ex-dividend dates. The clearinghouse coordinates these flows across all firms so that every exercised contract is paired with a corresponding assignment and the resulting cash and securities move correctly on settlement day.

What does not happen

Exercise and assignment do not change the strike price or retroactively alter the premium originally paid or received. Once an option is exercised and assigned, the option contract ceases to exist for those parties. The resulting stock or cash position is a new exposure subject to market movement, financing, and settlement rules. If an option expires out of the money and is not exercised, it expires worthless and no assignment occurs. There is no partial assignment without exercise. There is no discretionary refusal to perform once assignment has been allocated.

Putting the pieces together

Assignment and exercise are the conversion mechanisms that make option rights and obligations concrete. They connect the derivatives market to the underlying cash or index market, enforce the legal content of the contract, and complete the lifecycle of the position. They operate within a well-defined infrastructure of brokers, clearing members, and the clearinghouse. They occur according to explicit contract terms, settlement calendars, and corporate action adjustments. They are routine for market professionals and can be routine for individual participants when understood as standard operations rather than surprises.

Key Takeaways

- Exercise is the holder's decision to invoke an option right, and assignment is the allocation of the resulting obligation to a writer in the same series.

- Clearinghouses stand between buyers and sellers, process exercises, and allocate assignments to maintain orderly and enforceable markets.

- Physically settled equity options deliver shares and cash on the equity settlement cycle, while many index options are cash settled to a defined reference value.

- American-style options can be exercised and assigned before expiration, often around dividends or other economic drivers, while European-style options only settle at expiration.

- Automatic exercise by exception reduces operational errors at expiration, but contrary exercise instructions and after-hours price moves can affect which contracts settle and how.