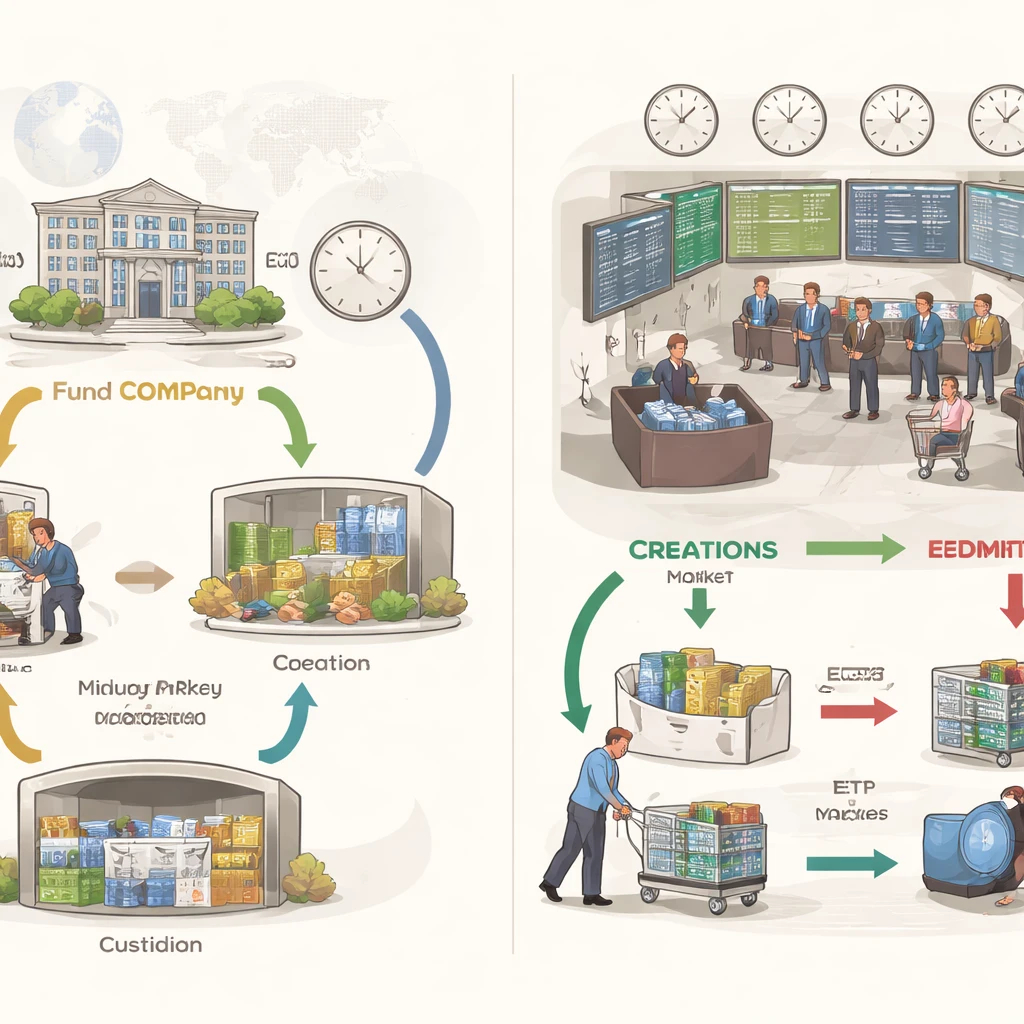

What Is an ETF?

An exchange-traded fund is a pooled investment vehicle that holds a portfolio of assets and trades on an exchange like a stock. This article explains how ETFs are structured, why they exist, how shares are created and redeemed, and where they fit within the broader market infrastructure.