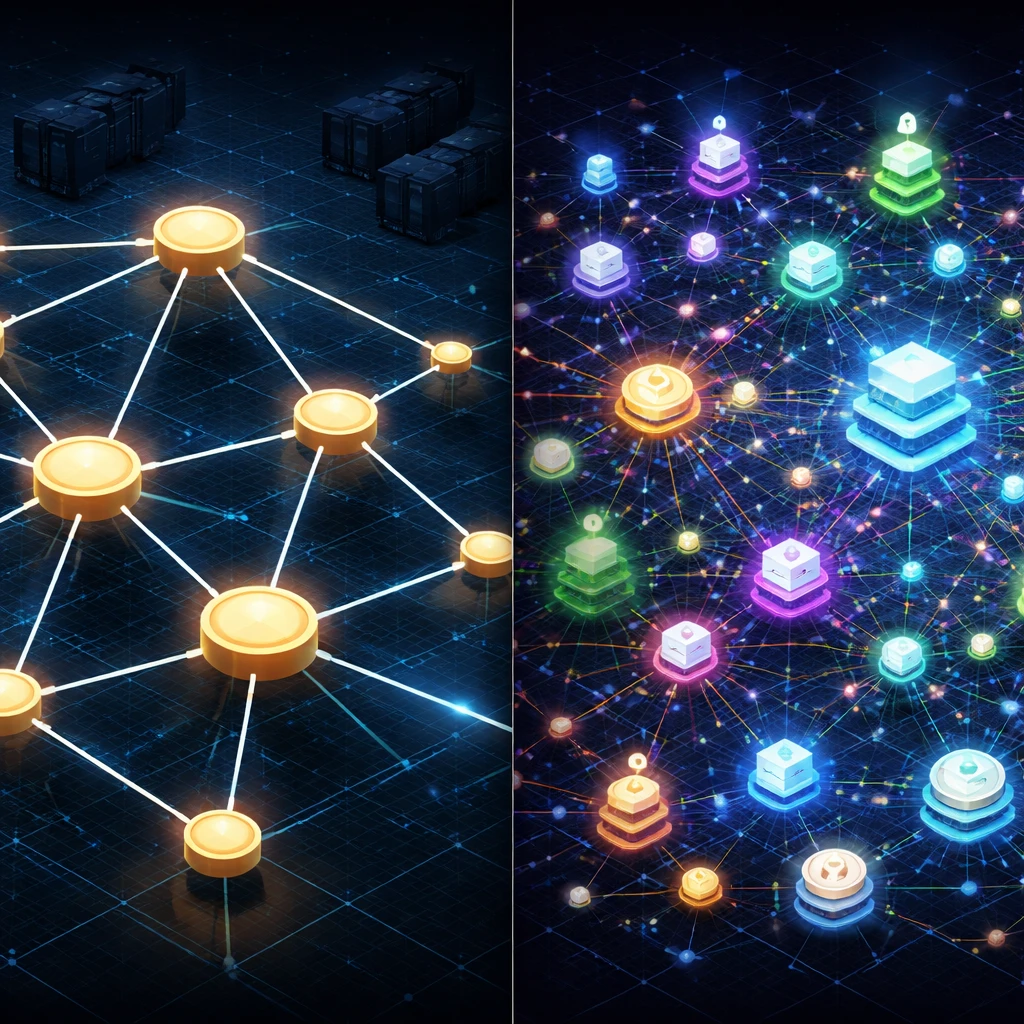

Bitcoin vs altcoins is a foundational distinction in crypto and blockchain fundamentals. It separates the original, purpose-built monetary network designed for censorship-resistant value transfer from the diverse set of other cryptoassets that seek to extend, modify, or diverge from Bitcoin’s design. Understanding the split clarifies why the market is structured the way it is, how different networks make different trade-offs, and where various applications fit into the broader ecosystem.

Defining Bitcoin and Altcoins

Bitcoin is a decentralized digital currency and payment network launched in 2009 by the pseudonymous creator Satoshi Nakamoto. Its core objective is to enable peer-to-peer electronic cash without reliance on a central authority. Bitcoin relies on proof of work to secure the ledger, follows a fixed issuance schedule capped at 21 million coins, and uses the UTXO model to track ownership. Its protocol intentionally changes slowly, prioritizing security, predictability, and censorship resistance.

Altcoins is a broad label for all cryptoassets that are not Bitcoin. The category includes general-purpose smart contract platforms, payment-focused coins, privacy-focused systems, platform governance tokens, utility tokens, and stablecoins. Altcoins can adopt different consensus mechanisms, monetary policies, programming models, and governance structures. The term is imprecise, and its usefulness depends on context. It signals that Bitcoin occupies a special role in the market’s infrastructure and narrative, while other networks tend to optimize for different capabilities or design goals.

Why the Distinction Exists

The distinction reflects history and technology. Bitcoin arrived first and proved that a decentralized, scarce digital money could function in practice. As developers and entrepreneurs explored limitations or alternative use cases, they launched new networks with different priorities. Some aimed for higher throughput, some for programmable applications, some for privacy, and others for stability relative to fiat currencies. Over time, exchanges, custodians, analytics providers, and media adopted the Bitcoin vs altcoins frame because it matched how liquidity, infrastructure, and user behavior clustered around the original asset and everything else.

This separation also mirrors different philosophies. Bitcoin emphasizes minimalism and robustness. Many altcoins emphasize flexibility, expressive programmability, or rapid iteration. These choices influence monetary policy, governance, tooling, and the risk profile of each network.

Market Structure: Roles and Plumbing

In market practice, Bitcoin functions as both an asset and a settlement network. It is widely listed on exchanges, commonly held by long-term oriented participants, and frequently used as a reference point for market conditions. The phrase “Bitcoin dominance” describes Bitcoin’s share of the total market capitalization of cryptoassets. While market capitalization is an imperfect metric, the dominance concept highlights the structural weight Bitcoin carries in pricing and liquidity.

Altcoins populate many layers of the market. Smart contract platforms underlie decentralized exchanges, lending protocols, and application ecosystems. Stablecoins serve as quote currencies and settlement instruments across centralized and decentralized venues. Privacy-focused networks cater to users with higher privacy needs, albeit with regulatory frictions. Payment-focused coins attempt to optimize for low fees and speed, though their security and decentralization profiles vary widely.

Exchanges historically offered many trade pairs denominated in Bitcoin. Over time, stablecoins, especially dollar-pegged tokens, became prominent quote assets because they simplify accounting and reduce the need to move between crypto and bank rails. Even with this shift, the Bitcoin vs altcoins lens still matters because it shapes index construction, liquidity routing, custody strategies, and infrastructure support decisions across the industry.

Bitcoin’s Core Design Choices

Bitcoin’s design can be summarized by several conservative choices that prioritize resilience:

- Consensus and security: Bitcoin uses proof of work, where miners expend energy to propose blocks. The system’s security arises from the cost of reordering the chain and the broad distribution of mining. Energy use is not incidental but integral to the consensus game.

- Monetary policy: The supply is capped at 21 million, with issuance declining by half approximately every four years through halving events. This predictable schedule makes Bitcoin’s monetary policy transparent and difficult to change.

- Data model: Bitcoin uses the unspent transaction output model, which treats ownership as spendable outputs rather than account balances. This model simplifies validation and enables parallel processing of outputs, though it limits expressiveness for complex smart contracts.

- Governance and changes: Bitcoin has a strong culture of minimizing changes, favoring small, peer-reviewed upgrades with widespread consensus. The ethos is to avoid breaking changes that might fragment the network or introduce security regressions.

The result is a network that behaves like a settlement layer for value storage and transfer, with programmability kept deliberately constrained. Layer-two and sidechain efforts attempt to add functionality or throughput without burdening the base layer with complexity.

Altcoins: Breadth of Designs and Goals

Altcoins are diverse. Lumping them together risks obscuring important differences, but several broad classes appear frequently in market discussions:

- Smart contract platforms: Networks such as Ethereum introduced programmable transactions and virtual machines. They enable decentralized applications, token issuance, decentralized finance, and non-fungible tokens. These platforms often evolve quickly and support rich developer tooling.

- Payment-focused networks: Some altcoins aim to achieve low-fee, fast settlement with varying decentralization trade-offs. They may employ different consensus mechanisms or validator designs.

- Privacy-focused systems: Projects such as those using ring signatures or zero-knowledge proofs add privacy to transaction amounts or participants. Privacy can complicate compliance and analytics.

- Stablecoins: Tokens pegged to external assets, often fiat currencies, have become integral to trading and payments within crypto ecosystems. Designs vary from fully reserved models to algorithmic schemes, each with distinct risk characteristics.

- Governance and utility tokens: Tokens used to coordinate upgrades, parameter changes, or participation in application-level economics. These often sit on top of smart contract platforms rather than operate their own base chains.

Because altcoins pursue many aims, their monetary policies, security models, and governance differ widely. Some adopt proof of stake with economic penalties for malicious behavior. Some rely on delegated validators to increase throughput. Others use hybrids or novel cryptography to achieve specific design targets. The diversity creates a broad landscape of trade-offs.

Consensus Mechanisms and Security Assumptions

Bitcoin and many early networks use proof of work. Later platforms often prefer proof of stake or related variants. The transition reflects different cost structures and security assumptions:

- Proof of work: Security depends on the cost of acquiring and operating mining hardware and electricity. Attacks require sustained expenditure to outcompete honest miners. The external cost anchors security in physical resources.

- Proof of stake: Security depends on capital locked in the protocol. Validators put funds at risk and can be penalized for misbehavior. Attacks require acquiring or corrupting enough stake to influence consensus. This model emphasizes economic finality and often reduces energy usage, but it raises questions about wealth concentration, governance capture, and the dynamics of penalties and recovery.

- Variants and hybrids: Some networks experiment with committee-based consensus, federated models, or new cryptographic proofs. Each design modifies assumptions about who can produce blocks, how finality is reached, and how the network recovers from faults.

No mechanism is universally superior. Each aligns with particular goals and constraints. Topics such as validator decentralization, the cost to attack, network liveness under stress, and the ease of client verification are central to evaluating how a chain protects its ledger.

Monetary Policy and Token Supply

Bitcoin’s monetary policy is fixed in code and socially reinforced by users and infrastructure providers who choose to run software that respects the 21 million cap. Supply reductions are predictable, and issuance is not subject to discretionary policy.

Altcoins exhibit a spectrum of approaches. Some have capped supplies with different schedules. Others are inflationary to fund staking rewards or ecosystem development. Some employ burn mechanisms tied to network usage, which can offset some issuance. Inflation, burn, and cap dynamics interact with fees, block rewards, and validator incentives. The choice of policy has consequences for security budgets in proof of work and for validator economics in proof of stake.

Governance and Upgrade Cadence

Bitcoin’s upgrades tend to be incremental and conservative, with long lead times and broad community review. Soft forks that maintain backward compatibility are typically preferred. Disagreements can lead to chain splits, but such events are infrequent and costly.

Altcoins vary dramatically in governance. Some employ on-chain voting that allows token holders or validators to signal preferences on upgrades. Others use off-chain processes with foundation oversight and core developer coordination. Faster upgrade cadence can improve features and performance, yet it expands the surface for governance risk. Concentration of decision-making or unclear authority can affect predictability and user trust.

Programmability and Application Layers

Bitcoin’s scripting system is limited by design. It enables multisignature transactions, timelocks, and basic conditional logic. For richer functionality, developers often build on layers above the base chain. The Lightning Network offers fast, low-cost payments by opening and closing channels on the base chain. Sidechains and federated solutions explore more flexible programming while preserving settlement finality on Bitcoin.

Smart contract platforms in the altcoin category offer Turing-complete environments. They support decentralized exchanges, lending markets, derivatives protocols, gaming, and digital collectibles. This expressiveness expands utility but increases the attack surface. Bugs in smart contracts, misconfigured oracles, and complex interactions among protocols create systemic risk within application ecosystems. Security practices such as audits and formal verification aim to mitigate these risks, though they cannot eliminate them.

Scalability Approaches

Scalability determines how many transactions a network can process and at what cost. Bitcoin prioritizes global verification over raw throughput, then leans on layers and batching techniques to scale usage without sacrificing decentralization at the base layer.

Altcoins explore different strategies. Some increase block size or reduce block times at the base layer, which can raise hardware requirements for validators and risk centralization. Others implement sharding, rollups, or specialized execution environments to push computation off-chain while preserving verifiable results on-chain. Each approach involves trade-offs among speed, cost, decentralization, and complexity.

Privacy Models

Bitcoin is pseudonymous. Addresses do not directly identify users, but transaction flows are public. Chain analysis can often cluster addresses over time. Privacy tools such as coinjoins, mixers, or specific transaction patterns attempt to improve privacy but add operational and regulatory complexity.

Privacy-focused altcoins integrate privacy at the protocol level. Techniques like zero-knowledge proofs or ring signatures conceal amounts and participants by default or as an option. While this improves financial privacy, it can complicate compliance workflows and exchange listings, which affects liquidity and accessibility.

Real-World Contexts and Examples

Examples help illustrate the different aims of Bitcoin and various altcoins without implying outcomes or preferences.

- Bitcoin as a settlement and savings instrument: Individuals and institutions may use Bitcoin to move value across borders without intermediaries. For instance, a firm can settle a large invoice by transmitting Bitcoin directly to a supplier’s address, with final settlement recorded on-chain once confirmations accrue. The provenance of funds is transparent to both parties, and no single institution can reverse the transaction.

- Ethereum for programmable finance: Developers can launch a decentralized borrowing platform using smart contracts. Users deposit collateral into a protocol and mint a stablecoin against it. All logic resides on-chain, including interest accrual and liquidation rules. This programmable environment is not natively available on Bitcoin’s base layer.

- Stablecoins for operational payments: A global services company can pay contractors in stablecoins to reduce delays associated with international banking systems. The token aims to track a fiat currency, which simplifies accounting. Operationally, this relies on the governance and reserves of the issuer and on the underlying platform where the token circulates.

- Privacy coins for sensitive transactions: A non-profit operating in a restrictive environment might favor a privacy-preserving network to protect the identity of recipients. This choice carries practical and legal considerations that vary by jurisdiction and service provider.

- Layer-two payments vs base-layer settlement: A retail merchant can receive small Bitcoin payments over a layer-two channel to minimize fees and latency, while occasionally using the base chain to open and close channels. This demonstrates how Bitcoin’s ecosystem separates high-frequency activity from foundational settlement.

Risk Profiles and Operational Considerations

Different designs lead to different risks. With Bitcoin, operational focus often centers on secure key management, understanding confirmation depth for finality, fee estimation during congestion, and the implications of protocol upgrades. The conservative roadmap reduces change-related surprises but also limits new features.

Altcoins introduce additional dimensions. Proof of stake networks require participants to understand validator behavior, slashing conditions, and governance processes. Smart contract platforms require due diligence on contract risk, oracle dependencies, upgradeability of contracts, and composability with other protocols. Stablecoins add issuer risk and reserve transparency questions. Privacy networks introduce compliance complexity. Any chain with lower liquidity faces different market plumbing challenges, such as wider exchange spreads and less predictable settlement during stress.

Regulatory Treatment and Classification

Legal frameworks are evolving, and they differ by country. In several jurisdictions, Bitcoin has been described by regulators as a commodity-like asset, reflecting its lack of a centralized issuer and its role as a native asset of a decentralized network. Many altcoins, particularly those distributed by identifiable teams with fundraising, face ongoing questions about whether they qualify as securities or other regulated instruments.

Stablecoins invite additional oversight related to reserves, disclosure, and operational resilience. Privacy-focused networks encounter heightened scrutiny due to anti-money-laundering obligations. The regulatory asymmetry is one reason the market continues to treat Bitcoin as distinct from the broader group of altcoins.

Liquidity, Infrastructure, and Benchmarking

Liquidity conditions differ markedly between Bitcoin and most altcoins. Bitcoin tends to have deeper order books, tighter spreads, and more exchange listings. Custody providers often support Bitcoin first and with more mature processes. Derivatives markets for Bitcoin, including futures and options, are generally more liquid and widely integrated into risk management workflows across exchanges.

Altcoin liquidity is heterogeneous. Some large platforms have significant depth and derivatives markets, while others trade thinly. Index providers and market data services often publish Bitcoin-only benchmarks alongside broader basket indices. Measures such as Bitcoin dominance, realized capitalization, transaction fees, and hash rate offer context for Bitcoin’s status. On smart contract platforms, metrics like active addresses, gas fees, contract calls, and total value locked illustrate network usage, although each metric has caveats and can be gamed or misinterpreted.

Interoperability and Bridges

As application ecosystems grew, demand for cross-chain value transfer increased. Bridges allow tokens to move between networks by locking an asset on one chain and minting a representation on another. This improves composability but adds new risks because bridges often concentrate control or rely on complex contracts and external validators. Security incidents in bridges have had systemic effects in application ecosystems, underscoring the importance of conservative assumptions when moving value across chains.

Limitations of the “Altcoin” Label

The term altcoin is a blunt instrument. Stablecoins serve a different function than a smart contract platform’s native asset. Privacy networks and application governance tokens also have distinct roles and risk models. The label persists because it is simple and reflects how the market clusters liquidity and infrastructure, but precise analysis requires examining the specific design, economics, and governance of each asset. Over time, some observers draw a line between Bitcoin, smart contract platform base assets, stablecoins, and everything else, acknowledging that “altcoin” hides meaningful differences.

Why Bitcoin Often Functions as a Reference Asset

Market participants often use Bitcoin as a reference point because it combines several properties that are uncommon in one asset: predictable monetary policy, widely distributed infrastructure, high liquidity, and a long operational history. This combination makes it a convenient benchmark for understanding market stress, liquidity conditions, and sentiment. Many infrastructure providers tune their systems first for Bitcoin’s operational nuances, then extend support to other chains as demand grows.

Broader Economic and Technical Context

Bitcoin’s design reflects a specific view of money, scarcity, and decentralization. Altcoins reflect a different emphasis on programmable finance, experimentation, and varied trust models. This diversity mirrors the broader software ecosystem, where general-purpose systems coexist with specialized tools. From an economic perspective, the coexistence of a conservative base money network and a set of experimental platforms is not unusual. It is similar to the relationship between a base settlement layer and higher-level financial services in traditional finance, though the analogies are imperfect.

Technical progress across cryptography and distributed systems continues to influence both sides. Advances in zero-knowledge proofs, formal verification, and client-side validation may change how privacy, scalability, and security trade-offs are managed. The Bitcoin community explores improvements like better signature schemes and more efficient transaction types. Smart contract platforms explore rollups, data availability layers, and virtual machine optimizations. The interplay between these efforts shapes the future capabilities of both Bitcoin and altcoin ecosystems.

A Note on Data Interpretation

Metrics help frame comparisons but require careful interpretation. On-chain transaction counts can include spam or automated activity. Active addresses can be inflated by wallet behavior. Total value locked can shift with price movements, leverage, and double counting across protocols. Hash rate reflects miner incentives and electricity markets. Staking ratios can be influenced by lockup requirements and yield dynamics. Comparing Bitcoin to altcoins often means comparing different economic systems with different behaviors, so raw metrics rarely map one-to-one.

Real-World Frictions That Shape Design

Several non-technical factors influence the Bitcoin vs altcoins landscape:

- Energy and geography: Bitcoin mining gravitates to locations with suitable energy economics. Policy changes, subsidies, and local grid conditions affect the distribution of hash power.

- Compliance and custody: Institutional custody standards, insurance options, and reporting requirements tend to be more mature for Bitcoin, which affects its accessibility in regulated channels.

- Developer ecosystems: Tooling, libraries, and documentation influence where developers build. Smart contract platforms invest heavily in developer experience, which can accelerate application growth and experimentation.

- User experience: Wallet design, transaction fee dynamics, and settlement times shape adoption channels. Different networks optimize for different user profiles, from retail payments to complex DeFi operations.

Putting the Concept in Perspective

Bitcoin vs altcoins is not a judgment of merit. It is a classification tool that highlights how one network carved a distinct role as a conservative, settlement-focused monetary system, while many others prioritized programmability, speed, privacy, or stability against fiat. The consequences of these choices appear in market plumbing, regulatory treatment, liquidity distribution, and the risk characteristics of the systems built on top of each network. A careful study of fundamentals looks past the label and analyzes the concrete properties of each protocol.

Key Takeaways

- Bitcoin’s design prioritizes security, predictable monetary policy, and conservative governance, which positions it as a settlement-focused network with broad liquidity.

- Altcoins encompass diverse systems, including smart contract platforms, stablecoins, privacy networks, and payment-focused chains, each with distinct trade-offs.

- Consensus, monetary policy, and governance models differ widely across networks, shaping security assumptions and upgrade processes.

- Market structure reflects the distinction: Bitcoin often acts as a reference asset, while altcoins provide programmability and varied applications across decentralized finance and beyond.

- The term “altcoin” is a coarse label; precise analysis requires evaluating each protocol’s design, economics, governance, and real-world frictions.