Fundamentals

Foundational knowledge covering what financial markets are, how different asset classes function, and the basic mechanics behind stocks, ETFs, options, crypto, and forex.

You will learn: The core concepts in this topic, common misconceptions, and how professionals think about the subject.

Educational content only. Not financial advice.

What you will get from this topic

- Clear definitions and real-world context

- Practical examples without trade recommendations

- Common mistakes to avoid

- A progression from basics to deeper understanding

Recommended order

View all lessonsScopes in Fundamentals

Stocks

Core concepts explaining what stocks are, how equity ownership works, and how stock markets function.

Explore ScopeETFs & Funds

Understanding exchange-traded funds, mutual funds, indexes, and pooled investment vehicles.

Explore ScopeOptions

Introduction to options contracts, rights vs obligations, and how derivatives function.

Explore ScopeCrypto & Blockchain

Foundational concepts behind cryptocurrencies, blockchain technology, and decentralized networks.

Explore ScopeForex & Currencies

How currency markets operate, currency pairs, and global foreign exchange systems.

Explore ScopePopular in Fundamentals

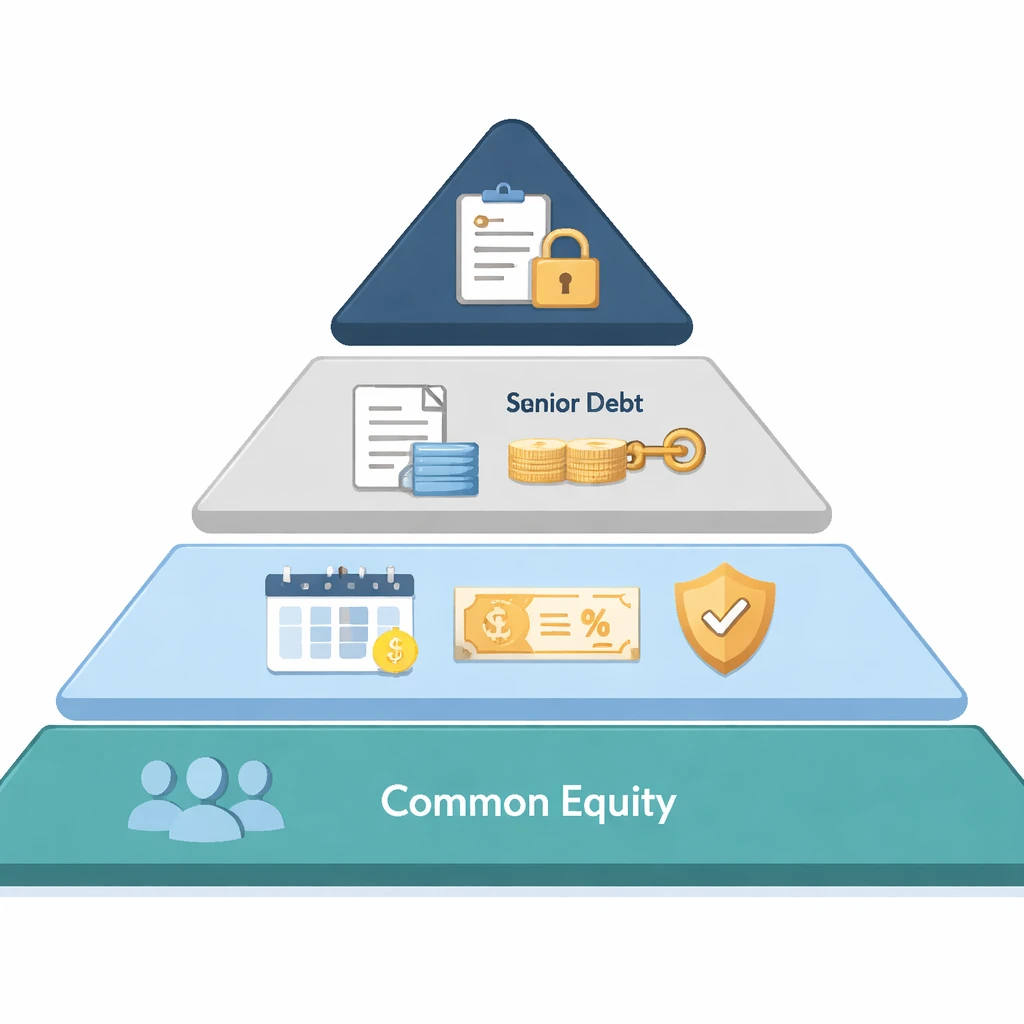

Common vs Preferred Stock

An in-depth explanation of common and preferred stock, how they fit into the corporate capital structure, why firms issue them, and how dividend, voting, and liquidation rights differ in practice. Includes real-world context and practical examples for clarity.

Equity Ownership Basics

A clear introduction to what equity represents in a corporation, how share ownership confers rights and obligations, how equity fits into market structure, and why equity exists in modern economies, with practical real-world context and examples.','content':'Equity ownership sits at the core of the stock market. A share of stock represents a fractional claim on a corporation. That claim is legal and financial in nature. It conveys specific rights, is subject to defined limits, and is embedded in a broader market structure that enables issuance, transfer, and governance. Understanding the ke

Why Companies Go Public

An in-depth explanation of why companies go public, how public listings fit into the market structure, the economic rationale for public equity, and the trade-offs involved, illustrated with real-world examples and practical context for understanding stocks as a financing tool.

How Shares Are Issued

A structured explanation of how companies create and sell shares, why issuance occurs, how it fits into the primary and secondary market structure, and what the legal and operational steps look like in practice, with concrete examples and key terminology.

Market Capitalization Explained

A clear, practical explanation of market capitalization in the stock market, including its definition, role in market structure, reasons it exists, and real-world examples of how it is used and misinterpreted in practice. Designed for readers who want firm grounding in equity fundamentals without trading advice.

Outstanding vs Float Shares

A clear explanation of outstanding shares and public float, why the distinction exists, how it fits into market structure, where the numbers come from, and how corporate actions and real-world situations affect both measures within stock fundamentals.

Ready to begin?

Start with the first scope to build a clean foundation, then move forward in order.

Start Stocks