TradeVae Academy

Practical education for stocks, ETFs, options, crypto, and forex. Learn how markets work, how traders manage risk, and how investors build portfolios.

Educational content only. Not financial advice.

New to the markets

Start with the essentials: what assets are, how trading works, and the vocabulary you need.

Start FundamentalsLearning to trade

Understand execution, chart behavior, and risk so you can trade with a process, not impulse.

Explore Trading BasicsBuilding long-term portfolios

Learn allocation, diversification, rebalancing, and portfolio-level risk management.

Explore Portfolio ConstructionBrowse by Topic

Choose a topic to see scopes and lessons.

Fundamentals

75 lessonsFoundational knowledge covering what financial markets are, how different asset classes function, and the basic mechanics behind stocks, ETFs, options, crypto, and forex.

View TopicTrading Basics

60 lessonsAn introduction to how trading works in practice, including order types, execution, liquidity, timeframes, and how trades are placed and managed.

View TopicTechnical Analysis

75 lessonsUnderstanding market price behavior through chart patterns, trends, support and resistance, volume, indicators, and price-based market structure.

View TopicRisk Management

75 lessonsCore principles focused on protecting capital, managing downside risk, position sizing, drawdowns, and maintaining long-term survivability in the markets.

View TopicFundamental Analysis

75 lessonsEvaluating the intrinsic value of assets by analyzing financial statements, earnings, macroeconomic forces, business models, and long-term growth drivers.

View TopicPortfolio Construction

75 lessonsBuilding resilient portfolios through diversification, asset allocation, correlation management, rebalancing strategies, and long-term capital planning.

View TopicTrading Strategies

75 lessonsStructured approaches that combine analysis, risk management, and execution into repeatable trading systems across different markets and timeframes.

View TopicMarket Mindset & Psychology

75 lessonsDeveloping the mental discipline required for trading and investing, including emotional control, cognitive bias awareness, decision-making under uncertainty, and process-driven thinking.

View TopicFeatured Lessons

Start with widely useful concepts.

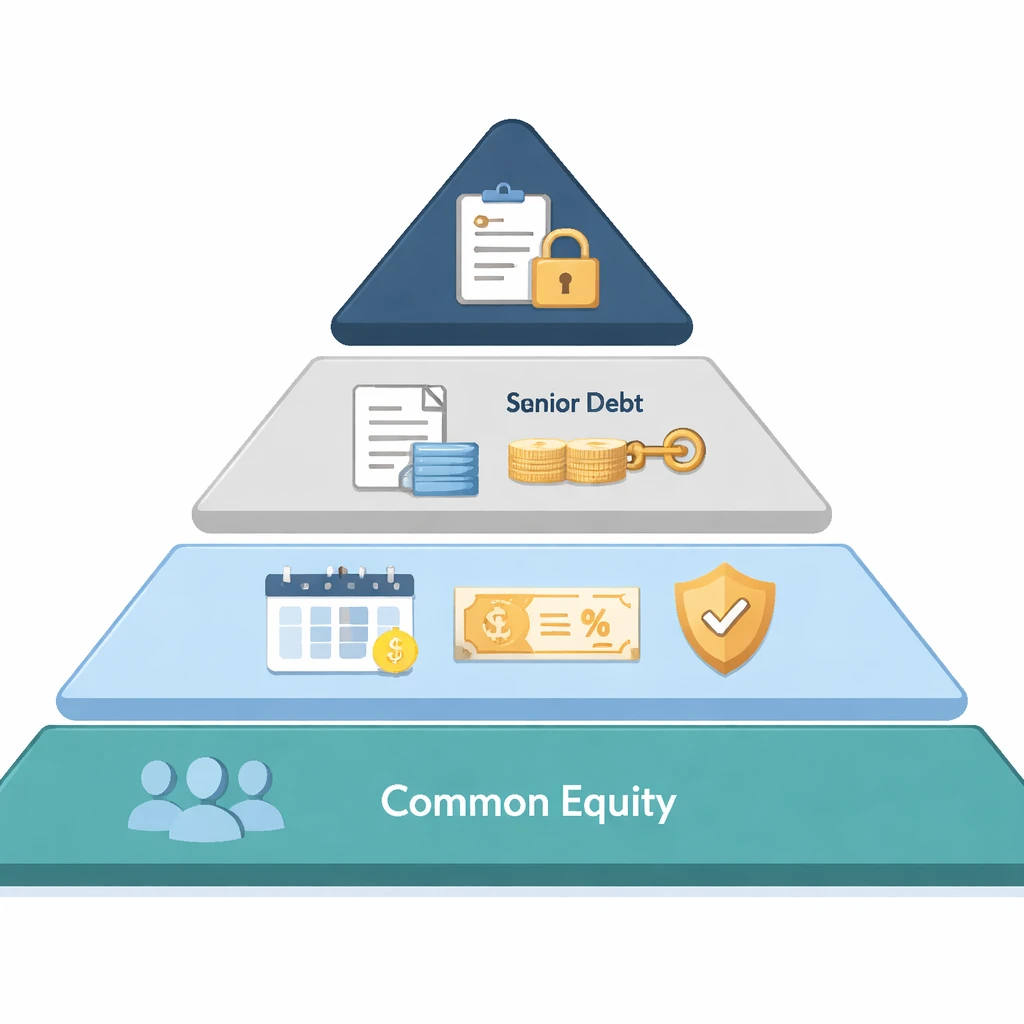

Common vs Preferred Stock

An in-depth explanation of common and preferred stock, how they fit into the corporate capital structure, why firms issue them, and how dividend, voting, and liquidation rights differ in practice. Includes real-world context and practical examples for clarity.

Equity Ownership Basics

A clear introduction to what equity represents in a corporation, how share ownership confers rights and obligations, how equity fits into market structure, and why equity exists in modern economies, with practical real-world context and examples.','content':'<p>Equity ownership sits at the core of the stock market. A share of stock represents a fractional claim on a corporation. That claim is legal and financial in nature. It conveys specific rights, is subject to defined limits, and is embedded in a broader market structure that enables issuance, transfer, and governance. Understanding the ke

Why Companies Go Public

An in-depth explanation of why companies go public, how public listings fit into the market structure, the economic rationale for public equity, and the trade-offs involved, illustrated with real-world examples and practical context for understanding stocks as a financing tool.

How Shares Are Issued

A structured explanation of how companies create and sell shares, why issuance occurs, how it fits into the primary and secondary market structure, and what the legal and operational steps look like in practice, with concrete examples and key terminology.

Market Capitalization Explained

A clear, practical explanation of market capitalization in the stock market, including its definition, role in market structure, reasons it exists, and real-world examples of how it is used and misinterpreted in practice. Designed for readers who want firm grounding in equity fundamentals without trading advice.

Outstanding vs Float Shares

A clear explanation of outstanding shares and public float, why the distinction exists, how it fits into market structure, where the numbers come from, and how corporate actions and real-world situations affect both measures within stock fundamentals.

Voting Rights & Shareholders

A clear, academically grounded explanation of what shareholder voting rights are, why they exist, how they operate within corporate and market structures, and how real companies implement them, with practical examples and institutional context. No strategies or recommendations.

Dividends Explained

A clear, academically grounded explanation of stock dividends, why they exist, how they are declared and paid, the key dates investors monitor, and how dividends fit into the broader market structure and corporate finance decisions, illustrated with practical examples.

Stock Splits & Reverse Splits

A comprehensive explanation of stock splits and reverse stock splits, why companies use them, how they are processed, and what changes and does not change for shareholders and the broader market structure. Includes real-world illustrations and key operational details.

How the Academy Works

Topics group lessons by major skill area.

Scopes break topics into focused subcategories.

Lessons are short, practical articles designed to be read in order or searched as needed.

Start with the foundations

If you are not sure where to begin, Fundamentals gives you the vocabulary and core mental models used across every market.

Start Fundamentals