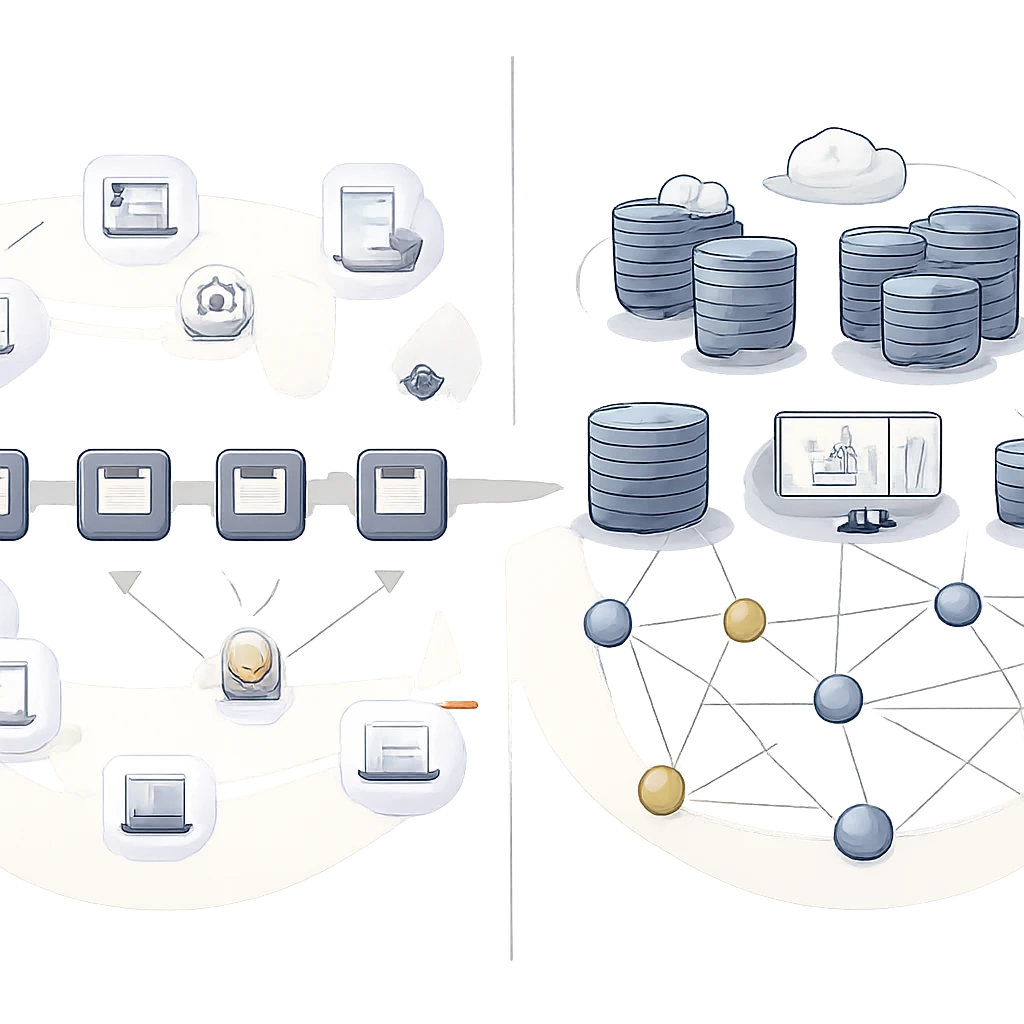

The distinction between on-chain and off-chain sits at the center of how modern crypto systems are designed, operated, and understood. It determines which actions are recorded in a public ledger under consensus, which activities happen elsewhere, and how the two realms eventually reconcile. For students of blockchain fundamentals, learning where computation and data live is as important as the cryptography that secures them.

Defining On-Chain

On-chain refers to any transaction, state transition, or data entry that is included in a block and validated by the network’s consensus mechanism. If a payment, smart contract call, or governance vote appears in the canonical chain, it is on-chain. The defining characteristics are:

- Consensus validation: Nodes reach agreement on the order and content of transactions.

- Immutability subject to consensus rules: Once finalized, entries are durable and tamper evident.

- Transparency: Data is typically public and auditable, even if identities behind addresses remain pseudonymous.

- Resource constraints: Throughput and storage are limited because every validating node must process or verify the data according to protocol rules.

Examples include transferring a token on Ethereum, executing an automated market maker swap directly in a contract, minting a non-fungible token, or casting a vote recorded by a governance contract. All of these appear in block explorers, are subject to gas fees or transaction fees, and become part of the chain’s permanent history once finalized.

Defining Off-Chain

Off-chain refers to operations that occur outside the base blockchain’s consensus. Off-chain actions may be recorded in private databases, bilateral ledgers, separate networks, or application servers. They can still be cryptographically secure, rule-based, and auditable, but they are not directly embedded in the canonical chain at the moment they occur.

Common off-chain contexts include centralized exchange order books and account ledgers, payment channels and state channels that settle periodically, game servers handling most logic while anchoring asset ownership on-chain, and content storage for large files such as NFT media. Oracles also function largely off-chain by gathering or computing data and then publishing attested results to a smart contract on a schedule or on demand.

Off-chain is not a synonym for insecure or informal. It is a category for activity that relies on trust assumptions, governance, or cryptographic proofs that are external to the base chain’s block-by-block validation. Many production systems use off-chain components to achieve latency, throughput, or privacy properties that are difficult to realize directly on-chain.

Why the Distinction Exists

Blockchains are built around a set of tradeoffs. A public network that many parties can verify independently must limit how much computation and data it performs per unit of time. This constraint produces high integrity but also introduces costs in the form of fees, latency, and capacity ceilings.

Off-chain solutions exist to complement these constraints. They reduce congestion by shifting some work elsewhere, then reconcile to the base chain at intervals. There are several recurring motivations:

- Scalability: Moving frequent or heavy operations off the base layer allows more activity without overwhelming consensus validators.

- Latency: Real-time applications such as fast payments or games often need sub-second responsiveness that block production cannot provide.

- Cost efficiency: Off-chain computation and storage can be cheaper than paying on-chain gas for every step.

- Privacy and compliance: Some data is sensitive, regulated, or legally protected. Keeping it off-chain with controlled access can be appropriate while still anchoring proofs on-chain.

- Specialized functionality: External systems can supply capabilities that the base chain does not natively offer, such as high-frequency matching engines or complex analytics.

Position in the Broader Market Structure

On-chain and off-chain are not isolated categories. They shape how the crypto market is organized across layers and institutions.

At the core is the base layer, often called Layer 1. This is the canonical ledger and consensus engine. Above it sit Layer 2 systems that execute transactions off-chain or in compressed batches while using the base layer for security and settlement. Beside them are sidechains and appchains with their own consensus that may bridge value back to the base layer. Off-chain infrastructure extends further to centralized exchanges, custodians, wallet providers, analytics services, and developer platforms.

This layered structure mirrors traditional financial market plumbing. A central settlement layer records final ownership, while higher layers handle aggregation, routing, and user interactions. In crypto, the base chain is the settlement layer. L2 rollups, state channels, and custodial platforms are aggregation and execution layers. Bridges, oracles, and data providers connect and translate across environments.

On-Chain Transaction Lifecycle

Understanding the path a transaction takes clarifies what makes it on-chain:

- Creation and signing: A user or application crafts a transaction and signs it with a private key.

- Propagation: The transaction is broadcast to peers and lands in a mempool or equivalent queue.

- Inclusion: A validator bundles the transaction into a block according to protocol rules and fee markets.

- Validation: Nodes verify signatures, balances, and contract logic, then apply the state changes.

- Finality: After sufficient confirmations or finality rules, the transaction is considered durable and economically impractical to reverse under honest-majority assumptions.

Each step is public, measurable, and auditable with standard tools. Costs are transparent through fees, and failure modes are tied to protocol behavior, adversarial activity, or network conditions.

Off-Chain Operations and Reconciliation

Off-chain systems have their own lifecycles. A centralized exchange, for instance, records a trade by updating an internal database. Only when a user deposits or withdraws does a transaction touch the base chain. Bilateral arrangements function similarly. Two parties can keep a shared off-chain ledger, settle net differences periodically, and rely on pre-agreed rules for dispute resolution.

Payment channels and state channels introduce cryptographic reconciliation. Parties exchange signed updates off-chain. If they disagree or need to finalize, they submit the latest mutually signed state on-chain. The chain acts as an arbiter of last resort, and security depends on honest behavior within time windows and on the difficulty of forging signatures.

Rollups use off-chain execution with on-chain settlement. They aggregate many transactions, execute them in an off-chain environment, and post compressed data and proofs to the base layer. This preserves verifiability while reducing per-transaction costs on the base chain. The result is a system that feels fast like an application server but inherits security properties from the underlying chain through data availability and proof verification.

Practical Examples

Payments at the Point of Sale

Consider a small purchase such as a coffee. An on-chain payment involves broadcasting a transaction, waiting for inclusion in a block, and possibly several confirmations. Fees fluctuate with network demand. An off-chain payment channel can allow an instant update between customer and merchant, with one on-chain opening transaction and one closing transaction. The coffee purchase becomes an off-chain state update that relies on cryptographic guarantees and channel rules, while settlement eventually anchors on-chain.

Centralized Exchange Trading vs On-Chain Swaps

An automated market maker executed through a smart contract is fully on-chain. The liquidity pool balances, price formula, and swap event are recorded under consensus. In contrast, a centralized exchange maintains an internal order book and account balances off-chain. A large number of trades can occur without touching the base chain. Only deposits and withdrawals appear on-chain. Users rely on the exchange’s solvency, controls, and audits, while on-chain swaps rely on contract code and network security.

NFTs and Content Storage

Minting an NFT typically records token ownership and metadata pointers on-chain. The underlying media file is often stored off-chain because large files are expensive to include in the chain’s state. Decentralized storage networks and content-addressed systems can provide persistence that complements on-chain records. The design choice affects availability guarantees and the cost of retrieval, and it determines what is cryptographically anchored in the base chain versus what requires separate availability assumptions.

Tradeoffs and Risk Profiles

On-chain and off-chain provide different guarantees. Selecting one or the other for a component involves balancing the following considerations:

- Security model: On-chain security derives from consensus and economic finality. Off-chain security may rely on operator integrity, legal contracts, committee signatures, or cryptographic dispute mechanisms.

- Transparency and auditability: On-chain data is globally visible and independently verifiable. Off-chain data may require attestations, proofs, or independent audits to achieve similar assurance.

- Performance and cost: Off-chain systems can offer high throughput and low latency at lower marginal cost. On-chain operations pay for decentralized verification, which can be expensive during congestion.

- Privacy: Off-chain environments can protect sensitive information more readily. On-chain transactions reveal patterns unless privacy technologies such as zero-knowledge proofs are used.

- Composability: On-chain smart contracts compose naturally because state is shared under a common ledger. Off-chain components require integration bridges and interfaces, which adds complexity.

Hybrid Designs in Practice

Many modern systems blend on-chain and off-chain components to capture the advantages of both. Several patterns are common.

Rollups

Rollups execute transactions off-chain, compress results, and post data or proofs on-chain. Optimistic rollups assume that posted results are correct unless challenged. Zero-knowledge rollups submit succinct validity proofs that the off-chain computation followed the rules. In both cases, the base chain acts as the settlement and data availability layer to varying degrees, while the rollup aims for higher throughput and lower per-transaction cost.

Validiums and Volitions

Validiums separate computation and data availability. They keep execution off-chain and data off-chain while providing validity proofs to the base chain. This design achieves high scalability but depends on off-chain data availability committees. Volitions allow users or applications to choose between on-chain and off-chain data availability modes depending on their needs for security and cost.

State Channels and Payment Channels

Channels keep most interactions off-chain and anchor final settlement on-chain. They reduce fees for repeated interactions between a set of parties and can provide near-instant responsiveness. The tradeoff is that channels require participants to remain responsive or use watchtowers that monitor the chain and act if a counterparty attempts to settle an outdated state.

Oracles

Oracles bridge off-chain information to on-chain contracts. Data providers aggregate prices, weather measurements, or event outcomes and publish signed updates to contracts. The integrity of the on-chain state then depends on oracle mechanisms and incentives. Oracles are inherently hybrid, as they transform real-world or off-chain data into on-chain inputs.

Bridges

Bridges transfer assets or messages across chains and layers. Some rely on trusted custodians. Others use light client verification or proof-based designs. The security model depends on how the bridge verifies the source chain’s state. Because cross-chain messages touch multiple consensus domains, bridge design is a prominent example of how on-chain and off-chain components must align to avoid inconsistencies or exploits.

Data, Measurement, and Observability

On-chain data is abundant and structured. Blocks, transactions, logs, and receipts describe what happened and in what order. Block explorers and analytics platforms allow anyone to inspect activity, reconstruct balances, and measure application usage. These capabilities make on-chain data a rich resource for research and monitoring.

Off-chain data is more varied. Centralized services maintain internal logs and may expose selected metrics through APIs. Some provide cryptographic attestations or proof-of-reserves style disclosures that anchor assertions to the base chain. Others rely on third-party audits. The result is a spectrum of observability, from fully open on-chain records to private data that must be sampled or attested.

A practical implication is that on-chain metrics can be precise within the scope of what is recorded by the protocol, while off-chain metrics often require context, sampling, and trust in external reporting. Analysts should be careful to distinguish between what is verifiable on-chain and what is derived from off-chain representations.

Legal, Governance, and Accountability Context

The on-chain record is often useful for audit and compliance because it establishes a tamper-evident history of transfers and contract events. However, on-chain data is pseudonymous and may not directly reveal the identities behind addresses. Compliance processes typically combine on-chain analysis with off-chain identity verification and recordkeeping.

Off-chain operators introduce governance and accountability considerations. Centralized exchanges, custody providers, and payment processors hold obligations under law and under their terms of service. Proof-of-reserves schemes, segregated accounts, and real-time attestations are examples of mechanisms that attempt to give users visibility into off-chain solvency while still relying on operator behavior and controls.

Hybrid designs also raise governance questions. A rollup managed by a multisignature committee, for example, must define how upgrades, emergency pauses, or fraud proofs are handled. The provenance of these decisions lives off-chain in documents and processes, even if key actions are enforced by on-chain contracts.

Design Considerations for Builders

Choosing between on-chain and off-chain for each component involves a methodical assessment of requirements and constraints. Several questions typically guide the process:

- What security guarantees are necessary for this function, and can they be provided within the base chain’s rules or through cryptographic proofs anchored on-chain?

- What latency and throughput are required, and how sensitive are users to fees associated with on-chain execution?

- What data must be public for auditability, and what data should remain private due to regulation, competitive sensitivity, or user expectations?

- How will the system behave under failure, dispute, or downtime, and where does the authoritative record live in those cases?

- What dependencies or external providers are involved, and how are their guarantees integrated into the system’s overall assurance model?

These considerations often lead to minimal on-chain designs that anchor ownership, settlement, and dispute resolution while moving heavy computation and volatile data off-chain. The result can be a system that preserves trust-minimized settlement yet achieves practical performance.

Common Misconceptions

Several misconceptions recur in discussions of on-chain and off-chain.

First, some assume off-chain equals untrustworthy. In reality, many off-chain systems are robust and subject to regulation, audits, and strong cryptography. They simply rely on different assurances than decentralized consensus.

Second, on-chain is sometimes treated as fully anonymous. Most public blockchains are pseudonymous. Analytical techniques can cluster addresses and associate activity with entities. Privacy requires additional measures such as mixers, shielded transactions, or zero-knowledge systems that hide transaction details while proving validity.

Third, rollups are occasionally described as off-chain only. Rollups are hybrid by design. Execution is off-chain, but settlement and proofs are on-chain, and security depends on how data availability and verification are handled.

Finally, some believe that placing data on-chain guarantees availability forever. While the ledger persists, accessing historical data at scale can still involve infrastructure choices. Indexers, archival nodes, and external storage can influence practical availability and cost, especially for large media files that are not stored directly on-chain.

Real-World Contexts

Lightning Network for Microtransactions

In a payment channel network, two parties lock funds in a multisignature output on-chain, then conduct many off-chain transfers by updating signed balances. Through routing, a user can pay a distant merchant without a direct channel. Only opening and closing transactions touch the base chain. This approach enables low-fee, instant payments while the base chain provides final settlement and dispute resolution.

Custodial Transfers Inside a Platform

When users move assets between accounts at a custodial platform, the platform can update internal ledgers without any on-chain transaction. Users see balances change immediately. Only when assets enter or leave the platform does the base chain record activity. This model reduces on-chain load but concentrates operational and custodial risk within the platform.

Blockchain Gaming Architectures

Many games handle physics, matchmaking, and rapid state changes off-chain to achieve performance. They record asset ownership, scarce items, or key checkpoints on-chain. This design allows high frame rates and rich gameplay while providing verifiable ownership of in-game items. The boundary between on-chain assets and off-chain game logic must be carefully managed to avoid exploits and to ensure consistency when assets move between players or marketplaces.

DeFi with External Price Feeds

Lending protocols often depend on price data to manage collateral and liquidations. Oracles aggregate prices off-chain and publish updates on-chain. The protocol’s behavior then depends on the oracle’s design, update frequency, and incentives. This illustrates how an on-chain system can inherit properties from off-chain components, making oracle risk a first-order consideration.

Future Directions

Several trends are shaping the frontier between on-chain and off-chain. Modular blockchain design separates execution, settlement, consensus, and data availability across layers and specialized networks. Rollup-centric roadmaps envision base layers that focus on security and data availability, while most execution occurs on higher layers with cryptographic proofs. Improvements in data availability, such as sampling techniques and dedicated availability layers, aim to reduce the cost of posting large batches or proofs.

Advances in zero-knowledge proofs are enabling privacy-preserving verification. Computations can run off-chain while succinct proofs attest to their correctness on-chain. This changes the privacy and performance calculus for many applications by allowing selective disclosure and verifiable computation without revealing inputs.

Finally, standardization of cross-chain messaging and bridge verification is receiving intense attention. Robust interoperability requires precise definitions of what the target chain believes about the source chain. Proof-based mechanisms that minimize trust in intermediaries are a focus. These developments will continue to refine how on-chain and off-chain components interlock in practice.

Choosing the Right Boundary

There is no universal rule for what must be on-chain. The appropriate boundary depends on the function, the required guarantees, and the environment. Settlement and ownership are often anchored on-chain. High-frequency interactions, heavy computation, and sensitive data often run off-chain with careful reconciliation. Hybrid patterns such as rollups and oracles exist to bridge these needs while preserving verifiability where it matters most.

Key Takeaways

- On-chain refers to actions recorded under consensus in a blockchain’s canonical ledger, while off-chain covers operations that occur outside that ledger.

- The distinction exists to balance integrity with performance, cost, latency, and privacy, leading to layered architectures across the ecosystem.

- Hybrid designs such as rollups, channels, oracles, and bridges rely on both realms, with security shaped by data availability and verification methods.

- On-chain data is transparent and auditable; off-chain data requires attestations, audits, or proofs to reach comparable assurance.

- Selecting the boundary is a design decision tied to required guarantees, not a statement of inherent superiority of one approach over the other.